Are G-7 De Minimis Tariffs On Chinese Goods About To Change?

Table of Contents

The de minimis value for tariffs on goods imported from China, a threshold currently set by the G-7 nations, plays a crucial role in global trade. Recent geopolitical shifts and economic pressures are raising questions: are these thresholds about to change? This article examines the current situation, potential scenarios, and the impact on businesses importing Chinese goods. Understanding these potential shifts is vital for effective import strategy and long-term business planning.

The Current State of G-7 De Minimis Tariffs on Chinese Goods

"De minimis," in the context of import tariffs, refers to the value below which imported goods are exempt from customs duties. These thresholds significantly impact businesses, particularly those importing smaller shipments or lower-value goods from China. The current de minimis thresholds vary considerably across G-7 countries. Let's examine some key examples:

| Country | Current De Minimis Threshold (USD, approximate) | Notes |

|---|---|---|

| United States | $800 | Subject to change; may vary by product category |

| United Kingdom | £135 | Subject to change; may vary by product category |

| Canada | CAD 20 | Subject to change; may vary by product category |

| Japan | ¥200,000 (approx. $1400) | Subject to change; may vary by product category |

| Germany | €22 | Subject to change; may vary by product category |

| France | €22 | Subject to change; may vary by product category |

| Italy | €22 | Subject to change; may vary by product category |

Current Impact: These varying thresholds create a complex landscape for businesses. Small businesses often benefit from lower thresholds, while larger importers may face higher tariff burdens. The current system affects different product categories differently, with some facing higher tariffs than others.

- Current tariff rates: Specific tariff rates depend on the Harmonized System (HS) code of the product and any bilateral trade agreements in place.

- Impact on businesses: Small businesses importing small quantities of goods benefit from lower thresholds, while large importers of high-value goods face significant tariff costs.

- Import volume statistics: A significant portion of Chinese imports fall below these thresholds, highlighting the system's substantial impact on global trade flows.

Factors Driving Potential Changes in De Minimis Tariffs

Several factors could trigger changes to G-7 de minimis tariffs on Chinese goods:

-

Geopolitical Tensions: Rising geopolitical tensions between the G-7 and China, including trade disputes and concerns over intellectual property rights, are pushing for a reassessment of import policies. Increased scrutiny of Chinese imports could lead to lower thresholds.

-

Inflation and Supply Chain Disruptions: Global inflation and ongoing supply chain disruptions are putting pressure on governments to protect domestic industries. Raising tariffs on Chinese goods could be seen as a way to support local producers and reduce reliance on imports.

-

Domestic Lobbying: Domestic industries facing competition from Chinese imports often lobby for higher tariffs or lower de minimis thresholds to protect their market share.

-

Specific Examples: The ongoing trade dispute over semiconductors and the restrictions imposed on certain Chinese technology companies illustrate the growing tensions.

-

Economic Data: Data indicating increased inflation and the impact on domestic industries provides justification for policy changes.

-

Lobbying Efforts: Examples of industry groups advocating for tariff increases or adjustments to de minimis thresholds provide insights into political influence.

Potential Scenarios for Future G-7 De Minimis Tariffs

Several scenarios could unfold regarding future G-7 de minimis tariffs:

-

Scenario 1: Increase in De Minimis Thresholds: Driven by a need to simplify customs procedures and boost cross-border e-commerce, some G-7 nations might raise their thresholds. This would benefit small businesses and consumers but could face opposition from domestic industries.

-

Scenario 2: Decrease in De Minimis Thresholds: Motivated by protectionist policies or concerns about unfair trade practices, a reduction in thresholds is possible. This would increase costs for importers and consumers.

-

Scenario 3: Differentiated Thresholds Based on Product Category: A more nuanced approach might involve setting different de minimis levels for various product categories, based on factors such as strategic importance or domestic production capacity.

-

Impacts on SMEs: Higher thresholds benefit SMEs, while lower thresholds increase their costs.

-

Impacts on Multinational Corporations: Large corporations have more resources to navigate tariff changes, but they would still be impacted.

-

Impacts on Consumers: Changes to tariffs ultimately affect consumer prices, potentially leading to increased costs for imported goods.

Preparing Your Business for Potential Changes in De Minimis Tariffs

Businesses importing goods from China need to proactively prepare for potential changes:

-

Diversify Sourcing: Reduce reliance on China by exploring alternative suppliers in other countries.

-

Inventory Management: Optimize inventory levels to mitigate the impact of potential tariff increases.

-

Track Policy Changes: Regularly monitor government websites, industry publications, and trade associations for updates.

-

Seek Professional Advice: Consult with customs brokers and trade lawyers for guidance on navigating the changing tariff landscape.

-

Specific Steps: Implement robust risk management strategies, including scenario planning and contingency plans.

-

Resources: Utilize official government websites, industry-specific publications, and trade news sources to stay informed.

-

Professional Consultation: Engage customs brokers, lawyers specializing in international trade, and logistics experts for assistance.

Conclusion

The future of G-7 de minimis tariffs on Chinese goods remains uncertain. Geopolitical tensions, economic pressures, and domestic lobbying efforts will significantly influence any changes. Several scenarios are plausible, each with potentially significant impacts on businesses of all sizes and consumers. Proactive preparation, including diversifying sourcing and closely monitoring policy changes, is crucial for mitigating potential risks and maintaining a competitive edge. Stay informed about changes to G-7 de minimis tariffs on Chinese goods to protect your business. Regularly check relevant government websites and industry news for updates on this crucial aspect of international trade. Understanding these potential shifts is critical for effective import strategy and long-term business planning.

Featured Posts

-

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025 -

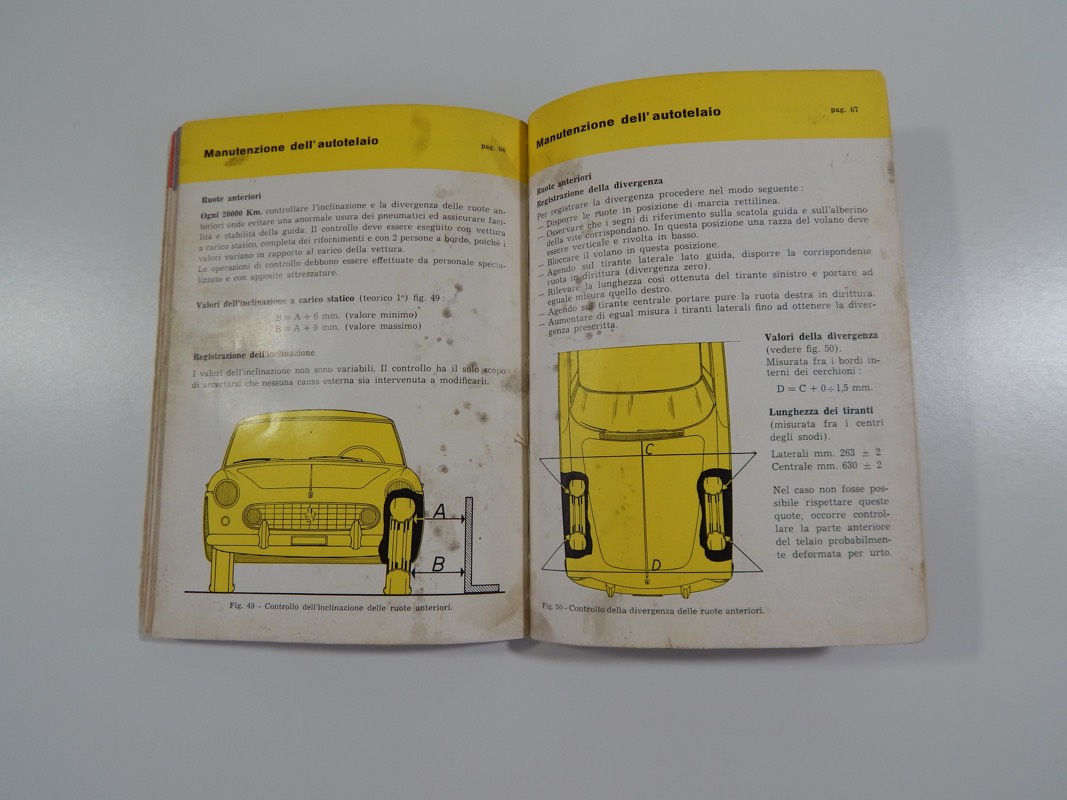

Ferrari Owners Kit The Ultimate Guide To Gear And Accessories

May 24, 2025

Ferrari Owners Kit The Ultimate Guide To Gear And Accessories

May 24, 2025 -

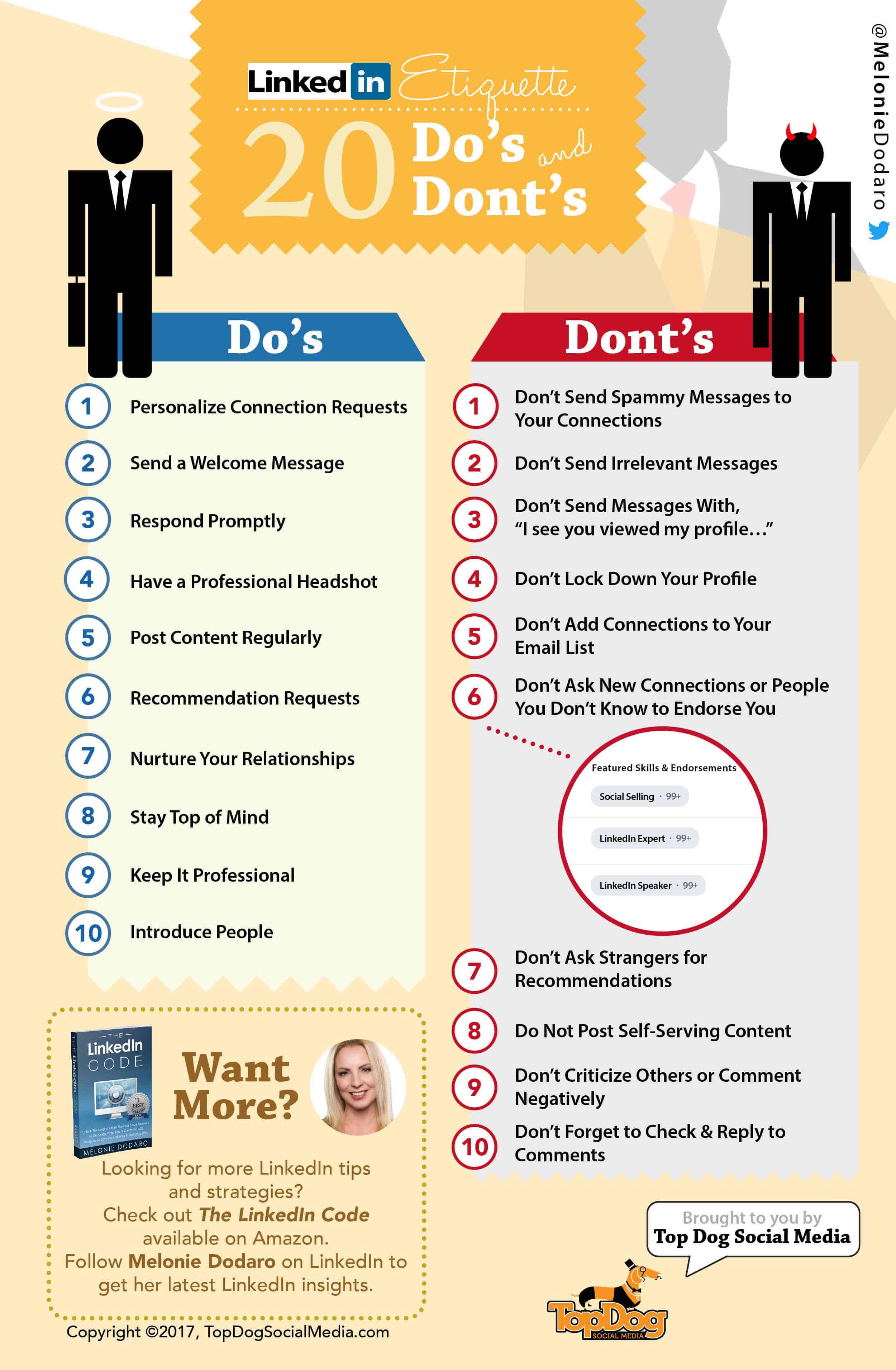

Land Your Dream Private Credit Role 5 Dos And Don Ts To Follow

May 24, 2025

Land Your Dream Private Credit Role 5 Dos And Don Ts To Follow

May 24, 2025 -

Evrovidenie Pobediteli Poslednikh 10 Let I Ikh Sudby Segodnya

May 24, 2025

Evrovidenie Pobediteli Poslednikh 10 Let I Ikh Sudby Segodnya

May 24, 2025 -

Live Stock Market Coverage Bond Sell Off Dow Futures Bitcoin Rally

May 24, 2025

Live Stock Market Coverage Bond Sell Off Dow Futures Bitcoin Rally

May 24, 2025

Latest Posts

-

Bjk Cup Final Kazakhstan Through Australia Eliminated

May 24, 2025

Bjk Cup Final Kazakhstan Through Australia Eliminated

May 24, 2025 -

Kazakhstan Triumphs Australias Bjk Cup Run Ends

May 24, 2025

Kazakhstan Triumphs Australias Bjk Cup Run Ends

May 24, 2025 -

Kazakhstan Triumfalnoe Vozvraschenie V Final Kubka Billi Dzhin King

May 24, 2025

Kazakhstan Triumfalnoe Vozvraschenie V Final Kubka Billi Dzhin King

May 24, 2025 -

Madrid Open Andreescu Secures Second Round Berth

May 24, 2025

Madrid Open Andreescu Secures Second Round Berth

May 24, 2025 -

Australia Misses Bjk Cup Finals Kazakhstan Advances

May 24, 2025

Australia Misses Bjk Cup Finals Kazakhstan Advances

May 24, 2025