Are High Stock Market Valuations A Cause For Concern? BofA Weighs In

Table of Contents

BofA's Current Market Assessment

BofA regularly publishes reports assessing global market conditions, providing valuable insights into stock market valuation. Their analyses often utilize a range of key metrics to gauge the overall market health and identify potential areas of risk or opportunity. These metrics include, but aren't limited to:

- Price-to-Earnings Ratio (P/E Ratio): This compares a company's stock price to its earnings per share, providing a measure of how expensive a stock is relative to its profitability. A high P/E ratio generally suggests a higher valuation.

- Shiller PE Ratio (CAPE Ratio): This is a cyclically adjusted P/E ratio that smooths out earnings fluctuations over a 10-year period, offering a more stable assessment of valuation over time. BofA often incorporates this metric for a longer-term perspective.

- Sector-Specific Valuations: BofA's analysis goes beyond broad market indices, examining individual sectors to identify overvalued or undervalued areas. Recent reports may highlight specific sectors showing signs of excessive optimism or pessimism in their valuations.

For example, a recent BofA report (cite specific report and date if available) might indicate that the technology sector shows a high P/E ratio compared to its historical average, suggesting potential overvaluation. Conversely, the energy sector might be identified as relatively undervalued based on their analysis, considering current market conditions and future growth prospects. (Insert specific data points from BofA reports here, with proper citation). This granular analysis provides a more nuanced view of the current market landscape than simple overall indices.

Factors Contributing to High Valuations

Several factors contribute to the elevated stock market valuations observed by BofA and other analysts. These are complex and interconnected:

- Low Interest Rates: Historically low interest rates make borrowing cheaper for businesses and investors, fueling investment and driving up asset prices, including stocks. This lowers the opportunity cost of investing in equities.

- Quantitative Easing (QE): Central banks' injection of liquidity into the financial system through QE programs can increase money supply and boost asset prices, including stocks.

- Robust Corporate Earnings (and Expectations): Strong corporate earnings, or even the expectation of strong future earnings, can justify higher stock prices based on discounted cash flow models. Positive investor sentiment further amplifies this effect.

- Investor Sentiment: Optimistic investor sentiment, fueled by factors like technological advancements, economic growth prospects, or simply fear of missing out (FOMO), can push stock prices beyond what might be justified by fundamentals alone.

BofA's View on Potential Risks

While high stock market valuations can indicate strong economic fundamentals, BofA also highlights several potential risks:

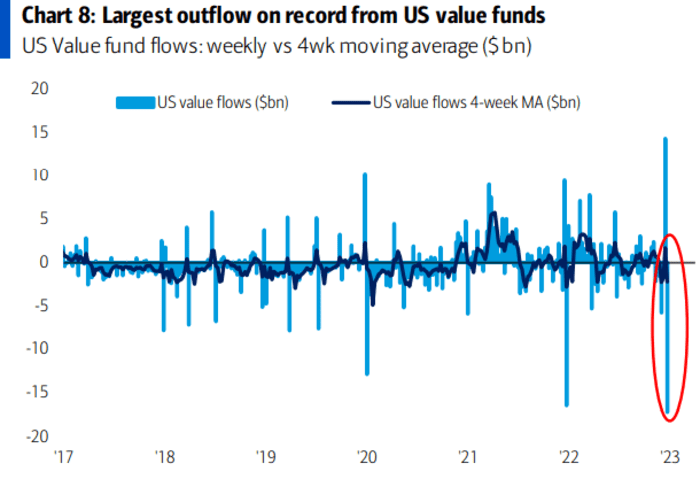

- Market Corrections: High valuations can leave markets vulnerable to sharp corrections, especially if investor sentiment shifts negatively. A sudden loss of confidence can trigger a sell-off.

- Inflation: Rising inflation can erode corporate profits and investor returns, leading to downward pressure on stock prices. BofA will consider inflation predictions in their risk assessment.

- Rising Interest Rates: Increased interest rates, often a response to inflation, can make borrowing more expensive, potentially slowing economic growth and impacting corporate profitability.

- Geopolitical Uncertainty: Global geopolitical events, such as wars or trade disputes, can create uncertainty in the market, leading to increased volatility and potential declines in stock prices.

BofA's Investment Recommendations

Based on their analysis of high stock market valuations and associated risks, BofA may offer specific investment recommendations. These could include:

- Shifting to a More Conservative Approach: Given the elevated valuations and potential risks, BofA might advise investors to reduce their exposure to equities and increase their holdings in less volatile asset classes, such as bonds or cash.

- Sector Rotation: Rather than abandoning stocks altogether, BofA might recommend shifting investments from perceived overvalued sectors to sectors they consider undervalued based on their analysis.

- Diversification: Maintaining a well-diversified portfolio across asset classes and sectors remains a cornerstone of prudent investment strategy, regardless of overall market valuations.

Alternative Perspectives and Counterarguments

It is crucial to acknowledge that high valuations don't automatically predict an impending market crash. Some analysts argue that:

- Innovation and technological advancements can justify higher valuations, as they promise sustained long-term growth.

- Low interest rates could continue to support equity markets for an extended period.

- Strong corporate earnings growth could offset the impact of high valuations.

Other financial institutions might offer differing viewpoints on the significance of current valuations and their implications for the future. It's vital to consider multiple perspectives before forming your investment strategy.

Conclusion: Navigating High Stock Market Valuations – BofA's Insights and Your Next Steps

BofA's analysis of high stock market valuations reveals a complex picture. While strong earnings and low interest rates have contributed to high prices, potential risks such as market corrections, inflation, and geopolitical uncertainty remain. BofA's recommendations likely emphasize a cautious approach, perhaps suggesting diversification or a shift towards less volatile assets. However, remember that this is just one perspective.

To navigate this environment effectively, conduct thorough research, consider the insights from various financial analysts, and consult with a qualified financial advisor to develop an investment strategy aligned with your risk tolerance and financial goals. Stay updated on BofA's continued analysis of stock market valuations and their evolving recommendations to make informed decisions about your portfolio. Remember, understanding stock market valuation is key to successful investing.

Featured Posts

-

Reduced Spending At Sse 3 Billion Cut Reflects Economic Slowdown

May 24, 2025

Reduced Spending At Sse 3 Billion Cut Reflects Economic Slowdown

May 24, 2025 -

Full Soundtrack For The Prime Video Film Picture This

May 24, 2025

Full Soundtrack For The Prime Video Film Picture This

May 24, 2025 -

Dax Rises Again Frankfurt Equities Opening And Record Highs

May 24, 2025

Dax Rises Again Frankfurt Equities Opening And Record Highs

May 24, 2025 -

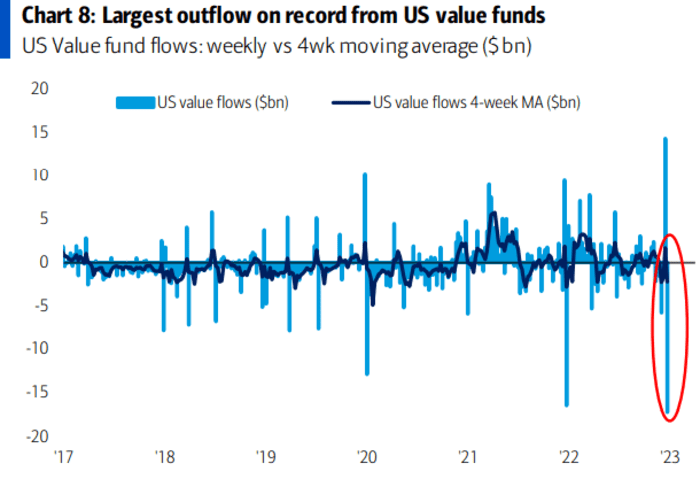

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

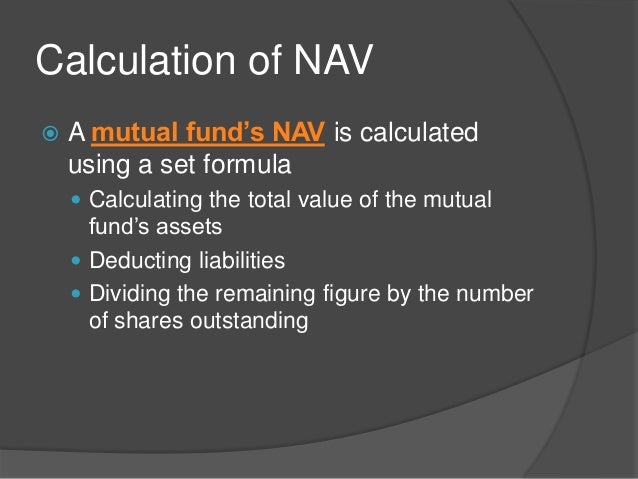

Musk In Vetta La Classifica Forbes Degli Uomini Piu Ricchi Del 2025

May 24, 2025

Musk In Vetta La Classifica Forbes Degli Uomini Piu Ricchi Del 2025

May 24, 2025

Latest Posts

-

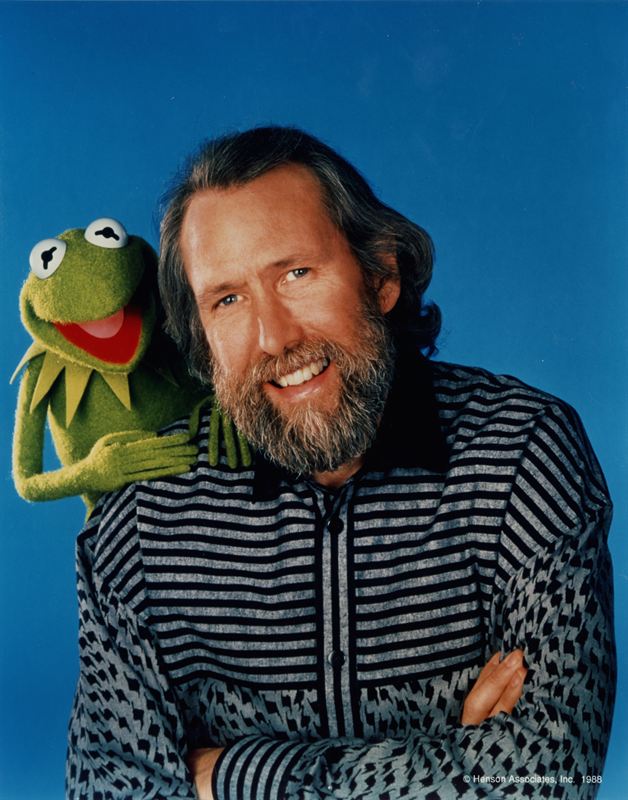

Kermit The Frog 2025 University Of Maryland Commencement Speaker

May 24, 2025

Kermit The Frog 2025 University Of Maryland Commencement Speaker

May 24, 2025 -

Kermit The Frog To Deliver 2025 Commencement Address At University Of Maryland

May 24, 2025

Kermit The Frog To Deliver 2025 Commencement Address At University Of Maryland

May 24, 2025 -

Kazakhstans Billie Jean King Cup Win A Detailed Match Report

May 24, 2025

Kazakhstans Billie Jean King Cup Win A Detailed Match Report

May 24, 2025 -

Billie Jean King Cup Qualifier Kazakhstan Beats Australia

May 24, 2025

Billie Jean King Cup Qualifier Kazakhstan Beats Australia

May 24, 2025 -

Kazakhstan Secures Billie Jean King Cup Spot After Australia Win

May 24, 2025

Kazakhstan Secures Billie Jean King Cup Spot After Australia Win

May 24, 2025