DAX Rises Again: Frankfurt Equities Opening And Record Highs

Table of Contents

Strong Opening Performance Fuels DAX Rise

The DAX's impressive rise was fueled by a strong opening performance on [Insert Date], setting the tone for the day's trading. The market opened with a significant surge, showcasing robust buying pressure from the outset. This early momentum was crucial in driving the index to its record high. Analyzing the Frankfurt Stock Exchange opening reveals a clear picture of the market's bullish sentiment.

- The DAX increased by [Insert Percentage]% from the previous day's closing, a significant jump indicating strong investor enthusiasm.

- Trading volume during the opening hours was exceptionally high, reaching [Insert Volume] shares traded, further demonstrating the market's activity.

- Several key stocks within the DAX, such as [Insert Example Stock 1] and [Insert Example Stock 2], experienced substantial gains, contributing significantly to the overall index performance. Their strong performances reflected positive industry-specific news and overall market sentiment.

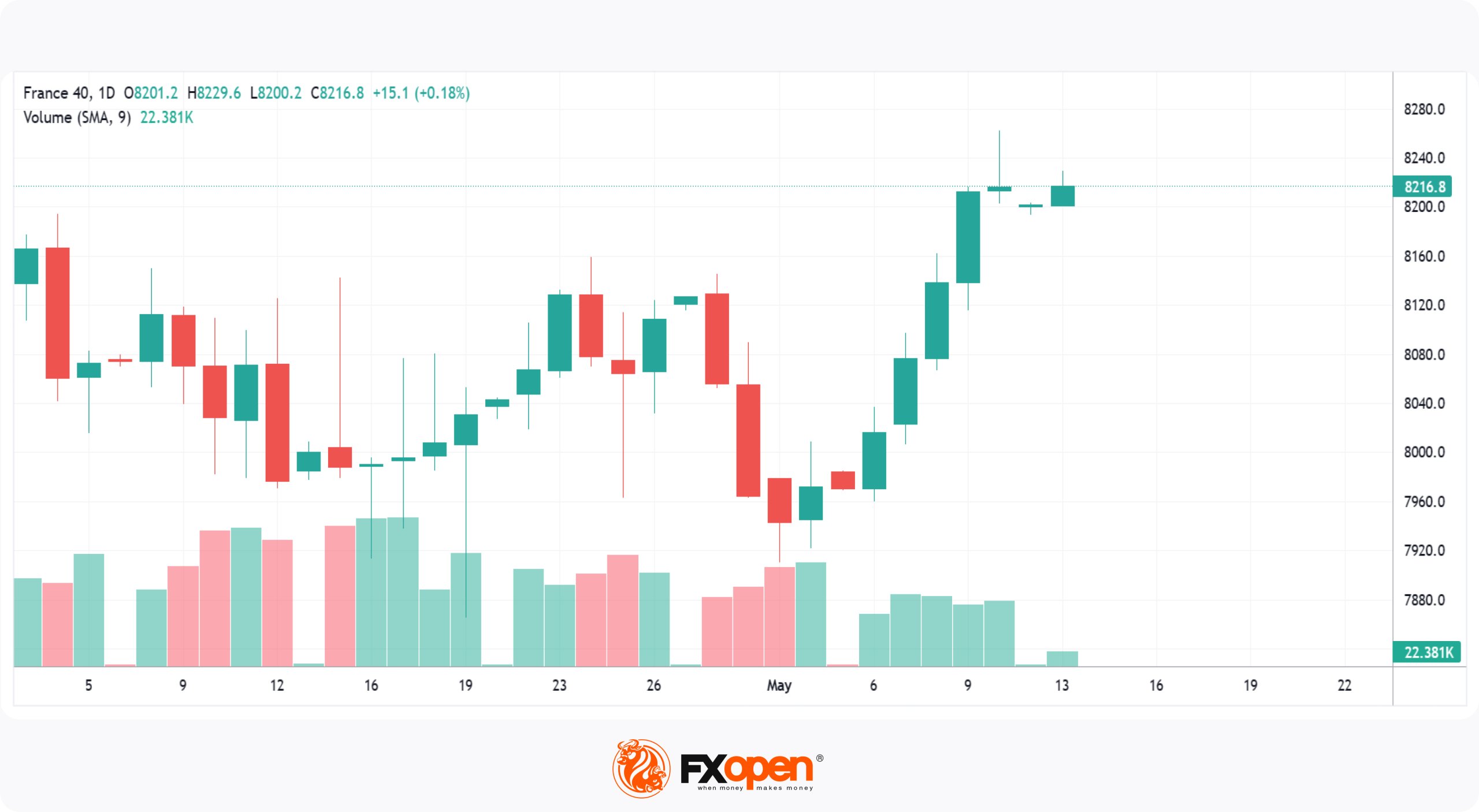

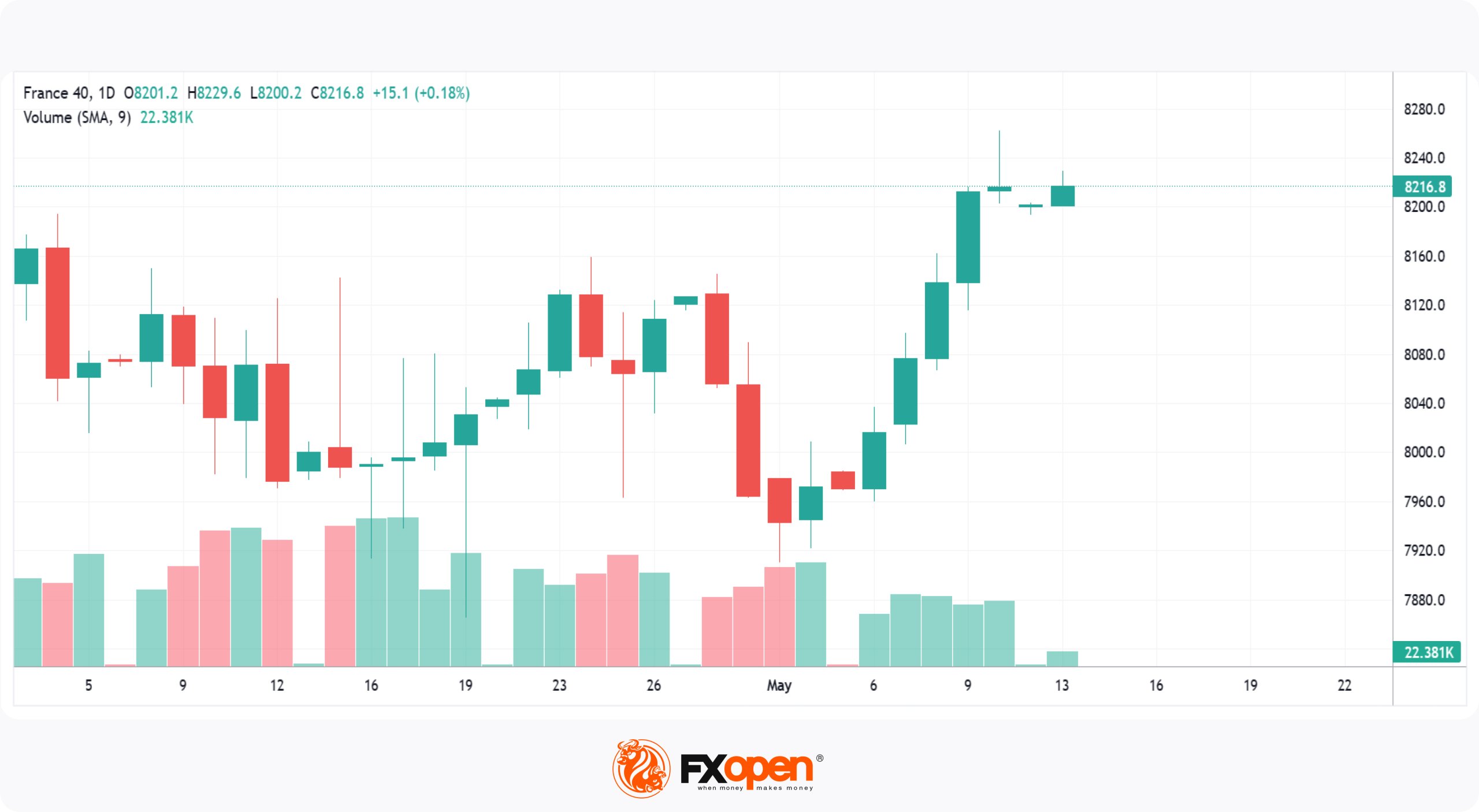

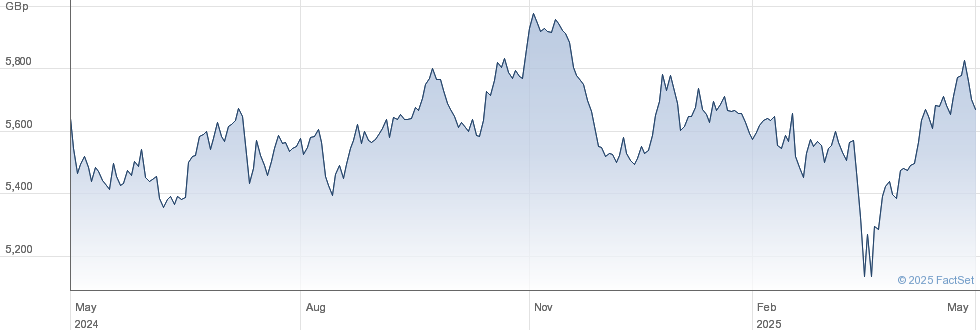

- Compared to other major European indices, the DAX outperformed both the CAC 40 and FTSE 100 on [Insert Date], highlighting the unique strength of the German market. This outperformance signals potentially stronger growth prospects for German equities relative to its European counterparts.

Key Factors Driving the DAX's Record Highs

The DAX's surge to record highs is not a singular event but rather the culmination of several positive factors impacting the German economy and investor sentiment. Understanding these growth drivers is crucial for assessing the sustainability of the current trend and the potential for future gains.

- Positive Economic Indicators: Recent economic data for Germany has been encouraging. [Insert Specific Data, e.g., GDP growth exceeding expectations, positive inflation figures within the target range]. These figures suggest a healthy and growing German economy, boosting investor confidence.

- Strong Corporate Earnings: Several DAX-listed companies have reported strong corporate earnings, exceeding analysts' expectations. [Insert Examples of Companies and Sectors, e.g., the technology sector showing strong growth, automotive sector recovering from previous setbacks]. These strong earnings demonstrate the underlying health and profitability of many German businesses.

- Global and Regional Events: [Insert specific global or regional events, e.g., positive geopolitical developments, easing of trade tensions]. These events have contributed to a more positive global outlook, which has positively impacted investor sentiment and flows into the German market.

- Government Policies: [Insert details of any recent supportive government policies, e.g., investments in green technology, infrastructure spending]. These policies foster economic growth and create a positive environment for business investment, further contributing to the DAX's growth.

Implications for Investors: Opportunities and Risks in the DAX

The DAX's rise to record highs presents both opportunities and risks for investors. Understanding these nuances is crucial for developing a sound investment strategy.

- Opportunities: The DAX's strong performance suggests potential for long-term growth, offering attractive opportunities for investors with a long-term horizon. The strong economic fundamentals of Germany support this potential for continued growth.

- Risks: Investing at record highs inherently carries a risk of a potential market correction. A sudden downturn could lead to significant losses. The current high valuations also need to be considered in any investment strategy.

- Risk Management: Diversification is key to mitigate risk. Investors should diversify their portfolios across different asset classes and sectors to reduce their exposure to any single market downturn. Utilizing stop-loss orders can help limit potential losses.

- Recommendations: Investors should carefully consider their investment horizon – long-term investors may be better positioned to weather potential short-term volatility. Consultation with a financial advisor is always recommended before making significant investment decisions in the DAX or any other market.

Conclusion

The DAX's recent surge to record highs is a testament to the strength of the German economy and the positive sentiment among investors. The strong opening performance and positive economic indicators all contribute to this upward trend. While the opportunities are compelling, investors must also be aware of the inherent risks associated with investing at such high levels.

Stay up-to-date on the latest DAX movements and capitalize on the opportunities presented by this dynamic market. Learn more about investing in the DAX and build a robust investment strategy today! Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value

May 24, 2025 -

Tracking The Daily Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025

Tracking The Daily Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025 -

Ranking The 10 Fastest Production Ferraris On Fiorano

May 24, 2025

Ranking The 10 Fastest Production Ferraris On Fiorano

May 24, 2025 -

880 Cv De Potencia Hibrida Conheca A Ferrari 296 Speciale

May 24, 2025

880 Cv De Potencia Hibrida Conheca A Ferrari 296 Speciale

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Significance

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Significance

May 24, 2025

Latest Posts

-

Analisi Borsa Focus Su Fed Banche Italiane E Italgas

May 24, 2025

Analisi Borsa Focus Su Fed Banche Italiane E Italgas

May 24, 2025 -

Mercati Europei Impatto Della Fed Performance Banche E Italgas

May 24, 2025

Mercati Europei Impatto Della Fed Performance Banche E Italgas

May 24, 2025 -

Borsa Italiana La Prudenza Prevale In Attesa Della Decisione Della Fed

May 24, 2025

Borsa Italiana La Prudenza Prevale In Attesa Della Decisione Della Fed

May 24, 2025 -

Borsa Europa Attenzione Fed Banche Deboli Italgas In Luce

May 24, 2025

Borsa Europa Attenzione Fed Banche Deboli Italgas In Luce

May 24, 2025 -

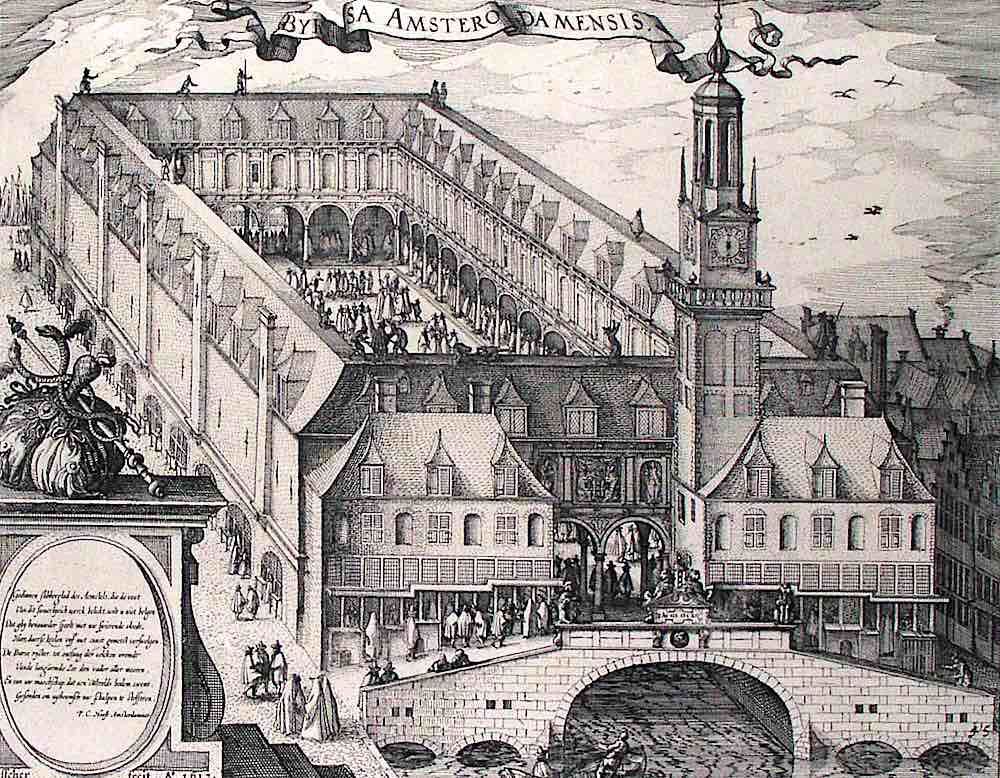

Amsterdam Stock Market 7 Opening Plunge Reflects Global Trade Uncertainty

May 24, 2025

Amsterdam Stock Market 7 Opening Plunge Reflects Global Trade Uncertainty

May 24, 2025