Bitcoin Vs. MicroStrategy Stock: Which To Invest In For 2025?

Table of Contents

Understanding Bitcoin's Investment Potential in 2025

Bitcoin's Volatility and Risk

Bitcoin's price is notoriously volatile. Its value fluctuates dramatically in response to various factors, making it a high-risk investment. These factors include:

- Regulation: Government regulations and policies around the world significantly influence Bitcoin's price. Positive regulatory developments can boost its value, while negative ones can trigger sharp declines.

- Adoption: Widespread adoption by businesses, institutions, and governments is crucial for Bitcoin's long-term success. Increased adoption generally correlates with price increases.

- Technological Advancements: Developments in Bitcoin's underlying technology, such as the Lightning Network, can impact its scalability and efficiency, influencing its market perception and price.

Investing in Bitcoin carries significant downsides:

- Price swings: Experience extreme price volatility, experiencing both substantial gains and losses in short periods.

- Regulatory uncertainty: The regulatory landscape for cryptocurrencies is still evolving, creating uncertainty and potential for future restrictions.

- Security risks: Security breaches on cryptocurrency exchanges and the loss of private keys can lead to significant financial losses for investors.

Bitcoin's Long-Term Growth Projections

Predicting Bitcoin's future price is inherently speculative, but several factors suggest potential for long-term growth:

- Increased institutional investment: Major financial institutions are increasingly allocating assets to Bitcoin, signaling growing acceptance and legitimacy.

- Growing adoption in developing countries: Bitcoin's potential as a store of value and a means of exchange in countries with unstable currencies is driving adoption.

- Potential use cases beyond currency: Bitcoin's underlying blockchain technology has applications beyond cryptocurrency, opening up potential for future growth.

While predictions vary widely, many analysts believe Bitcoin's scarcity and growing adoption could lead to substantial price appreciation over the long term. However, it's crucial to remember that these are projections, and the actual outcome could differ significantly.

Bitcoin's Role in a Diversified Portfolio

Bitcoin can be a valuable addition to a diversified investment portfolio, but only as a small percentage. Its high volatility demands a cautious approach. Risk management strategies include:

- Portfolio diversification: Spread your investments across various asset classes to reduce overall portfolio risk.

- Hedging against inflation: Bitcoin's limited supply could make it a hedge against inflation in the long run.

- Exposure to a disruptive technology: Investing in Bitcoin provides exposure to a potentially transformative technology.

Analyzing MicroStrategy's Investment Prospects for 2025

MicroStrategy's Bitcoin Holdings and Business Model

MicroStrategy, a business intelligence company, has made a significant strategic bet on Bitcoin, accumulating a large holding of the cryptocurrency. This strategy directly links its financial performance to Bitcoin's price.

- Size of Bitcoin holdings: MicroStrategy holds a substantial amount of Bitcoin, making it one of the largest corporate holders globally.

- Revenue generation outside Bitcoin: MicroStrategy also generates revenue through its core business, offering business analytics software and services.

- Impact of Bitcoin price fluctuations on MicroStrategy's stock price: MicroStrategy's stock price is highly correlated with Bitcoin's price, making it a leveraged play on Bitcoin's performance.

Risks and Rewards of Investing in MicroStrategy

Investing in MicroStrategy offers both potential rewards and significant risks:

- Correlation with Bitcoin price: The company's performance is heavily dependent on Bitcoin's price, making its stock highly volatile.

- Potential for business diversification: MicroStrategy's core business could provide some level of diversification, though its Bitcoin holdings remain a dominant factor.

- Financial health of MicroStrategy: The financial strength and stability of MicroStrategy are important considerations for investors.

MicroStrategy's Stock Price Volatility

MicroStrategy's stock price exhibits significant volatility, closely mirroring Bitcoin's price fluctuations. While it may offer a slightly more regulated entry point into the Bitcoin market, it doesn't eliminate the inherent risk.

- Historical volatility data: Analyze past performance data to understand the extent of price fluctuations.

- Correlation analysis between MicroStrategy stock and Bitcoin price: Examine the relationship between the two to assess the level of dependency.

- Comparison of risk profiles: Compare the risk profile of MicroStrategy stock to that of direct Bitcoin investment.

Direct Bitcoin Investment vs. MicroStrategy Stock: A Direct Comparison

| Feature | Bitcoin | MicroStrategy Stock |

|---|---|---|

| Volatility | Very High | High (correlated to Bitcoin) |

| Risk Level | Very High | High |

| Potential Returns | Potentially very high, but also very low | Potentially high, but also very low |

| Liquidity | Generally high | High (traded on major stock exchanges) |

| Ease of Purchase | Relatively easy (through exchanges) | Easy (through brokerage accounts) |

Conclusion

Investing in either Bitcoin or MicroStrategy stock for 2025 involves significant risks and potential rewards. Bitcoin offers potentially higher returns but with substantially greater volatility. MicroStrategy provides a somewhat less volatile entry point to the Bitcoin market, but its performance remains tightly coupled to Bitcoin's price. The choice depends heavily on your risk tolerance and investment goals. Both options require careful research and understanding of the inherent risks.

Making the right choice between Bitcoin and MicroStrategy requires careful consideration of your investment strategy and risk appetite. Before investing in either Bitcoin or MicroStrategy stock, conduct thorough research and seek professional financial advice. Learn more about the intricacies of Bitcoin vs. MicroStrategy investment strategies and make informed decisions for your financial future.

Featured Posts

-

Bondis Alleged Possession Of The Epstein Client List Fact Or Fiction

May 09, 2025

Bondis Alleged Possession Of The Epstein Client List Fact Or Fiction

May 09, 2025 -

February 15th Nyt Strands Puzzle 349 Complete Walkthrough

May 09, 2025

February 15th Nyt Strands Puzzle 349 Complete Walkthrough

May 09, 2025 -

Alaskan Protest Against Doge And Trump Administration Hundreds Gather

May 09, 2025

Alaskan Protest Against Doge And Trump Administration Hundreds Gather

May 09, 2025 -

Psychologists Controversial Daycare Claim Sparks Debate

May 09, 2025

Psychologists Controversial Daycare Claim Sparks Debate

May 09, 2025 -

Hollywood Shutdown Actors And Writers On Strike Impacting Film And Television

May 09, 2025

Hollywood Shutdown Actors And Writers On Strike Impacting Film And Television

May 09, 2025

Latest Posts

-

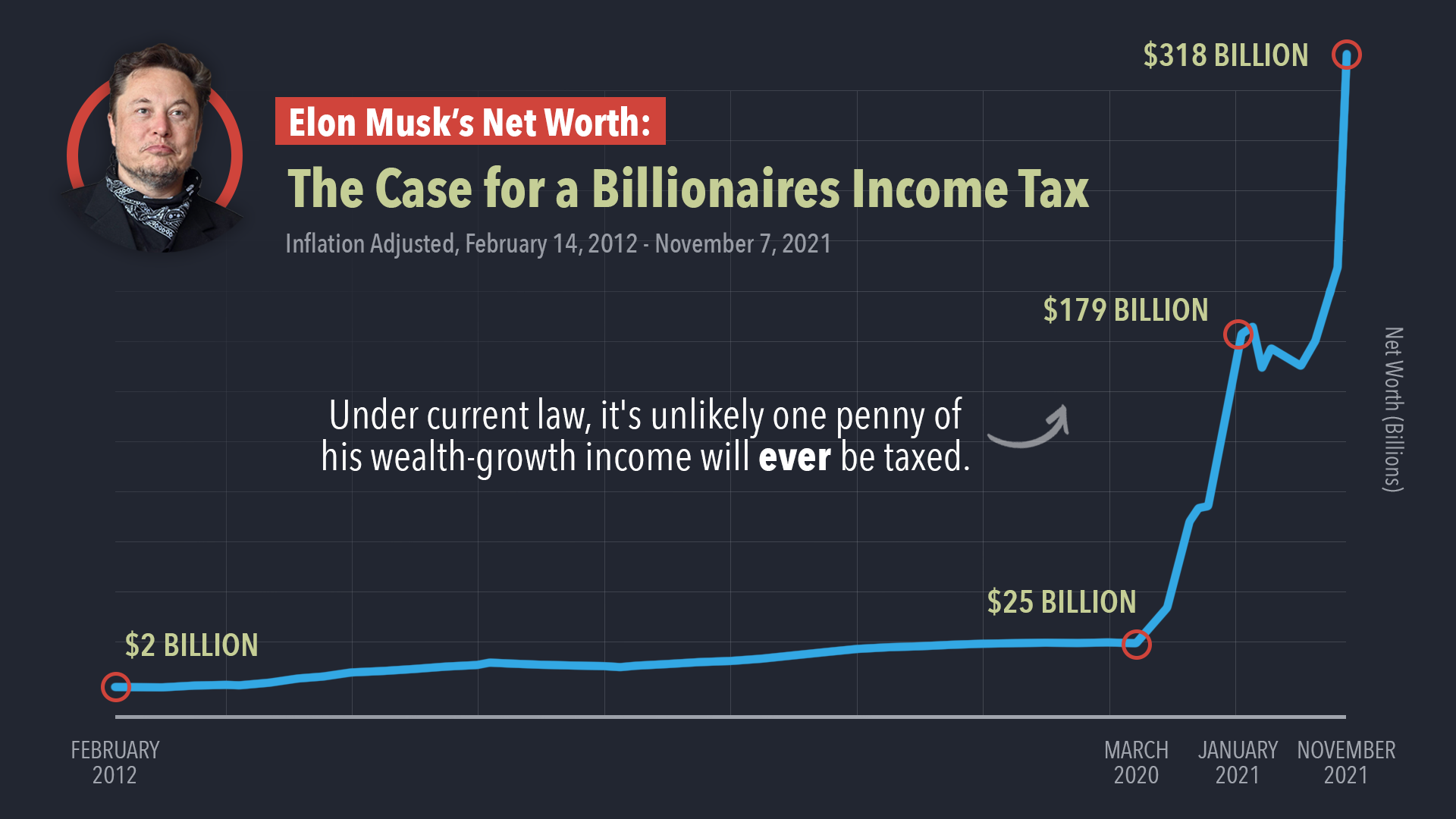

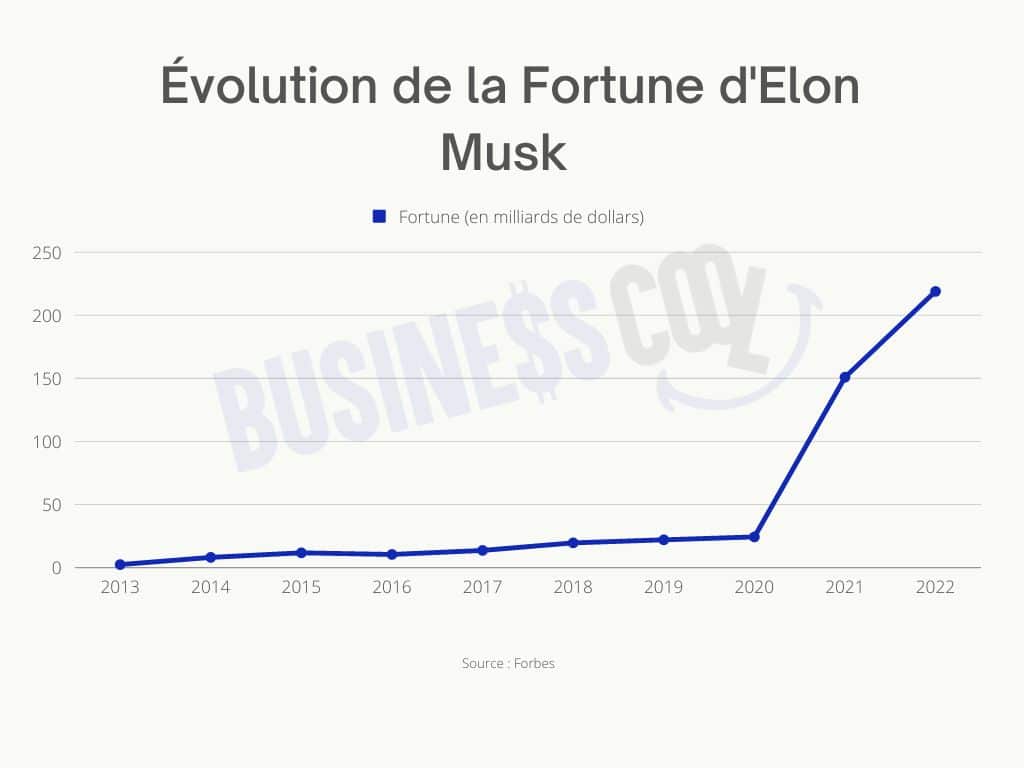

Examining The Relationship Between Us Economic Power And Elon Musks Wealth

May 10, 2025

Examining The Relationship Between Us Economic Power And Elon Musks Wealth

May 10, 2025 -

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Trends

May 10, 2025

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Trends

May 10, 2025 -

Teslas Success And Elon Musks Fortune An Examination Of Us Economic Factors

May 10, 2025

Teslas Success And Elon Musks Fortune An Examination Of Us Economic Factors

May 10, 2025 -

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025 -

The Tesla Dogecoin Connection Analyzing The Recent Market Volatility

May 10, 2025

The Tesla Dogecoin Connection Analyzing The Recent Market Volatility

May 10, 2025