Bitcoin's Recovery: Understanding The Factors Driving The Rebound

Table of Contents

Institutional Adoption and Investment

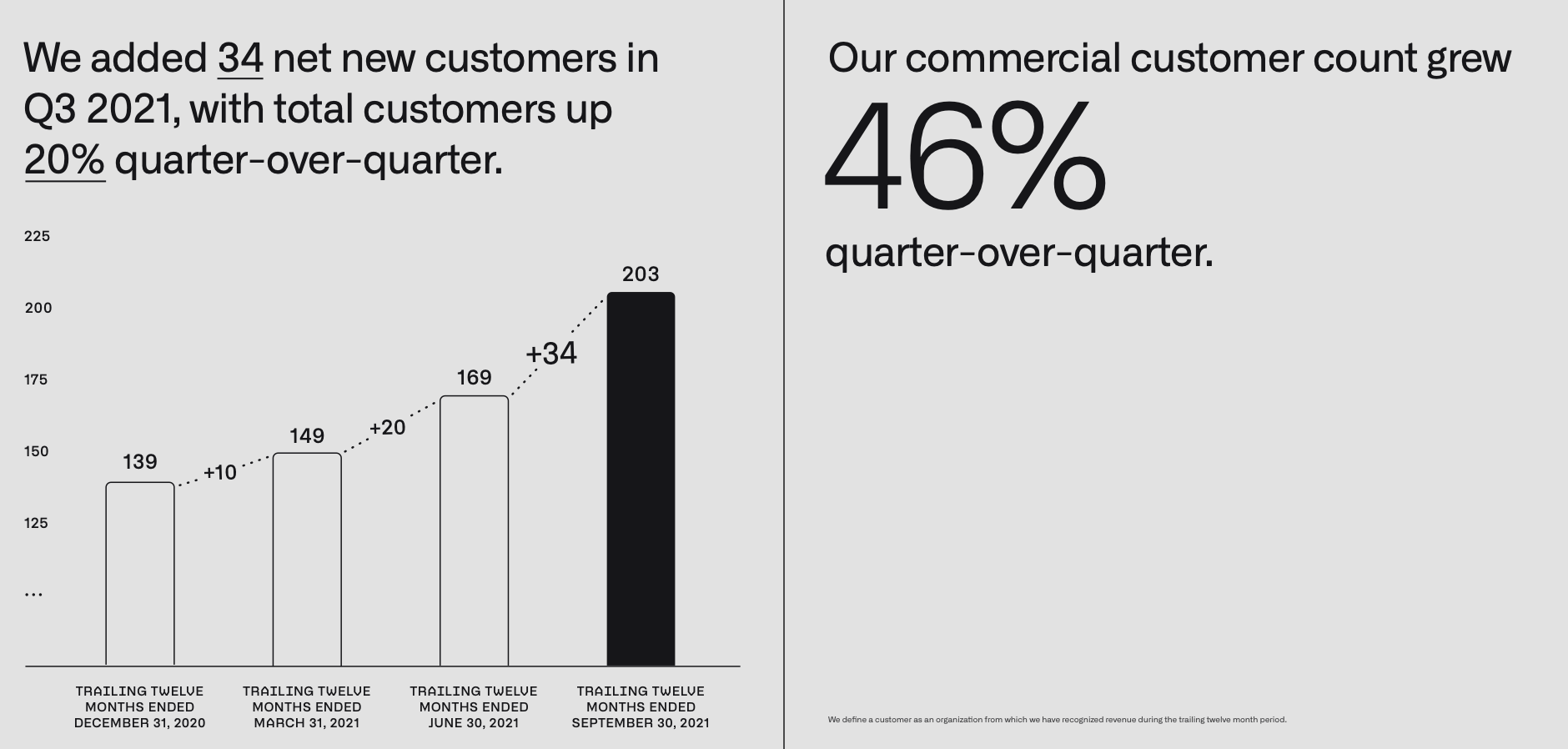

The growing acceptance of Bitcoin by institutional investors is a significant driver of Bitcoin's recovery. Hedge funds, corporations, and other large financial players are increasingly allocating capital to Bitcoin, viewing it as a valuable asset in their portfolios. This shift reflects a growing maturity in the cryptocurrency market and increased confidence in Bitcoin's long-term potential.

- Increased regulatory clarity in some jurisdictions: As regulatory frameworks around Bitcoin become clearer and more defined in certain regions, institutional investors feel more comfortable entering the market. This reduced regulatory uncertainty is a key catalyst for institutional investment.

- Growing belief in Bitcoin as a hedge against inflation: With persistent global inflation, many investors see Bitcoin as a potential hedge against the erosion of fiat currencies. Its fixed supply of 21 million coins makes it an attractive alternative asset in times of economic uncertainty.

- Examples of large-scale Bitcoin investments by major companies: Several publicly traded companies have made significant Bitcoin acquisitions, further legitimizing it as an asset class worthy of institutional consideration. These high-profile investments serve as strong signals to other potential investors.

- The role of Bitcoin ETFs in driving institutional interest: The potential approval of Bitcoin exchange-traded funds (ETFs) in major markets would significantly increase accessibility for institutional investors, potentially leading to a massive influx of capital into the Bitcoin market and further fueling Bitcoin's price recovery.

Macroeconomic Factors and Inflation

Global macroeconomic conditions play a crucial role in Bitcoin's price fluctuations. The current inflationary environment and economic uncertainty are pushing investors towards alternative assets, including Bitcoin.

- The relationship between inflation and Bitcoin's price: Historically, Bitcoin's price has often shown an inverse correlation with the US dollar's value, suggesting that during periods of high inflation, investors often seek refuge in Bitcoin as a store of value.

- How quantitative easing (QE) policies influence cryptocurrency markets: The implementation of expansive monetary policies, like quantitative easing, can lead to increased inflation and devalue fiat currencies, potentially driving investors towards Bitcoin as a less inflationary alternative.

- Impact of rising interest rates on Bitcoin investment: While rising interest rates can impact investment in riskier assets like Bitcoin, the ongoing inflation often outweighs this effect, maintaining investor interest.

- The role of geopolitical instability in driving safe-haven investment: During times of geopolitical uncertainty, investors often seek safe-haven assets. Bitcoin, due to its decentralized nature and independence from government control, is increasingly viewed as a potential safe haven.

Technological Advancements and Network Upgrades

Ongoing technological advancements within the Bitcoin network are bolstering confidence and improving its efficiency, thereby contributing to Bitcoin's recovery.

- The Lightning Network and its impact on transaction speed and fees: The Lightning Network is a layer-2 scaling solution that significantly reduces transaction fees and speeds up processing times, making Bitcoin more practical for everyday transactions.

- Taproot upgrade and its role in improving scalability and privacy: The Taproot upgrade enhanced Bitcoin's scalability and improved transaction privacy, addressing some of the network's previous limitations and making it more appealing to users and investors.

- Ongoing development and future upgrades planned for Bitcoin: The continuous development and implementation of upgrades demonstrate the commitment of the Bitcoin community to improving the network's functionality and long-term sustainability.

- The significance of these improvements for Bitcoin's long-term viability: These technological enhancements contribute to Bitcoin's long-term viability as a secure, reliable, and efficient digital currency.

Growing Retail Investor Interest

Retail investor interest in Bitcoin is another significant factor driving its recovery. Increased accessibility and education are playing a crucial role in this growth.

- Increased accessibility of Bitcoin through user-friendly platforms: The emergence of user-friendly cryptocurrency exchanges and wallets has made it easier than ever for individuals to purchase and manage Bitcoin.

- Growing awareness and education about Bitcoin among the general public: Increased media coverage and educational resources are contributing to a wider understanding of Bitcoin and its potential.

- The influence of social media and online communities: Social media platforms and online communities play a significant role in spreading information about Bitcoin and fostering engagement among retail investors.

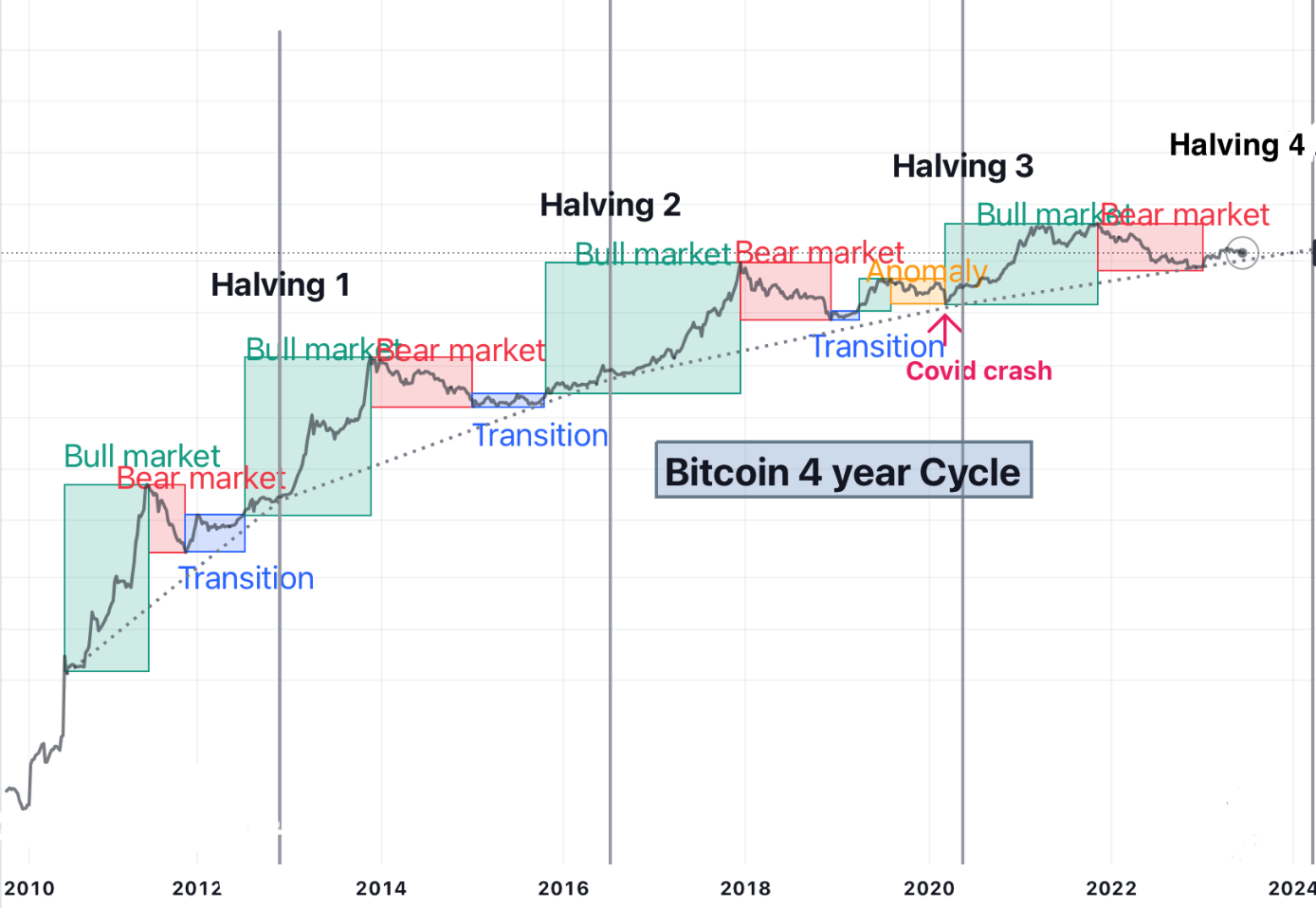

- The cyclical nature of retail investor enthusiasm: While retail investor sentiment can be volatile, the current surge in interest is contributing significantly to Bitcoin's price recovery.

Conclusion

Bitcoin's recovery is a result of a confluence of factors, including increased institutional adoption, the impact of macroeconomic conditions such as inflation, significant technological advancements, and growing interest from retail investors. Understanding these multifaceted drivers is crucial for navigating the complexities of the cryptocurrency market. The key takeaway is that Bitcoin's resurgence isn't a single event but a reflection of evolving market dynamics and the inherent value proposition of this innovative asset class. Stay informed about the latest developments in Bitcoin and explore the potential of this innovative asset class to better understand Bitcoin's price recovery and future market movements.

Featured Posts

-

Office365 Security Breach Nets Millions For Hacker According To Federal Authorities

May 09, 2025

Office365 Security Breach Nets Millions For Hacker According To Federal Authorities

May 09, 2025 -

Is Palantir Stock A Good Buy Before May 5th A Detailed Look

May 09, 2025

Is Palantir Stock A Good Buy Before May 5th A Detailed Look

May 09, 2025 -

Revised Palantir Stock Price Targets Following Market Rally

May 09, 2025

Revised Palantir Stock Price Targets Following Market Rally

May 09, 2025 -

Bitcoin Price Prediction 2024 Factors Affecting Btcs Future Value

May 09, 2025

Bitcoin Price Prediction 2024 Factors Affecting Btcs Future Value

May 09, 2025 -

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Gde Smotret

May 09, 2025

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Gde Smotret

May 09, 2025

Latest Posts

-

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025 -

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025 -

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025 -

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025