Brace For Impact: The Stock Market's Potential For Further Downturns

Table of Contents

Inflationary Pressures and Their Impact on Stock Market Performance

High inflation and stock market volatility are intrinsically linked. When prices rise rapidly, it erodes purchasing power and creates uncertainty. This uncertainty often leads to increased market volatility, as investors react to the changing economic landscape. The Federal Reserve and other central banks often combat inflation by raising interest rates. While this measure aims to curb inflation, it simultaneously impacts stock valuations negatively.

- Increased borrowing costs for companies: Higher interest rates make it more expensive for businesses to borrow money, hindering investment and potentially slowing economic growth. This can directly impact corporate earnings and lead to lower stock prices.

- Reduced consumer spending impacting corporate earnings: As the cost of goods and services increases, consumers have less disposable income, leading to reduced spending. This decrease in demand negatively affects corporate profits and, consequently, stock prices.

- Potential for a recession fueled by high inflation: Persistently high inflation can trigger a recession, as businesses struggle with rising costs and consumers cut back on spending. Recessions are historically associated with significant stock market corrections.

- Examples of historical periods: The stagflation of the 1970s serves as a stark example of how high inflation, coupled with slow economic growth, can lead to prolonged stock market corrections and significant losses. The relationship between inflation, interest rates, and recession is undeniable in shaping market performance.

Geopolitical Instability and its Ripple Effects on Global Markets

Geopolitical instability significantly impacts investor sentiment and market stability. Ongoing conflicts, such as the war in Ukraine, create uncertainty and risk aversion among investors. This uncertainty often leads to capital flight from riskier assets, driving down stock prices. Furthermore, global supply chain disruptions, often exacerbated by geopolitical events, contribute to economic uncertainty and inflationary pressures, further fueling market volatility.

- Increased uncertainty leading to risk aversion among investors: Investors tend to move towards safer assets (like government bonds) during periods of geopolitical instability, leading to a sell-off in riskier equity markets.

- Potential for further supply chain bottlenecks and inflationary pressures: Geopolitical events can disrupt global supply chains, leading to shortages of goods and services, driving up prices and exacerbating inflationary pressures.

- Impact on specific sectors: The energy sector, for example, is particularly vulnerable to geopolitical shocks, as are technology companies reliant on global supply chains. The impact of geopolitical risk varies across sectors, demanding a careful evaluation of portfolio exposure.

- Understanding global market volatility driven by supply chain disruptions is crucial for navigating these turbulent times.

Analyzing Potential Market Indicators Predicting Further Downturns

Predicting market downturns with certainty is impossible, but analyzing key economic indicators and using technical analysis can provide valuable insights. Monitoring these signals can help investors anticipate potential corrections or crashes.

- Inverted yield curve as a predictor of recession: An inverted yield curve (where short-term interest rates exceed long-term rates) is often seen as a reliable predictor of an upcoming recession.

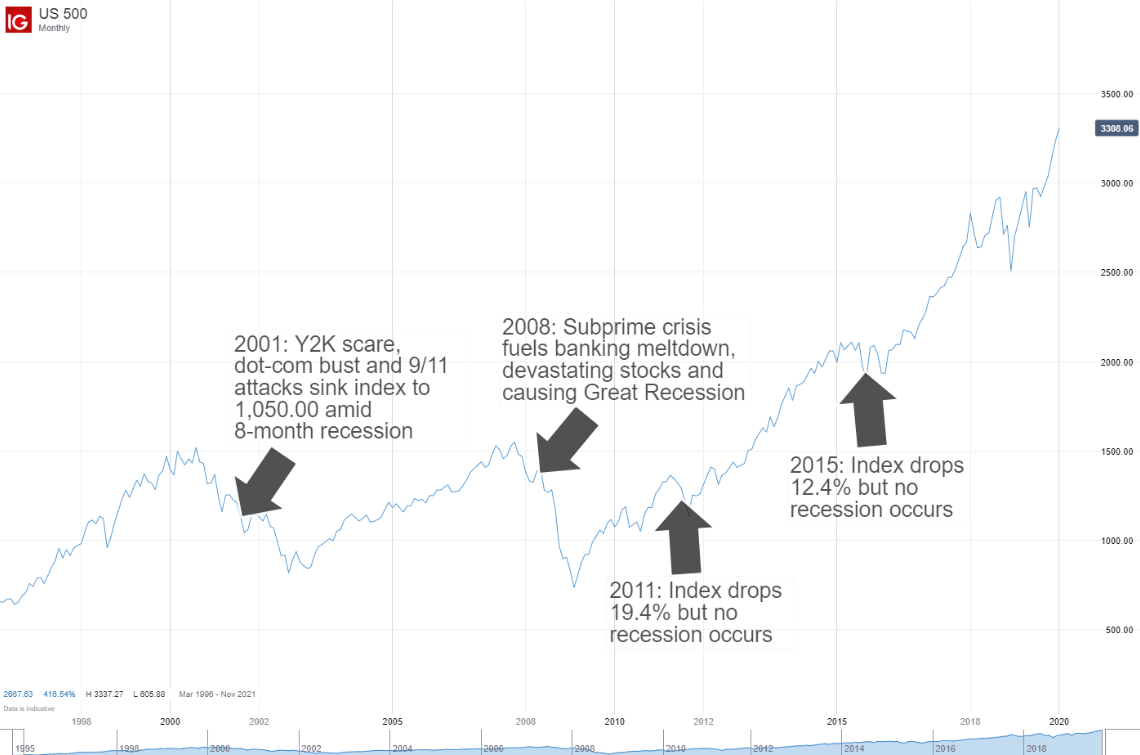

- Analysis of key market indices: Monitoring major indices like the S&P 500 and Dow Jones Industrial Average can provide insights into overall market trends and potential downturns. Analyzing their performance alongside other economic indicators is key.

- Importance of monitoring market sentiment through investor behavior: Investor behavior, as reflected in trading volume and market breadth, can signal shifts in market sentiment and potential turning points. Understanding market sentiment helps gauge potential changes.

- By combining fundamental analysis of economic indicators with technical analysis, investors can improve their recession prediction capabilities.

Strategies for Navigating Potential Stock Market Downturns

While predicting market downturns is difficult, investors can take proactive steps to mitigate risks and minimize potential losses. A robust investment strategy is paramount during periods of market uncertainty.

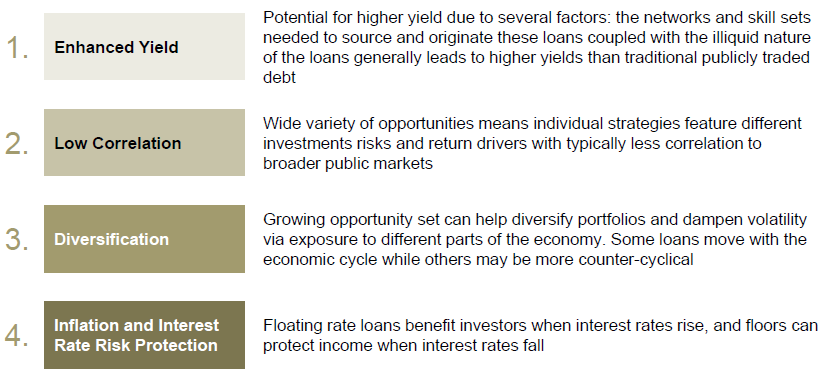

- Importance of a well-diversified investment portfolio: Diversification across different asset classes (stocks, bonds, real estate) and sectors helps to reduce risk. This approach minimizes the impact of any single asset underperforming.

- Strategies for reducing exposure to high-risk assets: During periods of heightened uncertainty, reducing exposure to high-risk assets, such as speculative stocks, is advisable.

- Consideration of defensive stocks during market downturns: Defensive stocks (e.g., consumer staples, utilities) tend to perform relatively well during economic downturns.

- Importance of a long-term investment horizon: Maintaining a long-term investment horizon allows investors to ride out short-term market fluctuations. A long-term perspective is crucial for weathering stock market downturns. Understanding risk mitigation and portfolio diversification is key to long-term success.

Preparing for Stock Market Downturns

This article has highlighted several key risks and potential indicators of further stock market downturns, including inflationary pressures, geopolitical instability, and concerning economic indicators. Proactive investment strategies, including diversification, risk mitigation, and a long-term perspective, are crucial for mitigating potential losses. Conduct thorough research, seek professional financial advice tailored to your individual circumstances, and develop a robust plan to navigate future stock market downturns. Remember that understanding stock market corrections and adopting a well-defined strategy for defensive investing are essential components of successful long-term investing. By proactively addressing potential stock market downturns, you can improve your chances of navigating these challenges and achieving your financial goals. For further information on investment strategies and market analysis, consult reputable financial news websites and investment platforms.

Featured Posts

-

Ukraine Conflict Kyivs Response To Trumps Peace Plan

Apr 22, 2025

Ukraine Conflict Kyivs Response To Trumps Peace Plan

Apr 22, 2025 -

Another 1 Billion Trump Administrations Renewed Assault On Harvard Funding

Apr 22, 2025

Another 1 Billion Trump Administrations Renewed Assault On Harvard Funding

Apr 22, 2025 -

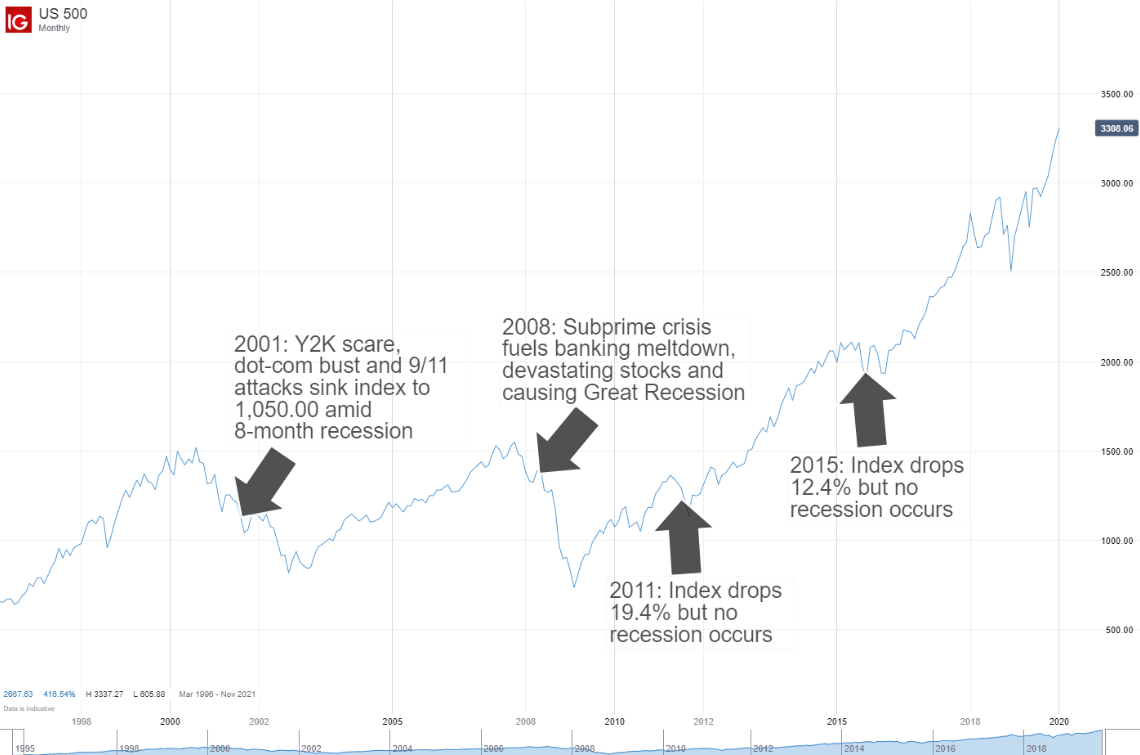

Investigation Into Hegseths Private Communications Military Data Breach Concerns

Apr 22, 2025

Investigation Into Hegseths Private Communications Military Data Breach Concerns

Apr 22, 2025 -

Hegseths Leaked Signal Chats Reveal Sensitive Military Information Shared With Wife And Brother

Apr 22, 2025

Hegseths Leaked Signal Chats Reveal Sensitive Military Information Shared With Wife And Brother

Apr 22, 2025 -

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025

Latest Posts

-

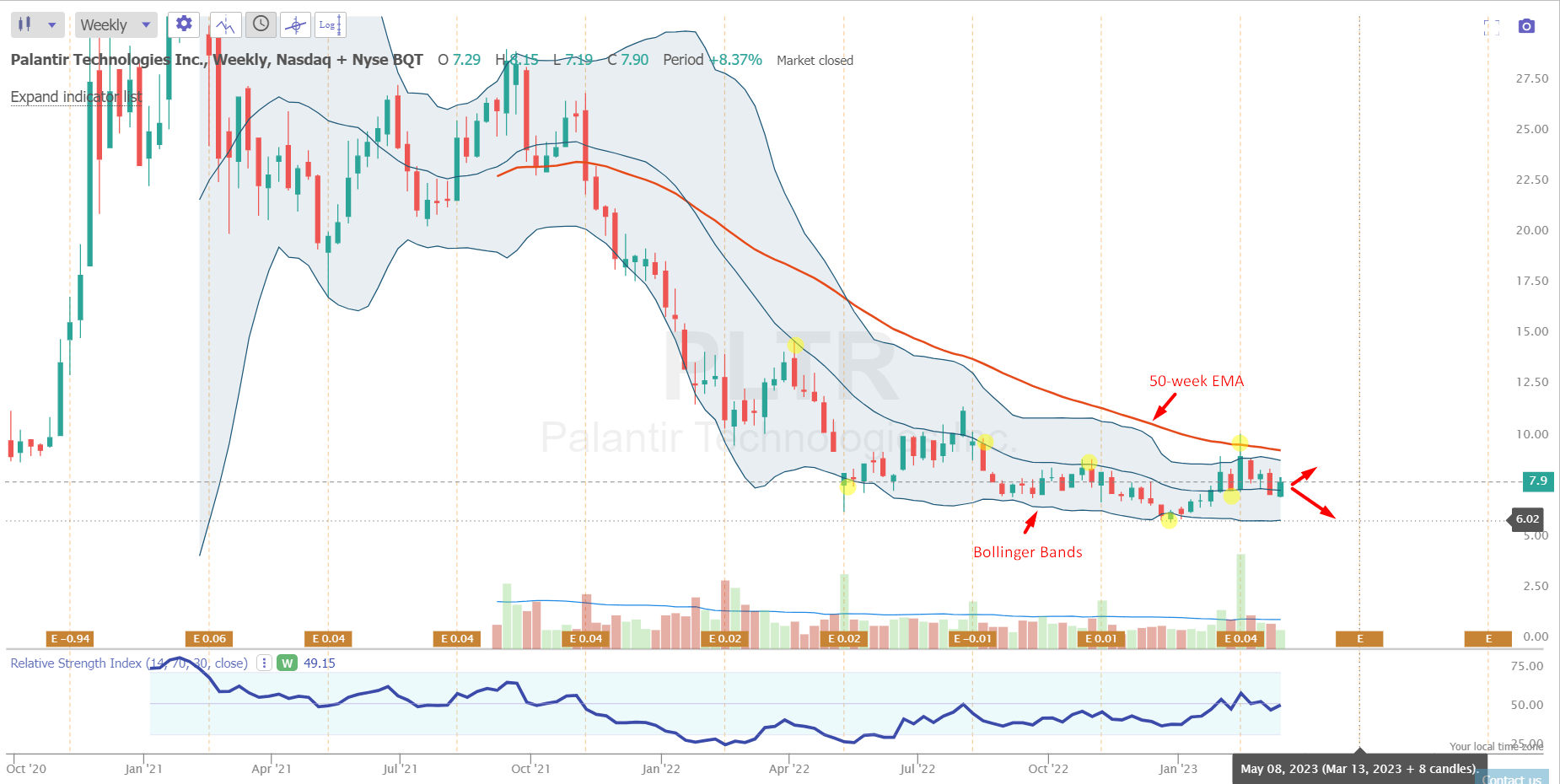

Palantir Technologies Stock Buy Sell Or Hold An Investment Guide

May 10, 2025

Palantir Technologies Stock Buy Sell Or Hold An Investment Guide

May 10, 2025 -

Is Palantir Stock A Good Investment In 2024 Pros Cons And Predictions

May 10, 2025

Is Palantir Stock A Good Investment In 2024 Pros Cons And Predictions

May 10, 2025 -

Should You Buy Palantir Technologies Stock In 2024

May 10, 2025

Should You Buy Palantir Technologies Stock In 2024

May 10, 2025 -

Palantir Technologies Stock Buy Sell Or Hold A Current Market Assessment

May 10, 2025

Palantir Technologies Stock Buy Sell Or Hold A Current Market Assessment

May 10, 2025 -

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 10, 2025

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 10, 2025