Broadcom's Proposed VMware Price Hike: A 1,050% Increase For AT&T

Table of Contents

The Magnitude of the Price Increase and its Impact on AT&T

The 1,050% price hike imposed on AT&T by Broadcom represents a monumental increase in licensing costs for VMware software. While the exact dollar figure remains undisclosed publicly, the scale of the increase is undeniably significant, potentially amounting to hundreds of millions, if not billions, of dollars annually for AT&T. This sudden financial burden places immense strain on AT&T's budget, forcing the company to reassess its IT spending priorities and potentially impacting other strategic initiatives.

- Quantify the cost increase in dollars: While the precise figure is confidential, industry analysts estimate the increase to be in the hundreds of millions, potentially impacting AT&T's bottom line drastically.

- Explain how this impacts AT&T’s bottom line: Such a substantial increase directly reduces AT&T's profitability, potentially impacting shareholder returns and investment decisions.

- Discuss potential service changes due to increased costs: To offset the increased VMware licensing costs, AT&T may be forced to consider service reductions, price increases for its own customers, or cut costs elsewhere.

Broadcom's Justification for the VMware Price Increase

Broadcom has yet to offer a fully transparent and satisfactory explanation for the exorbitant price increase. While the company may cite factors such as increased development costs, market demand, or the integration of VMware's technology into its broader portfolio, these justifications fall short of explaining the sheer magnitude of the 1,050% jump. A closer look suggests a potential strategy to maximize profits post-acquisition, potentially leveraging their market dominance to squeeze existing customers.

- Summarize Broadcom's official statement on the price increase: Broadcom's official statements have largely lacked specifics regarding the reasons for such a substantial price increase, leading to speculation and criticism.

- Analyze potential underlying factors contributing to the increase: Increased development costs, market dynamics, and a post-acquisition strategy to maximize returns are all potential factors but do not fully account for the sheer magnitude of the price hike.

- Compare Broadcom’s pricing to competitors: A comprehensive comparison with competitors' pricing strategies for similar virtualization solutions is crucial to assess whether Broadcom's pricing is justified or constitutes anti-competitive behavior.

Potential Implications for Other VMware Customers

The implications of this price increase extend far beyond AT&T. Other VMware customers are now understandably concerned about the risk of facing similar drastic price hikes. The situation raises concerns about "vendor lock-in," where businesses become heavily reliant on a single provider, leaving them with limited leverage in negotiating pricing.

- Highlight the potential financial burden on other businesses: Businesses of all sizes that rely heavily on VMware solutions now face the unsettling prospect of experiencing similarly substantial price increases.

- Discuss the options available to clients facing price increases: Options for clients include negotiating new contract terms, seeking alternative virtualization solutions, or exploring legal avenues to challenge the price hike.

- Analyze the risk of future price hikes from Broadcom: The precedent set by the AT&T case significantly increases the risk of future price hikes for other VMware customers, creating uncertainty and market instability.

Regulatory Scrutiny and Antitrust Concerns

The massive price increase following Broadcom's acquisition of VMware has inevitably attracted the attention of regulatory bodies and sparked significant antitrust concerns. The potential for monopolistic practices and the impact on competition within the enterprise software market warrant thorough investigation.

- Mention relevant regulatory bodies involved or potentially involved: Agencies like the FTC (Federal Trade Commission) in the US and similar antitrust authorities in other jurisdictions are likely to scrutinize this situation closely.

- Discuss the potential consequences of antitrust violations: Potential consequences for Broadcom could include hefty fines, mandated price reductions, or even forced divestiture of VMware.

- Highlight any ongoing or potential investigations: Any ongoing or future investigations into Broadcom's pricing practices and the impact of the VMware acquisition will significantly influence the future of enterprise software pricing.

Conclusion: Navigating the Broadcom VMware Price Hike Landscape

The 1,050% price increase imposed on AT&T by Broadcom serves as a stark warning to all businesses relying on enterprise software. Broadcom's justification remains unconvincing, and the potential for similar price hikes amongst other VMware customers remains a significant concern. Regulatory scrutiny is inevitable, and the long-term implications for the competitive landscape are far-reaching.

It's crucial for businesses to proactively assess their own VMware contracts, explore alternative virtualization solutions, and closely monitor the ongoing developments in this situation. Don't wait for a similar shock to your bottom line. Carefully examine your VMware pricing, understand the implications of the Broadcom acquisition, and proactively develop strategies for managing enterprise software costs. The future of enterprise software pricing is uncertain, but proactive planning can mitigate the risks of unexpected and substantial cost increases. Don't be caught unprepared; take control of your VMware licensing costs today.

Featured Posts

-

Pope Francis Death A Global Loss And A Time Of Reflection

Apr 22, 2025

Pope Francis Death A Global Loss And A Time Of Reflection

Apr 22, 2025 -

Saudi Aramco And Byd Partner To Explore Ev Technology

Apr 22, 2025

Saudi Aramco And Byd Partner To Explore Ev Technology

Apr 22, 2025 -

Hegseths Leaked Signal Chats Reveal Sensitive Military Information Shared With Wife And Brother

Apr 22, 2025

Hegseths Leaked Signal Chats Reveal Sensitive Military Information Shared With Wife And Brother

Apr 22, 2025 -

Stock Market Outlook Navigating The Current Challenges

Apr 22, 2025

Stock Market Outlook Navigating The Current Challenges

Apr 22, 2025 -

Analyzing The Impact Blue Origins Struggles Compared To Katy Perrys Career Trajectory

Apr 22, 2025

Analyzing The Impact Blue Origins Struggles Compared To Katy Perrys Career Trajectory

Apr 22, 2025

Latest Posts

-

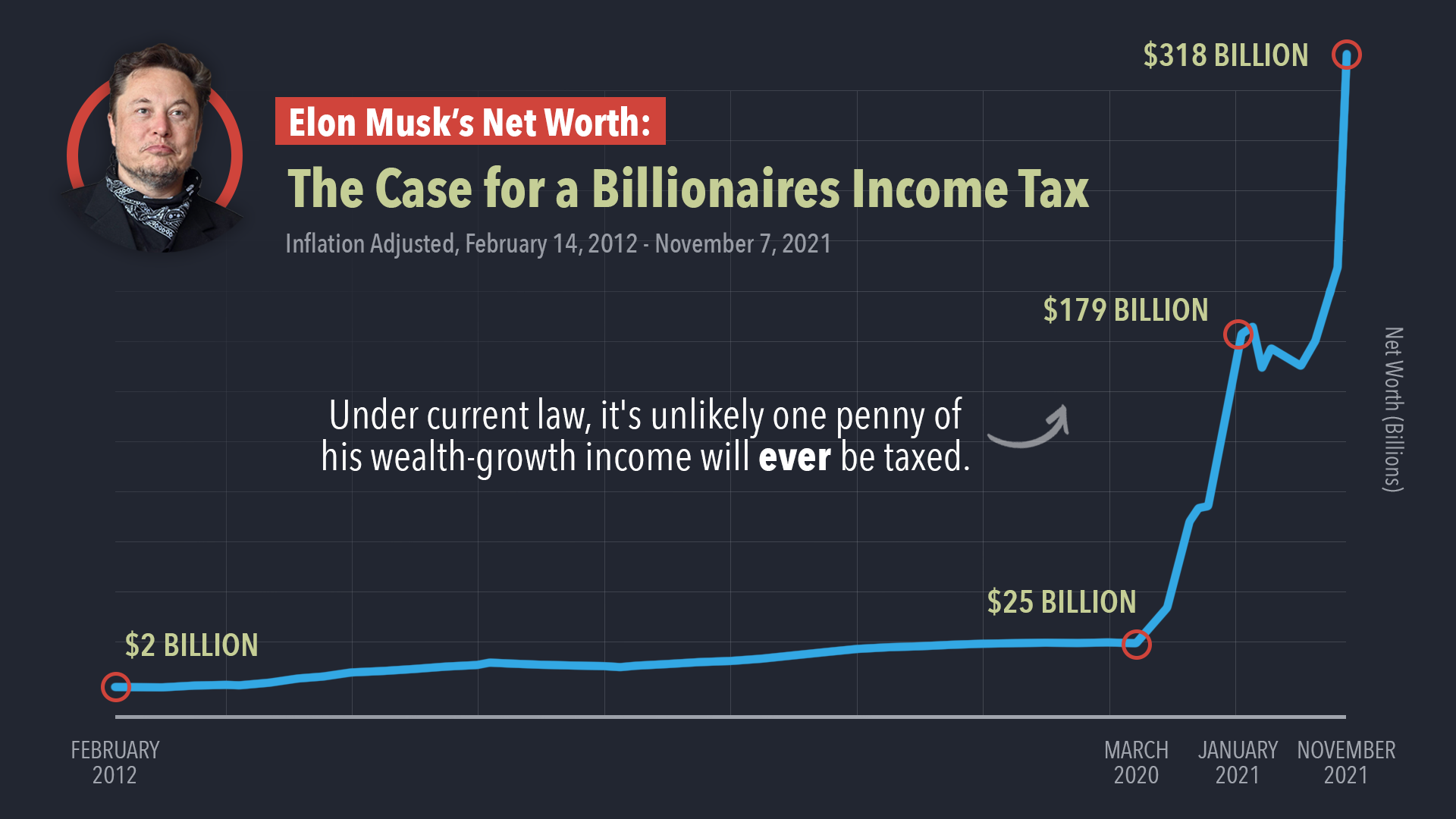

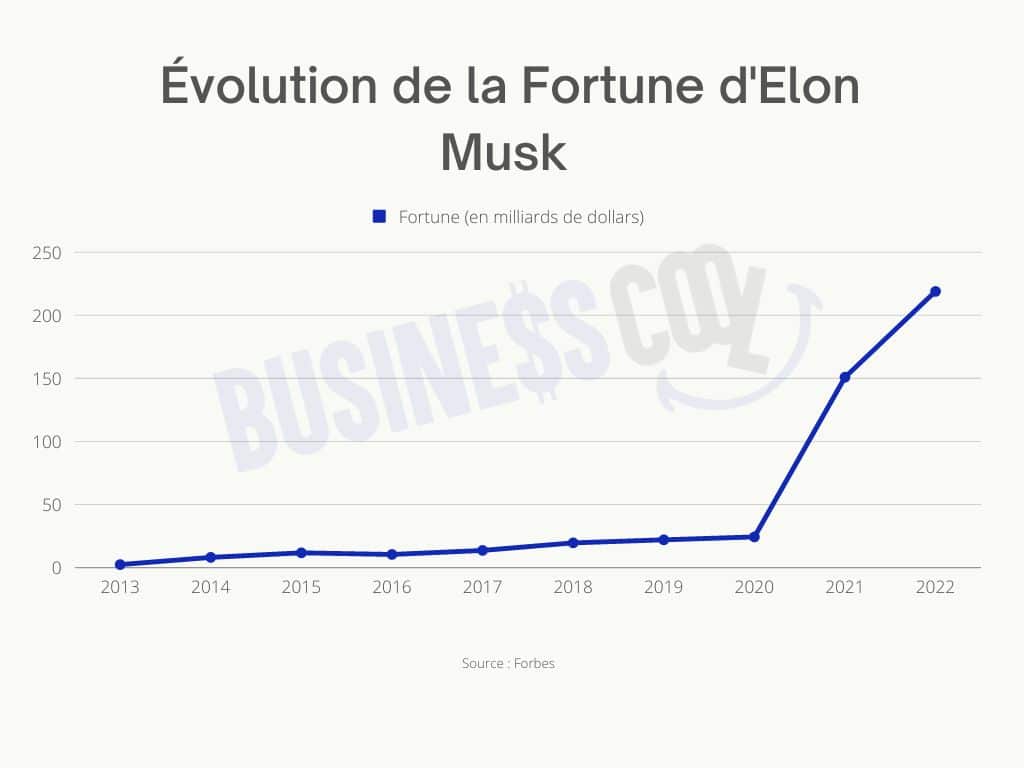

Examining The Relationship Between Us Economic Power And Elon Musks Wealth

May 10, 2025

Examining The Relationship Between Us Economic Power And Elon Musks Wealth

May 10, 2025 -

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Trends

May 10, 2025

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Trends

May 10, 2025 -

Teslas Success And Elon Musks Fortune An Examination Of Us Economic Factors

May 10, 2025

Teslas Success And Elon Musks Fortune An Examination Of Us Economic Factors

May 10, 2025 -

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025 -

The Tesla Dogecoin Connection Analyzing The Recent Market Volatility

May 10, 2025

The Tesla Dogecoin Connection Analyzing The Recent Market Volatility

May 10, 2025