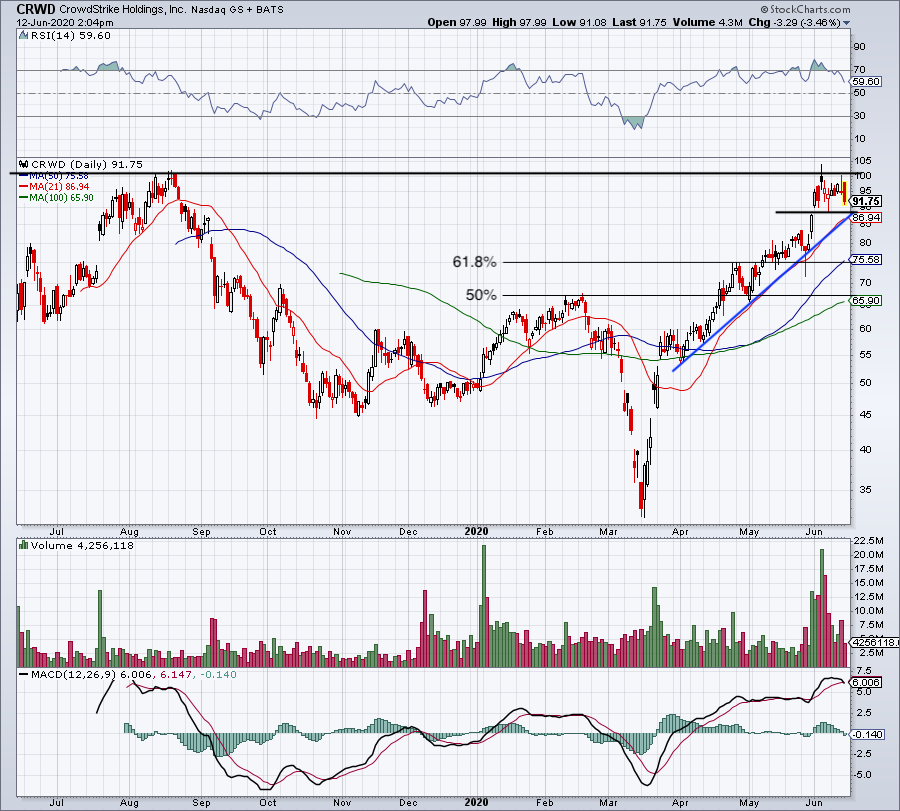

Why Did CoreWeave (CRWV) Stock Price Increase Today?

Table of Contents

Positive Earnings Report and Financial Performance

A strong earnings report often significantly impacts stock prices. Investors react positively to companies exceeding expectations, and CoreWeave is no exception. Let's examine the key financial metrics that might have contributed to the CRWV stock price increase:

-

Key Metrics: Did CoreWeave report higher-than-expected revenue? Did earnings per share (EPS) beat analyst estimates? Positive surprises in these key areas significantly influence investor sentiment. Investors look closely at the year-over-year growth and compare it to projections. A substantial increase in revenue and a positive EPS often signal strong financial health. Furthermore, the company's guidance for the coming quarters is critical. Positive future projections instill confidence and encourage investment.

-

Profitability: Increased profitability, often measured by gross margin and operating margin, is a strong indicator of a company's financial health. Improved margins demonstrate efficiency and cost-control, boosting investor confidence in CoreWeave's ability to generate sustainable profits. Any increase in profitability compared to previous quarters or analyst expectations would likely contribute to the positive stock price movement.

-

Customer Growth: A significant increase in customer acquisition or retention rates points to strong market demand for CoreWeave's services. A growing customer base, especially in the competitive cloud computing market, signifies market leadership and future potential, positively impacting investor perception and stock price. Analyzing the type of customers acquired – enterprise clients versus smaller businesses – also adds valuable context.

New Partnerships and Strategic Agreements

The announcement of major partnerships or strategic collaborations can inject significant positive momentum into a stock's price. For CoreWeave, new alliances could be a key driver behind the increase:

-

Industry Giants: Partnerships with established players in the cloud computing or data center industries could significantly bolster CoreWeave's credibility and market reach. Collaborations with industry leaders lend legitimacy and signal a commitment to growth and innovation. Such alliances often open doors to new customer segments and provide access to cutting-edge technologies.

-

Technology Advancements: Collaborations focusing on technological advancements, such as AI infrastructure or improved data processing capabilities, showcase CoreWeave's commitment to innovation and its ability to compete in a rapidly evolving market. This demonstrates future growth potential and can attract investors looking for companies at the forefront of technological innovation.

-

Market Expansion: Strategic alliances that help CoreWeave expand into new geographical markets or offer new services could drive substantial growth. Entering new markets diversifies revenue streams and mitigates risks, making the company more attractive to investors.

Market Sentiment and Overall Market Trends

The general market sentiment and broader industry trends significantly impact individual stock performance, including CoreWeave's.

-

Broader Tech Sector Performance: A positive performance in the overall technology sector, particularly within cloud computing and AI, creates a favorable environment for CoreWeave. When the tech sector is performing well, investors are often more inclined to invest in individual tech stocks, including CRWV.

-

Investor Confidence: Overall market confidence, influenced by macroeconomic factors like interest rates, inflation, and geopolitical stability, plays a critical role. Positive economic indicators often lead to increased investor confidence and a willingness to invest in riskier assets like growth stocks.

-

Analyst Ratings and Price Targets: Positive changes in analyst ratings or increases in price targets from reputable financial institutions can significantly boost investor optimism, leading to increased buying pressure and a subsequent rise in the stock price. A higher price target signals that analysts believe the stock is undervalued and is poised for further growth.

Speculative Trading and Short Covering

Sudden price spikes can be attributed to speculative trading activity or short covering.

-

Increased Trading Volume: An unusually high volume of trades might indicate significant buying pressure driven by speculation or short-sellers covering their positions. A surge in trading volume, combined with a price increase, often suggests substantial investor interest.

-

Social Media Influence: Positive sentiment expressed on social media platforms, especially among retail investors, could fuel a short-term price surge, even if not supported by fundamental factors. Social media buzz can create a bandwagon effect, leading to increased demand and higher prices.

-

Short Squeeze Potential: If a significant number of investors have bet against CoreWeave (short selling), a sudden rise in the stock price can trigger a short squeeze. Short sellers are forced to buy shares to cover their positions, further driving up the price.

Conclusion

Understanding why CoreWeave (CRWV) stock prices increased today requires a multifaceted analysis considering financial performance, strategic partnerships, overall market trends, and potential speculative trading activity. By examining these elements, investors can gain a more comprehensive understanding of the drivers behind the price change. To stay updated on CoreWeave's stock performance and future developments, continue to monitor its financial reports, news announcements, and analyst reviews. Regularly reviewing news and analysis concerning CoreWeave (CRWV) is essential for informed investment decisions. Understanding the intricacies of CRWV stock price fluctuations empowers you to make better-informed investment choices.

Featured Posts

-

A Baby Sister For Peppa Pig News And Excitement

May 22, 2025

A Baby Sister For Peppa Pig News And Excitement

May 22, 2025 -

Stephane De La Suisse A Paris L Ascension D Une Chanteuse

May 22, 2025

Stephane De La Suisse A Paris L Ascension D Une Chanteuse

May 22, 2025 -

Core Weave Crwv Jim Cramers Assessment And The Future Of Ai Infrastructure

May 22, 2025

Core Weave Crwv Jim Cramers Assessment And The Future Of Ai Infrastructure

May 22, 2025 -

Dancehall Musician Faces Travel Restrictions To Trinidad Kartels Message Of Support

May 22, 2025

Dancehall Musician Faces Travel Restrictions To Trinidad Kartels Message Of Support

May 22, 2025 -

Is Googles Ai Strategy Truly Sustainable Investor Confidence And The Future

May 22, 2025

Is Googles Ai Strategy Truly Sustainable Investor Confidence And The Future

May 22, 2025

Latest Posts

-

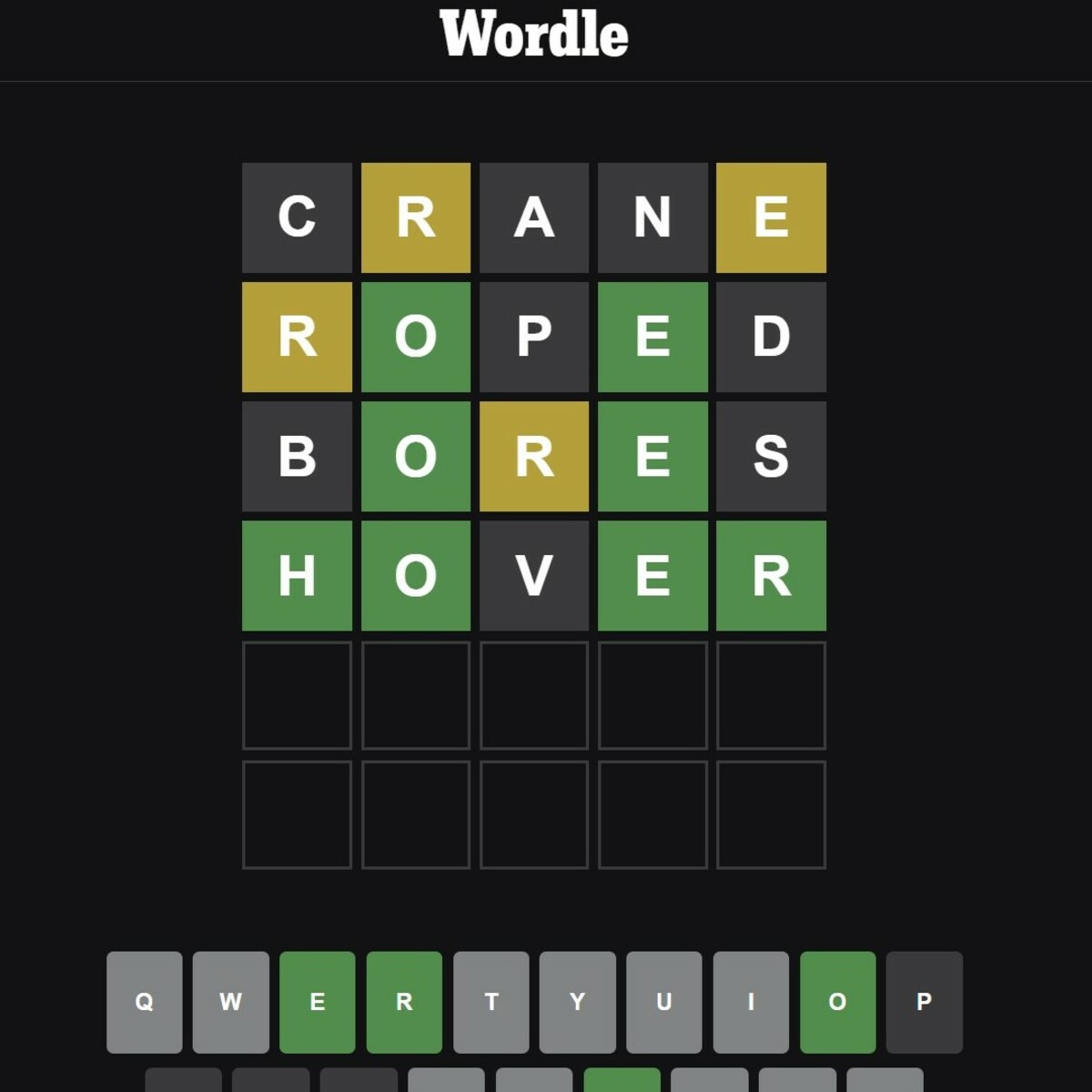

Wordle 370 March 20th Hints Clues And Answer

May 22, 2025

Wordle 370 March 20th Hints Clues And Answer

May 22, 2025 -

Wordle 370 Hints And Answer For Thursday March 20th

May 22, 2025

Wordle 370 Hints And Answer For Thursday March 20th

May 22, 2025 -

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025 -

Nyt Wordle Answer March 26 Difficulty And Solution

May 22, 2025

Nyt Wordle Answer March 26 Difficulty And Solution

May 22, 2025