Canadian Conservatives Vow To Lower Taxes, Curb Deficits

Table of Contents

Tax Reduction Proposals

The Conservative Party's platform includes a multi-pronged approach to tax reduction, aiming to stimulate economic growth and improve the lives of Canadians.

Personal Income Tax Cuts

The Conservatives propose significant cuts to personal income tax brackets. While specific percentages may vary depending on the final platform, the general aim is to provide tax relief for individuals across various income levels.

- Proposed changes: A potential reduction could involve lowering the top marginal tax rate and adjusting lower brackets to provide more disposable income for lower and middle-income earners.

- Impact on disposable income: Depending on the specifics, these cuts could lead to an increase in disposable income, potentially boosting consumer spending and economic activity. However, the extent of this impact will vary depending on the individual's income level and the specific tax bracket changes.

- Criticisms: Potential criticisms may centre on the distribution of tax cuts, with concerns that higher-income earners may benefit disproportionately. Arguments regarding the overall effectiveness of income tax cuts in stimulating economic growth compared to other fiscal policies will also likely surface.

Corporate Tax Rate Reductions

A cornerstone of the Conservative economic plan involves reducing the corporate tax rate. The party argues this will incentivize business investment, job creation, and ultimately, economic growth.

- Proposed corporate tax rate: The proposed reduction is expected to bring Canada's corporate tax rate more in line with other G7 countries, making it more competitive for attracting foreign investment.

- Impact on foreign investment: A lower corporate tax rate could make Canada a more attractive destination for foreign investment, potentially leading to increased job creation and economic activity.

- Impact on SMBs: The impact on small and medium-sized businesses (SMBs) is crucial. While a lower rate could benefit them, the actual effect will depend on the implementation and whether support measures are included to assist SMBs in navigating the changing tax landscape.

- International Comparison: Comparing Canada's proposed rate with those of other G7 nations will be essential to assess its competitiveness and potential effectiveness in attracting investment.

Other Tax Measures

Beyond personal and corporate income tax, the Conservatives may propose changes to other areas of the tax system.

- Capital gains tax: Potential adjustments to the capital gains tax rate could impact investment decisions and market activity.

- GST/HST: Any modifications to the Goods and Services Tax/Harmonized Sales Tax could significantly influence consumer spending and government revenue.

- Other indirect taxes: Changes to other indirect taxes, such as excise duties or environmental taxes, could have far-reaching effects on specific sectors and consumer behavior. Analysis of these potential changes will require a detailed examination of their projected impact on government revenue and the economy as a whole.

Deficit Reduction Strategies

The Conservatives' plan to curb the deficit involves a combination of spending cuts, efficiency improvements, and economic growth initiatives.

Spending Cuts

The party's platform will likely detail specific areas where spending cuts are proposed.

- Targeted programs: Identifying which government programs will face cuts is crucial. These could range from social programs to infrastructure projects.

- Projected savings: The Conservatives will need to demonstrate how these cuts will translate into significant savings for the government.

- Impact on public services: A critical aspect of the debate will focus on the potential negative impact of spending cuts on essential public services.

- Criticisms: Opposition parties and advocacy groups will likely criticize the choice of programs targeted for cuts and the potential consequences for vulnerable populations.

Increased Efficiency

Improving the efficiency of government operations is another key element of the Conservative plan.

- Measures for improvement: This could involve streamlining bureaucratic processes, leveraging technology, and eliminating redundancies.

- Estimated savings: Quantifying the potential savings from increased efficiency is critical to demonstrating the feasibility of the plan.

- Implementation challenges: Realizing increased efficiency in government operations is often challenging, requiring significant organizational changes and potentially facing resistance from within the bureaucracy.

Economic Growth Initiatives

Stimulating economic growth is essential to increase government revenue and reduce the deficit.

- Policies to boost growth: The Conservative plan may include measures such as deregulation, tax incentives for businesses, and investments in infrastructure.

- Projected growth rate: The Conservatives will need to provide realistic projections for economic growth resulting from their proposed policies.

- Risks and uncertainties: Unforeseen economic events or challenges in implementing policies could significantly affect the projected growth rate.

Potential Economic Impacts

The overall economic consequences of the Conservative economic policies are complex and require careful consideration.

Job Creation and Economic Growth

The Conservative party will likely argue that their tax cuts and spending policies will lead to significant job creation and economic growth.

- Projected job creation: The party will need to provide realistic projections for job creation based on their economic models.

- Potential GDP growth: Assessing the potential impact on GDP growth is crucial for evaluating the success of their plan.

- Influencing factors: A multitude of factors, including global economic conditions and the effectiveness of implementation, will influence the actual outcomes.

Inflationary Pressures

Tax cuts and increased spending could potentially lead to inflationary pressures.

- Potential inflationary pressures: Careful analysis is needed to assess the potential impact of the proposed policies on inflation.

- Measures to mitigate inflation: The Conservatives may need to outline measures to mitigate potential inflationary pressures, such as controlling government spending or raising interest rates.

- Impact on purchasing power: Inflation could erode the purchasing power of consumers, potentially negating some of the benefits of tax cuts.

Impact on Public Services

Spending cuts could significantly affect the quality and availability of public services.

- Areas potentially affected: Identifying which public services will be most impacted is critical.

- Consequences for citizens: The potential consequences for citizens, such as longer wait times for healthcare or reduced educational opportunities, will be a central point of debate.

- Alternative solutions: Exploring alternative solutions to reduce the deficit while minimizing the negative impact on public services is vital.

Conclusion

The Canadian Conservative Party's commitment to lower taxes and curb deficits represents a significant shift in economic policy. The success of this plan relies heavily on the effective implementation of tax reduction measures, careful management of spending cuts, and the successful stimulation of economic growth. The potential effects on job creation, inflation, and public services warrant careful scrutiny. Further analysis and informed public discussion are crucial to fully understand the long-term impacts of these proposed Canadian Conservative economic policies. Stay informed and actively engage in the conversation to understand how these potential changes might impact your future.

Featured Posts

-

High Profile Office365 Breach Results In Multi Million Dollar Loss

Apr 24, 2025

High Profile Office365 Breach Results In Multi Million Dollar Loss

Apr 24, 2025 -

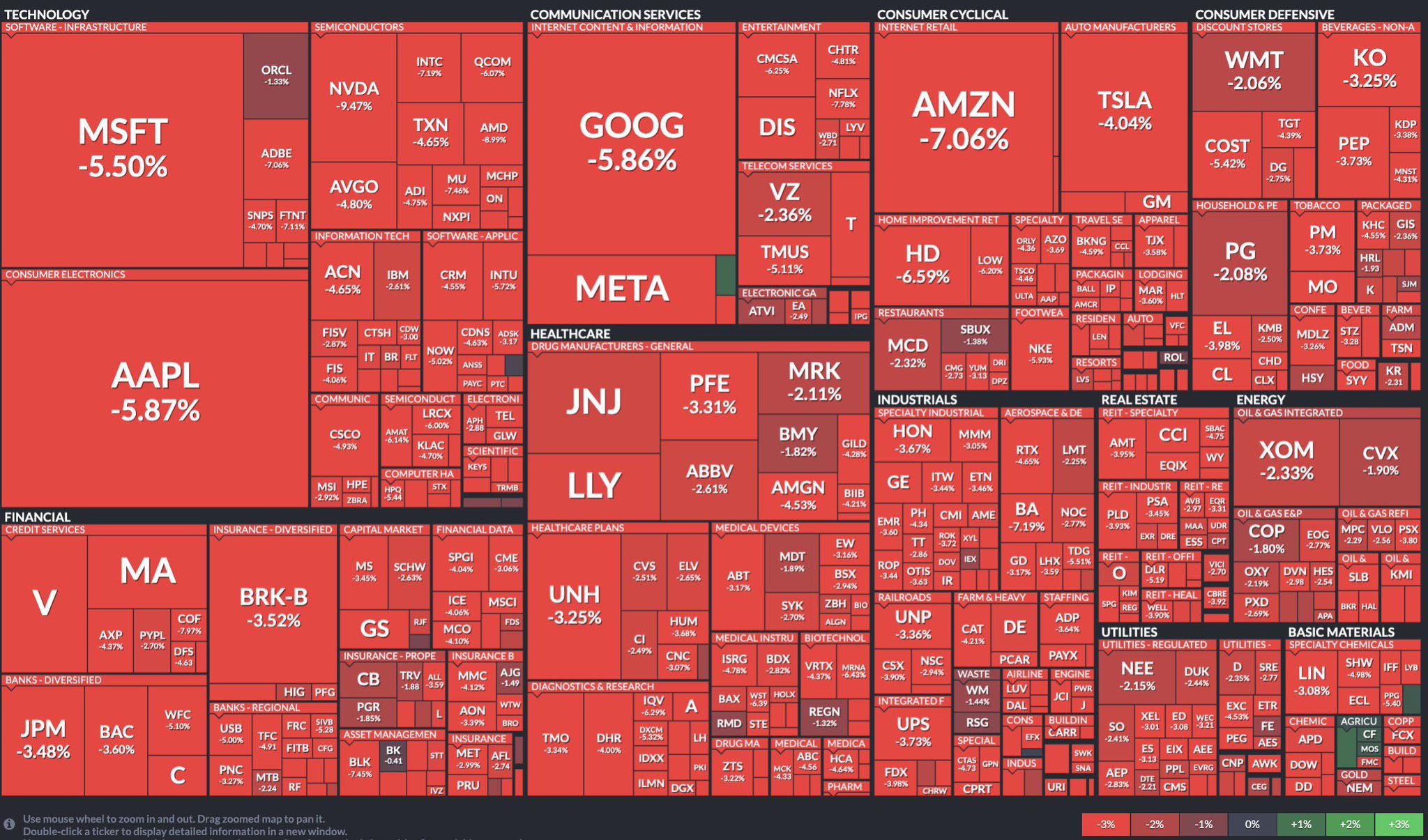

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025 -

Rocket Launch Abort Blue Origin Cites Subsystem Failure

Apr 24, 2025

Rocket Launch Abort Blue Origin Cites Subsystem Failure

Apr 24, 2025 -

Ted Lassos Revival Brett Goldsteins Thought Dead Cat Analogy

Apr 24, 2025

Ted Lassos Revival Brett Goldsteins Thought Dead Cat Analogy

Apr 24, 2025 -

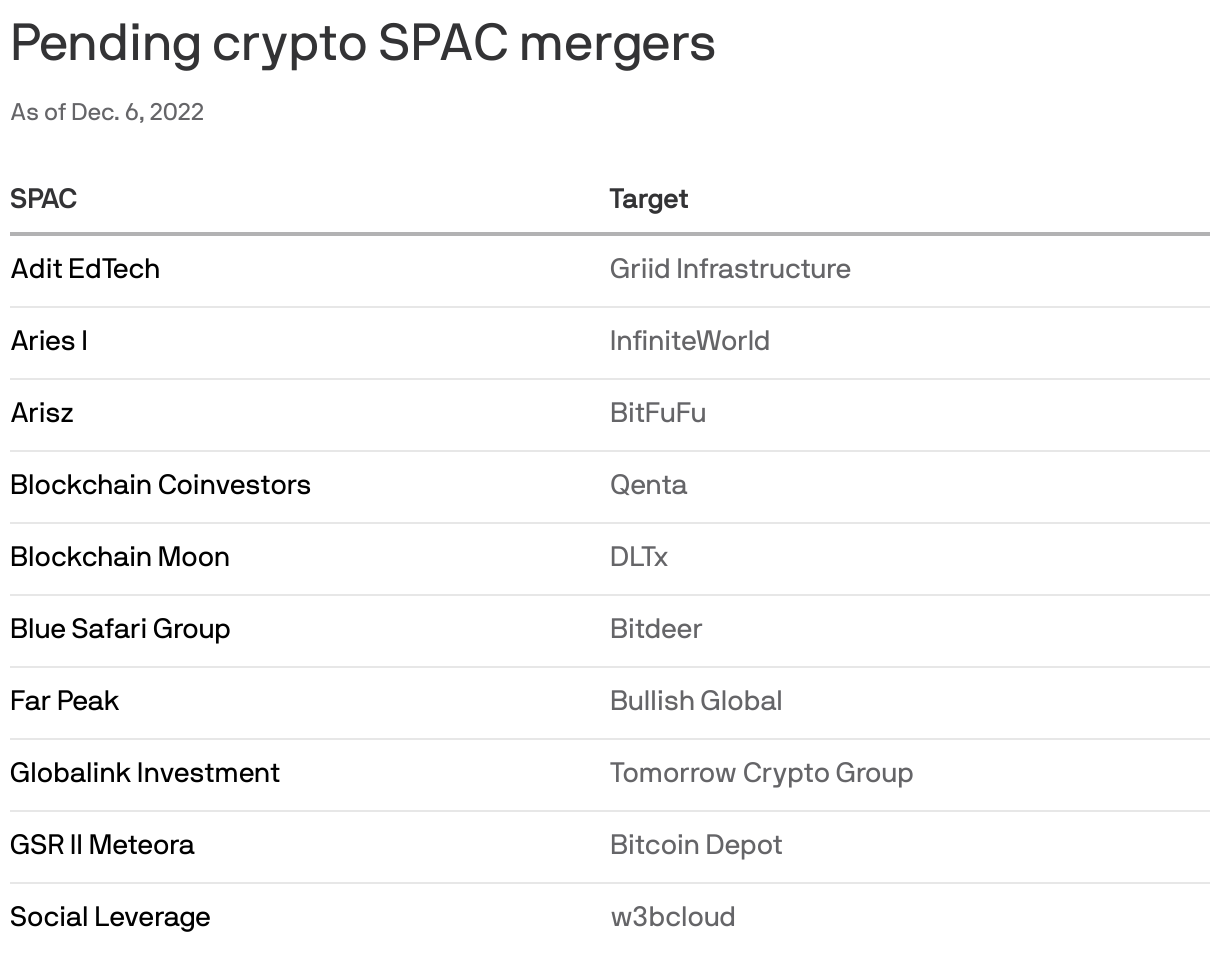

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involved

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involved

Apr 24, 2025