China's Steel Production Cuts: Impact On Iron Ore Prices And Global Markets

Table of Contents

The Drivers Behind China's Steel Production Cuts

Several interconnected factors are driving China's decision to curtail steel production. These cuts represent a significant move with broad economic and environmental implications.

Environmental Regulations and Carbon Emission Targets

China's unwavering commitment to reducing carbon emissions and improving environmental quality is a primary driver. The government is actively pursuing ambitious carbon neutrality goals, leading to increased scrutiny of steel mills' environmental practices.

- Increased scrutiny of steel mills' environmental practices: Regular audits and stricter enforcement of existing regulations are commonplace.

- Stricter emission standards: New, more stringent emission standards are being implemented, forcing steel mills to invest in cleaner technologies or face penalties.

- Penalties for non-compliance: Heavy fines and even factory closures are imposed on companies failing to meet environmental regulations.

- Government incentives for greener technologies: Financial incentives and subsidies are being offered to encourage the adoption of cleaner and more sustainable steel production methods.

Slowing Economic Growth and Reduced Construction Activity

A slower-than-expected economic recovery in China is another significant factor contributing to reduced steel demand. This slowdown directly impacts the construction and manufacturing sectors, both major consumers of steel.

- Impact on infrastructure projects: A decrease in large-scale infrastructure projects means less demand for steel reinforcement bars and other construction materials.

- Real estate sector slowdown: The cooling real estate market, a significant driver of steel demand, further reduces the overall need for steel.

- Decreased demand for steel in construction and manufacturing: This reduced demand translates directly into lower orders for steel mills, impacting production levels.

Government Policy Interventions and Production Quotas

The Chinese government is actively intervening to manage steel production capacity and prevent oversupply. This includes the implementation of production quotas and restrictions on new plant construction.

- Production quotas implemented by regional governments: Provincial and municipal governments are setting production limits for steel mills within their jurisdictions.

- Limitations on new steel plant construction: New steel plant construction is strictly controlled to prevent further expansion of production capacity.

- Targeted factory closures: Inefficient or environmentally polluting steel plants are being targeted for closure, further reducing overall production.

Impact on Iron Ore Prices and Market Volatility

The reduction in China's steel production has had a significant and immediate impact on iron ore prices and market stability. The relationship between steel production and iron ore demand is intrinsically linked.

Reduced Demand for Iron Ore

The decreased steel production directly translates into significantly lower demand for iron ore, the primary raw material in steelmaking.

- Impact on iron ore spot prices: Spot prices for iron ore have experienced considerable volatility, reflecting the changing dynamics of supply and demand.

- Price fluctuations: Significant price swings are expected as the market adjusts to the new reality of reduced Chinese steel production.

- Implications for iron ore mining companies: Mining companies are facing reduced revenue and pressure to adjust their production levels.

- Potential for price wars: Competition among iron ore producers may intensify, potentially leading to price wars to secure market share.

Supply Chain Disruptions and Price Uncertainty

The reduced steel production in China is creating disruptions throughout the global iron ore supply chain.

- Impact on shipping: Reduced demand leads to fewer shipments, affecting shipping companies and potentially leading to idle capacity.

- Port congestion: Reduced activity at major ports may lead to decreased efficiency and higher storage costs.

- Storage costs: Increased storage costs for iron ore may impact profitability for both miners and steel producers.

- Delays in deliveries: Supply chain disruptions can lead to delays in deliveries, impacting the timely execution of projects and production schedules.

Geopolitical Considerations and Global Iron Ore Trade

China's policy changes significantly impact global iron ore trade dynamics, particularly relationships with major exporters like Australia and Brazil.

- Impact on export volumes: Major iron ore exporters are experiencing a decrease in demand from China, impacting their export volumes.

- Trade agreements: Existing trade agreements between China and iron ore exporting countries are being renegotiated or impacted by these changes.

- Potential for trade disputes: The reduced demand could potentially lead to trade disputes or renegotiations of trade deals.

- Shifting market share: Other steel-producing nations might see an opportunity to increase their market share in the global steel market.

Wider Implications for Global Markets and Related Industries

The impact of reduced Chinese steel production extends far beyond the iron ore and steel sectors, affecting numerous related industries.

Impact on Global Steel Prices

The decrease in Chinese steel production has a ripple effect on global steel prices and competition.

- Changes in global steel prices: Steel prices in other regions may increase due to reduced supply from China.

- Competition among steel producers: Steel producers in other countries may see increased competition as they try to fill the gap in supply.

- Potential for price increases in other regions: Consumers in other regions may experience higher steel prices as a result of reduced supply from China.

Consequences for Related Industries

Industries heavily reliant on steel, such as automotive, construction, and manufacturing, face significant consequences.

- Increased input costs for manufacturers: Higher steel prices translate to increased input costs for manufacturers, impacting profitability.

- Potential delays in project completion: Supply chain disruptions and higher costs can lead to delays in project completion.

- Impacts on employment: Reduced demand and potential factory closures could lead to job losses in related industries.

Opportunities for Sustainable Steel Production

The shift towards reduced steel production also presents an opportunity to accelerate the adoption of more sustainable and environmentally friendly steel production methods.

- Investment in green technologies: This situation could incentivize greater investment in research and development of green steel production technologies.

- Development of new steelmaking processes: There's a push to develop innovative steelmaking processes that minimize environmental impact.

- Role of renewable energy: The transition to renewable energy sources in steel production is gaining momentum.

Conclusion

China's steel production cuts are a watershed moment with profound and far-reaching consequences. The decreased demand for iron ore has injected significant volatility into global markets, impacting prices and related industries. While challenges abound, this transition also presents opportunities for fostering more sustainable steel production methods. Understanding the intricacies of China's steel production cuts and their effect on iron ore prices is crucial for businesses navigating the global commodity markets. Stay informed about developments in China's steel production and its impact on the global iron ore market to effectively navigate this evolving landscape. Proactive monitoring of China steel production trends is essential for strategic decision-making in this sector.

Featured Posts

-

Nottingham Attack Survivor First Interview Heartbreaking Plea

May 10, 2025

Nottingham Attack Survivor First Interview Heartbreaking Plea

May 10, 2025 -

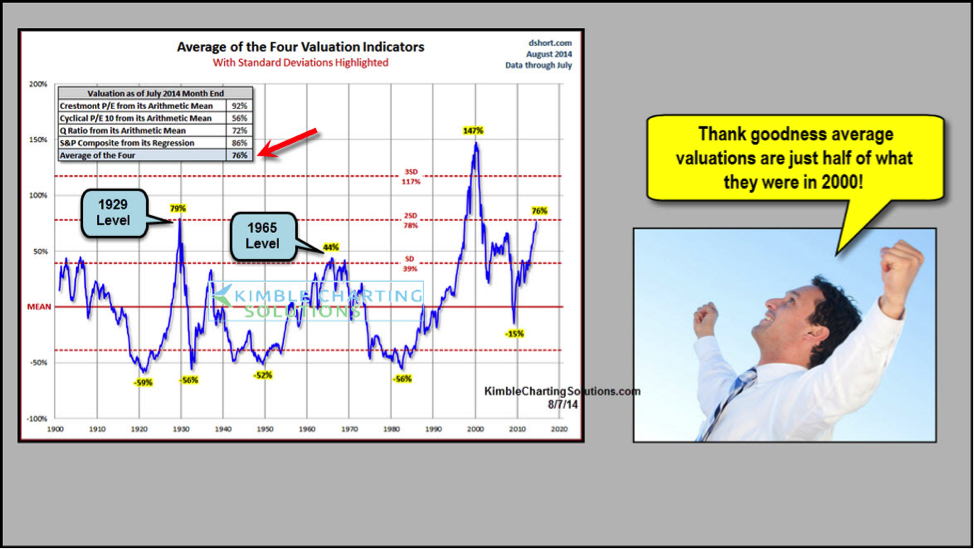

Bof As Reassurance Addressing Concerns About Stretched Stock Market Valuations

May 10, 2025

Bof As Reassurance Addressing Concerns About Stretched Stock Market Valuations

May 10, 2025 -

French Minister Further Eu Action Needed On Us Tariffs

May 10, 2025

French Minister Further Eu Action Needed On Us Tariffs

May 10, 2025 -

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025 -

Is Palantir Stock A Buy Before May 5th Analyst Ratings And Future Outlook

May 10, 2025

Is Palantir Stock A Buy Before May 5th Analyst Ratings And Future Outlook

May 10, 2025