Credit Suisse Whistleblower Case: A $150 Million Settlement

Table of Contents

The Whistleblower's Allegations and Their Impact

The whistleblower's accusations, which triggered the SEC and FINMA (Swiss Financial Market Supervisory Authority) investigations, detailed a pattern of alleged financial misconduct. These allegations spanned several years and involved multiple employees, encompassing a range of serious offenses, including potential tax evasion, money laundering, and other forms of financial fraud. The specifics of the allegations remain partially confidential due to ongoing legal processes, but public information suggests a systematic failure to uphold anti-money laundering regulations and to properly report suspicious activity.

The timeline of events began with the whistleblower's initial complaint, which was followed by lengthy investigations by both the SEC and FINMA. These regulatory bodies scrutinized Credit Suisse's internal processes, interviewing employees, examining financial records, and ultimately determining the extent of the alleged misconduct and the bank's responsibility. The investigation's findings led to the significant $150 million settlement.

- Specific examples of alleged misconduct: These included allegations of facilitating transactions for high-risk clients known to be involved in illicit activities and insufficient due diligence in onboarding new clients.

- Quantifiable losses attributed to the alleged misconduct: While the exact figures remain undisclosed, the settlement amount suggests substantial financial losses, both directly to Credit Suisse and indirectly through reputational damage.

- The whistleblower's motivation and protection measures: The whistleblower's identity remains confidential to ensure their safety and protection under whistleblower protection laws. The settlement included provisions to support and protect the whistleblower against potential retaliation.

The $150 Million Settlement: A Breakdown of the Costs

The $150 million settlement represents a substantial financial burden for Credit Suisse. While the exact breakdown isn't publicly available, it's likely composed of fines levied by the SEC and FINMA, restitution to affected parties, and legal fees associated with the protracted investigation and litigation. This substantial cost significantly impacts Credit Suisse's financial performance and further erodes its already damaged reputation.

The settlement’s implications extend beyond the immediate financial cost. The reputational damage incurred from this scandal can lead to decreased client trust, difficulty attracting and retaining talent, and potentially higher borrowing costs.

- The cost to Credit Suisse in terms of fines and legal fees: While precise figures are unavailable, it is safe to assume that a significant portion of the $150 million accounts for fines and the considerable legal expenses incurred throughout the investigation and settlement process.

- Potential impact on shareholder value: The settlement negatively impacts Credit Suisse's share price and erodes shareholder confidence, potentially leading to long-term financial instability.

- Comparison with other similar settlements in the financial industry: The $150 million settlement falls within the range of other significant settlements involving similar allegations of regulatory non-compliance within the financial services sector, highlighting the serious nature of the infractions and the considerable penalties involved.

Implications for Corporate Governance and Compliance

The Credit Suisse whistleblower case reveals significant weaknesses in the bank's internal control systems and compliance programs. The alleged misconduct suggests a failure of oversight and a lack of a robust culture of compliance within the organization. This highlights the critical need for strong ethical leadership, clearly defined compliance policies, and effective training programs for all employees.

- Recommendations for improving internal controls and compliance programs: This includes implementing more rigorous risk assessment procedures, enhancing due diligence processes for client onboarding, and providing regular, comprehensive compliance training to all staff.

- The role of board oversight in preventing such incidents: The case underscores the importance of effective board oversight and the responsibility of the board of directors in ensuring that robust internal controls and compliance programs are in place.

- The need for increased transparency and accountability: Increased transparency in reporting suspicious activities and a greater emphasis on accountability at all levels within the organization are vital to prevent future occurrences.

The Future of Whistleblower Protection

The Credit Suisse case underscores the critical role of whistleblower protection programs in uncovering and addressing financial misconduct. While current laws provide some protection, there’s ongoing debate regarding their effectiveness. Incentivizing whistleblowers to come forward, without fear of retaliation, remains crucial.

- Examples of successful whistleblower programs: Companies with robust and well-publicized whistleblower programs often experience fewer instances of misconduct and more effective resolution of issues when they do occur.

- Challenges faced by whistleblowers: Whistleblowers often face significant personal and professional risks, including job loss, social stigma, and legal challenges. Stronger protections are needed to encourage reporting.

- Proposed changes to legislation: Strengthening whistleblower protection laws, enhancing confidentiality provisions, and ensuring swift and effective investigations are key areas for reform.

Conclusion

The Credit Suisse whistleblower case and its resulting $150 million settlement serve as a stark reminder of the critical need for robust internal controls, ethical corporate governance, and effective whistleblower protection programs within the financial sector. The case highlights the significant consequences of failing to maintain a culture of compliance and accountability, emphasizing the substantial financial and reputational risks involved. The $150 million settlement, while substantial, only represents a fraction of the potential long-term damage caused by such misconduct. Addressing the systemic issues highlighted by this case is paramount for restoring trust and maintaining stability within the financial industry.

Call to Action: The Credit Suisse case underscores the importance of proactive measures to prevent financial misconduct. Learn more about strengthening your organization's whistleblower program and compliance strategies to avoid similar costly and damaging settlements. Understanding the implications of the Credit Suisse whistleblower case is crucial for preventing future financial scandals and building a more ethical and responsible financial system.

Featured Posts

-

Bao Mau Bao Hanh Tre Em O Tien Giang Giai Phap Toan Dien Cho Van Nan Nay

May 09, 2025

Bao Mau Bao Hanh Tre Em O Tien Giang Giai Phap Toan Dien Cho Van Nan Nay

May 09, 2025 -

Naein Britannian Kruununperimysjaerjestys Naeyttaeae Nyt

May 09, 2025

Naein Britannian Kruununperimysjaerjestys Naeyttaeae Nyt

May 09, 2025 -

Apples Ai Crossroads Innovation Or Obsolescence

May 09, 2025

Apples Ai Crossroads Innovation Or Obsolescence

May 09, 2025 -

Nhl Playoff Projections Following The 2025 Trade Deadline

May 09, 2025

Nhl Playoff Projections Following The 2025 Trade Deadline

May 09, 2025 -

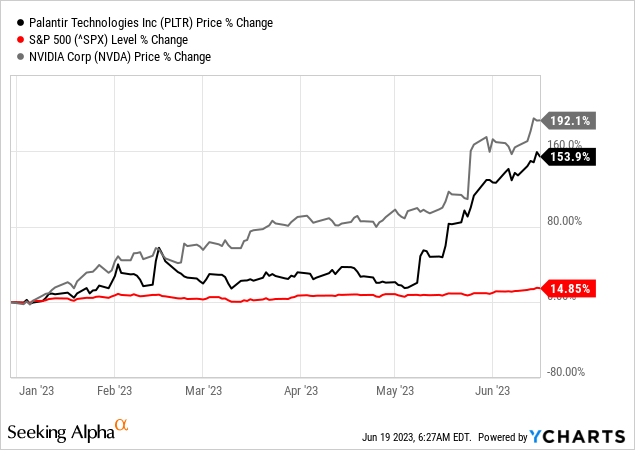

Should You Buy Palantir Stock Today Investment Analysis And Outlook

May 09, 2025

Should You Buy Palantir Stock Today Investment Analysis And Outlook

May 09, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025 -

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025 -

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025 -

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025