Should You Buy Palantir Stock Today? Investment Analysis And Outlook

Table of Contents

Palantir's Financial Performance and Recent Earnings

Analyzing Palantir's financial performance requires a close look at its recent quarterly and annual reports. Key metrics such as revenue growth, profitability (measured by EPS and operating margin), and cash flow are crucial indicators of the company's financial health. While Palantir has shown significant revenue growth, its path to profitability remains a key factor for investors to consider.

-

Revenue Growth Trajectory: Over the past few years, Palantir has demonstrated consistent revenue growth, fueled by increasing demand for its data analytics solutions from both government and commercial sectors. However, the rate of growth needs to be examined against industry benchmarks. Visual representations of this growth, such as charts and graphs, provide a clearer understanding.

-

Profitability Trends: Palantir’s profitability, as measured by its operating margin and EPS, is a critical aspect of its financial performance. Investors need to assess whether the company’s revenue growth translates into sustainable profitability. Analyzing trends in these metrics is essential to understanding the long-term financial viability of the company.

-

Key Revenue Drivers: Palantir's revenue is largely driven by government contracts and increasingly, commercial clients. Understanding the balance between these two revenue streams is vital, as dependence on government contracts can introduce certain risks.

-

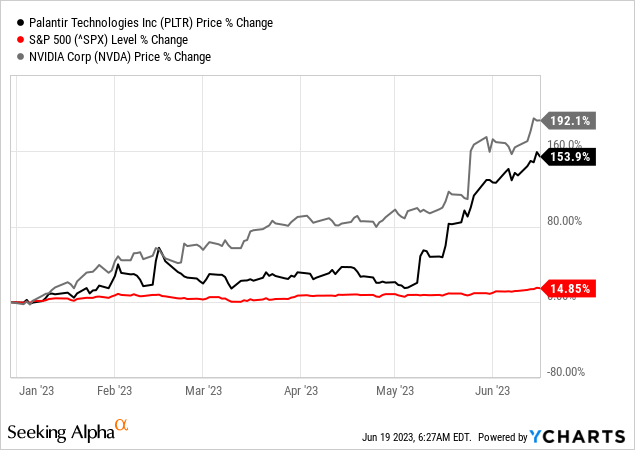

Industry Benchmarks: Comparing Palantir's financial performance against its competitors in the big data analytics market provides a relative perspective on its success and potential.

Growth Prospects and Future Market Opportunities

Palantir's growth strategy focuses on expanding its presence in both the government and commercial sectors. The company's potential for growth hinges on its ability to capitalize on burgeoning opportunities in emerging technologies, such as artificial intelligence (AI) and cloud computing, while effectively navigating the competitive landscape.

-

Key Growth Drivers: Key growth drivers for Palantir include the increasing adoption of AI and big data analytics across various industries, expansion into new geographic markets, and strategic partnerships.

-

Market Expansion Opportunities: Palantir has substantial potential for expansion into new geographic regions and technological domains. Exploring new applications of its technology within healthcare, finance, and other sectors could significantly broaden its revenue streams.

-

Competitive Advantages: Palantir’s strong technological capabilities and its reputation for delivering complex data solutions differentiate it from competitors. However, maintaining this competitive edge requires continuous innovation.

-

Challenges to Growth: Scaling operations, fierce competition, and potential regulatory hurdles present significant challenges to Palantir's future growth.

Competitive Landscape and Market Share

The big data analytics market is highly competitive, with established players and emerging startups vying for market share. Palantir faces competition from companies offering similar data analytics and software solutions.

-

Key Competitors: Identifying Palantir's main competitors (e.g., Databricks, Snowflake) and assessing their strengths and weaknesses provides a comprehensive view of the market dynamics.

-

Palantir's USPs: Palantir's unique selling propositions, such as its advanced data integration capabilities and strong relationships with government agencies, are critical to its competitive advantage.

-

Market Share Analysis: Understanding Palantir's current market share and projecting its potential for future market share gains requires an analysis of market trends and competitive pressures.

-

Impact of Competition: The intense competition in the big data analytics market can impact Palantir’s profitability and pricing strategies.

Risks and Challenges Facing Palantir Investors

Investing in Palantir stock involves several inherent risks that potential investors must carefully consider. Understanding these risks and developing mitigation strategies is crucial for informed investment decisions.

-

Concentration Risk: Palantir's reliance on a few large government contracts presents a concentration risk. A loss of a major contract could significantly impact the company's financial performance.

-

Technological Disruption: Rapid technological advancements could render Palantir's current technology obsolete, requiring substantial investments in research and development to maintain its competitive position.

-

Regulatory and Legal Risks: Operating in highly regulated industries exposes Palantir to regulatory and legal risks, potentially leading to fines or legal challenges.

-

Economic Downturn Risk: An economic downturn could reduce demand for Palantir's services, especially in the commercial sector.

Conclusion: Should You Invest in Palantir Stock? A Final Verdict

Our analysis reveals that Palantir's strong revenue growth is promising, but its path to sustained profitability remains a key concern. The company operates in a competitive landscape with significant growth potential, but faces considerable risks. The reliance on large government contracts and the possibility of technological disruption are important factors to weigh carefully.

Based on this analysis, a buy, hold, or sell recommendation depends heavily on individual investor risk tolerance and investment horizon. Investors with a higher risk tolerance and a longer-term perspective might view Palantir as a potential growth stock. However, those seeking stability and lower risk might consider other options.

Disclaimer: Investing in the stock market always involves risk. This analysis is for informational purposes only and should not be construed as financial advice. Conduct thorough research and consider your own risk tolerance before making any investment decisions.

Call to Action: To further your research on Palantir stock, explore reputable financial news sources and visit Palantir's investor relations page. Remember, understanding the intricacies of Palantir's business model and the risks involved is paramount before deciding whether to buy, hold, or sell Palantir stock.

Featured Posts

-

Queen Elizabeth 2 Post Makeover Exploring The 2000 Guest Vessel

May 09, 2025

Queen Elizabeth 2 Post Makeover Exploring The 2000 Guest Vessel

May 09, 2025 -

Mulher Presa Na Inglaterra Suspeita De Perseguir Pais De Madeleine Mc Cann

May 09, 2025

Mulher Presa Na Inglaterra Suspeita De Perseguir Pais De Madeleine Mc Cann

May 09, 2025 -

Arrest Made In Elizabeth City Weekend Shooting Suspect In Custody

May 09, 2025

Arrest Made In Elizabeth City Weekend Shooting Suspect In Custody

May 09, 2025 -

Randall Flagg Four Unconventional Theories That Reshape Your Understanding Of Stephen Kings Works

May 09, 2025

Randall Flagg Four Unconventional Theories That Reshape Your Understanding Of Stephen Kings Works

May 09, 2025 -

Elizabeth Arden Skincare Walmart Prices And Deals

May 09, 2025

Elizabeth Arden Skincare Walmart Prices And Deals

May 09, 2025

Latest Posts

-

Elon Musks Billions Teslas Rally And The Dogecoin Effect On His Net Worth

May 10, 2025

Elon Musks Billions Teslas Rally And The Dogecoin Effect On His Net Worth

May 10, 2025 -

Tesla Stock Fuels Elon Musks Billions Impact Of Ceos Dogecoin Decision

May 10, 2025

Tesla Stock Fuels Elon Musks Billions Impact Of Ceos Dogecoin Decision

May 10, 2025 -

Post Trump Inauguration Analyzing The Net Worth Changes Of Tech Billionaires

May 10, 2025

Post Trump Inauguration Analyzing The Net Worth Changes Of Tech Billionaires

May 10, 2025 -

Elon Musk Wealth Increase Billions Added After Tesla Rally And Dogecoin Step Back

May 10, 2025

Elon Musk Wealth Increase Billions Added After Tesla Rally And Dogecoin Step Back

May 10, 2025 -

The Impact Of Trumps Presidency On The Fortunes Of Musk Bezos And Zuckerberg

May 10, 2025

The Impact Of Trumps Presidency On The Fortunes Of Musk Bezos And Zuckerberg

May 10, 2025