Credit Suisse Whistleblower Reward: Up To $150 Million

Table of Contents

Understanding the Credit Suisse Whistleblower Reward Program

The Scale of the Potential Reward

The $150 million figure represents a landmark in whistleblower rewards. It dwarfs many previous awards, signaling a significant shift in how seriously authorities take financial crime reporting. This substantial sum is designed to incentivize individuals to come forward with information, even if they fear retaliation. The exact amount awarded will depend on several factors, including:

- Severity of the misconduct: The more serious the alleged crime (e.g., large-scale fraud versus minor infractions), the higher the potential reward.

- Quality of the information provided: Detailed, verifiable evidence significantly increases the value of a tip. The information must be original and lead to a successful investigation and recovery of funds.

- Cooperation with authorities: Whistleblowers who fully cooperate with investigations are more likely to receive a larger reward.

Examples of previous large whistleblower awards include the $14 million paid to a former employee of a pharmaceutical company for reporting fraudulent activities and the $30 million awarded for uncovering a massive Ponzi scheme. The Credit Suisse case, however, surpasses these significantly, setting a new benchmark.

Who is Eligible for the Reward?

Eligibility for the Credit Suisse whistleblower reward extends to a broad range of individuals, including:

- Current employees of Credit Suisse: Those with firsthand knowledge of misconduct within the company.

- Former employees of Credit Suisse: Individuals who previously worked for the bank and possess relevant information.

- Third parties: Individuals outside the company who have credible information about Credit Suisse's activities.

To qualify, the information provided must be original and previously unknown to authorities. The whistleblower must also be willing to cooperate fully with the investigation. Specific requirements may include providing supporting documentation and testifying in court.

The Reporting Process

Submitting a whistleblower tip concerning Credit Suisse involves several steps. Individuals can utilize various channels, including:

- The SEC website: The Securities and Exchange Commission (SEC) maintains an online portal for submitting whistleblower tips.

- A dedicated hotline: Credit Suisse, or relevant authorities, may operate a confidential hotline for reporting misconduct.

- Legal counsel: Consulting with an attorney experienced in whistleblower cases is highly recommended.

Confidentiality is paramount. Secure reporting methods are used to protect whistleblowers' identities. While complete anonymity is not always guaranteed, significant measures are taken to safeguard whistleblowers from retaliation. A step-by-step guide, often provided on official websites, outlines the process clearly. Emphasis is placed on secure submission methods and the assurance of confidentiality, wherever legally permissible.

The Implications of the Credit Suisse Case

Impact on Corporate Governance

The Credit Suisse whistleblower reward program signifies a significant shift in how corporate governance is viewed. This substantial reward emphasizes the importance of:

- Strengthening internal compliance programs: Companies will face increased pressure to implement robust systems for detecting and preventing financial crimes.

- Promoting independent oversight: The role of independent boards and external auditors will become even more critical in ensuring transparency and accountability.

- Enhancing whistleblower protection: Companies will need to create safer environments for employees to report misconduct without fear of retaliation.

The case highlights the need for proactive measures to prevent future financial scandals.

Encouraging Whistleblower Reporting

This substantial reward sends a clear message: reporting financial misconduct is both crucial and potentially lucrative. It's designed to encourage individuals who might otherwise hesitate due to fear or uncertainty to come forward. This has significant implications for:

- Uncovering further wrongdoing: The reward could lead to the uncovering of additional instances of misconduct within Credit Suisse and other financial institutions.

- Improving corporate culture: A culture of open reporting and accountability can be fostered through strong whistleblower protection policies and substantial rewards.

- Promoting ethical conduct: The substantial reward reinforces the importance of ethical conduct within the financial industry.

The ethical and legal considerations for whistleblowers must be carefully considered, and access to legal counsel is highly recommended.

The Future of Whistleblower Rewards

Setting a New Precedent

The Credit Suisse case is likely to set a significant precedent for future whistleblower rewards, particularly within the financial sector. This includes:

- Higher reward amounts: We may see an increase in the average reward offered for reporting serious financial crimes.

- Enhanced whistleblower protection: Legislation related to whistleblower protection may become stronger, providing increased safeguards for those who come forward.

- Increased regulatory scrutiny: Financial institutions may face greater regulatory scrutiny regarding their internal compliance programs.

This evolving landscape necessitates a continuing focus on proactive measures to encourage ethical conduct and responsible corporate governance.

Conclusion

The unprecedented Credit Suisse whistleblower reward of up to $150 million underscores the crucial role whistleblowers play in uncovering financial misconduct. This significant sum highlights the seriousness of the alleged wrongdoing and serves as a powerful incentive for individuals with knowledge of potential illegal activities to come forward. The implications of this case extend far beyond Credit Suisse, potentially reshaping corporate governance and enhancing whistleblower protection across the financial industry. If you have information regarding potential financial crimes at Credit Suisse or any other organization, consider utilizing available channels to report your concerns and potentially benefit from whistleblower reward programs. Don't hesitate to explore your options for reporting financial misconduct and seeking a Credit Suisse whistleblower reward.

Featured Posts

-

10 Film Noir Movies Guaranteed To Grip You

May 09, 2025

10 Film Noir Movies Guaranteed To Grip You

May 09, 2025 -

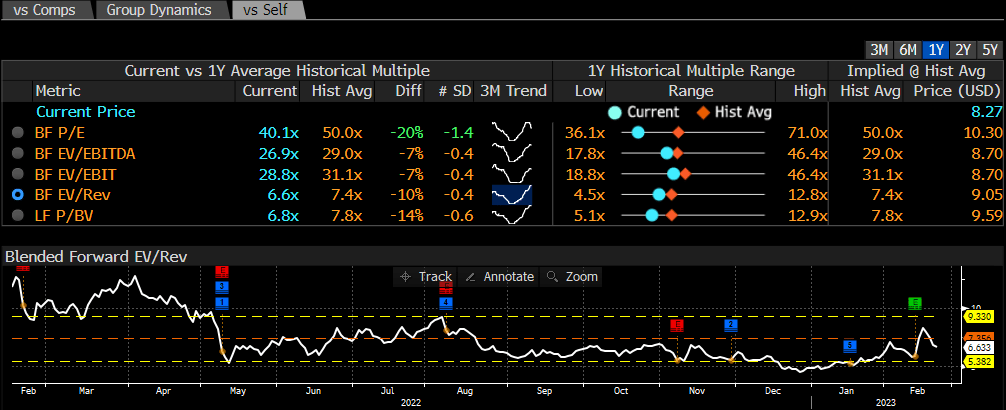

Palantir Pltr Stock Buy Or Sell Before May 5th Expert Opinion

May 09, 2025

Palantir Pltr Stock Buy Or Sell Before May 5th Expert Opinion

May 09, 2025 -

Kimbal Musks Public Criticism Of Trumps Tariffs A Deeper Dive

May 09, 2025

Kimbal Musks Public Criticism Of Trumps Tariffs A Deeper Dive

May 09, 2025 -

Woman 23 Claims To Be Madeleine Mc Cann Dna Test Results Revealed

May 09, 2025

Woman 23 Claims To Be Madeleine Mc Cann Dna Test Results Revealed

May 09, 2025 -

Can Palantir Reach A Trillion Dollar Valuation By 2030

May 09, 2025

Can Palantir Reach A Trillion Dollar Valuation By 2030

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025