De Minimis Tariffs On Chinese Goods: The G-7's Ongoing Deliberations

Table of Contents

The Current State of De Minimis Tariffs on Chinese Imports

The current de minimis thresholds for Chinese goods vary significantly across G7 countries, creating an uneven playing field for businesses.

Defining the Threshold

- United States: Currently holds a relatively low de minimis threshold, leading to higher customs duties for smaller shipments from China.

- European Union: Maintains a somewhat higher threshold, offering a more favorable environment for small-scale imports from China.

- Japan, Canada, UK: Each has its unique threshold, resulting in variations in the cost of importing Chinese goods. These discrepancies contribute to a complex and often confusing regulatory landscape.

The lack of harmonization across G7 nations creates uncertainty for businesses, particularly SMEs involved in e-commerce, impacting their ability to effectively manage import costs and plan future logistics.

Impact on Businesses

The current de minimis tariff structure significantly impacts businesses in several ways:

- Increased costs for businesses importing Chinese goods: Fluctuations and variations in tariffs lead to unpredictable pricing, making it difficult to budget and plan for imports.

- Potential impact on consumer prices: Increased import costs are often passed on to consumers, leading to higher prices for goods.

- Changes in import sourcing strategies: Businesses may shift their sourcing away from China, seeking alternative suppliers in countries with more favorable tariff policies. This impacts supply chains and potentially economic relations.

Trade Imbalances and their Relation to De Minimis Tariffs

The trade imbalance between the G7 and China is a significant factor in the ongoing debate over de minimis tariffs. Critics argue that lower tariffs disproportionately benefit Chinese exporters, exacerbating the trade deficit. Data from the World Trade Organization (WTO) shows a steady increase in imports from China into G7 countries, raising questions about the fairness and effectiveness of the current system. Analyzing the impact of different tariff levels on trade flow and balance requires a detailed investigation, factoring in economic growth, currency exchange rates and global demand.

The G-7's Discussions and Proposed Changes

The G7's discussions on de minimis tariffs are characterized by ongoing tension between competing interests.

Arguments for Raising De Minimis Tariffs

Proponents of raising the threshold emphasize several benefits:

- Increased efficiency in customs processing: Higher thresholds would reduce the volume of low-value shipments requiring customs clearance, streamlining the process.

- Reduced administrative burden on businesses: Simplified customs procedures would decrease the administrative burden on SMEs, fostering cross-border e-commerce.

- Stimulating cross-border e-commerce: Lower tariffs would boost online trade, benefitting both consumers and businesses engaged in e-commerce.

Concerns Regarding Lowering or Maintaining Current Tariffs

However, concerns remain about raising the threshold:

- Potential impact on domestic industries: A higher threshold could increase competition from cheaper Chinese goods, potentially harming domestic industries.

- Concerns about unfair trade practices: Some fear that raising thresholds would facilitate unfair trade practices, such as dumping or circumvention of existing tariffs.

- Revenue implications for governments: Higher thresholds could reduce government revenue from customs duties, necessitating adjustments in other areas of taxation.

The Role of International Trade Agreements

Existing international trade agreements, such as the WTO agreements, significantly influence the G7's deliberations. Any major changes to de minimis tariffs must comply with these agreements and avoid triggering retaliatory measures from other nations. This necessitates careful consideration of both economic and legal implications.

Potential Outcomes and Future Implications

The G7's decision on de minimis tariffs could have far-reaching implications.

Scenarios for De Minimis Tariff Adjustments

Several scenarios are possible:

- Harmonization: A unified approach across G7 countries would create a more predictable and stable trading environment.

- Divergence: Continued differences in thresholds would perpetuate the existing complexities and challenges for businesses.

- Gradual Adjustment: A phased approach would allow for smoother implementation and minimize disruption to businesses and trade flows.

Economic Impacts of Different Scenarios

Each scenario will have distinct economic consequences:

- GDP growth: Harmonization could stimulate growth by reducing uncertainty and promoting trade.

- Job creation/loss: Changes in tariffs can impact employment levels in various sectors.

- Consumer spending: Changes in import prices will affect consumer spending patterns.

Geopolitical Implications

The G7's decision will inevitably have geopolitical implications, influencing relations with China and other trading partners. A harmonized approach could signal a united front, while divergent policies could exacerbate existing tensions.

De Minimis Tariffs on Chinese Goods: A Call for Transparency and Harmonization

The debate over de minimis tariffs on Chinese goods highlights the complexities of international trade policy. While arguments exist for both raising and maintaining current thresholds, the lack of harmonization creates uncertainty and challenges for businesses. The G7's decision must prioritize transparency and collaboration to navigate these complexities, minimizing negative impacts on businesses and fostering a more stable and predictable global trade environment. We urge readers to stay informed about the ongoing deliberations on the impact of de minimis tariffs, Chinese import tariffs and G7 trade policy, and to actively engage with relevant organizations working to shape responsible international trade policy. The future of global commerce hinges on effective and equitable solutions regarding de minimis tariffs.

Featured Posts

-

Bank Of Canadas Tightrope Walk Balancing Growth And Inflation

May 22, 2025

Bank Of Canadas Tightrope Walk Balancing Growth And Inflation

May 22, 2025 -

The Goldbergs A Nostalgic Look At 80s Family Life

May 22, 2025

The Goldbergs A Nostalgic Look At 80s Family Life

May 22, 2025 -

Appeal Pending Ex Tory Councillors Wife And Racial Hatred Tweet

May 22, 2025

Appeal Pending Ex Tory Councillors Wife And Racial Hatred Tweet

May 22, 2025 -

Prediksi Juara Liga Inggris 2024 2025 Akankah Liverpool Menang

May 22, 2025

Prediksi Juara Liga Inggris 2024 2025 Akankah Liverpool Menang

May 22, 2025 -

World Trading Tournament Wtt Aimscaps Success And Challenges

May 22, 2025

World Trading Tournament Wtt Aimscaps Success And Challenges

May 22, 2025

Latest Posts

-

Crews Battle Blaze At Used Car Dealership

May 22, 2025

Crews Battle Blaze At Used Car Dealership

May 22, 2025 -

Recent Susquehanna Valley Storm Damage Cleanup Repairs And Community Support

May 22, 2025

Recent Susquehanna Valley Storm Damage Cleanup Repairs And Community Support

May 22, 2025 -

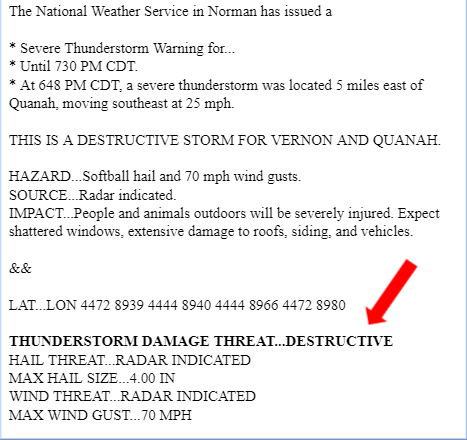

Urgent Severe Thunderstorm Watch In Effect South Central Pennsylvania

May 22, 2025

Urgent Severe Thunderstorm Watch In Effect South Central Pennsylvania

May 22, 2025 -

Investigation Launched Into Overnight Dauphin County Apartment Fire

May 22, 2025

Investigation Launched Into Overnight Dauphin County Apartment Fire

May 22, 2025 -

Susquehanna Valley Storm Damage The Extent Of The Destruction And Path To Recovery

May 22, 2025

Susquehanna Valley Storm Damage The Extent Of The Destruction And Path To Recovery

May 22, 2025