Dollar Rises: Trump's Softer Tone On Fed Chair Powell Boosts USD

Table of Contents

Trump's Changed Rhetoric and Market Reaction

President Trump's previous criticisms of Chairman Powell and the Federal Reserve's interest rate hikes were frequent and vocal. He openly expressed his displeasure with the Fed's tightening monetary policy, arguing it hampered economic growth. These statements often created uncertainty in the markets, contributing to volatility in the USD. However, a noticeable shift has occurred in recent weeks. Trump's recent statements have adopted a more conciliatory approach towards Powell and the Fed's actions. This change in tone signals a potentially more stable relationship between the executive branch and the central bank.

- Examples of Trump's previous critical statements: Publicly calling Powell's interest rate hikes "crazy" and "ridiculous," suggesting that the Fed was intentionally working against his administration's economic goals.

- Examples of his recent softer statements: More measured comments on interest rates, avoiding direct criticism of Powell and acknowledging the Fed's independence.

- Specific data points showing the USD's immediate appreciation following the shift: A noticeable jump in the US Dollar Index (DXY) following the shift in Trump's tone, indicating increased investor confidence in the USD. Specific percentage increases should be cited here, referencing reliable financial news sources.

- Analysis of investor sentiment changes: A reduction in market uncertainty and a clear shift towards a more positive outlook on the USD's future performance. This can be supported by references to surveys of investor confidence and market analysis reports.

Impact on Interest Rates and the US Economy

Trump's changed stance has significant implications for the Federal Reserve's independence and future interest rate decisions. A less confrontational relationship between the White House and the Fed could lead to greater predictability in monetary policy. However, the strengthening dollar itself presents complexities for the US economy. A stronger USD makes US exports more expensive for foreign buyers and imports cheaper for domestic consumers.

- Potential scenarios for future interest rate changes: Analysis of potential future interest rate adjustments based on current economic indicators and the projected impact of the stronger dollar.

- Analysis of the effect of a strong dollar on inflation: A stronger dollar generally puts downward pressure on inflation, as imported goods become cheaper.

- Discussion on the potential impact on US economic growth: The impact of a stronger dollar on US economic growth is nuanced, benefiting some sectors (e.g., consumers) while potentially harming others (e.g., exporters).

- Mention relevant economic indicators like trade balance and GDP growth: The discussion should include the potential effects on key economic indicators, using relevant data and projections.

Geopolitical Factors Contributing to USD Strength

The rise of the USD isn't solely due to Trump's changed rhetoric. Several geopolitical factors are also contributing to its strength. Global economic uncertainty often drives investors towards the USD as a safe-haven asset, particularly during times of international political or economic turmoil. The relative strength of the US economy compared to other major economies also plays a role.

- Mention specific global economic events influencing the USD: Examples could include Brexit developments, trade tensions between major global powers, or other significant geopolitical events.

- Highlight the USD's role as a safe-haven asset during times of uncertainty: Explain why investors flock to the USD during uncertain times, highlighting its stability and liquidity.

- Compare the US economy's performance to other major economies (e.g., Eurozone, China): A comparison of key economic indicators like GDP growth, inflation, and unemployment rates would provide context.

- Include relevant data such as currency exchange rates and economic growth figures: Supporting data from reputable sources is crucial to enhance credibility.

Long-Term Outlook for the USD

Predicting the long-term direction of the USD is challenging, with various expert opinions and forecasts available. Sustained growth is possible, but a correction is also a realistic scenario. The ongoing impact of Trump's policies, shifts in global economic conditions, and unexpected geopolitical events will all play a crucial role.

- Summarize different expert predictions on USD value: Present a range of forecasts from reputable financial institutions and economic analysts.

- Discuss potential risks and uncertainties affecting the USD's future: Identify key risks, including potential changes in US monetary policy, global economic downturns, and geopolitical instability.

- Analyze long-term implications for investors and businesses: Explain how the USD's future trajectory might affect investment strategies and business operations.

- Include relevant charts and graphs illustrating projections: Visual representations of different scenarios will enhance understanding and engagement.

Dollar Rises and the Future: What Investors Need to Know

The recent surge in the USD is a complex phenomenon driven by a confluence of factors, including President Trump's softened stance on Fed Chairman Powell, along with various geopolitical and economic considerations. Trump's more conciliatory approach has significantly reduced market uncertainty, bolstering investor confidence in the dollar. However, it's crucial for investors to stay informed about ongoing developments both domestically and globally that impact USD exchange rates and Federal Reserve policy. Understanding these factors is crucial for making sound investment decisions in this dynamic environment. Stay informed about the ongoing developments affecting the dollar's value and USD exchange rates to make informed investment decisions. Understanding the impact of Federal Reserve policy and geopolitical events on USD strengthening is crucial for navigating the current market.

Featured Posts

-

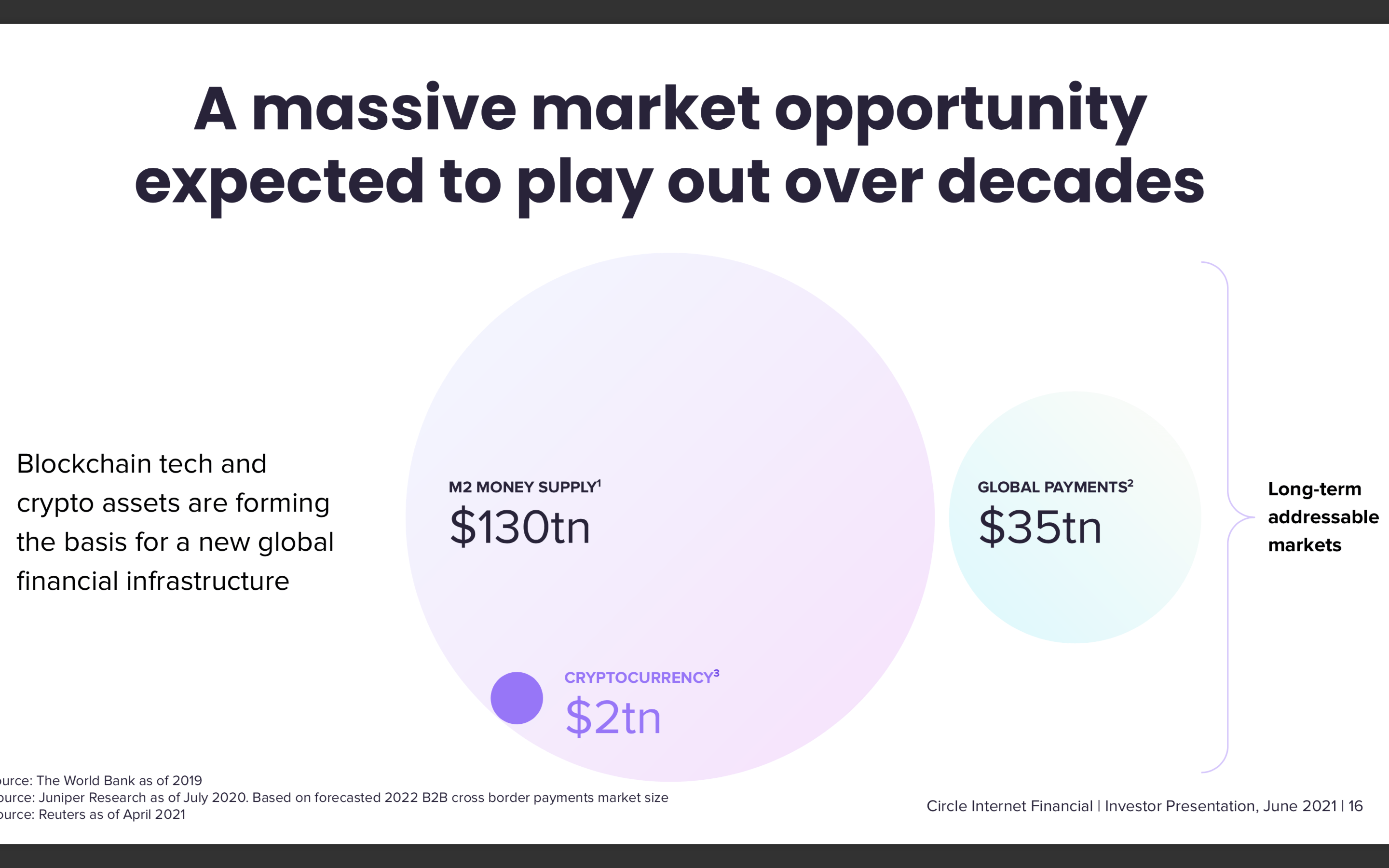

Cantor Tether And Soft Bank A 3 Billion Crypto Spac On The Horizon

Apr 24, 2025

Cantor Tether And Soft Bank A 3 Billion Crypto Spac On The Horizon

Apr 24, 2025 -

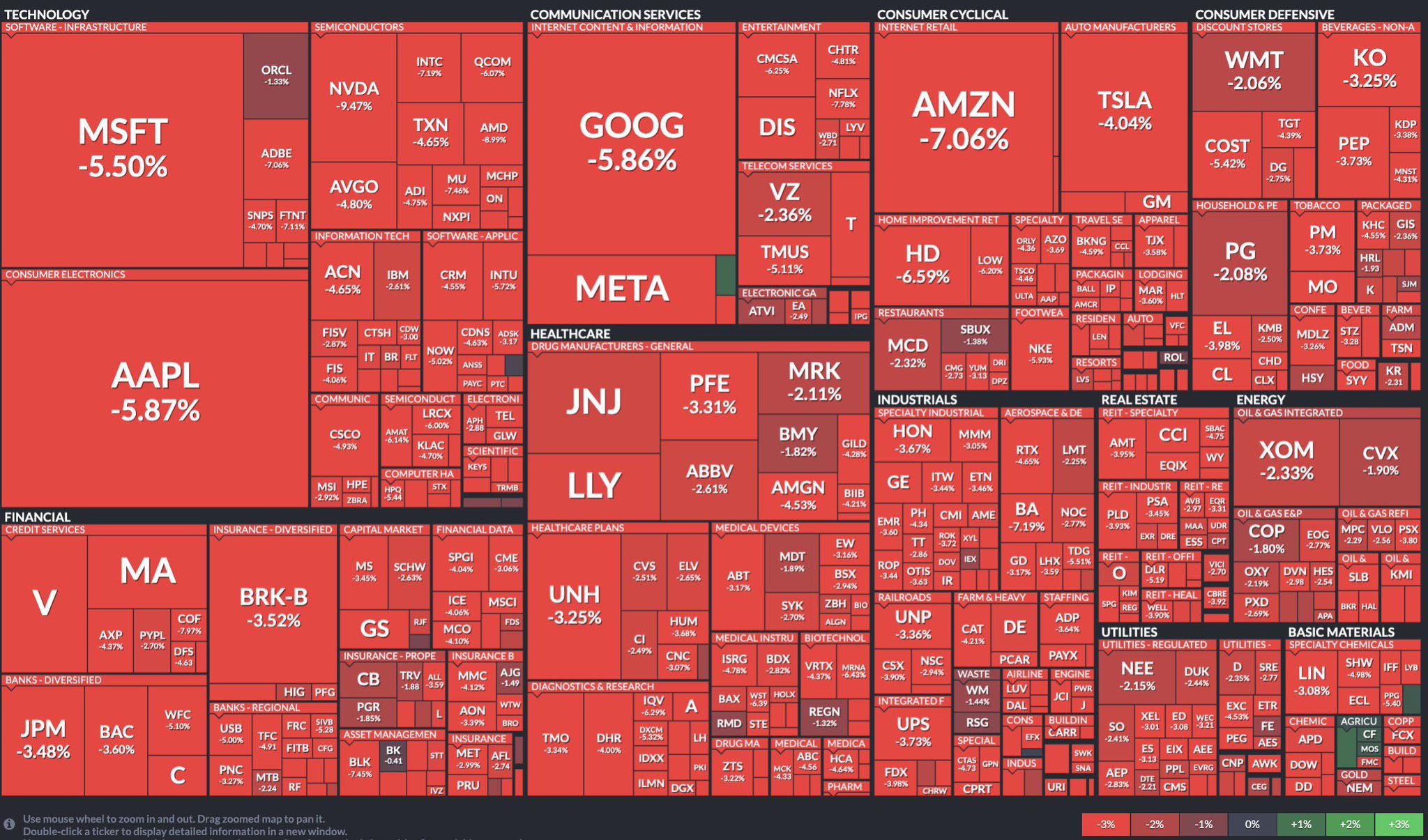

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025 -

The Financial Strain On Elite Universities Navigating The Trump Era

Apr 24, 2025

The Financial Strain On Elite Universities Navigating The Trump Era

Apr 24, 2025 -

Canadas Economic Future Prioritizing Fiscal Prudence

Apr 24, 2025

Canadas Economic Future Prioritizing Fiscal Prudence

Apr 24, 2025 -

Behind The Scenes The Reality Of Working As A Chalet Girl In Europe

Apr 24, 2025

Behind The Scenes The Reality Of Working As A Chalet Girl In Europe

Apr 24, 2025