Elon Musk's Net Worth: A 100-Day Analysis Under Trump's Presidency

Table of Contents

Keywords: Elon Musk net worth, Trump presidency, SpaceX, Tesla, billionaire, market fluctuations, economic impact, stock market analysis, Tesla stock price, SpaceX valuation

This article analyzes the fluctuations in Elon Musk's net worth during the first 100 days of Donald Trump's presidency. We'll examine how key policy decisions and market trends impacted the value of Tesla and SpaceX, the cornerstone of Musk's vast fortune. We’ll explore the correlation between political events and the billionaire's financial standing, providing a detailed look at the interplay between politics, economics, and the fluctuating net worth of one of the world's most influential entrepreneurs.

<h2>The Pre-Trump Baseline: Establishing Elon Musk's Net Worth</h2>

Before Donald Trump's inauguration, Elon Musk was already a prominent figure in the global business landscape. His net worth was largely driven by the success of two companies: Tesla, Inc., the electric vehicle manufacturer, and SpaceX, the aerospace manufacturer and space transportation services company.

Key factors contributing to his pre-presidency wealth included:

- Tesla's rising stock price: Tesla's innovative electric vehicles and ambitious expansion plans fueled investor confidence, significantly boosting its stock value and consequently, Musk's net worth.

- SpaceX's lucrative contracts: SpaceX secured significant contracts with NASA and other private entities, contributing substantially to its valuation and Musk's overall financial standing.

- Other Investments: Musk’s diverse investment portfolio, including ventures beyond Tesla and SpaceX, also contributed to his considerable wealth.

Several reputable sources estimated Musk's net worth before the Trump presidency. For example:

- Forbes: Placed Musk's net worth at [Insert Forbes Data – find a verifiable source and insert the number here] before Trump's inauguration.

- Bloomberg: Estimated Musk's net worth around [Insert Bloomberg Data – find a verifiable source and insert the number here] in the pre-inauguration period.

<h2>The First 100 Days: Economic Shifts and Their Impact on Musk's Holdings</h2>

Trump's early economic policies, focusing on deregulation and tax cuts, had a potentially significant impact on both Tesla and SpaceX. Deregulation could ease certain manufacturing and environmental constraints for Tesla, while tax cuts could boost profitability for both companies.

However, the stock market’s reaction to these policies was complex and not entirely predictable. During the first 100 days:

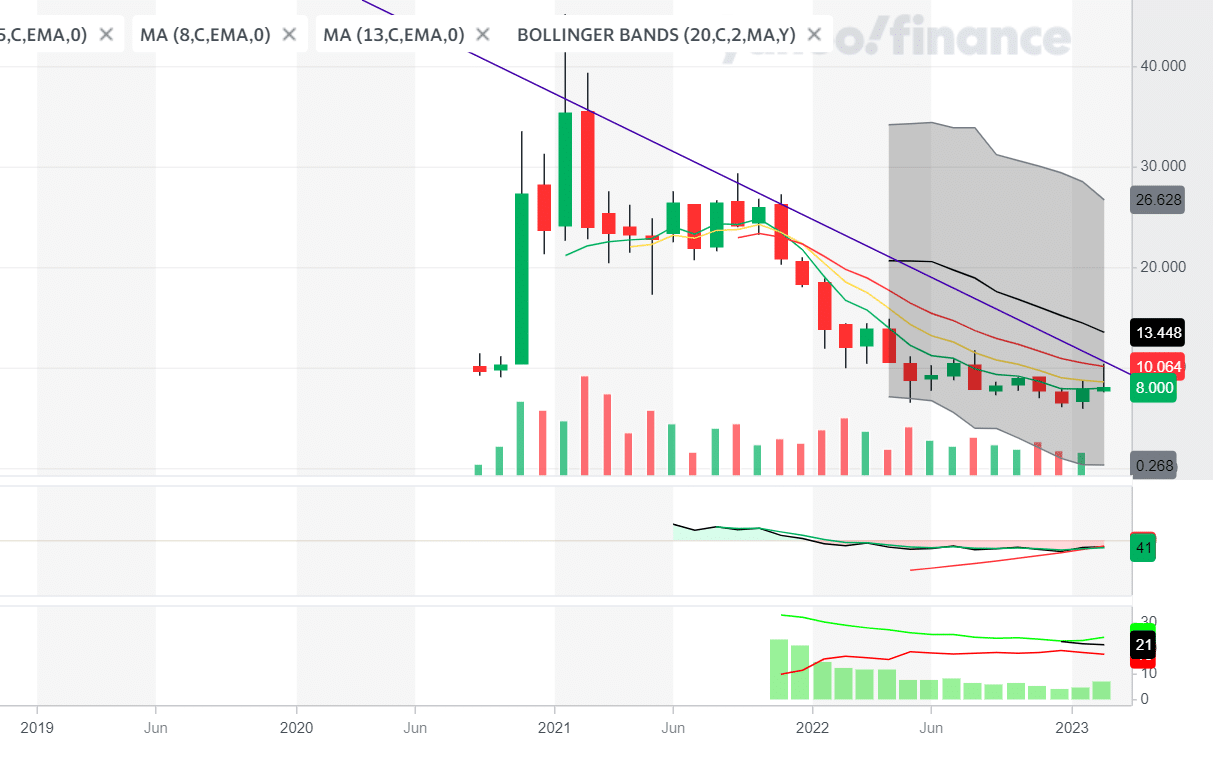

- Tesla's stock price experienced [Describe the fluctuation - increase, decrease, volatility]: [Insert detailed analysis of Tesla stock performance during the first 100 days of the Trump presidency. Include specific dates and percentage changes, and support with charts and graphs if possible]. This volatility was influenced not only by Trump's policies but also by factors specific to Tesla (production issues, delivery timelines etc.).

- Specific examples of Trump's policies: Trump’s focus on infrastructure development could potentially benefit Tesla's energy storage solutions and SpaceX’s ambitions in space transportation. Tax cuts, if enacted favorably, could increase profitability for both companies.

<h3>Tesla's Performance: A Driving Force in Musk's Net Worth Changes</h3>

Tesla's performance during this period was a major driver of changes in Musk's net worth. Beyond Trump's policies, several other factors played a significant role:

- Production challenges: Tesla struggled with production ramps, leading to temporary setbacks in meeting delivery targets.

- Model 3 launch: The launch of the more affordable Model 3 significantly impacted Tesla's overall production and sales figures, influencing its stock price.

- Competition: Increasing competition in the electric vehicle market added pressure on Tesla's performance.

[Include data points showing Tesla's sales and production figures during the period, alongside analysis of news and events affecting its stock price, both positive and negative. Include a comparative analysis against competitors such as GM or Nissan.]

<h3>SpaceX's Role: A Less Volatile, Yet Significant, Contributor</h3>

Compared to Tesla's volatile stock performance, SpaceX exhibited greater stability during this period. Its valuation was less susceptible to the immediate impacts of Trump’s policies. However, government contracts and space exploration initiatives played a role:

- Government Contracts: Securing additional contracts from NASA or the Department of Defense could positively influence SpaceX's valuation and contribute to Musk's net worth.

- SpaceX's Growth Trajectory: SpaceX continued its ambitious trajectory, expanding its capabilities in reusable rockets and commercial space transportation. This steady growth, independent of short-term political changes, maintained a significant contribution to Musk's overall net worth. [Include details on significant SpaceX contracts secured during this period and analyze its contribution to Musk’s overall net worth, comparing its growth trajectory with Tesla.]

<h2>External Factors: Beyond Trump's Influence</h2>

While Trump's presidency undoubtedly had an influence, other external factors significantly impacted Musk's net worth:

- Global Economic Trends: Global economic growth or recession directly affects the stock market and the valuation of companies like Tesla and SpaceX.

- Currency Fluctuations: Changes in currency exchange rates can affect the value of international investments and contracts.

- Personal Investments: Musk's personal investment choices outside of Tesla and SpaceX also affected his total net worth.

[Provide specific examples of these external factors and their impact on Musk's wealth during the 100-day period. Mention any major personal investments made during this time].

<h2>Conclusion</h2>

Analyzing Elon Musk's net worth during the first 100 days of the Trump presidency reveals a complex interplay of factors. While Trump's policies held potential implications for Tesla and SpaceX, the actual impact was interwoven with Tesla’s internal production challenges, SpaceX’s steady growth, and broader global economic trends. Understanding the fluctuations requires looking beyond simplistic correlations between politics and individual wealth.

Key Takeaways: Tesla's stock price performance was a primary driver of change in Musk's net worth. SpaceX's relative stability provided a counterbalance to Tesla's volatility. External factors beyond the Trump administration significantly influenced Musk’s overall financial picture.

Call to Action: To stay informed about the dynamic relationship between political and economic events and Elon Musk's net worth, continue your research using resources like "Elon Musk net worth tracker," "Tesla stock forecast," or "SpaceX valuation analysis." Understanding these factors is key to comprehending the complexities of modern finance and the remarkable influence of individuals like Elon Musk.

Featured Posts

-

Billionaires Favorite Etf Projected 110 Surge In 2025

May 09, 2025

Billionaires Favorite Etf Projected 110 Surge In 2025

May 09, 2025 -

Bitcoin Madenciligi Enerji Tueketimi Ve Yaklasan Son

May 09, 2025

Bitcoin Madenciligi Enerji Tueketimi Ve Yaklasan Son

May 09, 2025 -

Invest Smart A Guide To The Countrys Newest Business Hotspots

May 09, 2025

Invest Smart A Guide To The Countrys Newest Business Hotspots

May 09, 2025 -

Is A 40 Increase In 2025 Enough To Consider Palantir Stock

May 09, 2025

Is A 40 Increase In 2025 Enough To Consider Palantir Stock

May 09, 2025 -

Wynne And Joanna All At Sea Exploring The Themes And Characters

May 09, 2025

Wynne And Joanna All At Sea Exploring The Themes And Characters

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025