Federal Reserve Rate Decision: Holding Steady Amidst Rising Inflation

Table of Contents

Inflation Remains a Primary Concern

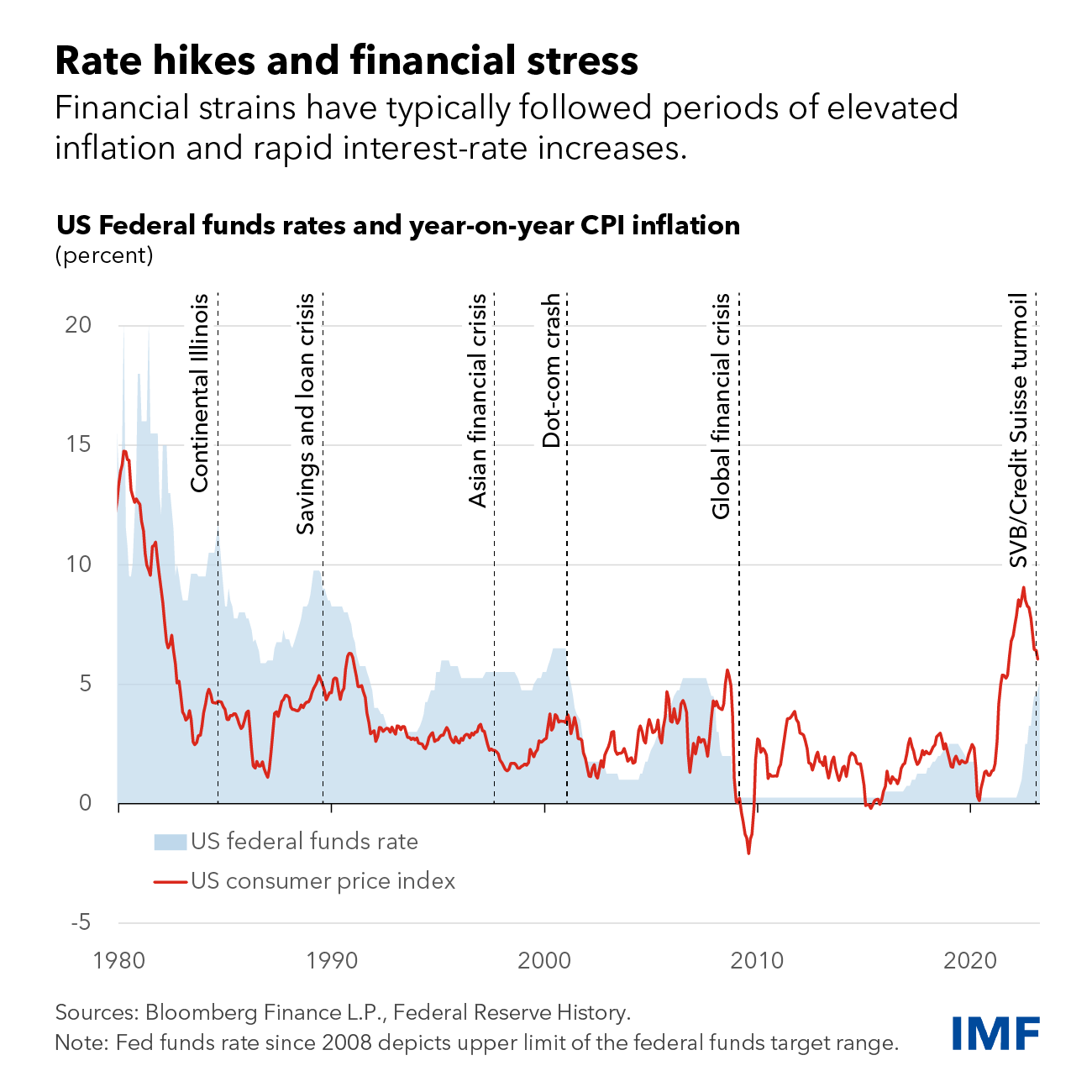

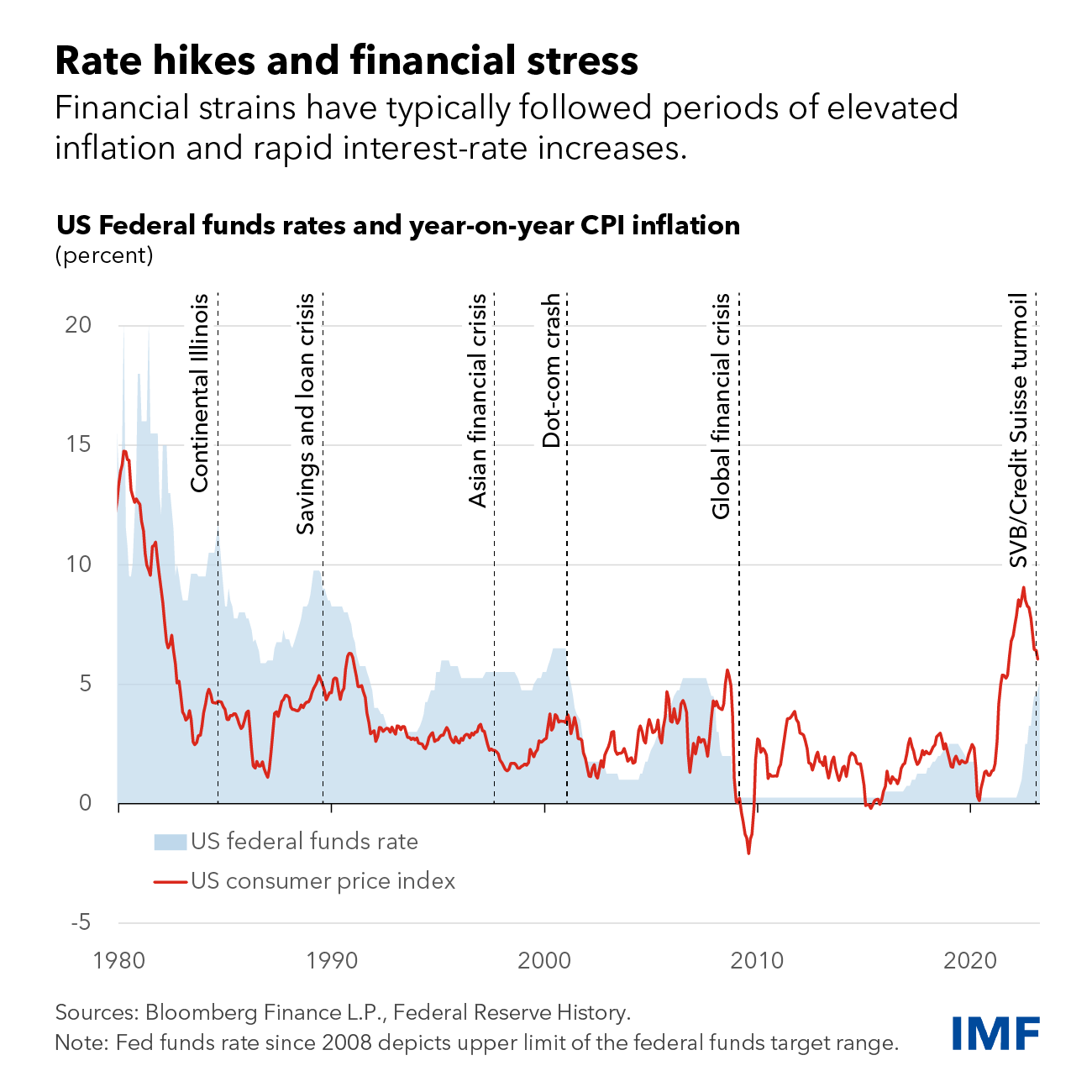

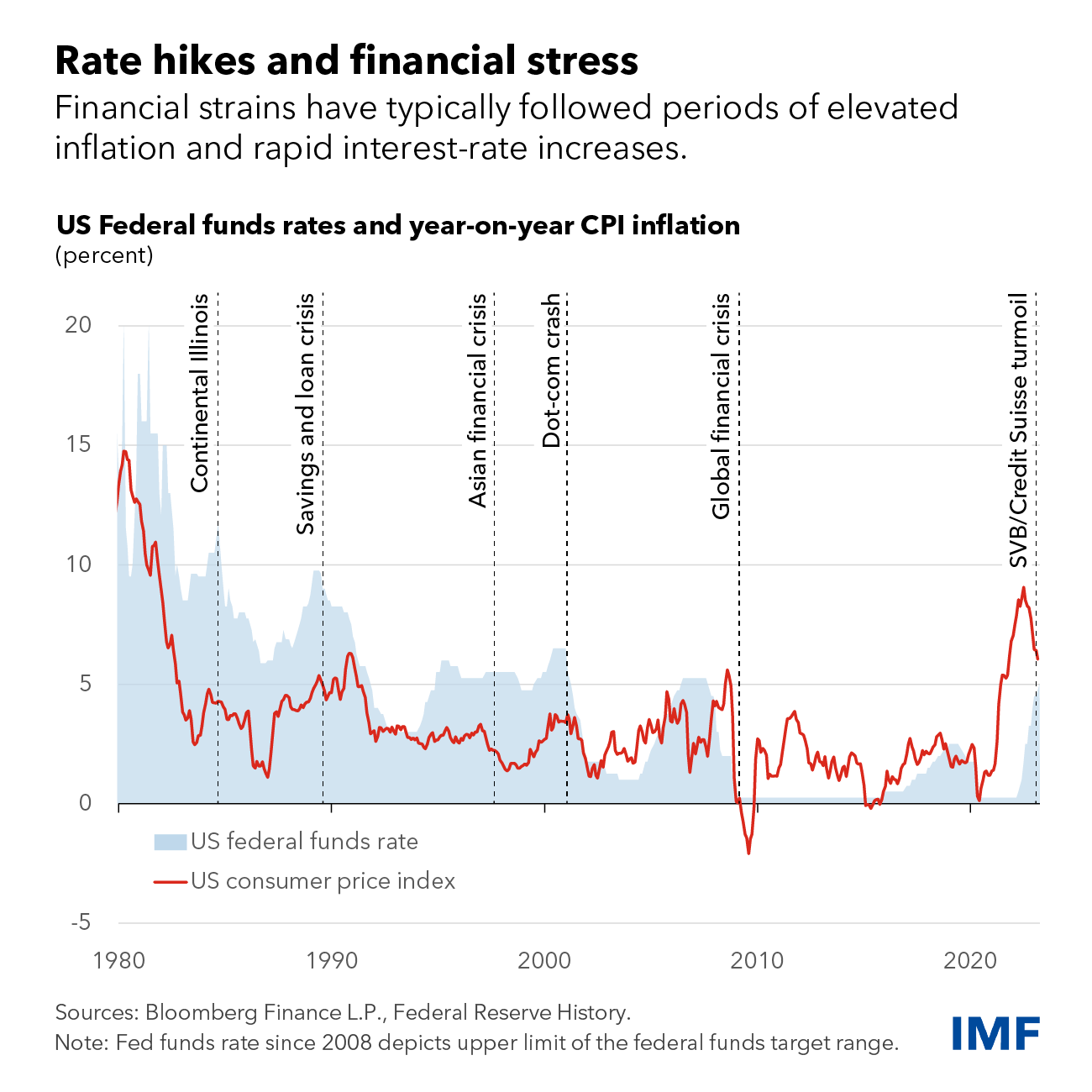

Inflation continues to be a major headache for the Federal Reserve. Current inflation levels, as measured by key indicators like the Consumer Price Index (CPI) and the Personal Consumption Expenditures index (PCE), remain significantly above the Fed's target of 2%. This persistent inflation is impacting consumers and businesses alike.

- CPI and PCE data showing persistent inflation: Recent reports indicate that inflation, while showing signs of cooling, is still considerably higher than the desired level. This persistent upward pressure on prices erodes purchasing power.

- Impact on consumer spending and purchasing power: High inflation reduces consumer spending as the cost of essential goods and services rises, squeezing household budgets. This decreased spending can impact overall economic growth.

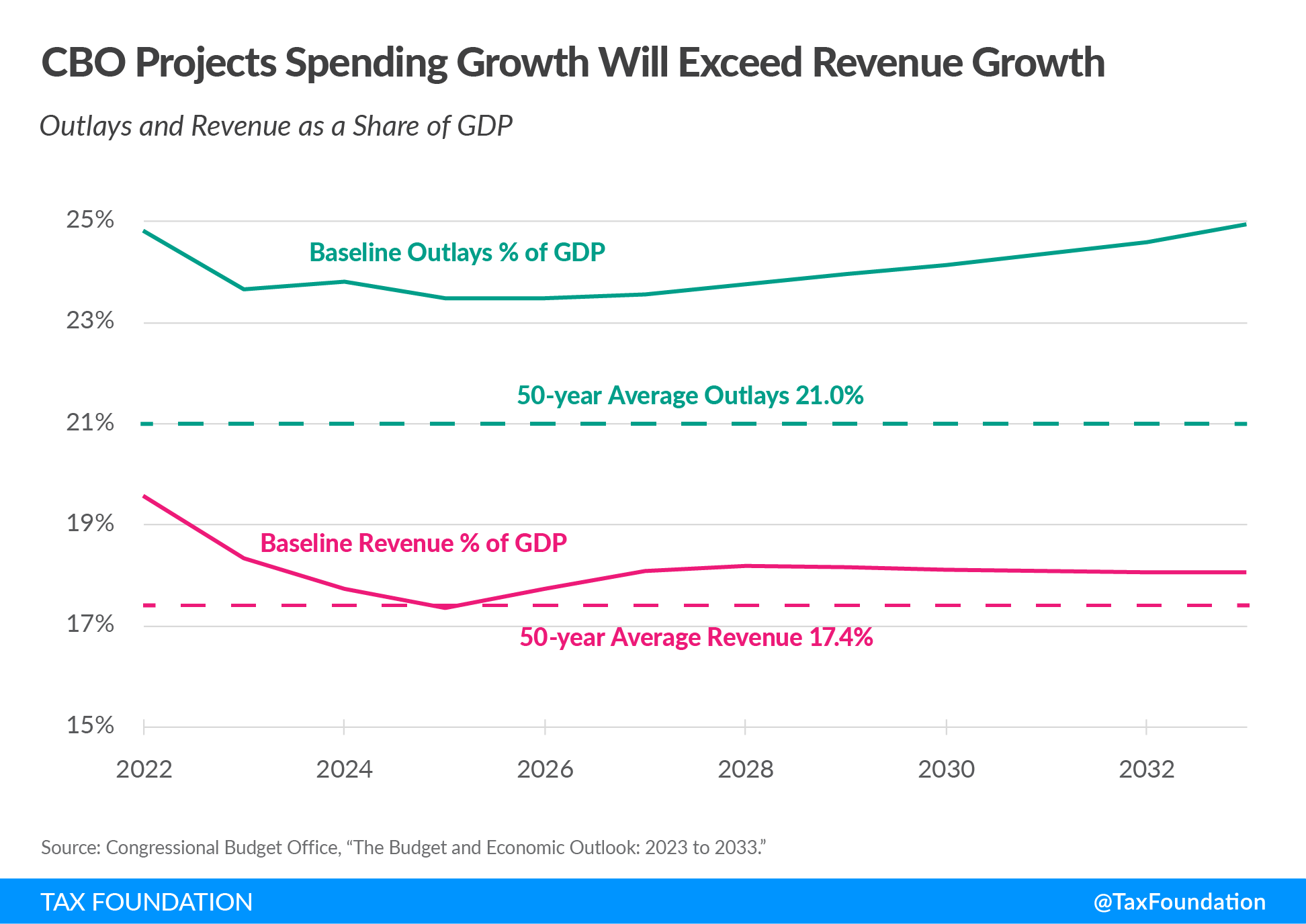

- Effect on business investment and economic growth: Businesses face increased costs for raw materials and labor, leading to potentially reduced investment and slower economic growth. Uncertainty surrounding inflation also discourages long-term planning.

Reasons for Holding Steady: A Cautious Approach

The Federal Reserve's decision to hold interest rates steady reflects a cautious approach, balancing the need to control inflation with concerns about triggering a recession. The rationale behind this decision is multifaceted.

- Lagging effects of previous rate hikes: The full impact of previous interest rate hikes takes time to filter through the economy. The Fed may be waiting to observe the cumulative effects of these increases before implementing further adjustments.

- Concerns about triggering a recession: Aggressive rate hikes risk pushing the economy into a recession. The Fed is carefully monitoring economic indicators to avoid such an outcome, prioritizing a "soft landing."

- Assessment of the current economic conditions and future projections: The Federal Reserve is carefully weighing various economic indicators, including inflation data, employment figures, and consumer spending, to make an informed decision about future monetary policy. This data-driven approach informs their strategy.

Assessing the Strength of the Labor Market

The strength of the labor market plays a significant role in the Federal Reserve's rate decisions. A robust labor market can fuel inflation through wage growth, but simultaneously contributes to overall economic health.

- Unemployment rate and its implications: While the unemployment rate remains relatively low, the Fed is monitoring it closely for any signs of overheating that could exacerbate inflationary pressures.

- Wage growth and its relationship to inflation: Strong wage growth, while positive for workers, can contribute to inflation if it outpaces productivity gains. The Fed carefully analyzes the relationship between wage growth and inflation.

- Labor market tightness and its effect on inflation: A tight labor market, where there are more job openings than available workers, can lead to upward pressure on wages and subsequently, inflation.

Potential Future Implications of the Decision

The Federal Reserve's decision to hold steady has potential economic consequences that will unfold over time. The coming months will be crucial in determining the future trajectory of interest rates.

- Impact on inflation trajectory: The decision's impact on inflation will be closely scrutinized. If inflation remains stubbornly high, future rate hikes remain a possibility.

- Effect on borrowing costs: Holding rates steady keeps borrowing costs relatively low, supporting consumer spending and business investment. However, prolonged high inflation could eventually lead to higher borrowing costs.

- Possible future rate adjustments: Future Federal Reserve rate decisions will depend heavily on upcoming economic data. The Fed will likely continue to monitor inflation and employment figures closely.

- Market reaction and investor sentiment: The market's reaction to the decision has been mixed, reflecting the uncertainty surrounding the future economic outlook. Investor sentiment will be influenced by subsequent economic data releases.

Conclusion

The Federal Reserve's decision to hold the Federal Reserve rate steady reflects a delicate balancing act between combating persistent inflation and avoiding a potential economic downturn. The ongoing assessment of economic data, particularly inflation and employment figures, will be crucial in informing future rate decisions. The impact of this decision on the economy will be felt across various sectors, influencing everything from consumer spending to business investment.

Call to Action: Stay informed about future Federal Reserve rate decisions and their implications for your financial planning. Regularly check reputable financial news sources for updates on the Federal Reserve rate and its impact on the economy. Understanding the Federal Reserve rate decision is crucial for making informed financial decisions, whether you are an individual investor or a business owner.

Featured Posts

-

Us Debt Limit August Deadline Raises Concerns Says Treasurys Bessent

May 10, 2025

Us Debt Limit August Deadline Raises Concerns Says Treasurys Bessent

May 10, 2025 -

Federal Reserve Rate Decision Holding Steady Amidst Rising Inflation

May 10, 2025

Federal Reserve Rate Decision Holding Steady Amidst Rising Inflation

May 10, 2025 -

Live Stock Market Updates 80 China Tariffs And Uk Trade Deal Developments

May 10, 2025

Live Stock Market Updates 80 China Tariffs And Uk Trade Deal Developments

May 10, 2025 -

Dijon La Contribution Essentielle De Melanie Eiffel A La Construction De La Tour Eiffel

May 10, 2025

Dijon La Contribution Essentielle De Melanie Eiffel A La Construction De La Tour Eiffel

May 10, 2025 -

Palantir Stock Weighing The Risks Before May 5th

May 10, 2025

Palantir Stock Weighing The Risks Before May 5th

May 10, 2025