Frankfurt Stock Market Closes Lower: DAX Below 24,000 Points

Table of Contents

Key Factors Contributing to the DAX Decline

Several interconnected factors contributed to the DAX's decline below 24,000 points. Understanding these elements is crucial for interpreting current market dynamics and formulating informed investment strategies.

Global Economic Uncertainty

Global economic headwinds significantly impacted the DAX's performance. Persistent inflation, aggressive interest rate hikes by central banks worldwide, and escalating geopolitical instability all played a role. These factors create uncertainty, prompting investors to adopt a more cautious approach.

- Inflation Concerns: High inflation erodes purchasing power and increases the cost of borrowing, impacting business profitability and consumer spending. For example, the recent Eurozone inflation figures exceeding expectations (link to source) directly influenced investor sentiment.

- Rising Interest Rates: Central banks' efforts to curb inflation through interest rate hikes increase borrowing costs for businesses, potentially slowing economic growth and reducing corporate investment. The recent 0.25% increase by the European Central Bank (link to source) is a case in point.

- Geopolitical Instability: The ongoing war in Ukraine, coupled with other geopolitical tensions, introduces significant uncertainty into the global economic outlook, negatively impacting investor confidence and driving capital towards safer assets.

Company-Specific News and Performance

Beyond macroeconomic factors, specific company news and performance also contributed to the DAX's decline. Several key players experienced setbacks, further exacerbating the downward trend.

- Weak Earnings Reports: Disappointing earnings reports from several DAX-listed companies (e.g., Volkswagen (VOW3.DE), Siemens (SIE.DE)) led to sell-offs, negatively impacting the overall index. (Link to relevant financial news source).

- Revised Corporate Outlooks: Some companies revised their growth forecasts downward, reflecting concerns about weakening demand and increased production costs. These revised outlooks contributed to investor apprehension and triggered further market sell-offs. (Link to relevant company announcements).

- Sector-Specific Challenges: The automotive sector, particularly sensitive to supply chain disruptions and economic downturns, experienced a steeper decline than other sectors.

Impact of the Euro and Global Markets

The performance of the Euro against other major currencies and the overall trend in global markets also played a role in the DAX's decline.

- Euro Depreciation: A weakening Euro against the US dollar can make German exports more competitive but also increases the cost of imported goods, impacting inflation and potentially dampening investor enthusiasm for the German market. (Link to a currency exchange rate chart).

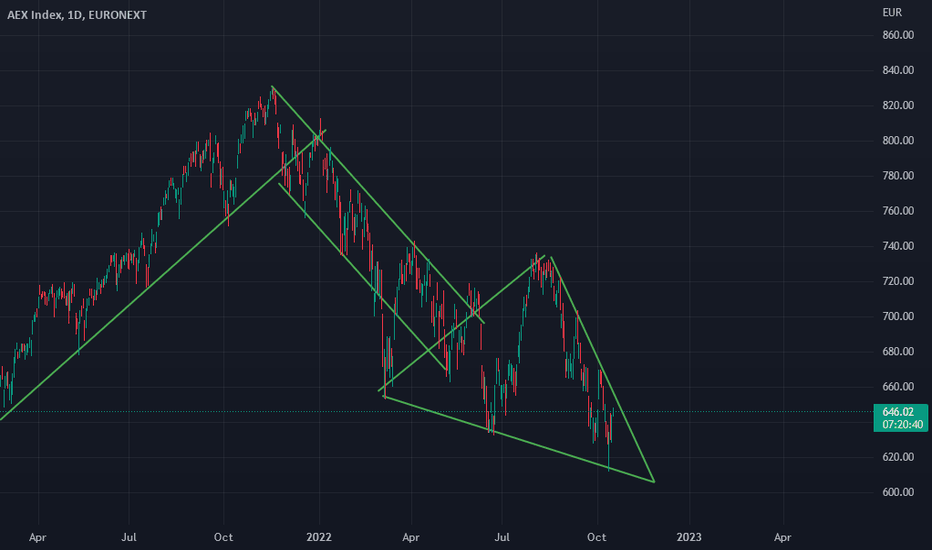

- Correlation with Global Indices: The DAX often mirrors the performance of other major global indices like the Dow Jones and S&P 500. Negative trends in these markets often translate into similar movements in the DAX, as investors react to global economic events. (Link to a chart showing correlation between indices).

Analysis of the DAX Performance Below 24,000 Points

The DAX trading below 24,000 points presents both short-term and long-term implications for investors.

Short-Term vs. Long-Term Implications

- Short-Term Implications: The short-term outlook remains uncertain. Further volatility is expected as investors react to incoming economic data and company news. A potential rebound is possible, but continued downward pressure cannot be ruled out.

- Long-Term Implications: While the short-term outlook is uncertain, the long-term prospects for the German economy and the DAX remain dependent on the resolution of global economic challenges. A return to sustainable growth will likely depend on inflation control, geopolitical stability, and successful adaptation to the ongoing energy transition.

Sector-Specific Performance

The impact of the decline wasn't uniform across all sectors. Some sectors were hit harder than others, reflecting varying sensitivities to the contributing factors.

- Technology and Automotive: These sectors were particularly impacted due to global supply chain issues, increased production costs and concerns about declining demand.

- Financials: The financial sector showed a mixed response, reflecting a balance between concerns about economic slowdown and the potential for higher interest rates to boost profits. (Link to relevant sector-specific data, if available)

Conclusion

The DAX closing below 24,000 points reflects a confluence of factors, including global economic uncertainty, company-specific news, and the performance of the Euro and global markets. Both short-term and long-term implications exist for investors. While the short-term outlook is volatile, the long-term success of the German economy and the DAX is contingent on addressing macroeconomic challenges. Stay tuned for updates on the Frankfurt Stock Market and the DAX. Continue monitoring the DAX performance closely and learn more about investing in the German Stock Market. Understanding the fluctuations of the Frankfurt Stock Market and the DAX is crucial for smart investment strategies.

Featured Posts

-

The Financial Aspects Of An Escape To The Country

May 24, 2025

The Financial Aspects Of An Escape To The Country

May 24, 2025 -

The Best Gear For Maintaining And Enjoying Your Ferrari

May 24, 2025

The Best Gear For Maintaining And Enjoying Your Ferrari

May 24, 2025 -

Moja Opinia O Porsche Cayenne Gts Coupe Po Przejazdzce

May 24, 2025

Moja Opinia O Porsche Cayenne Gts Coupe Po Przejazdzce

May 24, 2025 -

A Tour Of Nicki Chapmans Chiswick Garden Escape To The Country Style

May 24, 2025

A Tour Of Nicki Chapmans Chiswick Garden Escape To The Country Style

May 24, 2025 -

Shop Owners Murder Previously Bailed Teenager Arrested

May 24, 2025

Shop Owners Murder Previously Bailed Teenager Arrested

May 24, 2025

Latest Posts

-

Aex Stijgt Na Uitstel Trump Positief Herstel Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Uitstel Trump Positief Herstel Voor Alle Fondsen

May 24, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025 -

Aex Index Falls Below Key Support Level One Year Low Reached

May 24, 2025

Aex Index Falls Below Key Support Level One Year Low Reached

May 24, 2025 -

Amsterdam Aex Index Sharpest Decline In Over A Year

May 24, 2025

Amsterdam Aex Index Sharpest Decline In Over A Year

May 24, 2025 -

Amsterdam Stock Index Plunges Over 4 Hits Year Low

May 24, 2025

Amsterdam Stock Index Plunges Over 4 Hits Year Low

May 24, 2025