Amsterdam AEX Index: Sharpest Decline In Over A Year

Table of Contents

Keywords: Amsterdam AEX Index, AEX, Dutch stock market, stock market decline, market volatility, investment strategy, economic indicators, inflation, interest rates, ECB, geopolitical uncertainty, energy crisis, supply chain disruptions

The Amsterdam AEX Index suffered its steepest single-day drop in over a year, marking a significant downturn for the Dutch stock market. This unexpected volatility raises serious questions about the Netherlands' economic outlook and the future trajectory of its leading index. This article will dissect the contributing factors behind this sharp decline and analyze its implications for investors and the broader Dutch economy.

Key Factors Contributing to the AEX Index Decline

Several interconnected factors contributed to the recent dramatic fall in the Amsterdam AEX Index. Understanding these factors is crucial for navigating the current market volatility and making informed investment decisions.

Inflationary Pressures and Rising Interest Rates

High inflation across Europe, driven by factors such as supply chain disruptions and the ongoing energy crisis, has forced the European Central Bank (ECB) to aggressively raise interest rates. This has a direct and significant impact on the AEX:

- Reduced consumer spending: Higher interest rates increase borrowing costs, leading to reduced consumer spending and impacting businesses dependent on consumer demand.

- Increased borrowing costs for businesses: Companies face higher costs for loans and investments, hindering expansion plans and potentially impacting profitability.

- Impact on corporate profits: Rising costs and decreased demand can squeeze profit margins, leading to lower earnings and impacting stock valuations.

- Decreased investor confidence: The combination of high inflation and rising interest rates creates uncertainty and negatively impacts investor sentiment, leading to selling pressure.

For example, the ECB's recent interest rate hike of 0.5% (replace with actual data if available) directly contributes to the increased borrowing costs mentioned above. This directly impacts the profitability projections for many companies listed on the AEX, triggering a sell-off.

Geopolitical Uncertainty and Global Market Sentiment

Geopolitical instability, particularly the ongoing war in Ukraine and its impact on energy supplies, significantly influences global market sentiment and, consequently, the AEX.

- Impact of energy price volatility: The war in Ukraine has caused significant volatility in energy prices, impacting energy-intensive industries and increasing input costs for businesses across various sectors.

- Supply chain disruptions: The conflict and related sanctions continue to disrupt global supply chains, further exacerbating inflationary pressures and impacting the profitability of Dutch companies reliant on global trade.

- Potential for further geopolitical instability: Ongoing geopolitical tensions create uncertainty and risk aversion among investors, leading to capital flight from riskier assets like stocks.

News outlets constantly report on the ripple effects of the war in Ukraine, highlighting its impact on the global economy and investor sentiment. These reports often directly influence AEX performance.

Performance of Specific AEX Components

The decline in the AEX Index is not uniform across all sectors. Certain sectors and companies have been disproportionately affected:

- Financials: Banks and other financial institutions are particularly sensitive to interest rate changes, impacting their profitability and share prices.

- Energy: Energy companies, while potentially benefiting from higher energy prices in the short term, face regulatory pressures and supply chain issues.

- Technology: Tech companies, often reliant on investor confidence and future growth projections, have been particularly vulnerable to the current market uncertainty.

(Include charts or graphs illustrating the performance of specific AEX components – e.g., ING, ASML, Unilever – if available. Reference specific companies and their percentage drops.)

Implications for Investors and the Dutch Economy

The recent AEX decline has profound implications for both investors and the Dutch economy as a whole.

Short-Term Market Outlook

The short-term outlook for the AEX remains uncertain, with the potential for further volatility.

- Strategies for navigating market uncertainty: Investors should consider diversification, risk management strategies, and potentially shifting towards less volatile assets.

- Risk management techniques: Implementing stop-loss orders and carefully monitoring portfolio performance are crucial for mitigating potential losses.

The short-term outlook depends heavily on developments related to inflation, interest rates, and the geopolitical situation.

Long-Term Economic Impact

The long-term impact of the AEX decline on the Dutch economy warrants careful consideration.

- Impact on economic growth: A sustained decline in the stock market could dampen consumer and investor confidence, potentially slowing economic growth.

- Impact on employment: Economic slowdown may lead to reduced hiring and potential job losses in certain sectors.

- Government policies aimed at mitigating economic hardship: The Dutch government may need to implement fiscal policies to support businesses and mitigate the impact on employment.

Analyzing the AEX Decline: A Deeper Dive

To gain a more comprehensive understanding of the AEX decline, we need to analyze it from both technical and fundamental perspectives.

Technical Analysis

Technical analysis of the AEX suggests [insert technical analysis indicators, e.g., moving averages, RSI, MACD, and their interpretation indicating potential future trends]. (Note: This section requires expertise in technical analysis and should be written accordingly, or omitted if not possible.)

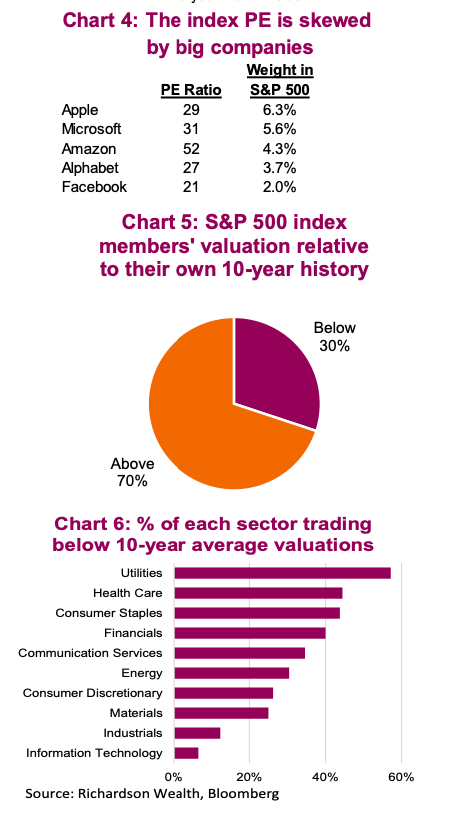

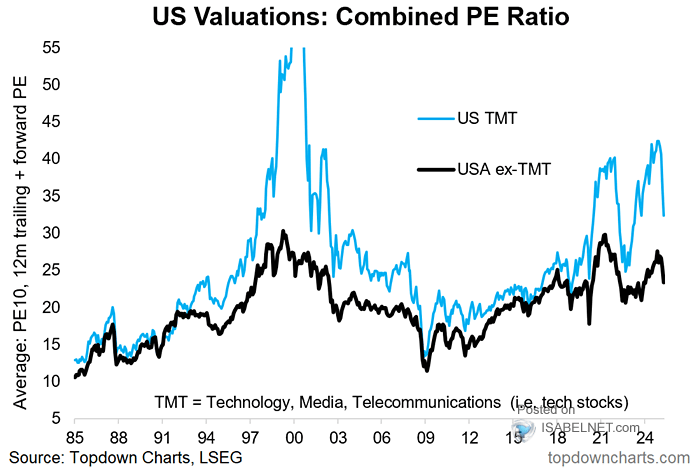

Fundamental Analysis

Fundamental analysis examines the intrinsic value of companies listed on the AEX. [Insert fundamental analysis of AEX components, e.g., P/E ratios, dividend yields, and growth prospects. Discuss whether these factors support or challenge future growth prospects]. (Note: This section requires expertise in fundamental analysis and should be written accordingly, or omitted if not possible).

Conclusion

The sharp decline in the Amsterdam AEX Index is a result of several intertwined factors: high inflation, rising interest rates implemented by the ECB, persistent geopolitical uncertainty, and the resulting impact on specific AEX components. These factors have created significant market volatility and uncertainty for investors.

Key Takeaways: The short-term outlook for the AEX remains uncertain, requiring investors to adopt cautious strategies. The long-term economic consequences for the Netherlands will depend on the evolution of these factors and the effectiveness of government policies.

Call to Action: Stay updated on the latest developments in the Amsterdam AEX Index and make informed decisions about your investment strategy. Monitor key economic indicators, including inflation rates and interest rate changes, and adjust your portfolio accordingly to navigate the volatility in the AEX and the broader Dutch stock market. Thorough research into individual company performance is also crucial for mitigating risk and maximizing potential returns.

Featured Posts

-

The Future Of Healthcare Analysis Of The Philips Future Health Index 2025 On Ai

May 24, 2025

The Future Of Healthcare Analysis Of The Philips Future Health Index 2025 On Ai

May 24, 2025 -

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 24, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 24, 2025 -

Nicki Chapmans Country Escape A Look At Her Stunning Garden

May 24, 2025

Nicki Chapmans Country Escape A Look At Her Stunning Garden

May 24, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekent Dit Voor Beleggers

May 24, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekent Dit Voor Beleggers

May 24, 2025

Latest Posts

-

Navigating High Stock Market Valuations Advice From Bof A

May 24, 2025

Navigating High Stock Market Valuations Advice From Bof A

May 24, 2025 -

Bof A On Stock Market Valuations A Reasoned Perspective For Investors

May 24, 2025

Bof A On Stock Market Valuations A Reasoned Perspective For Investors

May 24, 2025 -

Thames Water Executive Bonuses A Look At The Figures And Public Reaction

May 24, 2025

Thames Water Executive Bonuses A Look At The Figures And Public Reaction

May 24, 2025 -

Are Thames Water Executive Bonuses Fair A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Fair A Critical Analysis

May 24, 2025 -

Bof As View Why Current Stock Market Valuations Shouldnt Scare Investors

May 24, 2025

Bof As View Why Current Stock Market Valuations Shouldnt Scare Investors

May 24, 2025