How IBM Software Is Transforming Deutsche Bank Digitally

Table of Contents

IBM Cloud and Hybrid Cloud Solutions Powering Deutsche Bank's Infrastructure

Deutsche Bank's journey into the cloud represents a pivotal moment in its digital transformation strategy. The bank's adoption of IBM Cloud and a hybrid cloud approach is not simply a technological shift; it's a fundamental reshaping of its IT infrastructure, designed for greater scalability, resilience, and cost-efficiency.

-

Cloud Migration and Hybrid Approach: Deutsche Bank's migration to the cloud isn't a complete upheaval. Instead, it leverages a hybrid cloud strategy, intelligently integrating legacy systems with modern cloud-based applications. This phased approach minimizes disruption while maximizing the benefits of cloud technology. This careful integration ensures business continuity while reaping the rewards of improved agility and scalability.

-

Enhanced Scalability and Resilience: The benefits are clear. IBM Cloud provides Deutsche Bank with the scalability needed to handle fluctuating workloads and peak demands. This ensures consistent performance and availability, even during periods of high transaction volume. The inherent resilience of the cloud platform minimizes downtime and protects against potential outages.

-

Cost Optimization Through Cloud Adoption: Moving to the cloud isn't just about modernization; it's about optimizing costs. By consolidating infrastructure and leveraging cloud-based resources, Deutsche Bank realizes significant cost savings on hardware, maintenance, and energy consumption. This allows the bank to reinvest in innovative projects and enhance its competitive edge.

-

IBM Cloud Services in Action: Deutsche Bank utilizes several key IBM Cloud services, including IBM Cloud Private, offering a secure and controlled environment for deploying applications, and IBM Cloud Pak for Data, a crucial component in their data analytics strategy. These platforms provide the foundation for Deutsche Bank's modernized IT landscape.

AI and Data Analytics: Driving Smarter Decision-Making at Deutsche Bank

Artificial intelligence (AI) and advanced data analytics are no longer futuristic concepts; they're critical tools for modern financial institutions. Deutsche Bank is leveraging the power of IBM Watson and other AI-powered solutions to improve decision-making across its operations.

-

Risk Management and Fraud Detection: IBM Watson's AI capabilities are instrumental in enhancing risk management and fraud detection. The system analyzes vast datasets to identify patterns and anomalies indicative of fraudulent activity, allowing for proactive intervention and minimizing losses. This proactive approach strengthens the bank's security posture.

-

Enhanced Customer Service and Personalization: Data analytics, powered by platforms like IBM Cloud Pak for Data, allows Deutsche Bank to gain deeper insights into customer behavior and preferences. This data-driven approach enables personalized services, tailored financial advice, and improved customer experiences, fostering stronger client relationships.

-

AI-Powered Operational Efficiency: AI is also driving operational efficiencies. By automating routine tasks and optimizing processes, Deutsche Bank is freeing up employees to focus on more strategic initiatives. This leads to increased productivity and significant cost savings.

-

IBM AI and Data Analytics Platforms: The foundation of Deutsche Bank's AI-driven initiatives is built on robust platforms such as IBM Watson Studio, providing a collaborative environment for data scientists, and IBM Cloud Pak for Data, enabling the integration and analysis of diverse data sources.

Enhancing Cybersecurity and Protecting Sensitive Data

In the financial services sector, cybersecurity is paramount. Deutsche Bank recognizes this and has partnered with IBM to build a robust security framework capable of protecting sensitive data and systems from evolving cyber threats.

-

Protecting Against Cyber Threats: IBM Security solutions form a critical layer of defense for Deutsche Bank. These solutions provide advanced threat detection, prevention, and response capabilities, safeguarding the bank's valuable assets and customer data.

-

The Importance of Robust Cybersecurity: The financial industry is a prime target for cyberattacks. Deutsche Bank's commitment to robust cybersecurity underscores its dedication to safeguarding client information and maintaining the integrity of its operations. This proactive approach is essential for maintaining trust and compliance.

-

Specific IBM Security Tools: Deutsche Bank leverages several key IBM Security tools, including QRadar, a security information and event management (SIEM) platform, and Guardium, a data security solution protecting sensitive data across various platforms. These tools form the backbone of their comprehensive security architecture.

-

Meeting Regulatory Compliance: IBM Security solutions assist Deutsche Bank in meeting stringent regulatory compliance requirements. The bank's commitment to security ensures it adheres to industry standards and maintains the trust of its clients and regulators.

Automation and Process Optimization with IBM Software

Automation is a key driver of efficiency and cost savings in the modern financial industry. Deutsche Bank utilizes IBM's automation tools to streamline operations and reduce manual effort.

-

Streamlining Operations Through Automation: IBM's automation capabilities are transforming various aspects of Deutsche Bank's operations. Robotic Process Automation (RPA) is used to automate repetitive tasks, freeing up human resources for more strategic work.

-

Cost Savings and Improved Efficiency: Automation contributes significantly to cost savings by reducing manual labor costs and minimizing errors. Improved efficiency leads to faster processing times and increased productivity across the organization.

-

Examples of Automated Processes: These automated processes extend across various departments, from back-office functions like reconciliation to more customer-facing processes like account opening. The specific applications are tailored to Deutsche Bank’s needs.

-

IBM Automation Platforms: IBM Robotic Process Automation (RPA) is a core component of this automation strategy, enabling the development and deployment of automated workflows within Deutsche Bank's systems.

Conclusion

Deutsche Bank's digital transformation journey, powered by IBM software, represents a compelling success story in the fintech sector. By leveraging IBM's advanced capabilities in cloud computing, AI, data analytics, and cybersecurity, Deutsche Bank is modernizing its infrastructure, enhancing customer experiences, and strengthening its competitive position. This strategic partnership showcases the transformative power of IBM software in driving innovation and efficiency within the complex world of finance. The results achieved demonstrate the value of embracing advanced technology and strategic partnerships for digital transformation success.

Call to Action: Learn more about how IBM software solutions can drive your digital transformation. Explore IBM's comprehensive portfolio of offerings and discover the possibilities of partnering with a leader in technology innovation. Contact us today to discuss your specific needs and explore how IBM software can help your organization achieve its digital goals.

Featured Posts

-

Treyler Filma Frankenshteyn Ot Gilermo Del Toro Viydet V Etu Subbotu

May 30, 2025

Treyler Filma Frankenshteyn Ot Gilermo Del Toro Viydet V Etu Subbotu

May 30, 2025 -

Kivalliq Hydro Fibre Link Manitoba And Nunavut Forge A New Energy And Economic Corridor

May 30, 2025

Kivalliq Hydro Fibre Link Manitoba And Nunavut Forge A New Energy And Economic Corridor

May 30, 2025 -

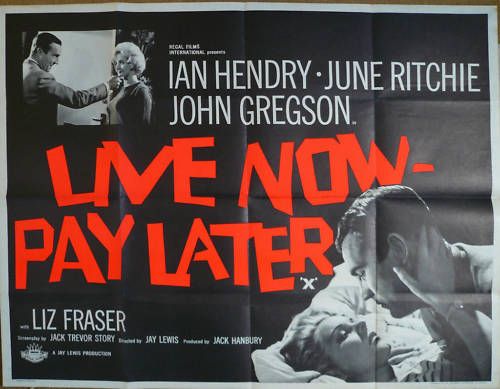

Compare Live Now Pay Later Options Find The Best Fit For You

May 30, 2025

Compare Live Now Pay Later Options Find The Best Fit For You

May 30, 2025 -

Travelers Canada Sold To Definity For 3 3 Billion Impact And Analysis

May 30, 2025

Travelers Canada Sold To Definity For 3 3 Billion Impact And Analysis

May 30, 2025 -

Live Streaming Pasxalinon Leitoyrgion E Thessalia Gr

May 30, 2025

Live Streaming Pasxalinon Leitoyrgion E Thessalia Gr

May 30, 2025