Invest Smart: A Guide To The Country's Hottest New Business Areas

Table of Contents

The Rise of Sustainable and Green Businesses

The global push towards environmental responsibility is creating a surge in sustainable and green businesses. This presents a significant opportunity for savvy investors looking for both financial returns and positive social impact. This sector encompasses a wide range of opportunities, from renewable energy to sustainable agriculture.

Renewable Energy Investments

The booming solar, wind, and geothermal energy sectors offer high returns and contribute to a positive environmental impact. Governments worldwide are heavily incentivizing the transition to renewable energy sources, creating a fertile ground for investment.

- Consider investments in:

- Established renewable energy companies (solar panel manufacturers, wind turbine producers)

- Infrastructure projects (solar farms, wind farms, geothermal power plants)

- Green bonds issued by governments or corporations committed to sustainability.

- Benefits: High growth potential, government support (tax credits, subsidies), positive ESG (Environmental, Social, and Governance) profile.

- Risks: Dependence on government policies, technological advancements potentially disrupting existing technologies.

Sustainable Agriculture and Food Tech

Growing consumer demand for sustainable and ethically sourced food is fueling the expansion of this sector. From vertical farming to organic food production, there are numerous avenues for investment.

- Investment opportunities include:

- Vertical farming companies utilizing innovative technologies to maximize efficiency and reduce environmental impact.

- Organic food production businesses focusing on sustainable practices and ethical sourcing.

- Companies developing sustainable packaging solutions to reduce waste.

- Key considerations: Focus on companies with strong ESG profiles, transparent supply chains, and a commitment to sustainable practices. The market is competitive, requiring thorough due diligence.

Eco-tourism and Sustainable Travel

Increasing awareness of environmental issues is driving growth in eco-conscious travel. Consumers are increasingly seeking out sustainable travel options, creating opportunities for businesses that prioritize environmental responsibility.

- Investment opportunities range from:

- Sustainable hotels and lodges committed to minimizing their environmental footprint.

- Eco-friendly tour operators offering experiences that respect local communities and ecosystems.

- Businesses developing sustainable transportation solutions for travel.

- Focus on: Businesses with relevant certifications (e.g., LEED, Green Globe), a demonstrable commitment to sustainability, and a strong focus on community engagement.

The Technological Revolution and its Investment Opportunities

Technological advancements are continuously reshaping industries, creating exciting investment opportunities. From artificial intelligence to cybersecurity, this sector offers significant growth potential.

Artificial Intelligence (AI) and Machine Learning

AI and ML are transforming numerous industries, creating huge investment potential. The applications of AI are vast, from automation to data analysis, making it a highly attractive sector for investors.

- Invest in:

- Companies developing AI software, hardware, and applications across various sectors (healthcare, finance, manufacturing).

- Venture capital funds specializing in early-stage AI startups.

- Key considerations: Thorough due diligence is crucial due to the rapid pace of innovation and potential for disruption.

Cybersecurity

The increasing reliance on technology makes cybersecurity a crucial and lucrative sector. Data breaches and cyberattacks are becoming increasingly sophisticated, driving demand for robust cybersecurity solutions.

- Invest in:

- Cybersecurity companies providing software, services, and consulting.

- Companies specializing in threat detection, incident response, and data protection.

- Look for: Companies with strong track records, proven solutions, and a commitment to innovation.

Fintech and Digital Finance

The Fintech revolution is disrupting traditional financial services. From mobile payment platforms to online lending, Fintech offers a range of innovative solutions that are reshaping the financial landscape.

- Investment opportunities include:

- Mobile payment platforms offering convenient and secure transaction processing.

- Online lending platforms utilizing alternative data and algorithms to assess creditworthiness.

- Companies leveraging blockchain technology for secure and transparent financial transactions.

- Analyze: The regulatory landscape and potential risks before investing in this rapidly evolving sector.

Healthcare and Wellness: A Growing Market

The healthcare and wellness sector is experiencing significant growth driven by aging populations, advancements in medical technology, and a growing focus on preventative care.

Telehealth and Remote Patient Monitoring

Telehealth is rapidly expanding, offering convenient and accessible healthcare. Remote patient monitoring devices are becoming increasingly sophisticated, enabling continuous health tracking and early detection of potential problems.

- Invest in:

- Telehealth platforms providing virtual consultations and remote diagnosis.

- Companies developing remote monitoring devices for various health conditions.

- Consider: The regulatory landscape and data privacy concerns related to sensitive patient information.

Personalized Medicine and Genomics

Advances in genomics are driving personalized medicine approaches. Genetic testing and personalized therapies are offering more targeted and effective treatments for various diseases.

- Investment opportunities include:

- Genetic testing companies providing personalized risk assessments and diagnostic tools.

- Companies developing personalized therapies and medications tailored to individual genetic profiles.

- Look for: Companies with strong scientific backing, a clear path to regulatory approval, and the potential for significant breakthroughs.

Wellness and Preventative Healthcare

Growing focus on preventative healthcare creates opportunities in wellness technology and services. Consumers are increasingly proactive in managing their health, driving demand for wellness products and services.

- Invest in:

- Fitness apps and wearable technology providing personalized health and fitness tracking.

- Wellness retreats and centers offering holistic health and wellness programs.

- Analyze: Market trends and consumer preferences to identify promising opportunities within this growing sector.

Conclusion

Investing smart requires careful consideration of emerging trends and market opportunities. This guide has highlighted some of the country's most promising new business areas, including sustainable businesses, technological advancements, and the growing healthcare sector. By focusing on these key sectors and conducting thorough research, you can position yourself for success. Don't wait – start exploring these opportunities and invest smart in your future today! Learn more about how to invest smart in these exciting new areas. Remember, diversification is key to mitigating risk when you invest smart.

Featured Posts

-

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive

Apr 22, 2025

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive

Apr 22, 2025 -

The Conclave A Critical Assessment Of Pope Franciss Papacy

Apr 22, 2025

The Conclave A Critical Assessment Of Pope Franciss Papacy

Apr 22, 2025 -

Brace For Impact The Stock Markets Potential For Further Downturns

Apr 22, 2025

Brace For Impact The Stock Markets Potential For Further Downturns

Apr 22, 2025 -

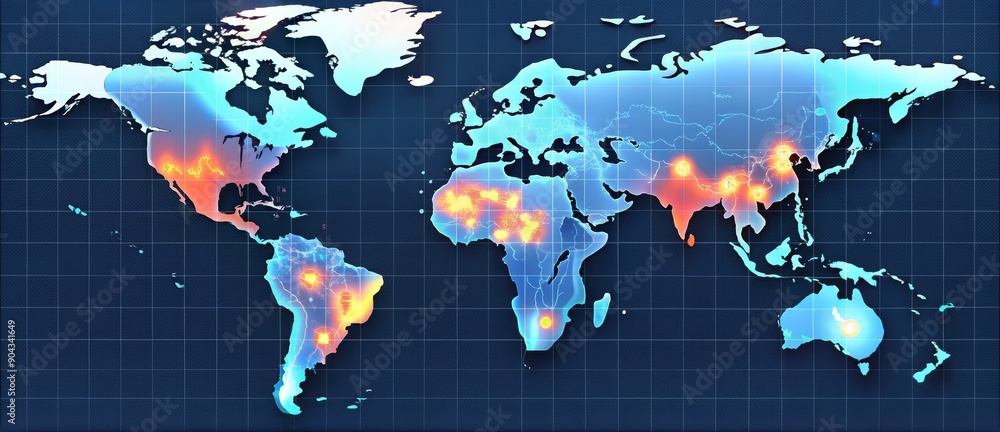

A Geographic Overview Of The Countrys Newest Business Hotspots

Apr 22, 2025

A Geographic Overview Of The Countrys Newest Business Hotspots

Apr 22, 2025 -

Assessing The Impact Of Trumps Trade Offensive On Us Financial Primacy

Apr 22, 2025

Assessing The Impact Of Trumps Trade Offensive On Us Financial Primacy

Apr 22, 2025

Latest Posts

-

Wynne Evans Seeks To Clear His Name With Fresh Evidence In Strictly Scandal

May 10, 2025

Wynne Evans Seeks To Clear His Name With Fresh Evidence In Strictly Scandal

May 10, 2025 -

Wynne Evans Faces Accusations Receives Public Backing

May 10, 2025

Wynne Evans Faces Accusations Receives Public Backing

May 10, 2025 -

Wynne Evans New Evidence Could Clear His Name After Strictly Scandal

May 10, 2025

Wynne Evans New Evidence Could Clear His Name After Strictly Scandal

May 10, 2025 -

Wynne Evans I Promise I Have Done Nothing Wrong Supporters Rally

May 10, 2025

Wynne Evans I Promise I Have Done Nothing Wrong Supporters Rally

May 10, 2025 -

Singer Wynne Evans Reveals Recent Health Struggle Hints At Stage Return

May 10, 2025

Singer Wynne Evans Reveals Recent Health Struggle Hints At Stage Return

May 10, 2025