Investing In Palantir Before May 5th: What To Consider

Table of Contents

Palantir's Current Financial Position & Recent Performance

Understanding Palantir's current financial health is crucial before investing. Analyzing recent financial reports reveals key insights into its revenue growth, profitability, and overall financial stability.

Revenue Growth and Profitability

Palantir's recent financial reports showcase a mixed bag. While revenue growth has been positive, profitability remains a challenge. Analyzing the figures requires a nuanced approach.

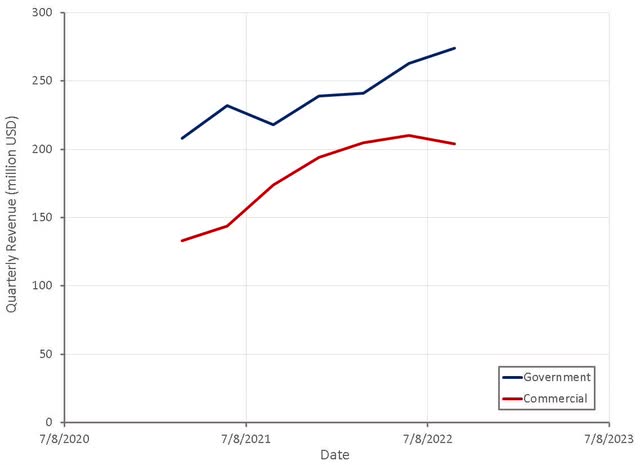

- Revenue Growth: Palantir has consistently shown revenue growth, but the rate of growth fluctuates. Investors should examine the specific quarterly and annual revenue figures to assess the trajectory. A detailed breakdown of revenue streams (government vs. commercial) is also essential.

- Profitability: Palantir's profitability has been inconsistent. Examining profit margins (gross, operating, and net) helps determine the company's ability to translate revenue into profits. Negative net income in some quarters raises concerns, and investors should compare these metrics to industry peers to gauge Palantir's performance relative to competitors.

- Notable Contracts: The securing and renewal of major contracts, both government and commercial, significantly impact Palantir's revenue and future prospects. Analyzing the size and duration of these contracts provides vital information for evaluating future performance. Tracking the success of contract wins and losses offers a clear picture of Palantir's competitiveness. Keywords: Palantir financials, PLTR revenue, Palantir profitability, financial performance analysis.

Debt Levels and Cash Flow

Assessing Palantir's debt levels and cash flow is vital for understanding its financial stability. High debt levels and low cash flow can expose the company to significant risks.

- Debt-to-Equity Ratio: A high debt-to-equity ratio indicates significant financial leverage, making the company more vulnerable to economic downturns. Investors should analyze this ratio to assess Palantir's financial risk.

- Cash Flow from Operations: Positive cash flow from operations shows the company's ability to generate cash from its core business activities. Consistent positive cash flow is a positive sign of financial health.

- Free Cash Flow: Free cash flow (FCF) indicates the cash available for reinvestment, debt repayment, or distribution to shareholders. A healthy FCF is crucial for long-term growth and sustainability. Keywords: Palantir debt, PLTR cash flow, financial stability, investment risk.

Market Analysis and Future Growth Prospects

Palantir operates in the rapidly growing data analytics market. Understanding its position within this market and its future growth prospects is key to evaluating its investment potential.

Growth Potential in the Data Analytics Market

The data analytics market is experiencing explosive growth, presenting significant opportunities for Palantir. However, the competitive landscape is intense.

- Market Size Projections: Researching market size projections provides context for Palantir's growth potential. Understanding the expected growth rate of the overall market helps assess Palantir's potential market share.

- Competitive Landscape: Palantir faces competition from established players like Snowflake and Databricks. Analyzing Palantir's competitive advantages, such as its proprietary technology and government contracts, is crucial.

- Competitive Advantages: Palantir's strengths lie in its sophisticated data integration and analysis capabilities, particularly its strong relationships within the government sector. Assessing whether these advantages are sustainable in the face of increasing competition is important. Keywords: Data analytics market, Palantir growth potential, competitive landscape, market share.

Government Contracts and Future Revenue Streams

Palantir's significant reliance on government contracts presents both opportunities and risks.

- Revenue Dependence: A significant portion of Palantir's revenue comes from government contracts. Analyzing this percentage is important because it reveals how reliant the company is on government spending.

- Potential for New Contracts: The potential for securing new government contracts significantly influences future revenue growth. Investors should research Palantir's pipeline of potential contracts and assess the likelihood of success.

- Government Spending Risks: Changes in government priorities or budget cuts could significantly impact Palantir's revenue. Analyzing the stability of government funding and potential risks is essential. Keywords: Government contracts, Palantir revenue streams, contract risk, government spending.

Risks and Potential Downsides of Investing in Palantir

Investing in Palantir carries inherent risks. A thorough understanding of these risks is crucial before making any investment decisions.

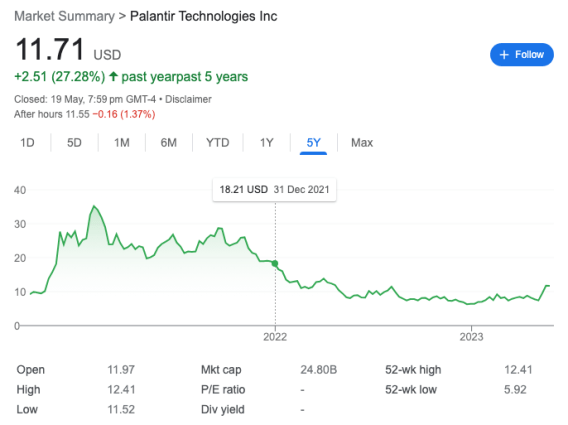

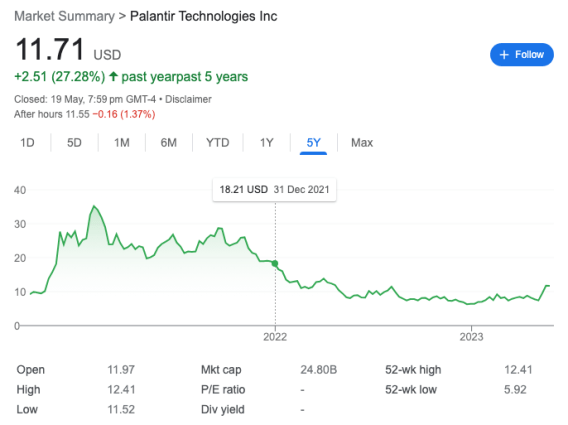

Valuation and Stock Price Volatility

Palantir's stock price has historically been volatile. Understanding its valuation and the factors driving this volatility is essential.

- Valuation Metrics: Analyzing key valuation metrics like the Price-to-Earnings ratio (P/E) and Price-to-Sales ratio (P/S) helps determine whether the stock is currently overvalued or undervalued.

- Stock Price Volatility: High volatility means significant price fluctuations, potentially leading to substantial gains or losses. Investors should evaluate their risk tolerance in relation to this volatility.

- Market Sentiment: Investor sentiment and overall market conditions significantly influence Palantir's stock price. Understanding these external factors is crucial for making informed investment decisions. Keywords: Palantir stock price, PLTR valuation, stock volatility, investment risk.

Competition and Technological Disruption

The data analytics market is dynamic, and Palantir faces threats from both existing and emerging competitors.

- Emerging Technologies: New technologies and innovative approaches to data analytics could disrupt Palantir's market position. Assessing the potential impact of these disruptive technologies is crucial.

- Competitive Threats: Competitors constantly improve their offerings, potentially eroding Palantir's market share. Analyzing the competitive threats and Palantir's strategies to mitigate these risks is vital.

- Maintaining Competitive Advantage: Palantir must consistently innovate to retain its competitive edge. Evaluating the company's investment in research and development and its ability to adapt to changing market conditions is key. Keywords: Technological disruption, Palantir competitors, competitive advantage, market disruption.

Conclusion

Investing in Palantir before May 5th requires a thorough understanding of its financial health, market position, growth prospects, and associated risks. Carefully weigh the potential rewards against the inherent volatility and competitive pressures. This analysis of Palantir's current situation, including financial performance and future projections, should inform your investment strategy. Remember to conduct your own thorough research before making any investment decisions in Palantir stock (PLTR) or any other security. Ultimately, the decision to invest in Palantir before May 5th rests solely with you, after a careful consideration of all factors. Remember to diversify your portfolio and consult with a financial advisor before making any significant investment in Palantir or any other stock.

Featured Posts

-

Government And Commercial Sectors Drive Palantir Stock Performance In Q1

May 10, 2025

Government And Commercial Sectors Drive Palantir Stock Performance In Q1

May 10, 2025 -

Capital Market Cooperation Deepens Pakistan Sri Lanka And Bangladesh Collaboration

May 10, 2025

Capital Market Cooperation Deepens Pakistan Sri Lanka And Bangladesh Collaboration

May 10, 2025 -

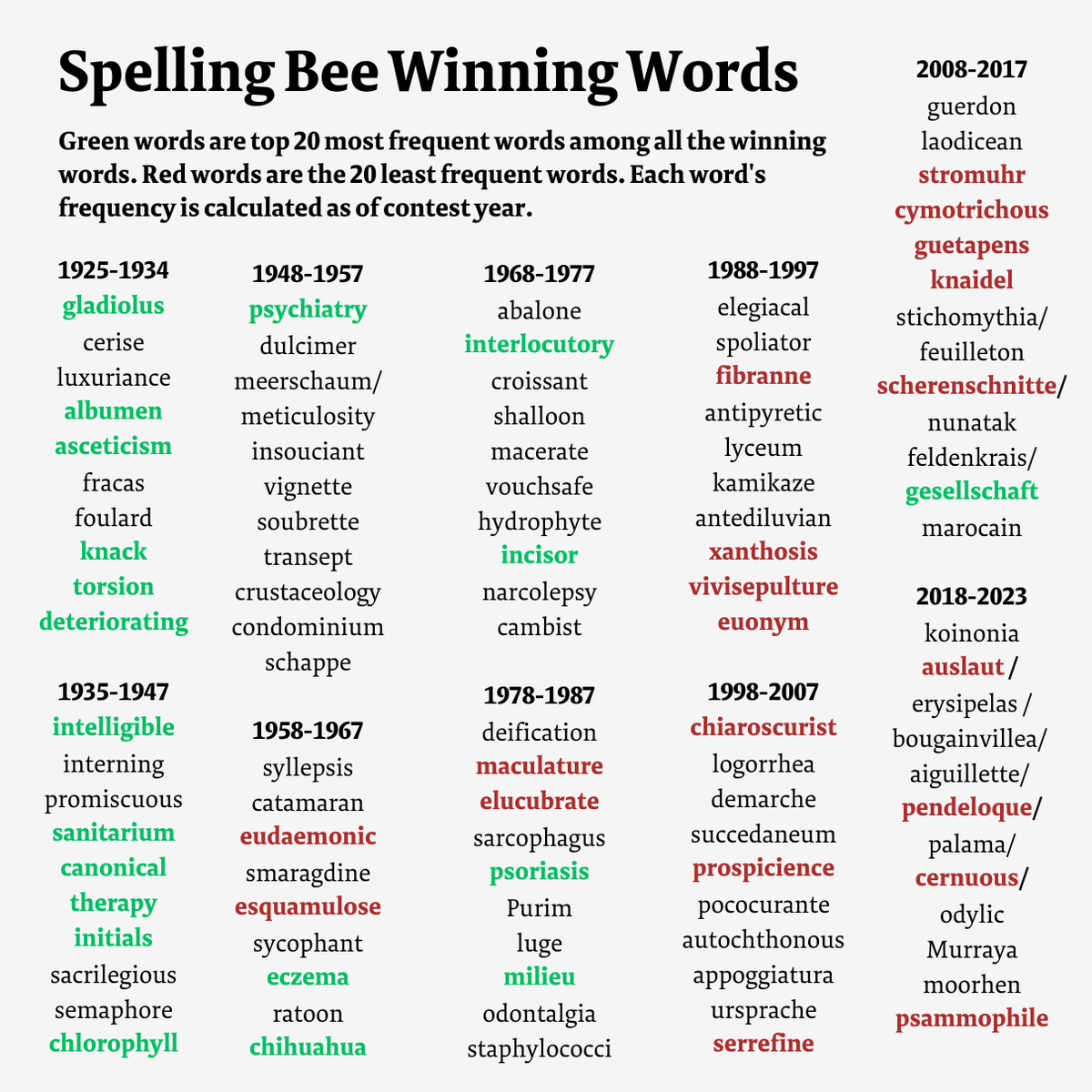

Solve The Nyt Spelling Bee April 1 2025 Puzzle Solutions

May 10, 2025

Solve The Nyt Spelling Bee April 1 2025 Puzzle Solutions

May 10, 2025 -

Elizabeth City Police Investigate String Of Car Break Ins At Apartment Complexes

May 10, 2025

Elizabeth City Police Investigate String Of Car Break Ins At Apartment Complexes

May 10, 2025 -

Should You Buy Palantir Stock Pre May 5th Analysis

May 10, 2025

Should You Buy Palantir Stock Pre May 5th Analysis

May 10, 2025