Is Palantir Stock A Buy Before May 5th? A Wall Street Perspective

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Palantir Technologies, a prominent player in the big data analytics sector, provides software platforms for government and commercial clients. Understanding its recent financial performance is crucial for assessing the value of Palantir stock.

Revenue Growth and Profitability

Palantir's recent quarterly earnings reports reveal important trends in revenue growth and profitability. Analyzing key financial metrics is vital for evaluating the company's financial health and future prospects.

- Key Financial Metrics: Closely examine earnings per share (EPS), total revenue, and operating income to gauge financial performance. Compare these figures to previous quarters and to analyst expectations.

- Year-over-Year Comparisons: Tracking year-over-year growth rates provides insights into the sustainability of Palantir's revenue streams and profitability. Consistent growth indicates a healthy trajectory for PLTR stock.

- Future Growth Drivers: Identify potential growth drivers such as new product launches, expansion into new markets, and increasing government and commercial contracts. These factors are crucial for predicting future revenue and earnings for Palantir shares.

Government Contracts and Commercial Partnerships

A significant portion of Palantir's revenue stems from government contracts. The stability and growth of this sector significantly impact the value of Palantir stock.

- Significant Government Contracts: Analyze recent contract wins and losses, assessing their impact on future revenue projections. Long-term, high-value contracts contribute to stable earnings for Palantir.

- Key Commercial Partnerships: Explore Palantir's strategic commercial partnerships and their contribution to revenue diversification. Expanding into the commercial sector reduces reliance on government contracts, benefiting PLTR stock in the long term.

- Risks Associated with Government Contract Reliance: Acknowledge the inherent risks of relying heavily on government contracts, including potential budget cuts and changes in government priorities. This is a crucial factor to consider when assessing Palantir stock.

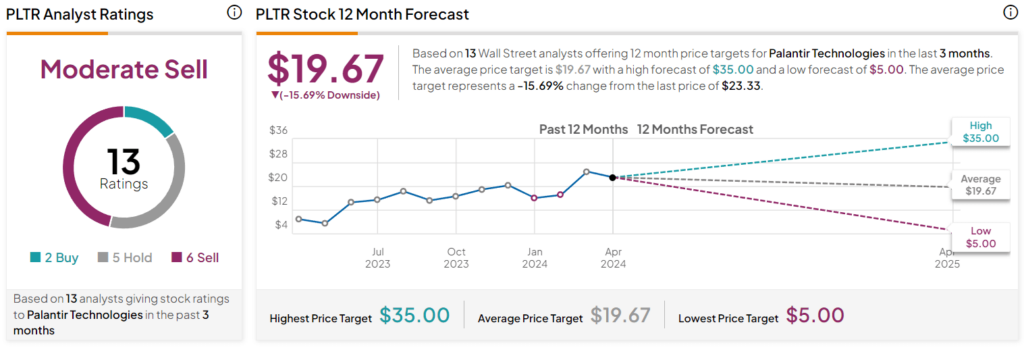

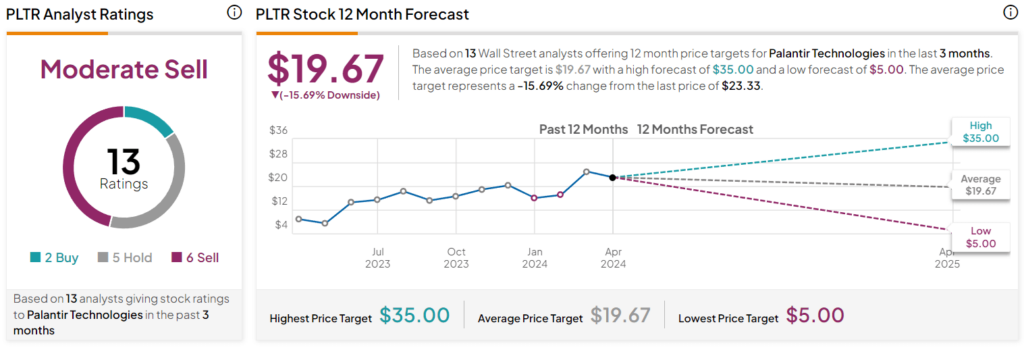

Analyst Ratings and Price Targets

Wall Street analysts offer valuable insights into Palantir's future performance and the potential trajectory of PLTR stock. Analyzing their consensus ratings and price targets is essential.

- Average Price Target: The average price target from multiple analysts provides a consensus view of the potential value of Palantir shares.

- Range of Price Targets: The range of price targets highlights the divergence in analyst opinions, showing the uncertainty surrounding the future of PLTR stock.

- Buy/Sell/Hold Ratings: The percentage of analysts recommending a buy, hold, or sell provides a quantitative assessment of market sentiment towards Palantir stock.

Market Factors Affecting Palantir Stock

Several macroeconomic and industry-specific factors influence the price of Palantir stock. Understanding these factors is critical for informed investment decisions.

Macroeconomic Conditions

Broader economic trends directly influence investor sentiment and spending, impacting the value of Palantir shares.

- Current Economic Climate: Assess the current economic environment, considering factors such as inflation, interest rates, and recessionary fears. A strong economy typically boosts investor confidence, benefiting PLTR stock.

- Potential Impact on Government Spending: Analyze how potential economic slowdowns or budgetary constraints might affect government spending on big data analytics, influencing Palantir's revenue from government contracts.

- Effect on Investor Sentiment: Investor sentiment is highly sensitive to economic conditions. Negative economic news can lead to a sell-off in Palantir shares.

Competition and Industry Trends

The competitive landscape and industry trends within the big data analytics market affect Palantir's market share and growth potential.

- Key Competitors: Identify Palantir's main competitors and analyze their market positions and strategies. Intense competition can put downward pressure on PLTR stock.

- Disruptive Technologies: Assess the impact of emerging technologies that could disrupt Palantir's business model. The emergence of new technologies can affect investor confidence in Palantir shares.

- Market Share Dynamics: Track Palantir's market share and its growth trajectory within the big data analytics industry. Market share gains are typically positive for PLTR stock.

Geopolitical Risks

Geopolitical events can impact Palantir's operations and financial performance, affecting the value of Palantir stock.

- Specific Geopolitical Events: Identify potential geopolitical risks, such as international conflicts or regulatory changes, that could affect Palantir's business in specific regions.

- Potential Impact on Revenue Streams: Assess the potential impact of geopolitical events on Palantir's revenue streams, particularly those related to government contracts.

- Mitigation Strategies: Examine the steps Palantir is taking to mitigate geopolitical risks and their potential effectiveness.

Technical Analysis of Palantir Stock

While fundamental analysis is paramount, a brief look at technical indicators can provide supplementary insights into potential short-term price movements. Remember, technical analysis is not a reliable predictor of future performance.

Chart Patterns and Indicators

Technical analysis can offer potential clues about short-term price movements.

- Key Chart Patterns: Observe chart patterns such as head and shoulders, triangles, or flags, which might suggest potential price reversals or breakouts.

- Technical Indicators: Analyze indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) for potential buy or sell signals.

- Limitations of Technical Analysis: It's crucial to acknowledge that technical analysis is not foolproof and shouldn't be the sole basis for investment decisions.

Trading Volume and Volatility

Trading volume and volatility provide insights into the market's sentiment towards Palantir stock.

- Average Daily Volume: High trading volume often indicates strong investor interest, while low volume can signal apathy.

- Volatility Metrics: Analyze volatility metrics such as the beta coefficient to understand the risk associated with Palantir stock.

- Implications for Potential Price Swings: High volatility increases the potential for significant price swings, either positive or negative.

Conclusion: Is Palantir Stock a Buy Before May 5th? A Wall Street Perspective

Determining whether Palantir stock is a buy before May 5th requires a comprehensive assessment of its financial performance, market position, and the overall economic climate. While Palantir boasts significant potential in the growing big data analytics market, considerable risks remain, including reliance on government contracts and intense competition. The macroeconomic environment and geopolitical factors also play a crucial role. Based on the analysis, a cautious approach is recommended. Further research is strongly advised before making any investment decisions related to Palantir shares. Conduct thorough due diligence and consult with a financial advisor before investing in Palantir stock or any other security. Learn more about Palantir stock and make an informed decision before May 5th.

Featured Posts

-

Microsoft Activision Deal Faces Ftc Appeal A Deep Dive

May 09, 2025

Microsoft Activision Deal Faces Ftc Appeal A Deep Dive

May 09, 2025 -

Iditarod 2024 Following Seven Rookie Mushers To Nome

May 09, 2025

Iditarod 2024 Following Seven Rookie Mushers To Nome

May 09, 2025 -

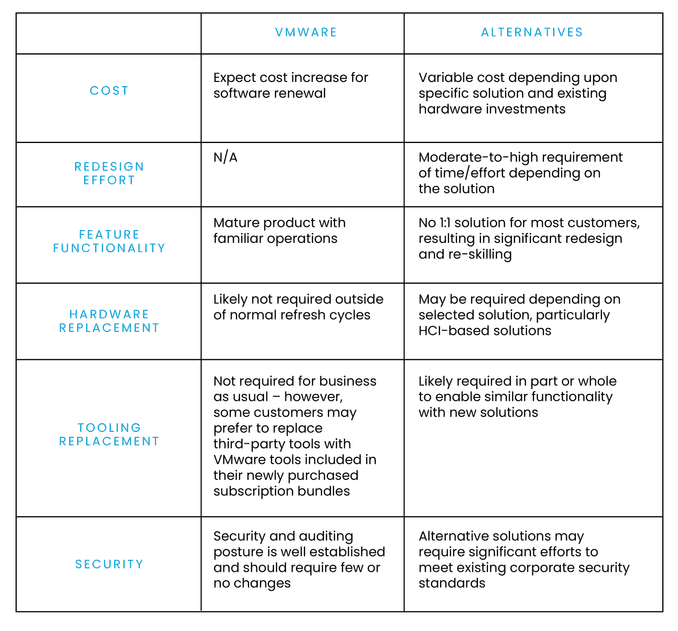

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike Concerns

May 09, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike Concerns

May 09, 2025 -

Summer Travel 2024 Real Id Requirements And Airport Security

May 09, 2025

Summer Travel 2024 Real Id Requirements And Airport Security

May 09, 2025 -

When To Watch The Next High Potential Episode On Abc

May 09, 2025

When To Watch The Next High Potential Episode On Abc

May 09, 2025

Latest Posts

-

The Brutal Reality Of Racist Violence One Familys Tragedy

May 10, 2025

The Brutal Reality Of Racist Violence One Familys Tragedy

May 10, 2025 -

Hanh Trinh Chuyen Gioi Cua Lynk Lee Tu Nhan Sac Den Tinh Yeu Tron Ven

May 10, 2025

Hanh Trinh Chuyen Gioi Cua Lynk Lee Tu Nhan Sac Den Tinh Yeu Tron Ven

May 10, 2025 -

Punjabs Initiative Technical Training For Transgender Community

May 10, 2025

Punjabs Initiative Technical Training For Transgender Community

May 10, 2025 -

Family Torn Apart By Hate Crime A Story Of Loss

May 10, 2025

Family Torn Apart By Hate Crime A Story Of Loss

May 10, 2025 -

Lynk Lee Su Ung Ho Cua Ban Trai Va Nhan Sac Ngay Cang Thang Hang Sau Chuyen Gioi

May 10, 2025

Lynk Lee Su Ung Ho Cua Ban Trai Va Nhan Sac Ngay Cang Thang Hang Sau Chuyen Gioi

May 10, 2025