Microsoft Activision Deal Faces FTC Appeal: A Deep Dive

Table of Contents

The FTC's challenge stems from concerns about the potential for anti-competitive practices resulting from Microsoft's acquisition of Activision Blizzard, a powerhouse behind iconic franchises like Call of Duty, World of Warcraft, and Candy Crush. This article will delve into the complexities of this legal battle, examining the key arguments presented by both sides and exploring the potential outcomes.

The FTC's Case Against the Microsoft Activision Deal

The FTC's central argument against the Microsoft Activision deal hinges on the belief that the merger would create an unfair monopoly, stifling competition and harming consumers.

Concerns about Anti-Competitive Practices

The FTC argues that Microsoft, once in control of Activision Blizzard's vast catalog of games, particularly the immensely popular Call of Duty franchise, could leverage its market power to harm competitors.

- Exclusive Content: Microsoft could make Call of Duty and other Activision Blizzard titles exclusive to Xbox, or offer them on other platforms at significantly higher prices, giving Xbox a significant competitive advantage over PlayStation and other gaming platforms.

- Pricing Strategies: The FTC is concerned that Microsoft could use its combined market share to artificially inflate prices for Activision Blizzard games across all platforms, reducing consumer choice and increasing costs.

- Platform Lock-in: By controlling key franchises, Microsoft could lock players into the Xbox ecosystem, hindering the ability of competitors to attract and retain customers. The FTC points to Microsoft's history of acquiring studios and making games exclusive as evidence of this potential behavior. Their filings cite specific concerns about the potential for Microsoft to leverage this power to harm competitors, specifically mentioning Sony's Playstation and Nintendo's Switch platforms.

The FTC's arguments are supported by extensive documentation detailing Microsoft's past acquisitions and business practices.

The Impact on Game Developers and Consumers

Beyond the immediate impact on established competitors, the FTC argues the merger could harm independent game developers and ultimately, consumers.

- Reduced Competition: A lack of competition could lead to reduced innovation and fewer incentives for Microsoft to invest in improving its games or services.

- Higher Prices: Eliminating competition increases the likelihood of higher prices for games and related services, squeezing consumers.

- Market Dominance: The FTC fears the merger would solidify Microsoft's market dominance, reducing consumer choice and stifling competition in the wider gaming market. This could result in less variety, less innovation, and ultimately a less appealing gaming landscape for everyone.

The FTC's Proposed Remedies

The FTC has proposed remedies aiming to prevent the merger or at least mitigate its potentially negative effects. These may include:

- Blocking the Merger Entirely: The most drastic measure would be to completely prevent the acquisition from happening.

- Behavioral Remedies: These could involve stipulations requiring Microsoft to license Activision Blizzard titles to competitors or preventing the company from making games exclusive to its platforms. Specific stipulations on pricing and marketing strategies may also be included.

Microsoft's Defense of the Microsoft Activision Deal

Microsoft counters the FTC's arguments, emphasizing the potential benefits of the merger for gamers and the broader industry.

Arguments for Competitive Benefits

Microsoft argues the acquisition will bring significant advantages for gamers.

- Increased Game Availability: Microsoft pledges to bring Activision Blizzard games to a wider range of platforms, including cloud gaming services like Xbox Cloud Gaming, thus increasing access for players regardless of their preferred console or device.

- Wider Access to Activision Games: They promise to continue releasing Activision Blizzard games on various platforms, including PlayStation and PC, ensuring that a vast audience remains able to access the games they love.

- Investment in Game Development: Microsoft has committed to investing in the further development of Activision Blizzard's franchises, potentially leading to improved game quality and more frequent releases.

Addressing the FTC's Concerns

Microsoft actively refutes the FTC's claims of anti-competitive practices.

- Licensing Agreements: Microsoft has proposed licensing agreements to ensure that Call of Duty and other key franchises remain available on competing platforms.

- Cross-Platform Availability: They have pledged to maintain cross-platform functionality and play, preventing the kind of platform lock-in that the FTC fears. This includes making commitments to the continued availability of Call of Duty on PlayStation for a minimum of ten years.

The Importance of Cloud Gaming

Cloud gaming plays a central role in Microsoft's defense.

- Expanded Access: Microsoft argues that cloud gaming expands access to games for everyone, negating concerns about platform exclusivity. This allows for a broader and more inclusive gaming experience.

Potential Outcomes and Implications of the Appeal

The FTC's appeal leaves several potential outcomes:

Possible Scenarios

- The merger is blocked: This would be a significant victory for the FTC and could set a precedent for future mergers and acquisitions in the tech industry. It would also likely lead to significant upheaval in the gaming industry.

- The merger proceeds with conditions: This outcome would likely involve Microsoft agreeing to significant concessions regarding licensing, pricing, and exclusivity.

- The case is settled out of court: A negotiated settlement may involve similar concessions to the ones in the previous point, but it avoids a lengthy and expensive court battle.

The Broader Context of Mergers and Acquisitions in the Tech Industry

This case sets a crucial precedent for future mergers and acquisitions in the tech industry.

- Increased Regulatory Scrutiny: The FTC's appeal signals increased regulatory scrutiny of large tech company mergers, particularly in industries with significant market consolidation. This case is closely watched by other tech companies who are either contemplating their own mergers or operating under similar regulatory frameworks.

Conclusion: The Future of the Microsoft Activision Deal

The Microsoft Activision deal is far from settled. The FTC's appeal highlights crucial questions about market dominance, competitive practices, and the future of gaming. While Microsoft argues for the benefits of increased access and investment, the FTC emphasizes the potential for anti-competitive behavior and harm to consumers. The potential outcomes – a blocked merger, a conditional approval, or an out-of-court settlement – will have profound implications for the gaming industry and the tech sector at large. Stay updated on the developments of the Microsoft Activision merger, and share your thoughts on this pivotal moment in the gaming world. The future of the Activision Blizzard acquisition, and similar mergers in the tech industry, hangs in the balance.

Featured Posts

-

Rethinking Stephen King Four New Theories About Randall Flagg

May 09, 2025

Rethinking Stephen King Four New Theories About Randall Flagg

May 09, 2025 -

Analysis Trump Names Fox News Personality Jeanine Pirro Dc Prosecutor

May 09, 2025

Analysis Trump Names Fox News Personality Jeanine Pirro Dc Prosecutor

May 09, 2025 -

2023 23

May 09, 2025

2023 23

May 09, 2025 -

Billionaire Elon Musks Fortune Boosted By Tesla Stock Rally

May 09, 2025

Billionaire Elon Musks Fortune Boosted By Tesla Stock Rally

May 09, 2025 -

Naein Britannian Kruununperimysjaerjestys Naeyttaeae Nyt

May 09, 2025

Naein Britannian Kruununperimysjaerjestys Naeyttaeae Nyt

May 09, 2025

Latest Posts

-

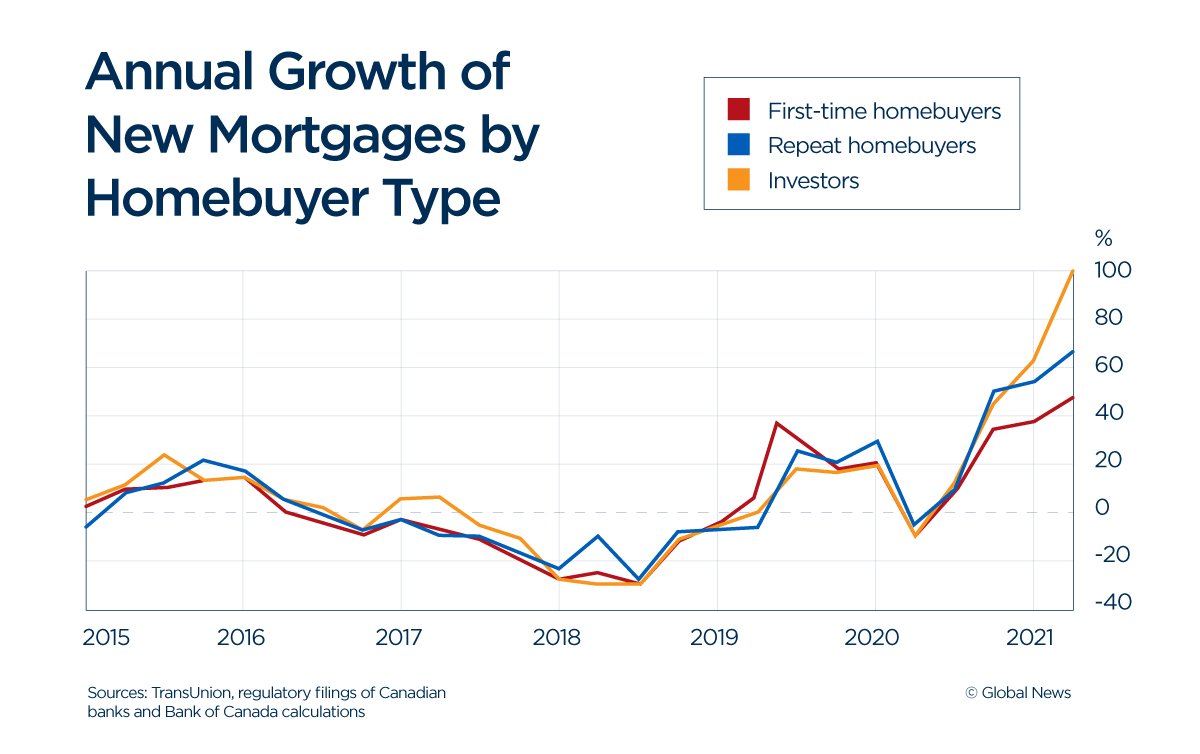

Canadas Housing Market The Impact Of Steep Down Payments

May 10, 2025

Canadas Housing Market The Impact Of Steep Down Payments

May 10, 2025 -

Pam Bondi Accused Of Hiding Epstein Records Senate Democrats Speak Out

May 10, 2025

Pam Bondi Accused Of Hiding Epstein Records Senate Democrats Speak Out

May 10, 2025 -

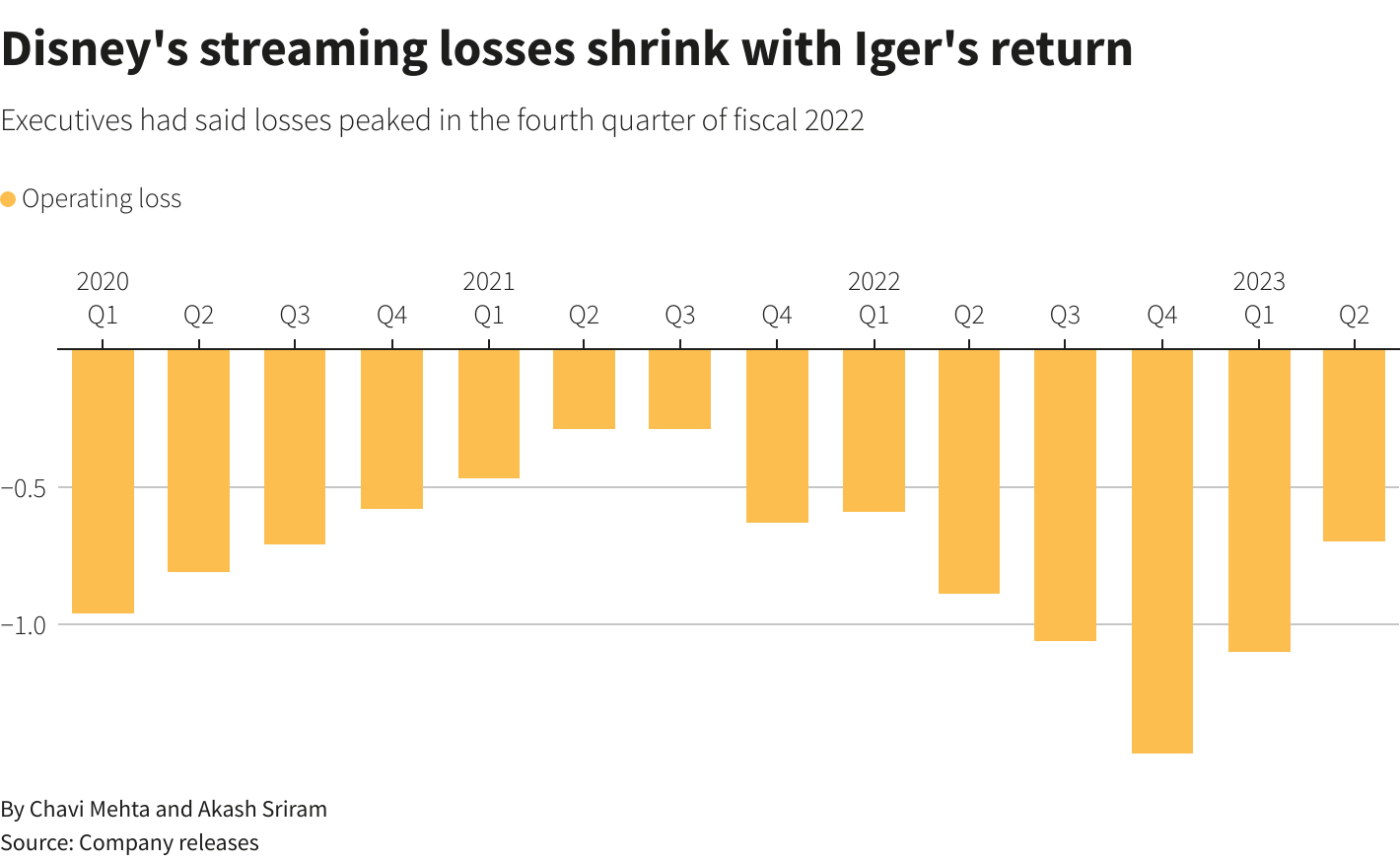

Disneys Increased Profit Strong Parks And Streaming Performance

May 10, 2025

Disneys Increased Profit Strong Parks And Streaming Performance

May 10, 2025 -

Posthaste High Down Payments And The Canadian Housing Crisis

May 10, 2025

Posthaste High Down Payments And The Canadian Housing Crisis

May 10, 2025 -

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025