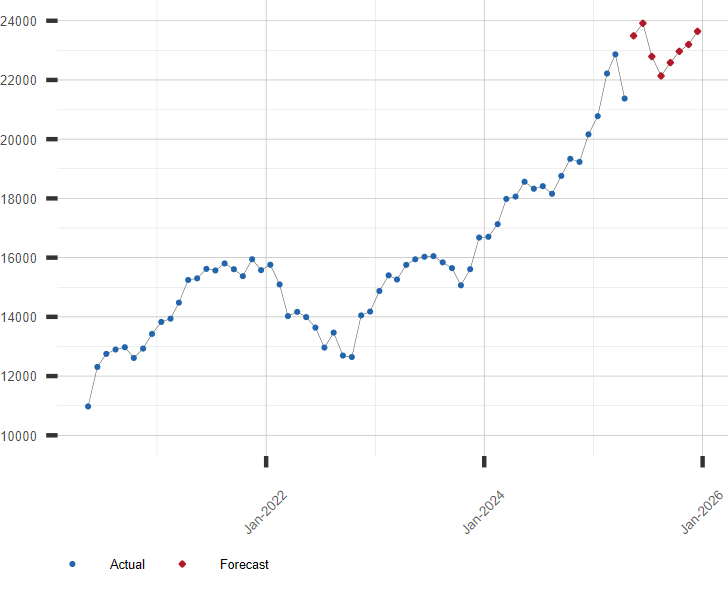

Kering's Q1 Performance: A 6% Share Price Slump

Table of Contents

Declining Sales Growth in Key Brands

Kering's Q1 performance was largely driven by weaker-than-expected sales growth across several key brands. While the company remains a powerhouse in the luxury sector, the numbers tell a concerning story. The slowdown wasn't uniform across all brands, but the impact on the overall Kering revenue is undeniable. Let's look at the specifics:

-

Gucci: Gucci, Kering's flagship brand, experienced a noticeable deceleration in sales growth, a significant factor in the overall Q1 slump. While precise figures require further analysis of the released financial reports, preliminary indications suggest a considerable drop compared to previous quarters. This could be attributed to factors such as changing consumer preferences, increased competition, and possibly a saturation of the market with Gucci products.

-

Yves Saint Laurent (YSL): YSL, another major contributor to Kering's revenue, also showed signs of slowing growth. While the brand still maintains a strong position, the less-than-stellar performance adds to the overall concerns surrounding Kering's Q1 performance. This further highlights the challenges faced within the luxury market.

-

Other Brands: While Gucci and YSL dominated the narrative, other brands under the Kering umbrella also contributed to the subdued sales growth. This underscores the systemic nature of the challenges facing Kering, rather than isolated issues affecting individual brands. The interconnectedness of the luxury market is clearly playing a crucial role.

Keywords: Gucci sales, Yves Saint Laurent sales, Kering revenue, brand performance, sales growth, luxury market trends.

Impact of Macroeconomic Factors on Kering's Q1 Performance

The global economic landscape played a significant role in shaping Kering's Q1 performance. Several macroeconomic factors contributed to the weaker-than-expected results:

-

Inflation and Recession Fears: Rising inflation and growing fears of a global recession significantly impacted consumer spending. Luxury goods, often considered discretionary purchases, are particularly vulnerable during economic uncertainty. Consumers are more likely to cut back on non-essential spending, directly affecting sales of high-end products.

-

Reduced Consumer Spending: The impact of inflation and recession fears is clearly visible in reduced consumer spending on luxury items. This downturn is not limited to any specific geographic region; it's a global phenomenon affecting major luxury brands worldwide.

-

Currency Fluctuations: Currency exchange rate volatility also impacted Kering's financial results, affecting the translation of sales figures into euros. Fluctuations in major currencies such as the US dollar and the Chinese yuan create uncertainty and can negatively impact profitability.

-

Geopolitical Instability: Ongoing geopolitical instability in various parts of the world further contributed to the uncertainty surrounding the global luxury market, making it more challenging for companies like Kering to predict and manage their performance.

Keywords: macroeconomic factors, inflation, recession, consumer spending, currency exchange rates, geopolitical risk.

Kering's Strategic Response and Future Outlook

Kering is not standing idly by. The company has outlined several strategic steps to navigate the current challenges and improve its future outlook:

-

New Product Launches: Kering is likely to focus on introducing new and innovative products to rejuvenate its brands and capture evolving consumer demand. A strategic pipeline of new products is crucial for maintaining brand relevance and market share.

-

Refined Marketing Strategies: Adjusted marketing campaigns targeting specific consumer segments and effectively communicating brand value are crucial for boosting sales in a challenging market. Adapting to changing trends and utilizing innovative marketing channels will be key.

-

Cost-Cutting Measures: Kering might implement cost-cutting measures to enhance profitability and strengthen its financial position during uncertain times. Streamlining operations and optimizing spending are vital strategies for navigating the current economic climate.

-

Financial Guidance: The company's financial guidance for the remaining quarters of the year will offer valuable insights into its expectations and strategies for recovery. Analysts' forecasts should also be considered when assessing Kering's future outlook.

Keywords: Kering strategy, future outlook, financial guidance, marketing strategy, product launches, cost-cutting.

Comparison with Competitors in the Luxury Goods Sector

Benchmarking Kering's Q1 performance against its major competitors, such as LVMH and Richemont, provides valuable context. While both companies also faced challenges, a comparative analysis reveals relative strengths and weaknesses:

-

LVMH: LVMH, Kering's main competitor, often shows more resilience during economic downturns, suggesting possible differences in brand positioning, product diversification, or overall strategic management.

-

Richemont: Richemont's performance may offer further comparative insights, particularly concerning specific market segments and brand strategies.

-

Market Share Dynamics: Analyzing the shift in market share amongst these luxury giants reveals important trends and competitive pressures within the sector.

Keywords: LVMH, Richemont, luxury market competition, market share, competitive analysis.

Conclusion: Assessing Kering's Q1 Performance and Future Prospects

The 6% share price slump in Kering's Q1 reflects a confluence of factors: slower-than-expected sales growth in key brands, the impact of macroeconomic headwinds, and intense competition within the luxury goods sector. While the situation presents challenges, Kering's strategic responses—including new product launches, refined marketing strategies, and potential cost-cutting measures—indicate a proactive approach to navigating these difficulties. The company's future performance will depend on its ability to effectively adapt to evolving consumer preferences, manage macroeconomic uncertainties, and maintain a strong competitive position. The long-term outlook for Kering remains uncertain, making it crucial for investors to carefully monitor its performance and the broader luxury goods market. Stay informed about Kering's performance by following future updates on the Kering Q1 performance and its stock price. Share your insights and opinions on Kering's performance in the comments section below!

Featured Posts

-

Under 1m Dream Homes Escape To The Country Buyer Success Stories

May 24, 2025

Under 1m Dream Homes Escape To The Country Buyer Success Stories

May 24, 2025 -

Your Escape To The Country Awaits Property Search And Relocation Advice

May 24, 2025

Your Escape To The Country Awaits Property Search And Relocation Advice

May 24, 2025 -

K 100 Letiyu Innokentiya Smoktunovskogo Dokumentalniy Film Menya Vela Kakaya To Sila

May 24, 2025

K 100 Letiyu Innokentiya Smoktunovskogo Dokumentalniy Film Menya Vela Kakaya To Sila

May 24, 2025 -

Record High Followed By Stability Frankfurts Dax Market Opens

May 24, 2025

Record High Followed By Stability Frankfurts Dax Market Opens

May 24, 2025 -

Listen Now Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025

Listen Now Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025

Latest Posts

-

The Sean Penn Woody Allen Relationship A Persistent Me Too Issue

May 24, 2025

The Sean Penn Woody Allen Relationship A Persistent Me Too Issue

May 24, 2025 -

Sean Penns Allegiance To Woody Allen A Me Too Case Study

May 24, 2025

Sean Penns Allegiance To Woody Allen A Me Too Case Study

May 24, 2025 -

Is Sean Penns Support Of Woody Allen A Sign Of Continued Me Too Blindness

May 24, 2025

Is Sean Penns Support Of Woody Allen A Sign Of Continued Me Too Blindness

May 24, 2025 -

Mia Farrow Michael Caine And An Ex Husband A Behind The Scenes Story

May 24, 2025

Mia Farrow Michael Caine And An Ex Husband A Behind The Scenes Story

May 24, 2025 -

Michael Caines Unexpected On Set Visit During Mia Farrow Sex Scene Filming

May 24, 2025

Michael Caines Unexpected On Set Visit During Mia Farrow Sex Scene Filming

May 24, 2025