Record High Followed By Stability: Frankfurt's DAX Market Opens

Table of Contents

Record-Breaking Open: Analyzing the Initial Surge

The DAX's impressive start was fueled by a confluence of positive economic indicators and investor sentiment. This initial surge provides valuable insights into the current state of Frankfurt's DAX market and its potential future trajectory.

Factors Contributing to the Record High:

- Strong Corporate Earnings: Several DAX-listed companies reported better-than-expected earnings, boosting investor confidence and driving up share prices. Strong performances from key players in the automotive and technology sectors were particularly notable.

- Positive Economic Data from Germany and the Eurozone: Positive economic data releases from Germany and the broader Eurozone, including robust GDP growth and falling unemployment figures, contributed to a generally optimistic market outlook. These figures suggest a healthy economic foundation for sustained growth.

- Global Market Optimism: A positive global market sentiment, driven by positive developments in other major stock markets, also played a significant role. This global optimism spilled over into the Frankfurt's DAX market, further amplifying the upward momentum.

- Specific Company Performance Driving the Index: Strong performance from individual companies, particularly those with a significant weighting in the DAX index, exerted considerable influence on the overall market performance. News of successful product launches or strategic partnerships also contributed.

Impact on Investors:

The record high presented both opportunities and challenges for investors:

- Potential for Profit-Taking: The surge created an opportunity for short-term investors to lock in profits, potentially leading to some selling pressure and price corrections.

- Increased Risk Appetite: The positive market sentiment encouraged increased risk appetite amongst investors, leading to higher trading volumes and potentially more volatile market conditions.

- Impact on Investment Strategies: Investors needed to re-evaluate their investment strategies in light of the record high, considering potential risks and opportunities presented by the market's dynamic behavior.

Stabilization and Consolidation: Understanding the Market's Calm

Following the initial surge, Frankfurt's DAX market showed remarkable stability, indicating a period of consolidation and cautious optimism.

Factors Contributing to Market Stability:

- Profit-Taking: The initial surge was followed by a period of profit-taking, where investors who had benefited from the rise sold off some of their holdings to secure gains. This helped moderate the upward momentum.

- Cautious Optimism: While positive, the market sentiment shifted towards cautious optimism, as investors awaited further economic data and assessed the sustainability of the initial surge.

- Anticipation of Upcoming Economic Data: The market's stability can also be attributed to the anticipation of upcoming economic data releases, which could potentially influence investor sentiment and market direction.

- Central Bank Policies: The stance of the European Central Bank (ECB) regarding monetary policy played a significant role in shaping market expectations and influencing investor behavior.

- Geopolitical Factors: Global geopolitical events and their potential impact on the German economy and the Eurozone also contributed to the overall cautious market sentiment.

Sector-Specific Performance:

The performance varied across different sectors within the DAX.

- Performance of Key Sectors: The automotive sector, a major component of the DAX, showed mixed results, with some companies performing better than others. The technology sector generally performed well, mirroring global trends. The financial sector exhibited moderate growth.

- Individual Company Performances: Individual companies within each sector experienced varying degrees of success, reflecting their specific circumstances and performance.

- Correlation with Global Market Trends: The performance of the DAX remained closely correlated with global market trends, suggesting a degree of interconnectedness in the global financial system.

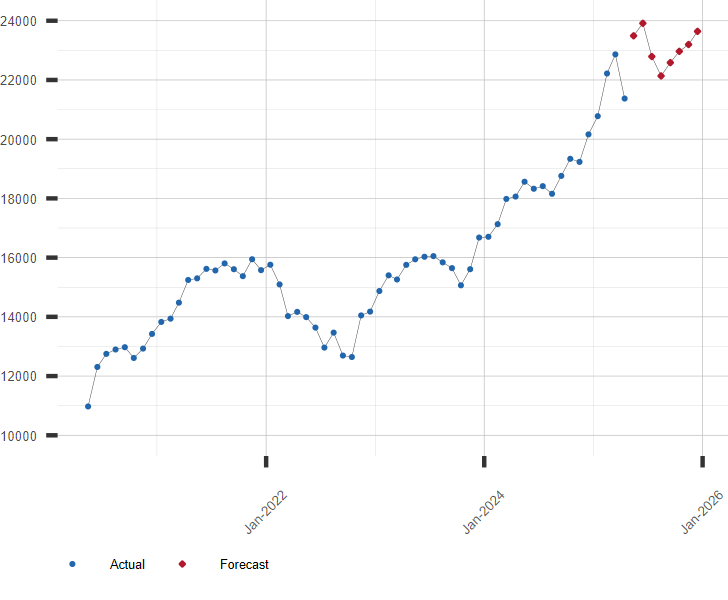

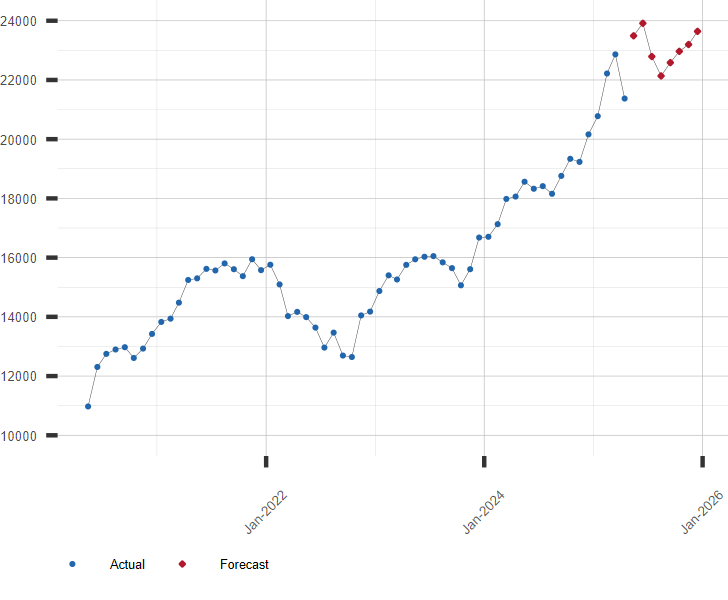

Outlook for Frankfurt's DAX Market: Predictions and Analysis

Predicting the future of Frankfurt's DAX market requires careful consideration of both short-term and long-term factors.

Short-Term Predictions:

- Potential for Further Growth: Depending on upcoming economic data and global market conditions, the DAX could experience further growth in the short term.

- Likelihood of Correction: However, a short-term correction is also possible, as investors consolidate their positions and react to new information.

- Influence of Upcoming Economic Reports: Key economic reports and announcements will have a significant impact on market sentiment and direction in the coming weeks.

Long-Term Projections:

- Impact of Long-Term Economic Trends: Long-term economic trends, including demographic shifts, technological advancements, and global economic growth, will play a crucial role in shaping the long-term trajectory of the DAX.

- Geopolitical Risks: Geopolitical risks and uncertainties remain a potential threat to sustained economic growth and could negatively impact market performance.

- Technological Advancements: Technological advancements and their impact on German industries will create both opportunities and challenges for DAX-listed companies.

- Potential for Sustainable Growth: Despite the risks, the long-term outlook for the German economy and the Frankfurt's DAX market remains positive, given the country's strong industrial base and its position within the Eurozone.

Conclusion

Today's opening of Frankfurt's DAX market showcased a dynamic interplay between a record-breaking surge and subsequent stabilization. This volatility highlighted the influence of corporate earnings, positive economic data, global market sentiment, and various geopolitical factors. Understanding these interconnected elements is key to navigating this complex market. To stay updated on Frankfurt's DAX Market performance and gain deeper insights into its future movements, monitor key economic indicators, follow financial news closely, and consider subscribing to reputable market analysis services. Stay informed about Frankfurt's DAX market; its fluctuations offer both challenges and significant opportunities for investors.

Featured Posts

-

Demna At Gucci Analyzing The Creative Direction Change

May 24, 2025

Demna At Gucci Analyzing The Creative Direction Change

May 24, 2025 -

Escape To The Country Making The Transition To Rural Living

May 24, 2025

Escape To The Country Making The Transition To Rural Living

May 24, 2025 -

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets The Complete Guide

May 24, 2025

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets The Complete Guide

May 24, 2025 -

Lauryn Goodmans Italy Move The Full Story After Kyle Walkers Ac Milan Transfer

May 24, 2025

Lauryn Goodmans Italy Move The Full Story After Kyle Walkers Ac Milan Transfer

May 24, 2025 -

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025

Latest Posts

-

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025 -

Amsterdam Stock Exchange Drops 2 After Trumps Tariff Hike

May 24, 2025

Amsterdam Stock Exchange Drops 2 After Trumps Tariff Hike

May 24, 2025 -

Aex Stijgt Na Uitstel Trump Positief Herstel Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Uitstel Trump Positief Herstel Voor Alle Fondsen

May 24, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025 -

Aex Index Falls Below Key Support Level One Year Low Reached

May 24, 2025

Aex Index Falls Below Key Support Level One Year Low Reached

May 24, 2025