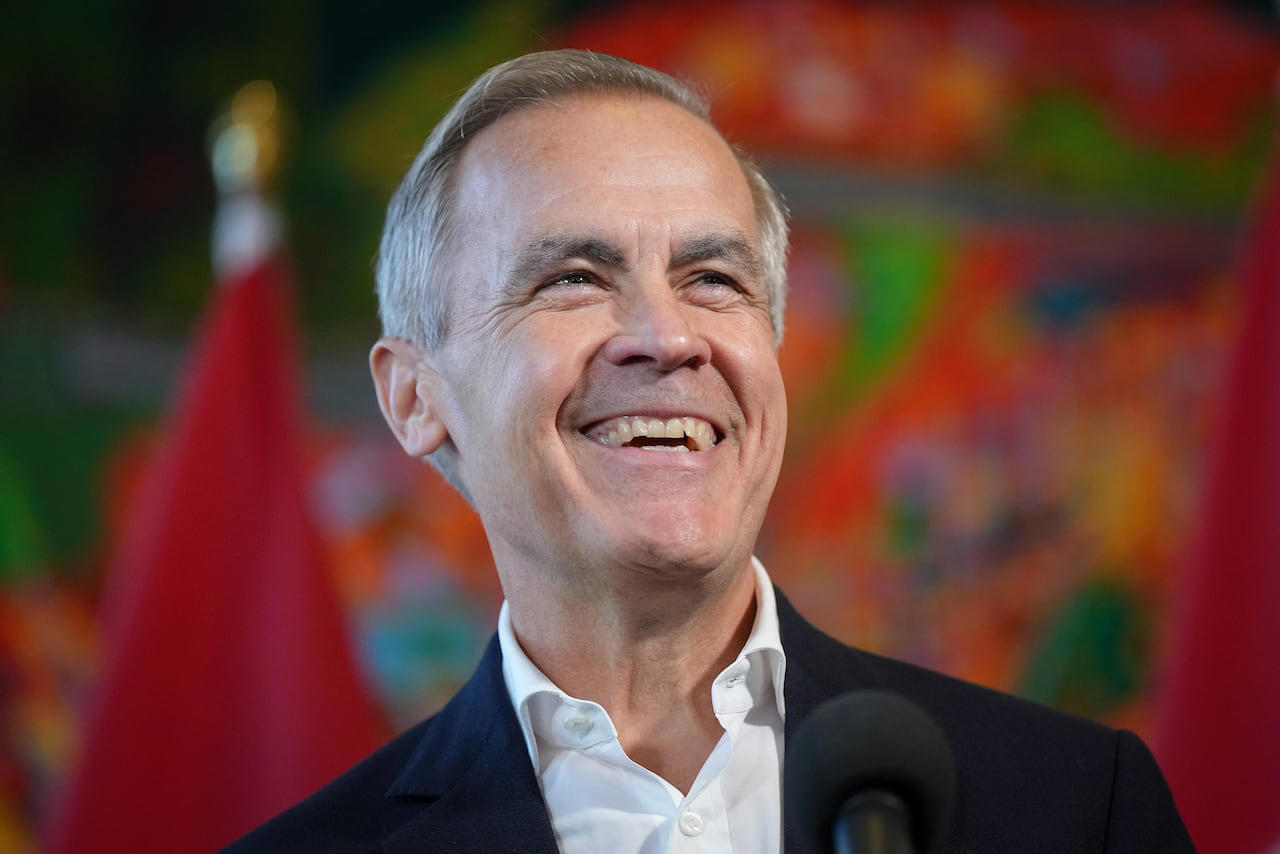

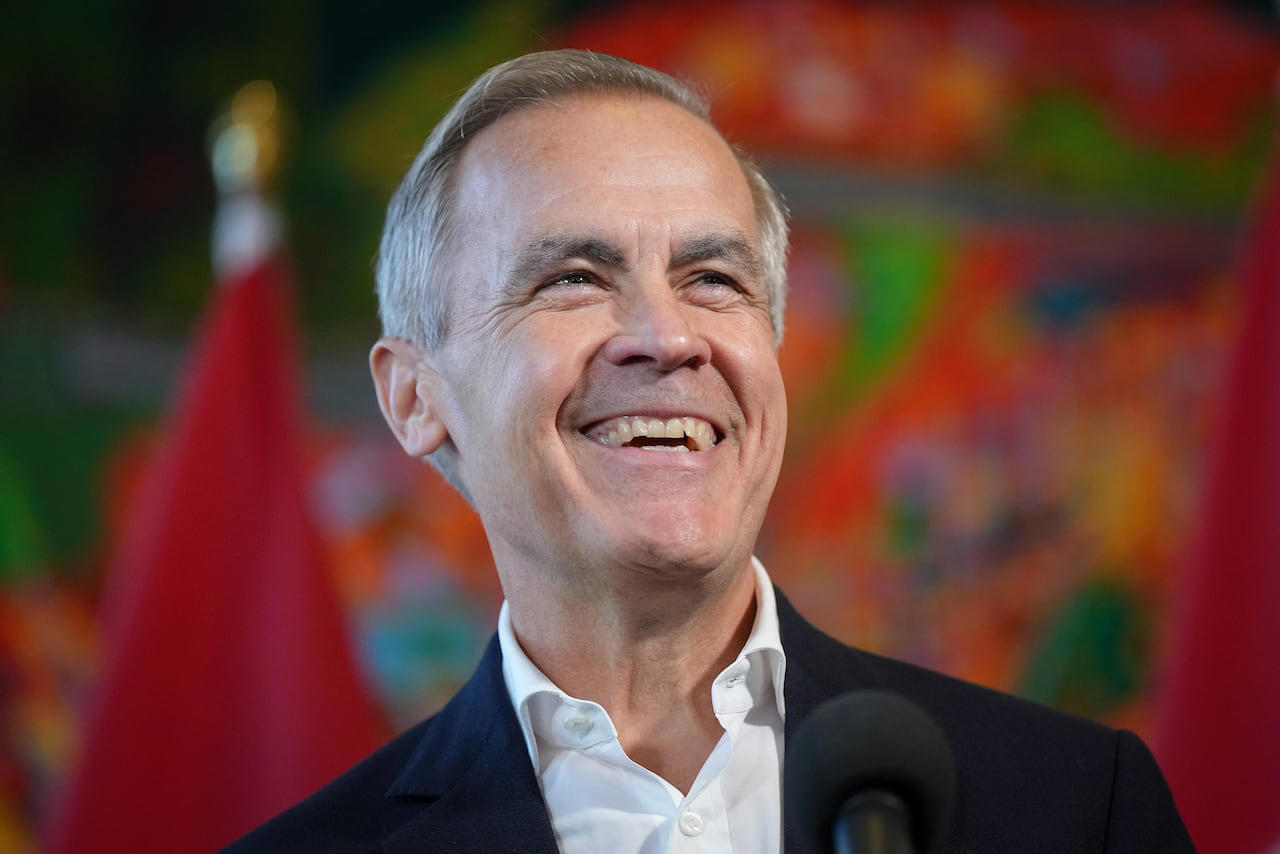

No New Rules To Oust Mark Carney: Canada's Liberal Party Decision

Table of Contents

The Context: Why the Debate Around Mark Carney Arose

The debate surrounding Mark Carney's role stemmed from a confluence of factors, including specific policy decisions and broader political pressures. Criticisms of his leadership ranged from his handling of interest rate adjustments – perceived by some as too slow to respond to economic shifts – to his communication style, which some found lacking in transparency.

-

Specific Policy Criticisms: Some argued that Carney's monetary policy decisions, particularly regarding interest rate adjustments, were insufficiently aggressive in responding to inflation or economic slowdowns. Others criticized his approach to financial regulation, deeming it either too lax or overly burdensome for specific sectors.

-

Sources of Political Pressure: Pressure on Carney came from various sources, including certain segments of the business community, who felt that his policies hindered economic growth, and elements within the political opposition who sought to leverage dissatisfaction with his performance for partisan gain. Lobbying efforts, though not always publicly visible, likely played a role in intensifying the debate.

-

Timeline of Events: The debate escalated significantly in the months leading up to the Liberal Party's announcement, with increased media coverage and public statements from political figures fueling the speculation about possible changes to Carney's position. This heightened the political stakes and made the Liberal Party's decision even more significant.

The Liberal Party's Justification: Reasons for Maintaining the Status Quo

The Liberal Party's official statement emphasized the importance of maintaining stability and continuity within the Bank of Canada. They argued that removing or significantly altering Carney's role would introduce unnecessary uncertainty into the Canadian economy, potentially undermining investor confidence and hindering economic growth.

-

Quotes from Party Officials: [Insert quotes from relevant Liberal Party officials emphasizing the importance of maintaining stability and expressing confidence in Mark Carney's leadership.]

-

Economic Stability Arguments: The Liberal Party highlighted the potential negative economic consequences of changing leadership at the Bank of Canada, suggesting that such a move could unsettle financial markets and damage Canada's international economic standing.

-

Potential Risks of Change: The party emphasized the risks associated with replacing Carney, citing the need for experienced leadership during times of economic volatility. They argued that a change in leadership could disrupt ongoing policies and negatively impact the central bank's effectiveness.

Opposition Reactions: Responses from Other Canadian Political Parties

The Conservative and NDP parties responded to the Liberal Party’s decision with varying degrees of criticism. While the Conservatives expressed concerns about Carney's performance, suggesting certain aspects of his tenure warranted further scrutiny, the NDP, while not explicitly calling for his removal, emphasized the need for increased transparency and accountability within the Bank of Canada.

-

Statements from Conservative Party: [Insert quotes or summaries of statements from Conservative Party officials regarding Mark Carney and the Liberal Party's decision.]

-

Statements from NDP: [Insert quotes or summaries of statements from NDP officials regarding Mark Carney and the Liberal Party's decision.]

-

Public Opinion Polling Data: [If available, include relevant polling data reflecting public opinion on Mark Carney and the Bank of Canada.]

The Future of the Bank of Canada's Governance: Long-Term Implications

The Liberal Party's decision to stand by Mark Carney has significant long-term implications for the Bank of Canada's governance. It establishes a precedent for how future leadership changes might be handled and reinforces the importance of political stability in navigating economic challenges.

-

Discussion of Governance Structure: This decision prompts discussion about the optimal governance structure for the Bank of Canada, balancing the need for political accountability with the importance of operational independence.

-

Potential Future Scenarios: Several potential scenarios could unfold in the coming years, including potential reforms aimed at enhancing transparency and accountability, or further debates regarding the Bank's mandate and responsibilities.

-

Analysis of Long-Term Stability: The decision, while offering short-term stability, may not preclude future challenges to Carney’s leadership or further discussions about the Bank of Canada's governance in the long term.

Conclusion: The Decision Stands: No New Rules to Oust Mark Carney – What's Next?

The Liberal Party’s decision to maintain the status quo regarding Mark Carney's position as Governor of the Bank of Canada marks a significant moment in Canadian politics. Their reasoning, emphasizing economic stability and the importance of experienced leadership, has been met with mixed reactions from other parties. While this decision provides temporary stability, questions remain about the long-term governance of the Bank of Canada and the ongoing need for transparency and accountability in financial policy. We encourage you to share your thoughts on this critical decision and engage in further discussion about the future of the Bank of Canada and the role of Mark Carney in shaping Canada's economic future. What are your predictions for the future of the Bank of Canada under Mark Carney’s continued leadership? Let us know your perspective on Canadian politics and financial policy in the comments below.

Featured Posts

-

Viyskova Dopomoga Ukrayini Vid Nimechchini Onovleniy Spisok Ozbroyennya

May 27, 2025

Viyskova Dopomoga Ukrayini Vid Nimechchini Onovleniy Spisok Ozbroyennya

May 27, 2025 -

Gucci Re Motion Bag White Original Gg Canvas Style Code 832461 Aaew 39045

May 27, 2025

Gucci Re Motion Bag White Original Gg Canvas Style Code 832461 Aaew 39045

May 27, 2025 -

Le Ps Face A La Division Les Opposants A Olivier Faure Organisent Leur Riposte

May 27, 2025

Le Ps Face A La Division Les Opposants A Olivier Faure Organisent Leur Riposte

May 27, 2025 -

Hbcu Spring Breaks Return The Story Of Orange Crush 2025 On Tybee Island

May 27, 2025

Hbcu Spring Breaks Return The Story Of Orange Crush 2025 On Tybee Island

May 27, 2025 -

Matlock Return Date When Can You Watch New Episodes

May 27, 2025

Matlock Return Date When Can You Watch New Episodes

May 27, 2025

Latest Posts

-

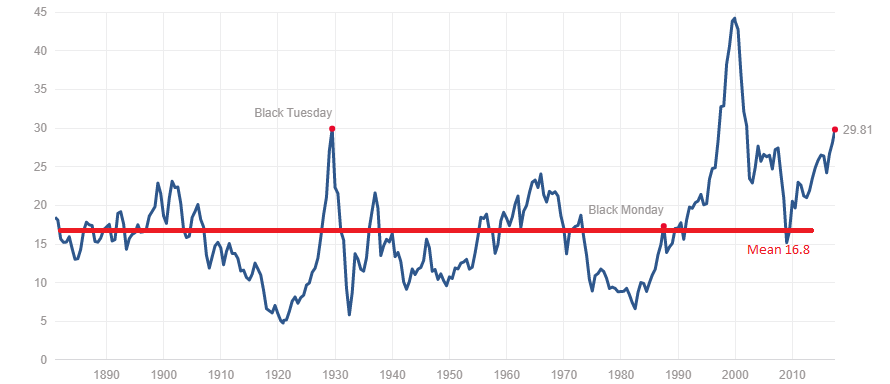

Investor Concerns About High Stock Market Valuations Bof As Analysis

May 29, 2025

Investor Concerns About High Stock Market Valuations Bof As Analysis

May 29, 2025 -

Are Stretched Stock Market Valuations A Risk Bof As Response

May 29, 2025

Are Stretched Stock Market Valuations A Risk Bof As Response

May 29, 2025 -

Addressing High Stock Market Valuations Insights From Bof A For Investors

May 29, 2025

Addressing High Stock Market Valuations Insights From Bof A For Investors

May 29, 2025 -

The Countrys Top Emerging Business Markets An In Depth Look

May 29, 2025

The Countrys Top Emerging Business Markets An In Depth Look

May 29, 2025 -

Stock Market Valuations Bof A Says Dont Worry Heres Why

May 29, 2025

Stock Market Valuations Bof A Says Dont Worry Heres Why

May 29, 2025