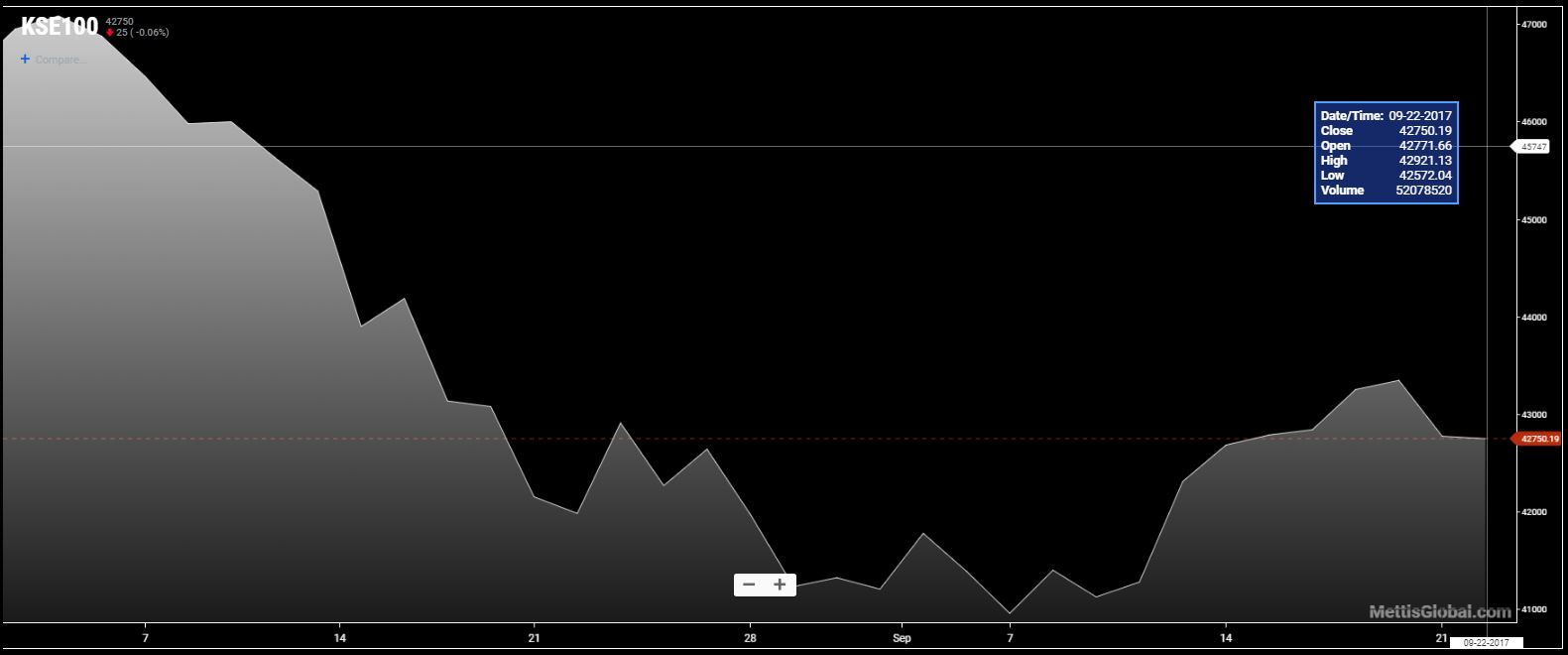

Pakistan Stock Market Crash: Operation Sindoor Triggers KSE 100 Plunge

Table of Contents

Operation Sindoor: Unveiling the Controversy and its Market Impact

Operation Sindoor, a regulatory crackdown targeting alleged market manipulation and insider trading, is widely considered a key trigger for the KSE 100 plunge. While its stated objective was to cleanse the PSX of illicit activities and promote fair trading practices, its methods and execution significantly impacted investor sentiment. The operation involved a series of investigations, regulatory actions, and suspensions that created uncertainty and fear among investors. The timeline of Operation Sindoor, characterized by swift and sometimes opaque actions, exacerbated the negative impact on the market.

- Specific actions taken during Operation Sindoor that impacted the market: Sudden suspensions of trading in specific stocks, investigations into prominent brokerage houses, and the freezing of assets all contributed to widespread panic selling.

- Examples of companies affected by Operation Sindoor: Several publicly listed companies experienced sharp declines in their share prices following investigations and regulatory actions under Operation Sindoor. The specifics of these cases are still emerging, but the uncertainty alone created a negative market spiral.

- Expert opinions on the operation's impact: Financial analysts and economists have expressed concerns that the abrupt and sweeping nature of Operation Sindoor undermined investor confidence, potentially outweighing the benefits of targeting market manipulation. The lack of transparency surrounding some actions also fueled speculation and fear. Keywords: "Operation Sindoor details," "Operation Sindoor consequences," "regulatory crackdown Pakistan Stock Market."

Analyzing the KSE 100 Plunge: Factors Beyond Operation Sindoor

While Operation Sindoor played a significant role in the KSE 100 crash, it wasn't the sole contributing factor. Several other macroeconomic and geopolitical factors exacerbated the situation, creating a perfect storm that resulted in the sharp decline.

- Political instability in Pakistan: Ongoing political uncertainty and tensions often create a climate of risk aversion, discouraging investment and leading to market volatility.

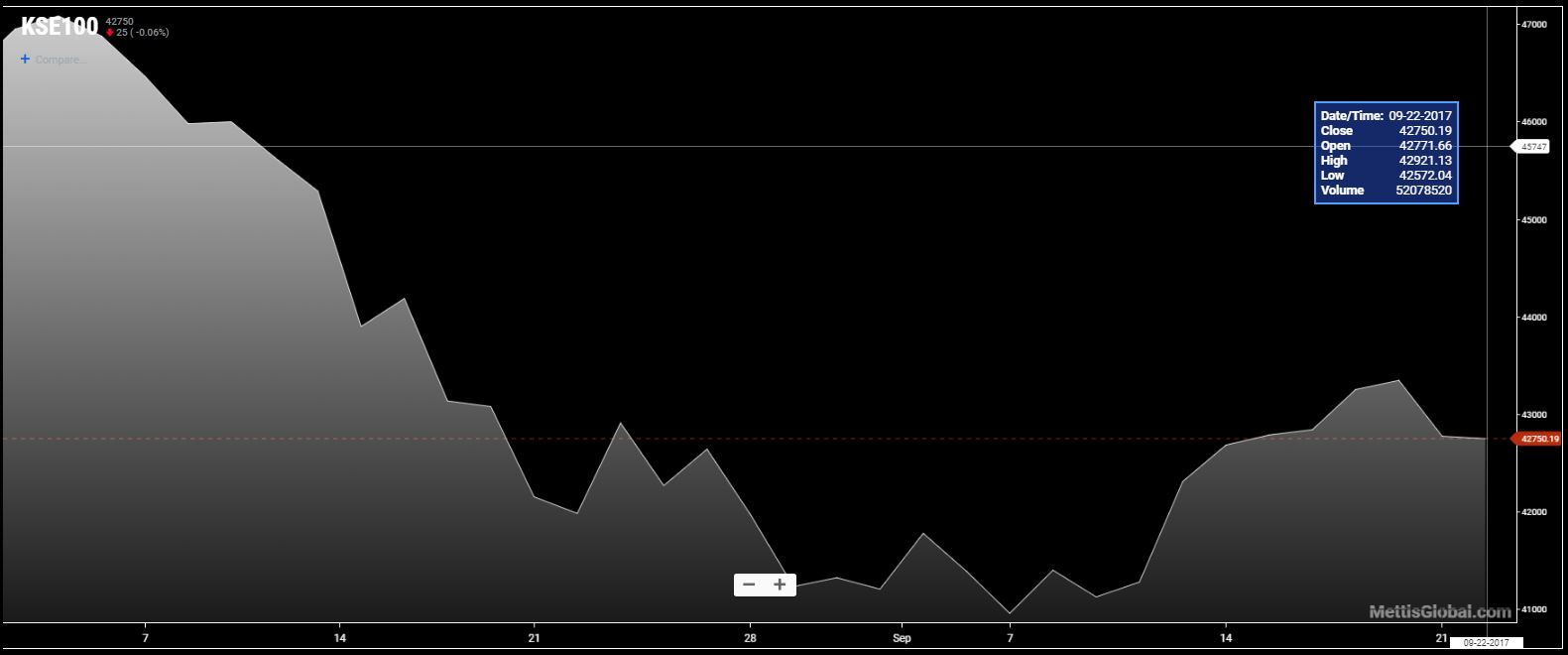

- Economic challenges and inflation: Soaring inflation, a weakening rupee, and dwindling foreign exchange reserves created a challenging economic backdrop, further dampening investor sentiment and driving down the KSE 100 index.

- Global market trends impacting the PSX: Global economic headwinds, including rising interest rates in developed economies, also negatively impacted the Pakistani stock market.

- Impact of foreign exchange reserves: The dwindling foreign exchange reserves created further uncertainty about Pakistan's economic stability, leading to capital flight and a downward pressure on the currency, which in turn impacts the stock market. Keywords: "KSE 100 index drop," "Pakistan economic crisis," "global market impact on Pakistan stock market."

The Ripple Effect: Impact on Investors and the Economy

The KSE 100 plunge had far-reaching consequences, affecting individual investors and the broader Pakistani economy.

- Consequences for individual investors: Many investors suffered significant losses due to the sharp decline in share prices, leading to widespread panic selling and a loss of confidence in the market.

- Wider economic impact: The crash reduced investment, both domestic and foreign, leading to decreased business confidence and potentially hindering economic growth. The reduced investment can impact various sectors of the economy, slowing down development and job creation.

- Statistics on investor losses: While precise figures are still being tallied, anecdotal evidence suggests substantial losses for individual and institutional investors.

- Impact on foreign investment: The crash likely deterred foreign investors, leading to a decrease in capital inflows, further stressing the country's foreign exchange reserves.

- Government response to the crash: The government's response to the crash, including potential policy interventions and regulatory adjustments, will be crucial in determining the market's recovery trajectory. Keywords: "Pakistan investor losses," "economic impact of KSE crash," "government response to stock market crash."

Future Outlook: Recovering from the Pakistan Stock Market Crash

Recovering from this significant setback requires a multi-pronged approach focused on restoring investor confidence and addressing the underlying economic challenges.

- Potential government interventions: The government may need to implement policies to stabilize the economy, attract foreign investment, and improve transparency in the regulatory environment.

- Strategies for investor recovery: Investors will need support and guidance to navigate the aftermath of the crash and make informed investment decisions. Financial literacy programs and investor protection measures could play a significant role.

- Long-term predictions for the PSX: The long-term outlook for the PSX depends on the effectiveness of government policies, economic reforms, and the restoration of investor confidence. Keywords: "Pakistan stock market recovery," "PSX future outlook," "rebuilding investor confidence."

Conclusion: Navigating the Aftermath of the Pakistan Stock Market Crash and Operation Sindoor

The October 26th KSE 100 plunge was a complex event triggered by a confluence of factors, most prominently Operation Sindoor and broader economic challenges. The impact on individual investors and the Pakistani economy is significant, underscoring the need for a strategic and comprehensive response. The severity of the crash highlights the vulnerability of emerging markets to both internal regulatory actions and external global economic pressures. Staying informed about the evolving situation is crucial. Stay updated on the evolving situation of the Pakistan Stock Market crash and Operation Sindoor by following reputable financial news sources and official government announcements. Learn more about mitigating risks in the volatile Pakistan Stock Market by consulting with financial advisors and staying informed about market trends.

Featured Posts

-

32

May 09, 2025

32

May 09, 2025 -

Expansion Viticole A Dijon 2500 M De Vignes Aux Valendons

May 09, 2025

Expansion Viticole A Dijon 2500 M De Vignes Aux Valendons

May 09, 2025 -

The Posthaste Reality High Down Payments And The Canadian Dream

May 09, 2025

The Posthaste Reality High Down Payments And The Canadian Dream

May 09, 2025 -

Palantir Stock Buy Sell Or Hold A Data Driven Investment Guide

May 09, 2025

Palantir Stock Buy Sell Or Hold A Data Driven Investment Guide

May 09, 2025 -

Indonesias Foreign Exchange Reserves Plummet Two Year Low Amidst Rupiah Weakness

May 09, 2025

Indonesias Foreign Exchange Reserves Plummet Two Year Low Amidst Rupiah Weakness

May 09, 2025

Latest Posts

-

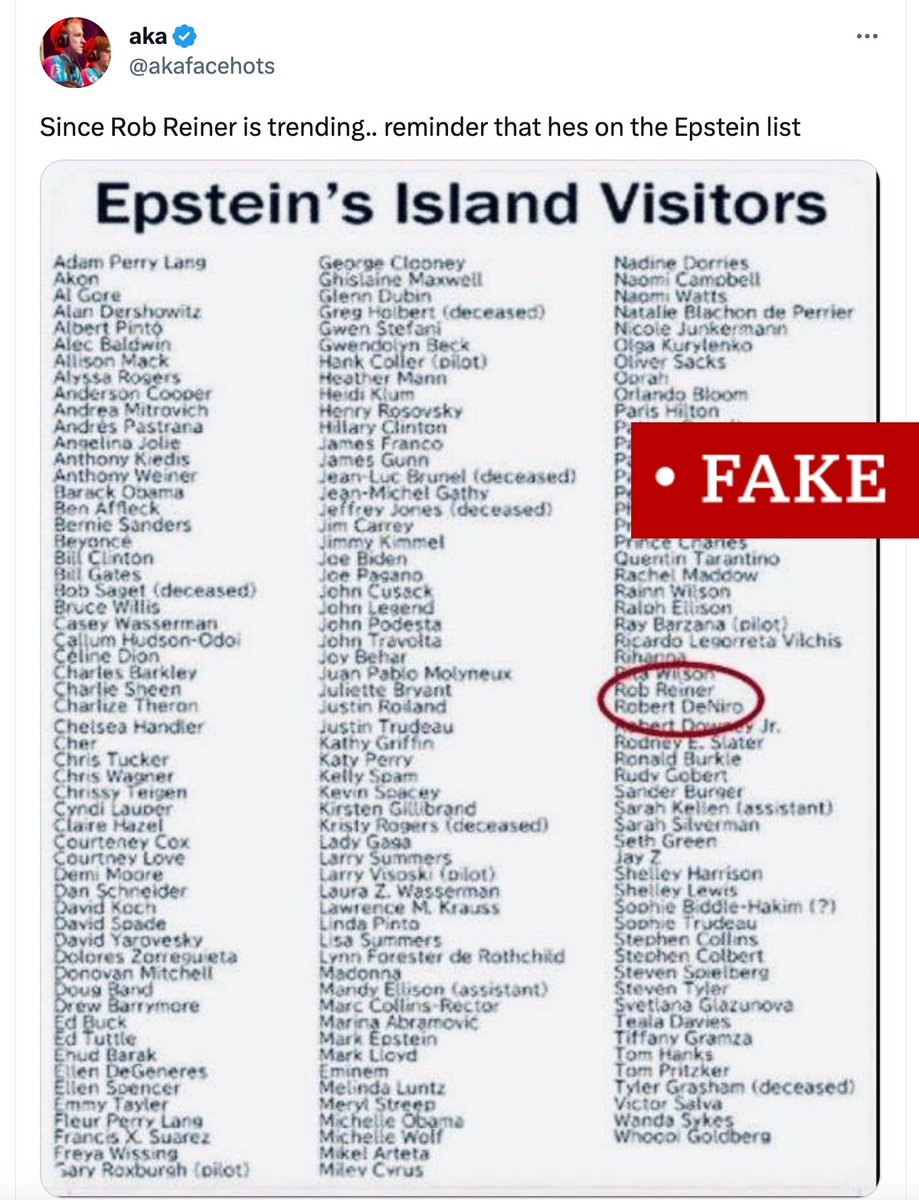

The Jeffrey Epstein Case Public Opinion On Ag Pam Bondis Decision To Release Files

May 10, 2025

The Jeffrey Epstein Case Public Opinion On Ag Pam Bondis Decision To Release Files

May 10, 2025 -

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025 -

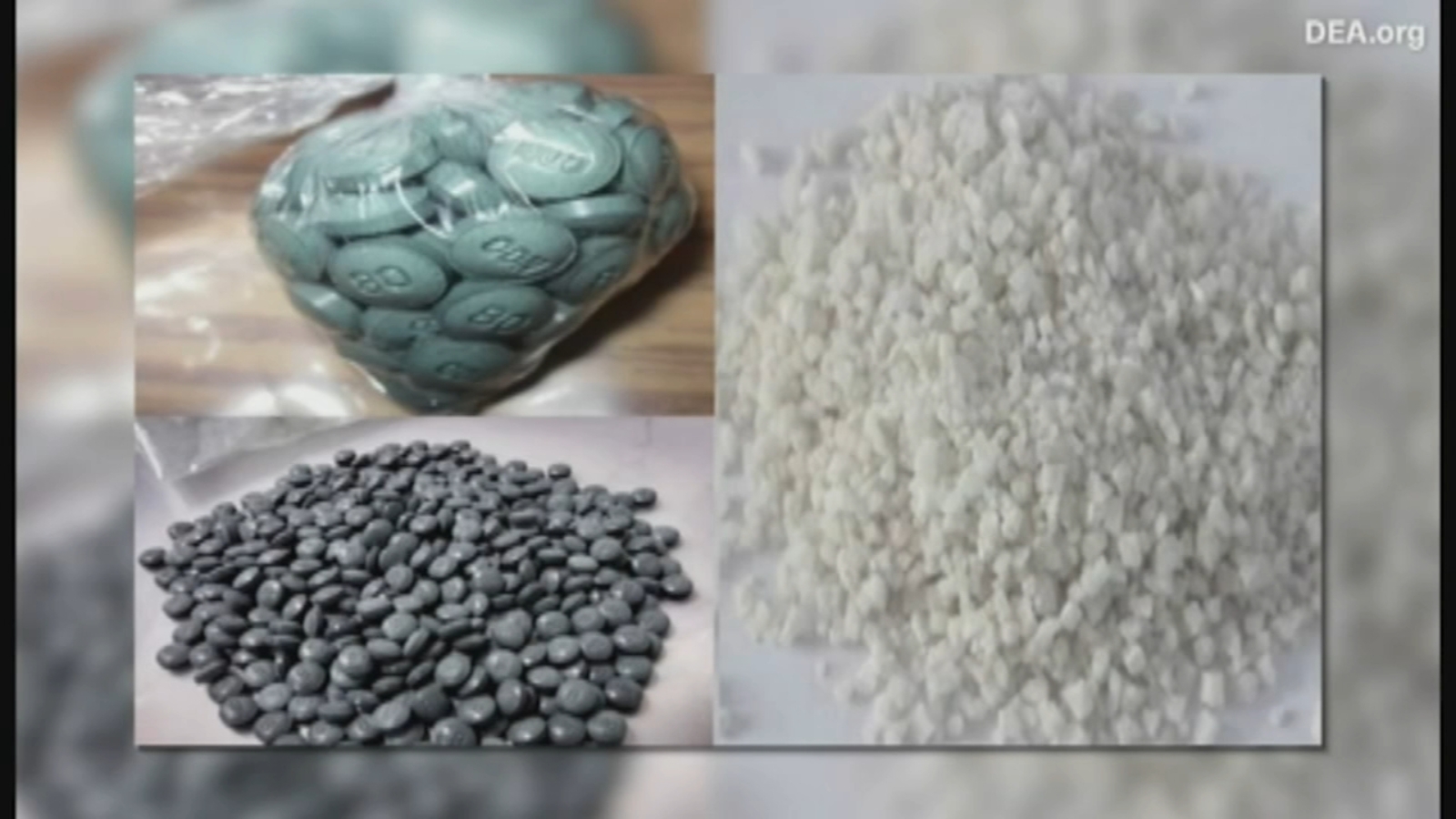

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025 -

Transparency And Justice Evaluating The Release Of Jeffrey Epstein Files And Ag Pam Bondis Role

May 10, 2025

Transparency And Justice Evaluating The Release Of Jeffrey Epstein Files And Ag Pam Bondis Role

May 10, 2025 -

Pam Bondis Claim Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 10, 2025

Pam Bondis Claim Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 10, 2025