Payden & Rygel: Analyzing China To US Containerized Shipping Trends

Table of Contents

Trade Volume Fluctuations and Their Impact

Trade volume between China and the US fluctuates significantly, impacting the entire supply chain. These fluctuations are influenced by a multitude of factors, including economic indicators, consumer demand, and unforeseen disruptions. Analyzing historical trends reveals a complex interplay of supply and demand.

- Seasonal Variations: Shipping volumes naturally peak during certain times of the year, such as before major holidays like Christmas, impacting freight rates and port capacity.

- Industry-Specific Impacts: Industries like electronics and apparel heavily influence overall trade volume. Shifts in consumer preferences or technological advancements can drastically alter demand and shipping needs.

- Government Policies and Regulations: Trade wars, tariffs, and other government interventions directly impact import/export volumes and, subsequently, shipping demands. For example, the US-China trade war significantly impacted shipping volumes in certain sectors.

(Insert chart/graph here visualizing historical trade volume data between China and the US)

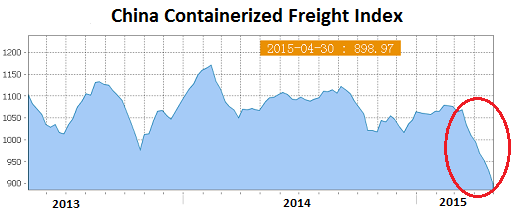

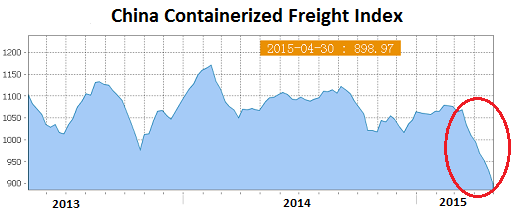

Freight Rate Volatility and its Drivers

Freight rates on the China to US route are notoriously volatile, influenced by a complex interplay of market forces. Understanding these drivers is crucial for businesses to accurately budget and plan their logistics.

- Fuel Price Fluctuations: Fuel represents a substantial portion of shipping costs. Significant increases in fuel prices directly translate to higher freight rates, impacting profitability and consumer prices.

- Vessel Availability and Capacity: Shortages or surpluses of vessels directly affect freight rates. A shortage leads to higher prices due to increased demand, while an oversupply can cause rates to plummet.

- Alliances and Consolidation: The consolidation of shipping lines through alliances impacts market dynamics. This can lead to both price increases due to reduced competition and price decreases through efficiency gains.

(Insert chart/graph here visualizing freight rate trends over time on the China to US route)

Port Congestion and Supply Chain Bottlenecks

Port congestion in both China and the US is a persistent challenge, significantly impacting shipping times and overall supply chain efficiency. This congestion creates delays, increases costs, and can lead to significant disruptions.

- Major Congestion Points: Identifying specific ports experiencing consistent congestion is crucial for effective logistics planning. This often involves analyzing data from major ports like Los Angeles, Long Beach, and Shanghai.

- Technological Solutions: Digitalization, automation, and improved port infrastructure are vital in addressing congestion. Technologies like predictive analytics can help optimize port operations and reduce bottlenecks.

- Labor Shortages and Related Issues: Labor shortages and related logistical issues, such as truck driver availability, can exacerbate port congestion, contributing to further delays and increased costs.

(Insert map here highlighting congested ports and data on average shipping times)

The Impact of Geopolitical Factors

Geopolitical events and international relations significantly influence China-US shipping dynamics. These factors introduce uncertainty and risk into the supply chain.

- Trade Wars and Sanctions: Trade disputes and sanctions directly affect shipping volumes and costs. Political instability can lead to disruptions and uncertainty in the trade relationship.

- Political Risk: Changes in government policies, international relations, and other geopolitical factors create uncertainty and potential risks for businesses relying on this trade route. Effective risk management strategies are crucial.

Conclusion

The China to US containerized shipping route is a dynamic and complex system influenced by trade volume fluctuations, freight rate volatility, port congestion, and significant geopolitical factors. Understanding the interplay of these elements is vital for businesses aiming to optimize their supply chains and mitigate potential disruptions. By staying informed on these trends and utilizing resources (like Payden & Rygel, replace with actual source if applicable), companies can make informed decisions to navigate the intricacies of this crucial trade lane and ensure efficient, cost-effective operations. Further research into China to US shipping trends is strongly recommended for proactive risk management and opportunity identification.

Featured Posts

-

Paige Bueckers Wnba Debut One Citys Unique Tribute

May 19, 2025

Paige Bueckers Wnba Debut One Citys Unique Tribute

May 19, 2025 -

Restauration De Notre Dame De Poitiers Le Departement S Engage

May 19, 2025

Restauration De Notre Dame De Poitiers Le Departement S Engage

May 19, 2025 -

Finalen I Melodifestivalen 2025 Artister Startordning Och Allt Du Behoever Veta

May 19, 2025

Finalen I Melodifestivalen 2025 Artister Startordning Och Allt Du Behoever Veta

May 19, 2025 -

Muere Joan Aguilera El Primer Espanol En Ganar Un Masters 1000 Nos Deja

May 19, 2025

Muere Joan Aguilera El Primer Espanol En Ganar Un Masters 1000 Nos Deja

May 19, 2025 -

The Financial Reality Check Stars Income Compared To A List Spouses

May 19, 2025

The Financial Reality Check Stars Income Compared To A List Spouses

May 19, 2025