PMI Beat Propels Dow Jones To Further Gains

Table of Contents

Understanding the PMI and its Significance

The Purchasing Managers' Index (PMI) is a crucial economic indicator that tracks the activity levels of both the manufacturing and services sectors. It's compiled monthly by surveying purchasing managers at companies across various industries. A PMI reading above 50 signifies expansion in the sector, while a reading below 50 points to contraction. The PMI's significance stems from its ability to provide an early indication of the overall health of the economy. A strong PMI reflects robust economic activity, often signaling increased consumer spending, business investment, and job creation.

- A high PMI indicates increased business activity and confidence.

- It provides a forward-looking view of economic growth.

- Historically, a strong PMI has correlated with positive stock market performance.

The PMI's history dates back to the 1930s, with its modern form evolving in the 1980s. Its predictive power has been extensively studied and proven valuable for economists, investors, and policymakers.

PMI Beat Exceeds Expectations

The latest PMI reading came in at [Insert Actual PMI Reading], significantly exceeding analysts' forecasts of [Insert Analyst's Forecast]. This positive surprise was driven by strong performances across several key sectors. [Insert Specific Sectors, e.g., Manufacturing and Services].

- Employment: The PMI report showed a significant increase in employment across both sectors, indicating robust hiring activity. [Source Data and Citation]

- New Orders: New orders also surged, reflecting a healthy demand for goods and services. [Source Data and Citation]

- Business Confidence: The survey also indicated an uplift in business confidence, suggesting a positive outlook for future economic growth. [Source Data and Citation]

This unexpected strength could be attributed to [Insert Potential Reasons, e.g., government stimulus, easing supply chain pressures, increased consumer spending].

Impact on the Dow Jones Industrial Average

Following the release of the surprisingly strong PMI report, the Dow Jones Industrial Average experienced a substantial increase of [Insert Percentage Change]%, closing at [Insert Closing Value]. The positive sentiment rippled through various sectors of the Dow, with [Insert Specific Sectors, e.g., technology and consumer discretionary] stocks experiencing the most significant gains.

- Technology Sector: Tech giants like [mention specific companies] saw notable increases in their stock prices, reflecting investor confidence in the sector's future growth.

- Consumer Discretionary Sector: Companies in this sector, such as [mention specific companies], benefited from the indication of increased consumer spending power.

- Trading Volume: Trading volume also increased significantly, suggesting heightened investor activity and participation in the market.

Wider Market Implications and Future Outlook

The positive PMI report extends its influence beyond the Dow Jones, suggesting a broader positive trend for the global economy. Other major market indices are likely to experience similar positive reactions, although the extent of their gains may vary.

- Global Market Impact: International markets are likely to respond positively, with investors showing increased confidence in global economic recovery.

- Future Economic Scenarios: The strong PMI reading points toward sustained economic growth in the coming months, although unforeseen factors could influence this trajectory.

- Potential Risks: Geopolitical uncertainties, inflation pressures, and potential interest rate hikes remain potential headwinds that could impact market performance.

Market analysts predict [Insert Analyst Predictions, source and cite if possible], suggesting a continued, though potentially volatile, upward trend in the near term. It is crucial to monitor upcoming economic indicators, such as inflation data and consumer confidence reports, to get a better picture of the ongoing economic situation.

Conclusion: PMI's Positive Influence on Dow Jones Gains – What's Next?

The unexpectedly strong PMI reading played a significant role in propelling the Dow Jones Industrial Average to further gains. This highlights the crucial role of the PMI as a leading economic indicator and its direct impact on market sentiment and investor behavior. The positive PMI suggests a robust economic outlook, potentially leading to sustained market growth. However, maintaining awareness of potential risks and closely monitoring future PMI releases and other key economic data remain vital. Stay updated on PMI data to make informed investment decisions and follow the PMI and Dow Jones to anticipate future market movements.

Featured Posts

-

Real Madrid De Sok Gelisme 4 Oyuncuya Sorusturma

May 25, 2025

Real Madrid De Sok Gelisme 4 Oyuncuya Sorusturma

May 25, 2025 -

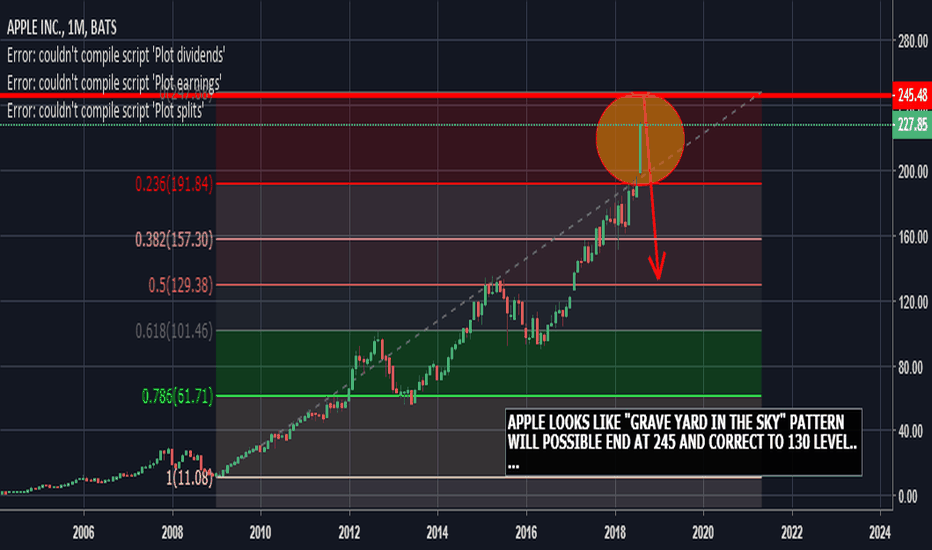

Understanding The Next Key Price Levels For Aapl

May 25, 2025

Understanding The Next Key Price Levels For Aapl

May 25, 2025 -

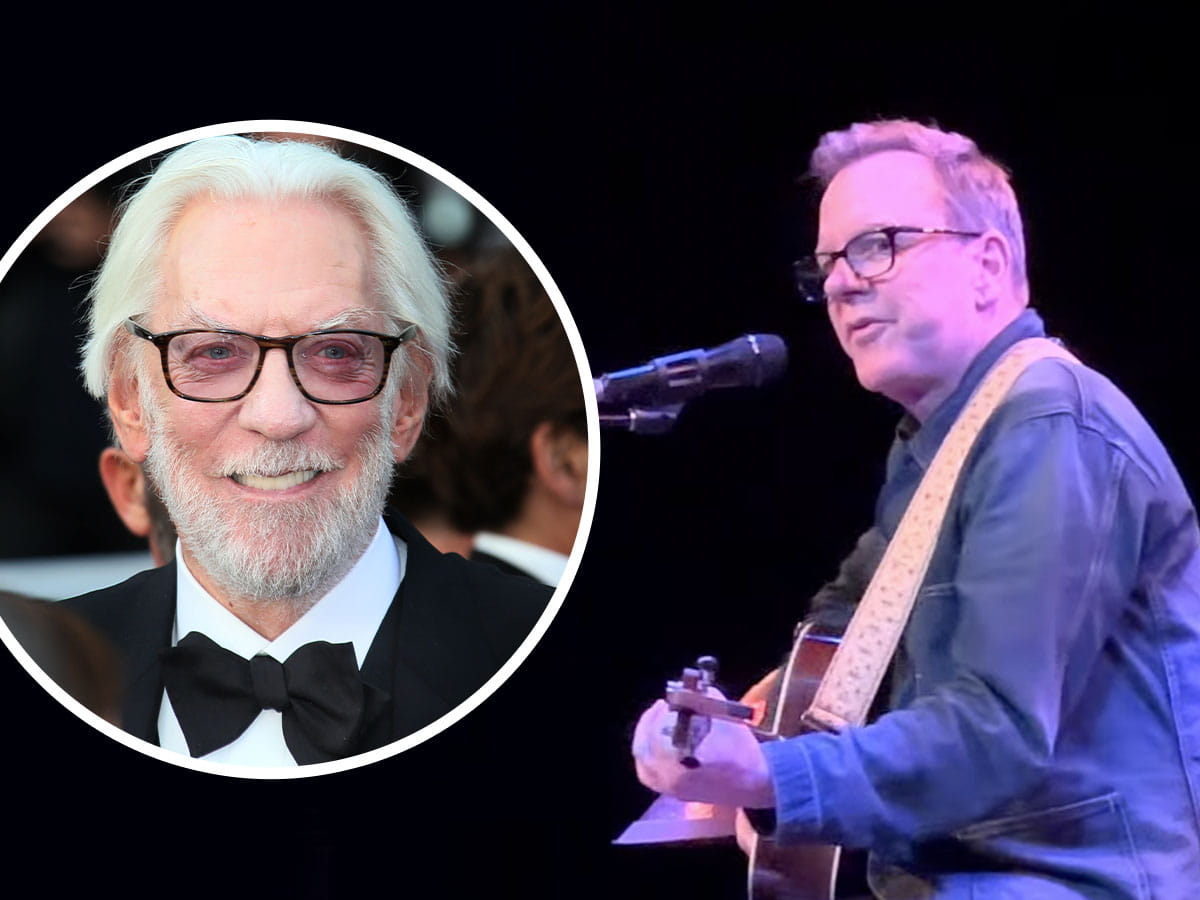

Kiefer Sutherland To Honor Father Donald At Canadian Screen Awards

May 25, 2025

Kiefer Sutherland To Honor Father Donald At Canadian Screen Awards

May 25, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 25, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 25, 2025 -

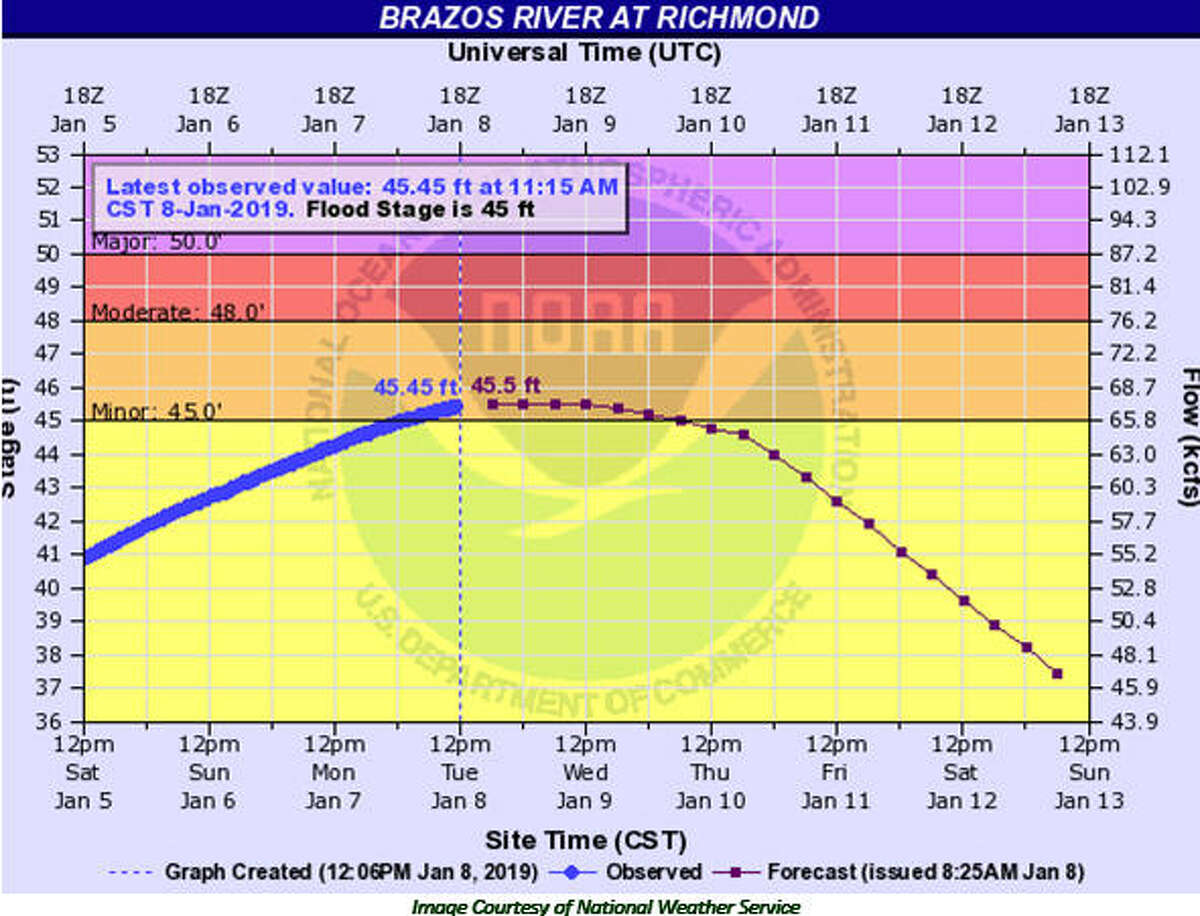

Severe Weather Alert Flash Flood Warning For Pennsylvania Until Thursday

May 25, 2025

Severe Weather Alert Flash Flood Warning For Pennsylvania Until Thursday

May 25, 2025