Private Credit Jobs: 5 Crucial Do's And Don'ts For Success

Table of Contents

DO: Network Strategically to Find Private Credit Jobs

The private credit industry thrives on relationships. Strategic networking is paramount to uncovering hidden job opportunities and making valuable connections.

Leverage LinkedIn Effectively:

- Optimize your profile: Use keywords like "private credit analyst," "private debt," "structured finance," "leveraged finance," "direct lending," and "alternative credit" throughout your profile summary, experience, and skills sections.

- Engage actively: Comment on posts, participate in discussions, and connect with recruiters and professionals specializing in private credit and related fields such as private equity and investment banking.

- Join relevant groups: Participate in conversations within LinkedIn groups focused on private credit, alternative investments, and finance. Share insightful commentary to establish yourself as a knowledgeable professional.

- Utilize job alerts: Set up job alerts on LinkedIn to receive notifications for new private credit job postings that match your skills and experience.

Attend Industry Events:

- Target relevant events: Attend conferences, workshops, and seminars focused on private credit, alternative investments, and broader finance topics.

- Prepare your pitch: Craft a concise and compelling elevator pitch summarizing your skills, experience, and career aspirations within the private credit sector.

- Follow up diligently: After each event, send personalized connection requests and follow-up emails to individuals you've met, reinforcing your interest and sharing additional relevant information.

Informational Interviews:

Reaching out to professionals for informational interviews is a powerful networking strategy. These conversations provide invaluable insights into the industry, different career paths, and potential job opportunities. Remember to always express gratitude and offer to reciprocate assistance in the future.

DON'T: Neglect Your Financial Modeling Skills

Proficiency in financial modeling is non-negotiable for private credit roles. Your ability to build accurate and insightful models will be rigorously tested.

Master Excel and Financial Modeling Software:

- Advanced Excel skills: Develop expertise in advanced Excel functions, including VBA macros for automation and data manipulation.

- Specialized software: Gain proficiency in financial modeling software such as Argus, Bloomberg Terminal, and other industry-standard tools.

- Practice consistently: Regularly practice building complex financial models, including leveraged buyouts (LBOs), discounted cash flow (DCF) analysis, and waterfall calculations—all critical in private credit.

Underestimate the Importance of Accuracy:

Errors in financial modeling can have significant consequences. Develop a meticulous approach to your work, regularly double-checking your calculations and assumptions.

Ignore Industry-Specific Models:

Familiarize yourself with the specific models and metrics commonly used in private credit, such as debt service coverage ratio (DSCR), loan-to-value (LTV) ratios, and different types of waterfall structures. Demonstrate your understanding of these during interviews.

DO: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. They must showcase your qualifications effectively and highlight your suitability for each specific role.

Highlight Relevant Experience:

Emphasize experiences that demonstrate your analytical, financial, and problem-solving skills. Use action verbs and quantify your achievements whenever possible.

Quantify Your Achievements:

Instead of simply stating responsibilities, quantify your achievements using metrics and numbers. For example, instead of "Improved team efficiency," say "Improved team efficiency by 15%, resulting in a 10% reduction in processing time."

Customize for Each Application:

Don't send a generic resume and cover letter. Tailor each application to the specific job description, highlighting relevant skills and experience mentioned in the posting.

Proofread Meticulously:

Typos and grammatical errors are unacceptable. Thoroughly proofread your resume and cover letter before submitting them.

DON'T: Underprepare for Interviews

Interviews are your chance to shine. Thorough preparation is essential to showcase your skills and personality.

Practice Behavioral Questions:

Prepare answers to common behavioral interview questions using the STAR method (Situation, Task, Action, Result). Practice articulating your experiences clearly and concisely.

Research the Firm and Interviewers:

Thoroughly research the firm's investment strategy, recent transactions, portfolio companies, and the interviewers' backgrounds on LinkedIn. Demonstrate your knowledge during the interview.

Neglect Technical Questions:

Be prepared for technical questions related to financial modeling, valuation, credit analysis, and industry-specific concepts. Practice explaining complex concepts clearly and concisely.

Forget to Ask Questions:

Asking insightful questions demonstrates your interest and engagement. Prepare a few thoughtful questions to ask the interviewers about the role, the team, and the firm's culture.

DO: Follow Up After Interviews

Following up after interviews is crucial in reinforcing your interest and making a lasting impression.

Send a Thank-You Note:

Send a personalized thank-you note within 24 hours of each interview, expressing your gratitude and reiterating your interest in the position.

Maintain Contact:

Follow up with the interviewers a week or two after the interview to reiterate your interest and address any outstanding questions.

Be Patient and Persistent:

The job search process can take time. Remain patient and persistent in your efforts, continuing to network and apply for suitable roles.

Conclusion

Securing a successful career in private credit jobs requires a combination of skill, strategy, and perseverance. By following these five crucial do's and don'ts, you can significantly improve your chances of landing your dream role. Remember to network strategically, master your financial modeling skills, tailor your application materials, prepare thoroughly for interviews, and follow up effectively. Don't delay – start implementing these strategies today to begin your journey towards a rewarding career in private credit! Good luck in your search for private credit analyst positions and other exciting opportunities in the private credit industry!

Featured Posts

-

Rigetti Rgti And Ion Q A Deep Dive Into Quantum Stock Performance In 2025

May 21, 2025

Rigetti Rgti And Ion Q A Deep Dive Into Quantum Stock Performance In 2025

May 21, 2025 -

Understanding D Wave Quantums Qbts Monday Stock Market Drop

May 21, 2025

Understanding D Wave Quantums Qbts Monday Stock Market Drop

May 21, 2025 -

Alito And Roberts Two Decades On The Supreme Court Bench

May 21, 2025

Alito And Roberts Two Decades On The Supreme Court Bench

May 21, 2025 -

The Arrival Of Peppa Pigs Sibling A Fans Guide

May 21, 2025

The Arrival Of Peppa Pigs Sibling A Fans Guide

May 21, 2025 -

Big Bear Ai Holdings Inc Bbai Stock Plunge Missed Revenue And Leadership Issues

May 21, 2025

Big Bear Ai Holdings Inc Bbai Stock Plunge Missed Revenue And Leadership Issues

May 21, 2025

Latest Posts

-

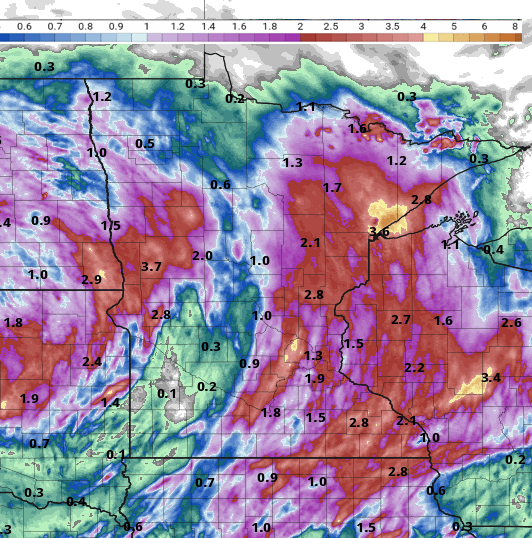

Updated Rain Forecast Knowing When Showers Will Start And Stop

May 21, 2025

Updated Rain Forecast Knowing When Showers Will Start And Stop

May 21, 2025 -

Precise Rain Timing Latest Updates And Probability Forecasts

May 21, 2025

Precise Rain Timing Latest Updates And Probability Forecasts

May 21, 2025 -

When To Expect Rain Updated Forecast With On Off Predictions

May 21, 2025

When To Expect Rain Updated Forecast With On Off Predictions

May 21, 2025 -

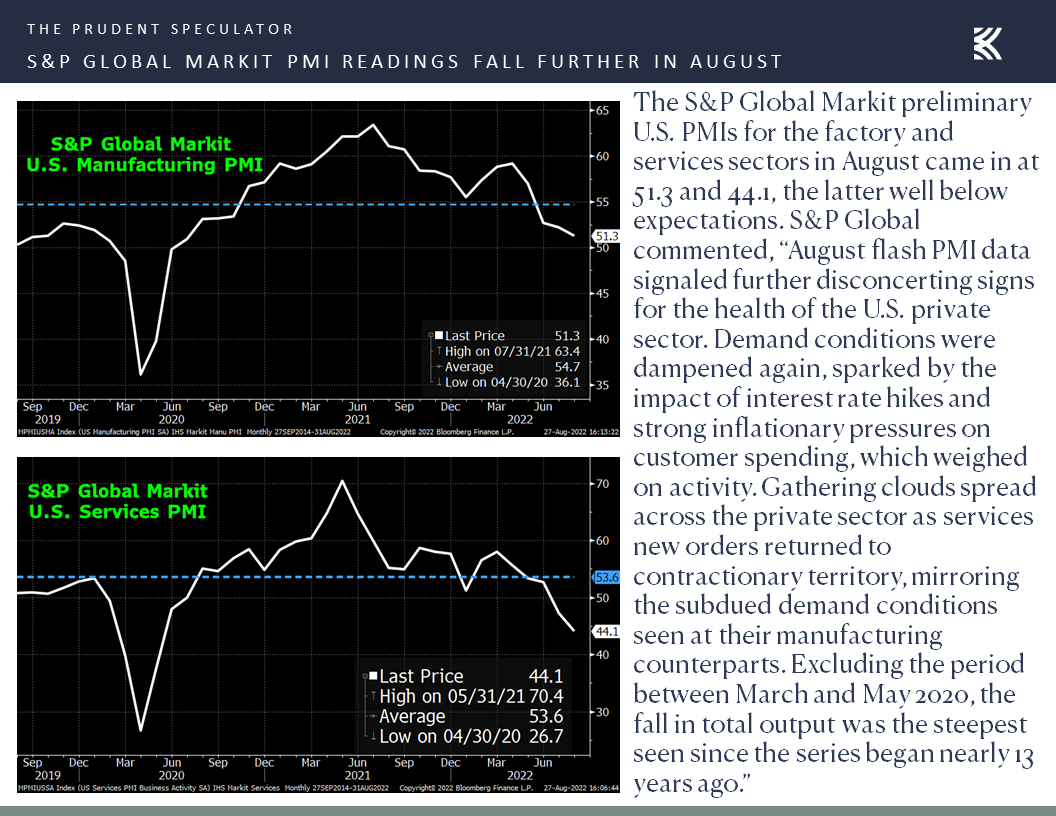

Big Bear Ai A Prudent Investment Strategy For The Current Market

May 21, 2025

Big Bear Ai A Prudent Investment Strategy For The Current Market

May 21, 2025 -

Analyzing Reddits Top 12 Ai Stock Recommendations

May 21, 2025

Analyzing Reddits Top 12 Ai Stock Recommendations

May 21, 2025