Record Label Offloads $200 Million Stake In Morgan Wallen's Music

Table of Contents

The $200 Million Deal: Who Bought What and Why?

While the specific details surrounding the buyer and the exact composition of the $200 million stake remain somewhat shrouded in secrecy, reports suggest a significant portion of Morgan Wallen's catalog was sold. This likely includes a combination of publishing rights (the rights to the songs themselves) and master recordings (the actual recordings of the songs). The buyer's identity hasn't been officially confirmed, but speculation points towards a large investment firm looking to capitalize on the predictable and substantial long-term revenue streams generated by Wallen's incredibly popular music. Their motivation is likely a blend of investment in a high-growth asset and portfolio diversification.

- Specific details about the assets sold: The exact breakdown between publishing and master rights remains undisclosed, but the sheer size of the deal implies a substantial portion of Wallen's back catalog and potentially future releases were included.

- The implied valuation of Wallen's entire catalog: The $200 million sale represents a significant portion of Wallen's overall catalog value, suggesting a total valuation in the hundreds of millions, possibly exceeding a billion dollars given his continued success.

- Potential future earnings projections: Wallen's consistent high streaming numbers and touring revenue ensure a steady income stream for years to come, making this a highly attractive investment for the buyer.

The Implications for Morgan Wallen's Career

The sale of a significant portion of his music rights likely won't dramatically impact Wallen's creative freedom in the short term. However, future album releases and touring might be subtly influenced by the buyer's interests. It’s crucial to remember that Wallen will likely still receive royalties from this sale, though the exact structure and percentage are unknown. This structure would be outlined in the complex legal agreements associated with such a transaction.

The Broader Impact on the Music Industry

This $200 million deal sets a powerful precedent for future music rights deals. It underscores the increasing trend of artists and record labels selling off catalogs, driven by the need for immediate liquidity or strategic financial maneuvering. This trend significantly impacts artist compensation and ownership, potentially shifting power dynamics within the music industry.

- Comparison to similar high-profile music catalog sales: This deal dwarfs many previous sales, signifying a potential new benchmark for high-profile artists in the streaming era. It's a significant escalation compared to previous transactions involving artists of similar stature.

- Analysis of the impact on artist-label relationships: The sale highlights the evolving relationships between artists and labels, showing that artists are increasingly exploring avenues to capitalize directly on their intellectual property.

- Discussion of the changing landscape of music rights ownership in the streaming age: The consistent and predictable revenue streams generated by streaming platforms make music catalogs increasingly attractive assets, driving up their valuations.

The Role of Streaming and Valuation

The exorbitant valuation of Morgan Wallen's music catalog is directly linked to the consistent and substantial revenue generated by music streaming platforms. Streaming provides predictable long-term royalties, far more reliable than traditional album sales, making these catalogs exceptionally attractive to investors.

- Statistics on Morgan Wallen's streaming numbers: Wallen consistently ranks among the top artists globally across major streaming services, generating millions of streams every month. These numbers translate into substantial and reliable revenue streams.

- Comparison of streaming revenue to traditional album sales: Streaming revenue often surpasses the income generated from physical album sales and downloads, making it a primary driver of music catalog valuations.

- Explanation of how predictable, long-term revenue streams drive up catalog value: Investors are willing to pay hefty sums for assets that generate predictable, long-term income. The stability of streaming royalties compared to the fluctuating nature of physical album sales is a key factor here.

Future Predictions and Analysis

The future of music catalog sales appears bright, given the demonstrated financial success and the ongoing growth of streaming platforms. This trend might lead to increased consolidation in the music industry, with larger companies acquiring catalogs of both established and emerging artists. Smaller artists and independent labels might struggle to compete in this changing landscape, potentially facing challenges in securing financing and maintaining ownership of their work.

- Possible scenarios for future music rights ownership: We might see more artists selling off portions or all of their catalogs earlier in their careers, taking advantage of favorable valuations.

- Discussion of the potential for increased consolidation in the music industry: Large corporations and investment firms could dominate the music landscape by acquiring valuable music catalogs.

- Predictions regarding artist compensation models: New compensation models may emerge to address the potential for power imbalances between artists and large corporations that control music catalogs.

Conclusion: Understanding the Morgan Wallen Music Rights Sale

The $200 million sale of a stake in Morgan Wallen's music catalog represents a significant moment in the music industry. This deal highlights the increasing value of music catalogs in the streaming era, the evolving relationship between artists and labels, and the potential for increased industry consolidation. The implications for artists, labels, and the overall landscape of music ownership are profound and far-reaching.

What are your thoughts on this record-breaking sale of Morgan Wallen's music? Share your insights and predictions for the future of music rights in the comments below! Let's discuss the implications of this $200 million deal and the changing landscape of music ownership.

Featured Posts

-

A Crypto Traders White House Dinner The Tale Of The Trump Short

May 29, 2025

A Crypto Traders White House Dinner The Tale Of The Trump Short

May 29, 2025 -

Annuals Or Perennials A Guide To Choosing The Perfect Flowers

May 29, 2025

Annuals Or Perennials A Guide To Choosing The Perfect Flowers

May 29, 2025 -

Southwests On Time Performance At Risk After Ending Free Checked Bags

May 29, 2025

Southwests On Time Performance At Risk After Ending Free Checked Bags

May 29, 2025 -

Mir Y Marini En Cota Ambicion Y Oportunidad En El Moto Gp De Austin

May 29, 2025

Mir Y Marini En Cota Ambicion Y Oportunidad En El Moto Gp De Austin

May 29, 2025 -

Ramalan Cuaca Besok 24 April 2024 Di Jawa Tengah

May 29, 2025

Ramalan Cuaca Besok 24 April 2024 Di Jawa Tengah

May 29, 2025

Latest Posts

-

International Companies To Present At Virtual Investor Conference On May 15 2025

May 30, 2025

International Companies To Present At Virtual Investor Conference On May 15 2025

May 30, 2025 -

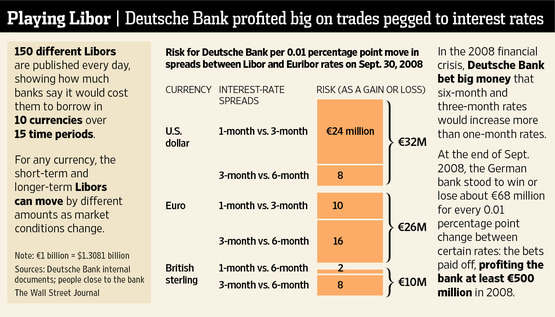

Security Risks Deutsche Bank Contractor Allowed Unauthorized Access To Data Center

May 30, 2025

Security Risks Deutsche Bank Contractor Allowed Unauthorized Access To Data Center

May 30, 2025 -

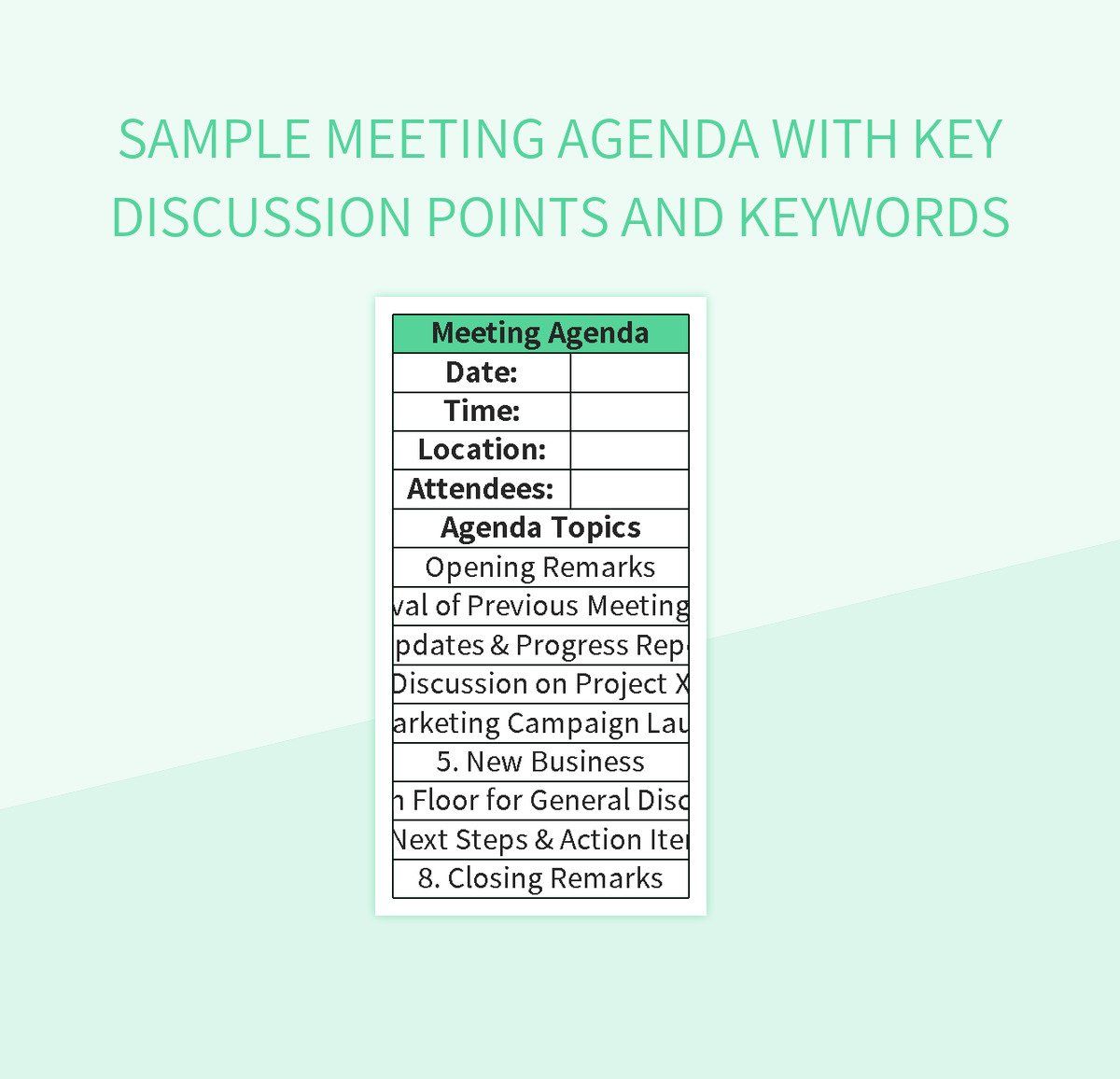

Finance Ministers Meeting With Deutsche Bank Executives Key Discussion Points

May 30, 2025

Finance Ministers Meeting With Deutsche Bank Executives Key Discussion Points

May 30, 2025 -

Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025

Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025 -

Data Center Security Lapse Deutsche Bank Employee And Unauthorized Guest

May 30, 2025

Data Center Security Lapse Deutsche Bank Employee And Unauthorized Guest

May 30, 2025