Ripple XRP And SBI Holdings: Shareholder Rewards And Market Impact

Table of Contents

Explore the powerful synergy between Ripple (XRP) and SBI Holdings, a significant investor in Ripple. This article delves into the shareholder rewards reaped by SBI Holdings through its XRP investment and analyzes the broader impact of this partnership on the cryptocurrency market. We'll examine the strategic implications for both entities and the potential future developments, focusing on the key relationship between Ripple XRP and SBI Holdings.

H2: SBI Holdings' Investment in Ripple and its Returns:

H3: The Strategic Rationale Behind SBI Holdings' XRP Investment: SBI Holdings, a major Japanese financial services company, made a strategic early investment in Ripple, recognizing the potential of XRP and RippleNet to revolutionize cross-border payments. Their decision was driven by:

- Blockchain Technology Adoption: SBI Holdings saw the efficiency and cost-reduction benefits of blockchain technology for financial transactions.

- RippleNet Access: Investment granted SBI Holdings potential access to RippleNet, a global network for fast and low-cost international payments, providing a significant competitive advantage.

- Diversification: Investing in XRP allowed SBI Holdings to diversify its portfolio beyond traditional financial instruments.

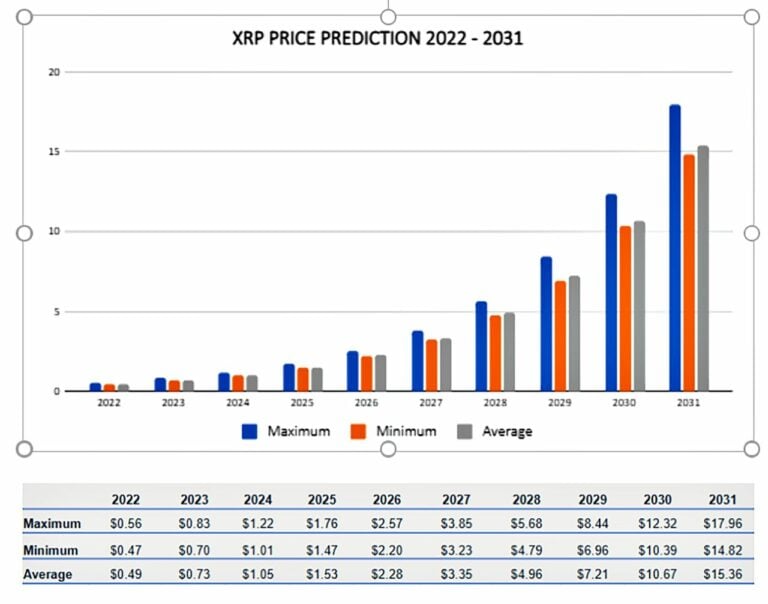

H3: Analyzing SBI Holdings' Returns on its XRP Investment: While precise figures on SBI Holdings' XRP holdings aren't publicly available, analyzing XRP's price fluctuations against the timeline of their investment allows for an assessment. Early adoption likely resulted in significant gains during periods of XRP price appreciation. However, the cryptocurrency market is notoriously volatile, and periods of decline would have impacted returns. Potential returns also include:

- Potential Capital Appreciation: Increased XRP price translates directly into higher asset value.

- Indirect Revenue: SBI Holdings' utilization of RippleNet may generate revenue streams separate from XRP price movements.

- Strategic Advantages: The partnership provides intangible benefits, like access to technology and market influence.

H3: Comparing SBI Holdings' XRP Investment to other Investments: A direct comparison to SBI Holdings' other investments requires confidential internal data. However, qualitatively, the XRP investment, if successful, represents a foray into a high-growth, albeit high-risk, asset class. Compared to traditional, lower-risk investments, the potential for substantial returns (and losses) is significantly higher.

H2: The Impact of the SBI Holdings-Ripple Partnership on the XRP Market:

H3: SBI Holdings' Influence on XRP Price and Liquidity: SBI Holdings' considerable investment undoubtedly influences XRP's market dynamics. Large-scale buying or selling by such a significant player can impact:

- Price Stability: Large orders can temporarily affect XRP's price, though this impact is moderated by market forces.

- Liquidity: SBI Holdings' participation provides liquidity to the XRP market, making it easier for other investors to buy and sell.

H3: Ripple's strategic partnerships and its effect on XRP adoption: The SBI Holdings partnership is vital to Ripple's strategy. It strengthens:

- RippleNet Expansion: The partnership extends RippleNet's reach into the significant Japanese market and beyond.

- Regulatory Acceptance: SBI Holdings' involvement lends credibility and potentially facilitates regulatory discussions in Japan.

- XRP Demand: Integration into SBI Holdings' financial services network drives demand for XRP in practical applications. Other key partnerships with institutions like MoneyGram further bolster adoption.

H3: The broader market implications of the partnership for the cryptocurrency landscape: The SBI Holdings-Ripple collaboration has broader market implications:

- Investor Sentiment: The partnership fosters a positive perception of XRP and Ripple, attracting further investment.

- Technological Innovation: The collaboration encourages further development and adoption of blockchain technology in finance.

- Regulatory Discussions: The success of this partnership may inform future regulatory frameworks for cryptocurrencies.

H2: Future Prospects and Potential Developments:

H3: Predictions for SBI Holdings' continued involvement with Ripple: The future likely involves:

- Continued Investment: SBI Holdings may continue to increase its XRP holdings.

- Joint Ventures: New collaborations focusing on payment solutions or technological advancements are possible.

- Market Expansion: Expansion into new geographical markets utilizing RippleNet and XRP is likely.

H3: The long-term outlook for XRP and its potential market capitalization: The long-term outlook for XRP hinges on several factors:

- Regulatory Clarity: Clearer regulatory frameworks could significantly boost XRP adoption.

- Wider Adoption: Continued integration into global payment networks is crucial.

- Technological Advancements: Innovation and upgrades to RippleNet and XRP will drive its competitiveness.

3. Conclusion:

The collaboration between Ripple XRP and SBI Holdings exemplifies a successful partnership in the volatile cryptocurrency market. SBI Holdings' investment has likely yielded significant shareholder rewards, and this relationship has positively impacted XRP's market position and liquidity. The strategic importance of this partnership for both entities is undeniable, and it may serve as a model for future collaborations within the cryptocurrency sector.

Call to Action: Learn more about the dynamic relationship between Ripple XRP and SBI Holdings by exploring further research and analysis of their collaboration. Stay informed about the latest developments in the XRP market and continue to investigate the potential rewards and risks involved in investments related to Ripple XRP and SBI Holdings.

Featured Posts

-

Orta Afrika Cumhuriyeti Nin Bae Ile Yeni Ticaret Anlasmasi Ekonomik Etkiler

May 02, 2025

Orta Afrika Cumhuriyeti Nin Bae Ile Yeni Ticaret Anlasmasi Ekonomik Etkiler

May 02, 2025 -

Xrp Price Prediction Impact Of Ripples 50 M Sec Settlement

May 02, 2025

Xrp Price Prediction Impact Of Ripples 50 M Sec Settlement

May 02, 2025 -

Ray Epps V Fox News A Deep Dive Into The Jan 6 Defamation Lawsuit

May 02, 2025

Ray Epps V Fox News A Deep Dive Into The Jan 6 Defamation Lawsuit

May 02, 2025 -

Chief Election Commissioner Confident A Robust Poll Data System

May 02, 2025

Chief Election Commissioner Confident A Robust Poll Data System

May 02, 2025 -

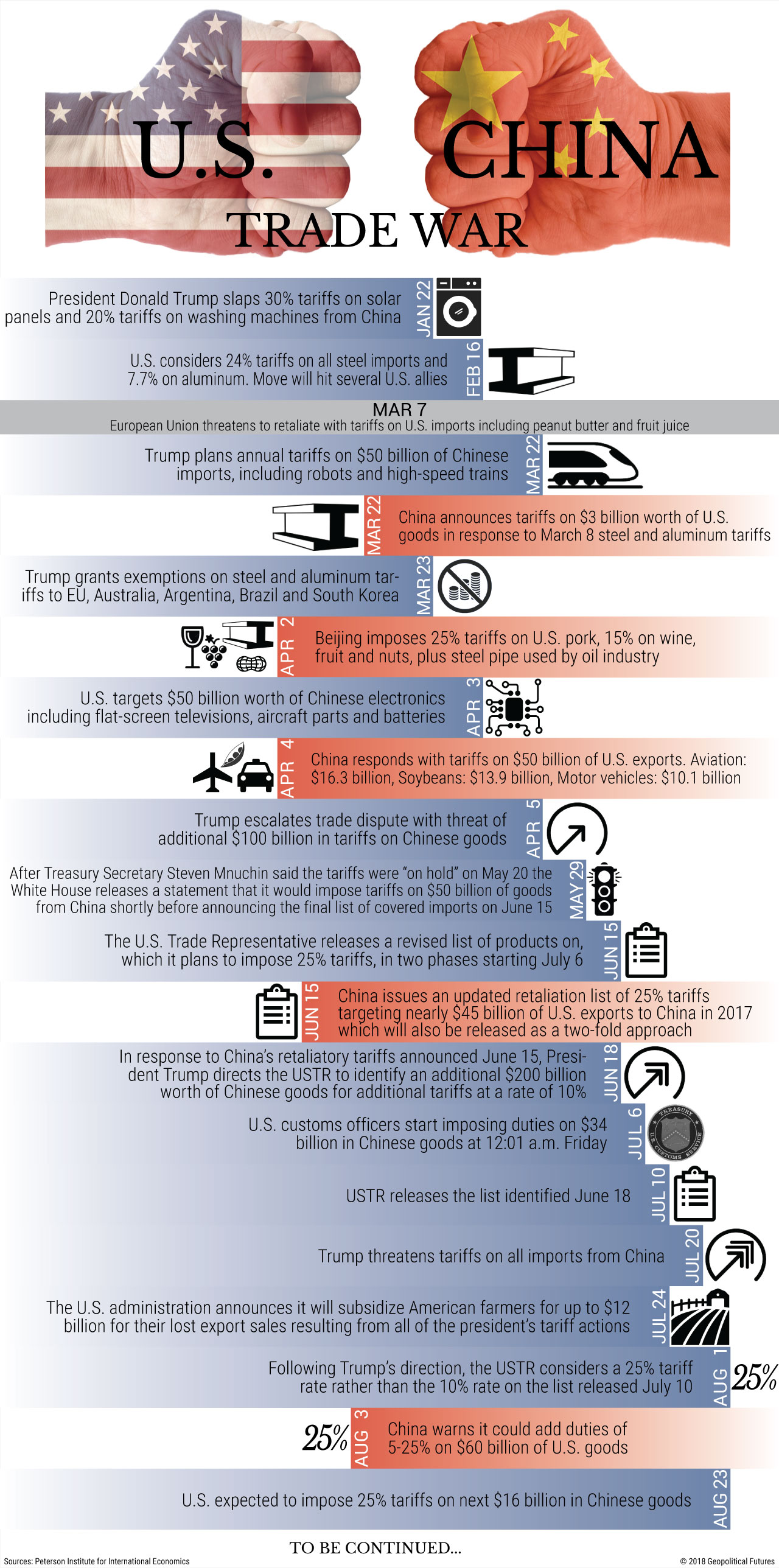

Assessing The Damage How Much Is The Trade War Really Costing China

May 02, 2025

Assessing The Damage How Much Is The Trade War Really Costing China

May 02, 2025

Latest Posts

-

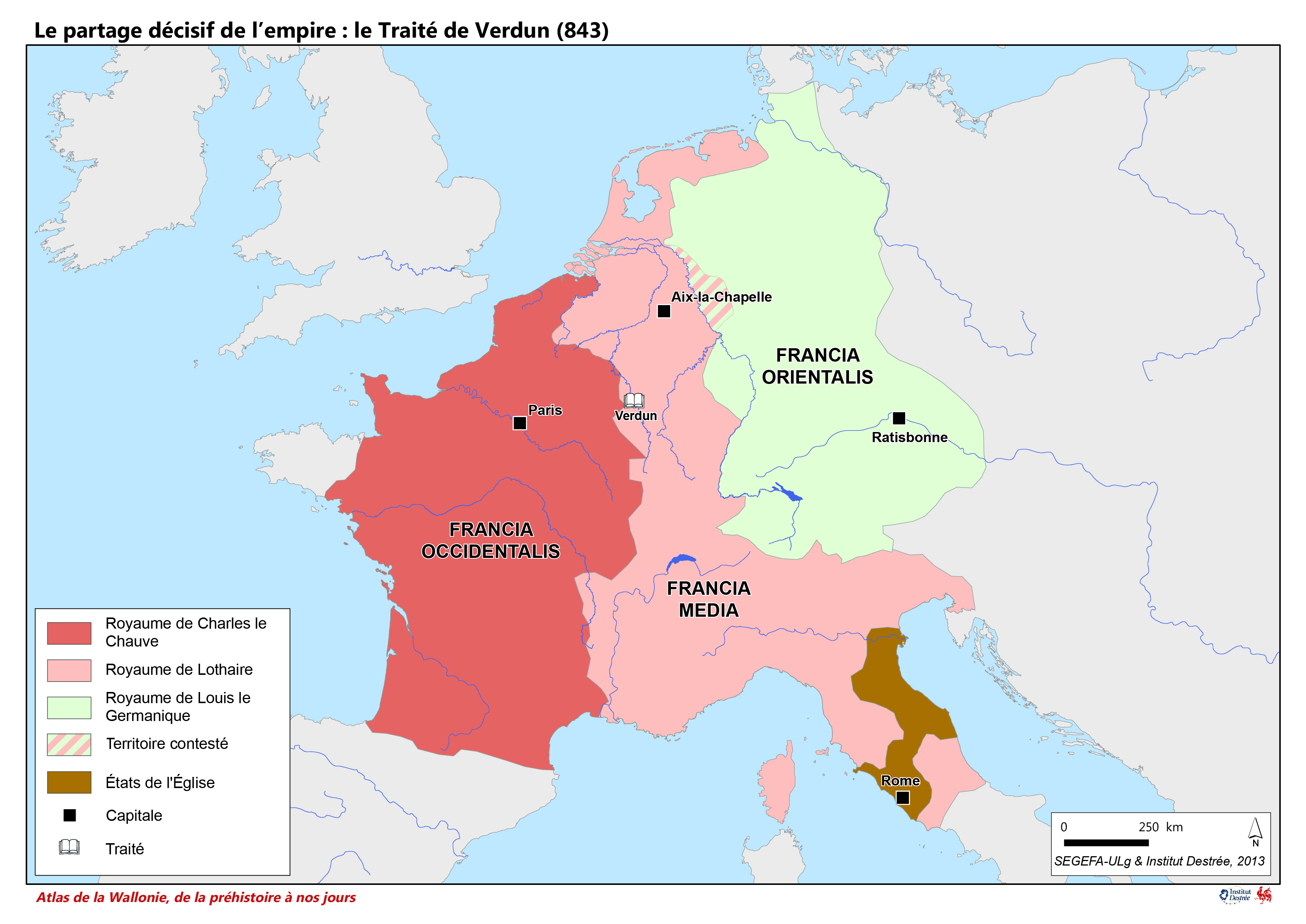

Position De La France Sur Le Partage De La Dissuasion Nucleaire Declaration Du Ministre

May 10, 2025

Position De La France Sur Le Partage De La Dissuasion Nucleaire Declaration Du Ministre

May 10, 2025 -

Declaration Du Ministre Francais Sur Le Partage Du Bouclier Nucleaire Europeen

May 10, 2025

Declaration Du Ministre Francais Sur Le Partage Du Bouclier Nucleaire Europeen

May 10, 2025 -

Ministre Francais De L Europe Defend Le Partage Du Parapluie Nucleaire

May 10, 2025

Ministre Francais De L Europe Defend Le Partage Du Parapluie Nucleaire

May 10, 2025 -

Le Ministre Europeen Francais Vante Le Partage Du Bouclier Nucleaire

May 10, 2025

Le Ministre Europeen Francais Vante Le Partage Du Bouclier Nucleaire

May 10, 2025 -

Ukrainskie Bezhentsy I S Sh A Prognozy Dlya Germanii

May 10, 2025

Ukrainskie Bezhentsy I S Sh A Prognozy Dlya Germanii

May 10, 2025