Stock Market News: Trump's Tariff Plan & Implications For UK Trade Agreement

Table of Contents

Trump's Tariff Policies: A Recap

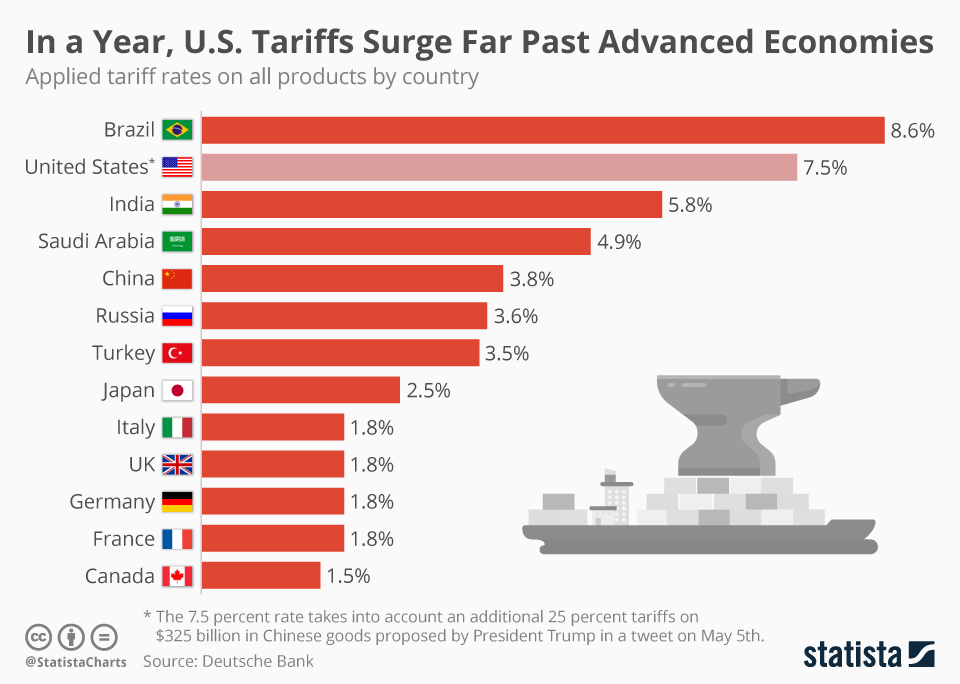

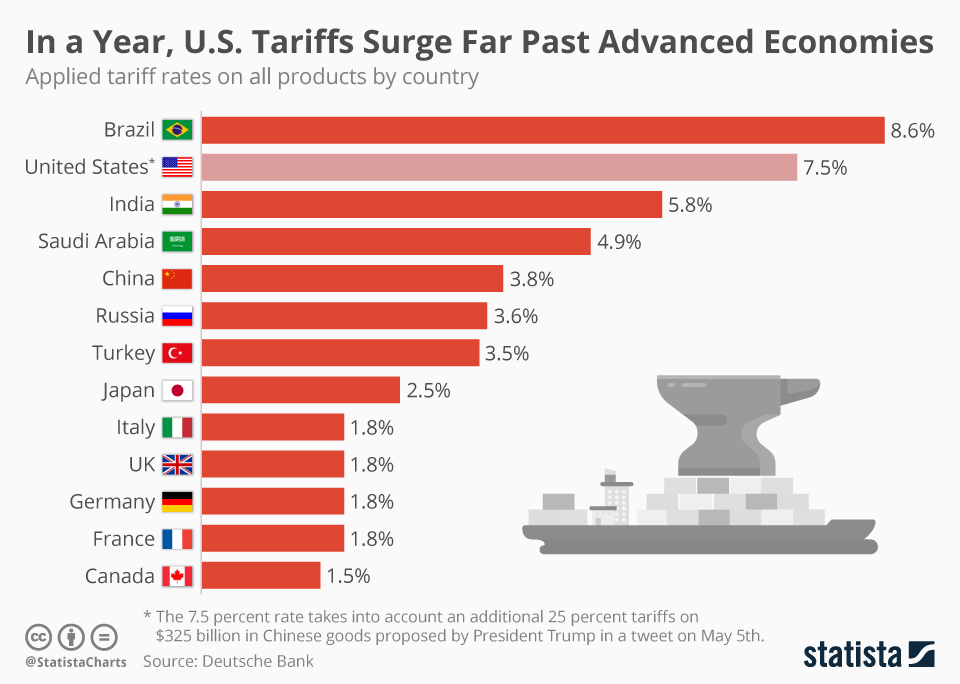

Trump's "America First" trade policy prioritized protecting American industries through the widespread imposition of tariffs. This strategy, often employing Section 301 tariffs (allowing the President to impose tariffs on goods deemed to violate US intellectual property rights or threaten national security), targeted numerous countries and sectors. Key targets included steel and aluminum imports from various nations, and a significant focus on Chinese goods. This led to a trade war, with retaliatory tariffs imposed by affected countries, creating significant disruptions in global supply chains.

- "America First" trade policy goals: Prioritizing domestic industries and jobs above free trade agreements.

- Use of Section 301 tariffs: A powerful tool used to justify tariffs on a wide range of imported goods.

- Retaliatory tariffs from other countries: Escalating trade tensions and disrupting global commerce.

- Impact on global supply chains: Increased costs, delays, and uncertainty for businesses worldwide.

The UK-US Trade Deal: Pre-existing Challenges

Negotiating a post-Brexit trade deal with the US presented numerous complexities even before Trump's tariffs entered the equation. Pre-existing differences in priorities and regulatory frameworks created significant hurdles. The UK and US have diverging standards on food safety and agricultural products, creating challenges for agricultural trade. Disagreements over pharmaceutical pricing and data privacy regulations further complicated negotiations. The Northern Ireland Protocol, a key part of the Brexit agreement, also added another layer of complexity to any potential trade deal, impacting the flow of goods between Great Britain and Northern Ireland.

- Differing standards on food safety and agricultural products: Making it difficult to achieve a mutually beneficial agreement on agricultural trade.

- Concerns about pharmaceutical pricing: Differing approaches to drug pricing creating tension between the two nations.

- Data privacy regulations: The GDPR in the EU (and its implications for the UK) contrasting with US data privacy laws.

- The impact of the Northern Ireland Protocol: Creating logistical challenges and potential trade barriers within the UK itself.

Trump's Tariffs & The UK Trade Deal: Direct Impacts

Trump's tariffs injected considerable uncertainty into the already challenging UK-US trade negotiations. The imposition of tariffs increased costs for UK businesses importing US goods, reducing their competitiveness. Conversely, UK exports to the US faced higher tariffs, further hindering trade. This created uncertainty for investors, making it difficult to predict the long-term trajectory of the UK-US trade relationship. The risk of further retaliatory tariffs added to the instability.

- Increased costs for UK businesses importing US goods: Making imported goods more expensive for consumers and businesses.

- Reduced competitiveness for UK exports to the US: Limiting the UK's access to the US market.

- Uncertainty for investors regarding long-term trade relationships: Making investment decisions more challenging.

- Potential for further retaliatory tariffs: Adding to the instability and unpredictability of the trade relationship.

Stock Market Reactions to Tariff-Related News

Announcements regarding Trump's tariff plans and their potential effects on the UK-US trade deal frequently caused significant stock market volatility. News of new tariffs or escalations in trade disputes often led to declines in market indices. Specific sectors, such as automotive and agriculture, were particularly vulnerable to tariff-related news, experiencing heightened volatility. Investor sentiment played a crucial role, with negative news leading to sell-offs and increased uncertainty. Currency fluctuations also amplified the market's reaction to tariff-related announcements.

- Impact on specific sectors (e.g., automotive, agriculture): These sectors were particularly exposed to the effects of tariffs.

- Investor sentiment and its effect on stock prices: Negative news frequently led to decreased investor confidence and falling stock prices.

- The role of currency fluctuations: Exchange rate movements amplified the impact of tariffs on import and export prices.

- Analysis of market indices in response to relevant news: Clear correlations were often observed between tariff announcements and market index performance.

Future Outlook: Navigating Uncertainty

The current state of the UK-US trade relationship is still evolving post-Trump. While the current US administration has shifted its approach to trade, the lingering effects of past policies continue to influence the market. The possibility of a revised trade agreement remains, though the specifics are uncertain. Ongoing global trade tensions also add to the complexity. Investors need to adopt diversification strategies and employ robust risk management techniques to navigate this uncertainty.

- Potential for a revised trade agreement: The possibility of a new agreement, but with lingering uncertainties.

- Continued impact of global trade tensions: Global trade remains a complex and volatile landscape.

- Importance of diversification for investors: Spreading investments across different asset classes and sectors to mitigate risk.

- Risk management strategies in a volatile market: Implementing strategies to protect investments from market downturns.

Conclusion:

Trump's tariff plan left a significant mark on global trade, and its implications for the UK's trade agreement with the US remain complex and uncertain. While the current US administration has adopted a different approach, the lingering effects of past trade policies continue to shape market dynamics. Understanding the historical context and potential future scenarios surrounding "Trump's Tariff Plan & UK Trade" is crucial for investors navigating the complexities of the global market. Stay informed on developments in international trade to make well-informed investment decisions. Continue to monitor news related to Trump's Tariff Plan & UK Trade for the latest updates and analysis.

Featured Posts

-

Celebrity Antiques Road Trip Locations Where To Find The Best Vintage Finds

May 10, 2025

Celebrity Antiques Road Trip Locations Where To Find The Best Vintage Finds

May 10, 2025 -

Effortless Dividend Investing For Higher Returns

May 10, 2025

Effortless Dividend Investing For Higher Returns

May 10, 2025 -

Nyt Spelling Bee Strands April 12 2025 Complete Gameplay Guide

May 10, 2025

Nyt Spelling Bee Strands April 12 2025 Complete Gameplay Guide

May 10, 2025 -

U S And China Seek Trade De Escalation Key Developments This Week

May 10, 2025

U S And China Seek Trade De Escalation Key Developments This Week

May 10, 2025 -

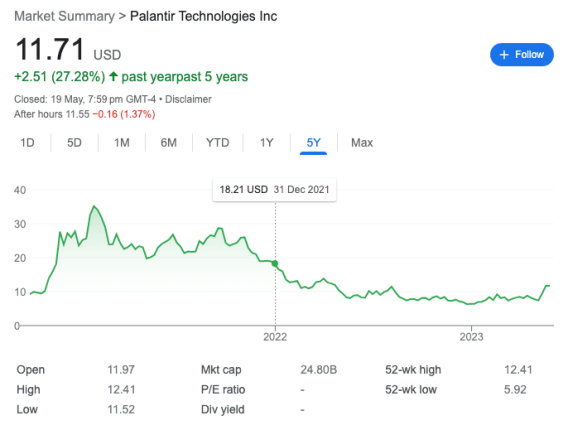

Investing In Palantir Before May 5th What To Consider

May 10, 2025

Investing In Palantir Before May 5th What To Consider

May 10, 2025