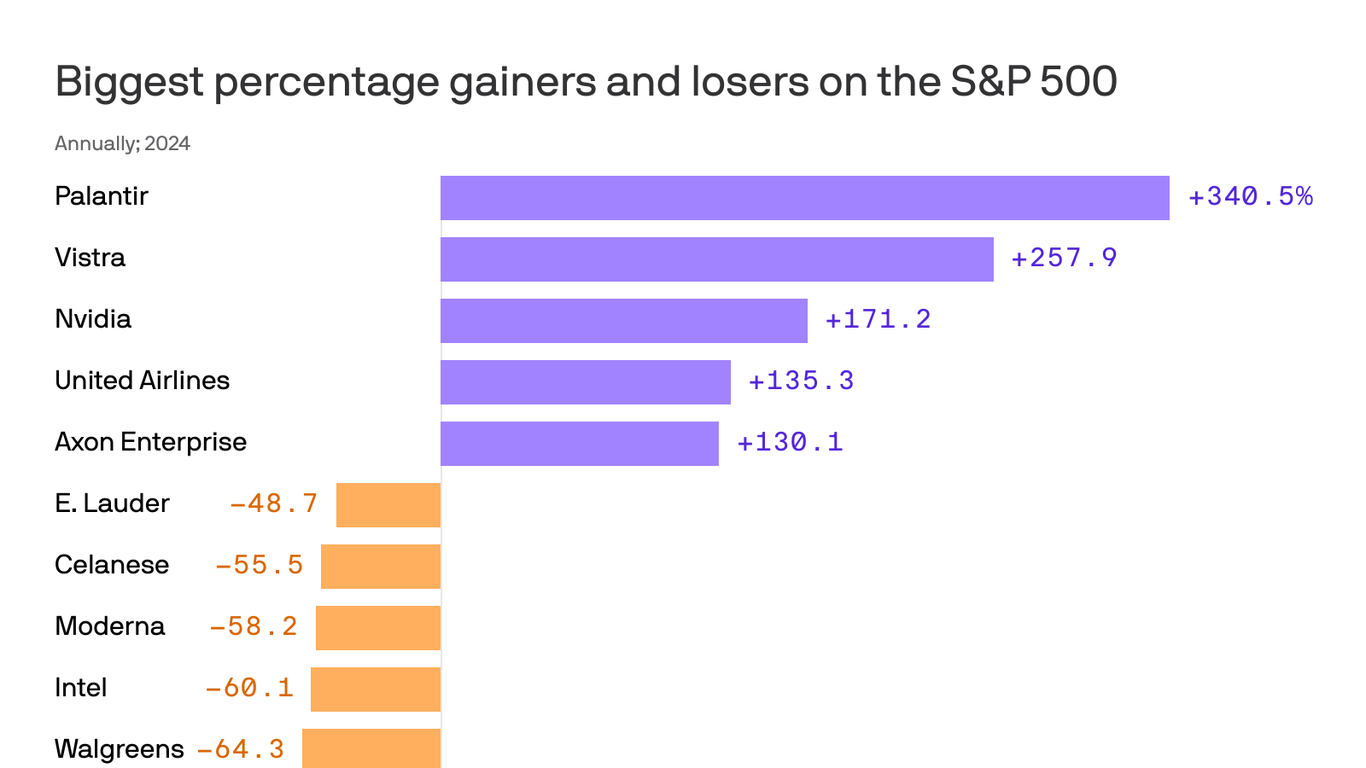

Stock Market Prediction: 2 Potential Winners Over Palantir (3-Year Outlook)

Table of Contents

Company A: A Deep Dive into Tesla and its Growth Potential

Analyzing Tesla's Business Model and Competitive Advantages

Tesla's core business revolves around designing, developing, manufacturing, and selling electric vehicles (EVs), battery energy storage devices, and solar panels. Its target market is broad, encompassing both individual consumers and businesses seeking sustainable transportation and energy solutions. Tesla's competitive advantages include its strong brand recognition, a vertically integrated supply chain giving it greater control over production and pricing, and continuous innovation in battery technology and autonomous driving capabilities. Relevant keywords include Tesla stock, electric vehicle industry, growth stock, and competitive advantage.

Financial Performance and Future Projections

Tesla's financial performance has been remarkable, showcasing consistent revenue growth and increasing profitability. Analysts predict continued strong growth fueled by increasing EV adoption globally and expansion into new markets.

- Revenue growth: Projected to exceed 20% annually for the next 3 years.

- Profitability: Improving margins due to economies of scale and increased production efficiency.

- Earnings per share (EPS): Steady growth reflecting strong financial performance.

These key financial highlights support our stock market prediction of Tesla outperforming Palantir. Relevant keywords used here include financial performance, revenue growth, profitability, and earnings per share (EPS).

Risks and Mitigation Strategies

Potential risks include intense competition from established automakers and emerging EV startups, reliance on government incentives, and supply chain disruptions. Tesla's mitigation strategies involve continuous innovation, expansion of its Supercharger network, and diversification of its supply chain. Keywords used here: risk assessment, risk mitigation, market volatility.

Company B: Nvidia – A Strong Contender for Superior Returns

Understanding Nvidia's Disruptive Technology and Market Position

Nvidia dominates the graphics processing unit (GPU) market, with its technology playing a crucial role in artificial intelligence (AI), gaming, and high-performance computing. Nvidia's disruptive technology lies in its powerful GPUs, increasingly crucial for the development and application of AI. Its market penetration is significant, and future expansion is expected across various sectors like autonomous vehicles, data centers, and cloud computing. Relevant keywords: disruptive technology, market share, innovation, semiconductor industry.

Evaluating Nvidia's Financial Health and Investment Outlook

Nvidia boasts a strong financial health, with consistently high revenue growth and impressive profitability. Its financial performance surpasses that of Palantir in key metrics.

- Strong balance sheet: With low debt-to-equity ratio.

- High profit margins: Reflecting its strong market position and pricing power.

- Consistent revenue growth: Driven by increasing demand for its GPUs.

This data suggests a strong investment opportunity with significant return on investment (ROI). Keywords: financial health, investment opportunity, return on investment (ROI).

Addressing Potential Challenges and Opportunities

Potential challenges include geopolitical risks impacting supply chains and competition from other chip manufacturers. Opportunities lie in the explosive growth of AI, the expansion of the data center market, and the development of the metaverse. Nvidia's strategic planning actively addresses these aspects. Keywords: market challenges, growth opportunities, strategic planning.

Conclusion: Investing Wisely: Making Informed Stock Market Predictions

Based on their strong financial performance, disruptive technologies, and significant growth potential, Tesla and Nvidia are predicted to outperform Palantir over the next three years. This stock market prediction is based on thorough analysis, but remember that all investments carry risk. It's crucial to conduct thorough due diligence before making any investment decisions. Consider investing in these potential outperformers, learn more about these stock market predictions, and improve your stock market portfolio with these top picks. Remember to diversify your portfolio and consider long-term investment strategies. By carefully examining these factors, you can make informed decisions and potentially benefit from these strong stock market predictions. Research these companies further and consider them for your investment portfolio. Remember to always diversify your portfolio and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Fyraty Fy Alerby Alqtry Ma Aldhy Qdmh Mndh Antqalh Mn Alahly

May 09, 2025

Fyraty Fy Alerby Alqtry Ma Aldhy Qdmh Mndh Antqalh Mn Alahly

May 09, 2025 -

2 Stocks Predicted To Surpass Palantirs Value In 3 Years

May 09, 2025

2 Stocks Predicted To Surpass Palantirs Value In 3 Years

May 09, 2025 -

Debut D Incendie A La Mediatheque Champollion De Dijon

May 09, 2025

Debut D Incendie A La Mediatheque Champollion De Dijon

May 09, 2025 -

Whats App Spyware And Meta Understanding The 168 Million Verdict And Its Impact

May 09, 2025

Whats App Spyware And Meta Understanding The 168 Million Verdict And Its Impact

May 09, 2025 -

Nottingham A And E Records Breach Families Demand Accountability From Nhs Staff

May 09, 2025

Nottingham A And E Records Breach Families Demand Accountability From Nhs Staff

May 09, 2025

Latest Posts

-

Beyonces Cowboy Carter Sees Streaming Numbers Double Following Tour Start

May 10, 2025

Beyonces Cowboy Carter Sees Streaming Numbers Double Following Tour Start

May 10, 2025 -

43 Billion Increase Space X Outpaces Tesla In Elon Musks Portfolio

May 10, 2025

43 Billion Increase Space X Outpaces Tesla In Elon Musks Portfolio

May 10, 2025 -

Elon Musks Space X Stake Surges Now Worth 43 B More Than Tesla Holdings

May 10, 2025

Elon Musks Space X Stake Surges Now Worth 43 B More Than Tesla Holdings

May 10, 2025 -

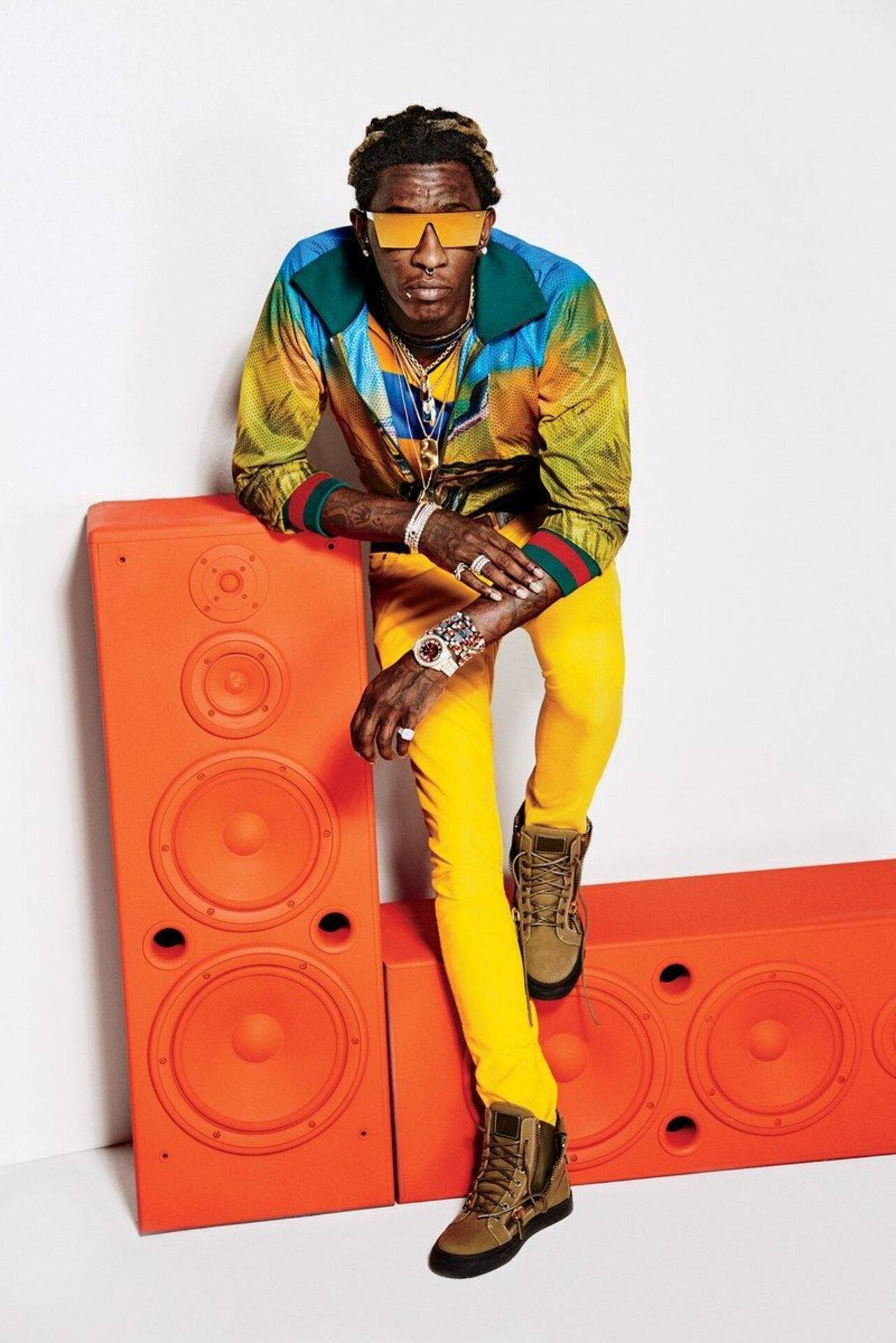

Young Thugs Back Outside Everything We Know About The Upcoming Album

May 10, 2025

Young Thugs Back Outside Everything We Know About The Upcoming Album

May 10, 2025 -

Mariah The Scientist And Young Thug A New Song Snippet Hints At Commitment

May 10, 2025

Mariah The Scientist And Young Thug A New Song Snippet Hints At Commitment

May 10, 2025