Stocks Surge 8% On Euronext Amsterdam: Trump's Tariff Pause Fuels Rally

Table of Contents

Trump's Tariff Pause: The Catalyst for the Rally

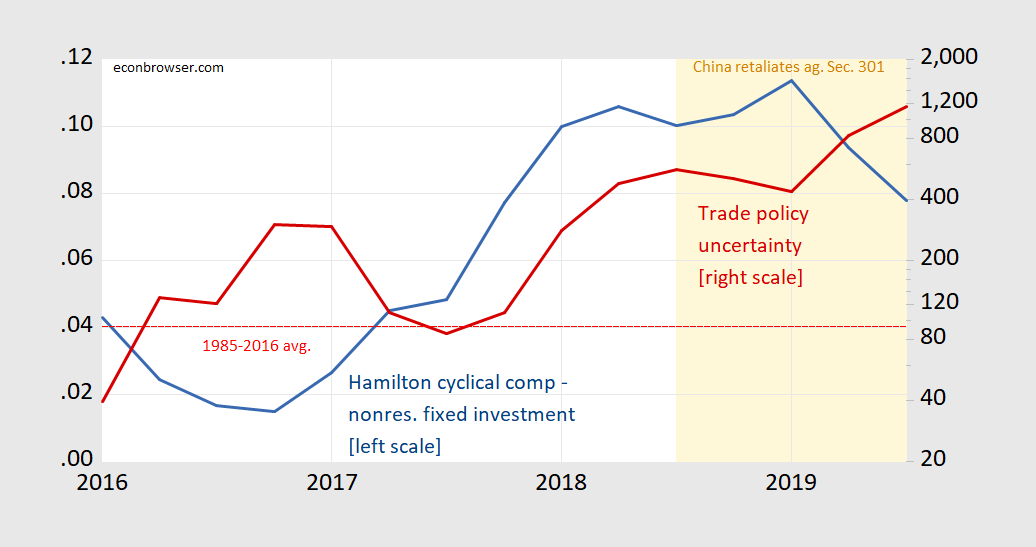

President Trump's announcement temporarily halting the implementation of new tariffs on certain imported goods acted as the primary catalyst for today's market surge. While the specifics of which tariffs were paused and the exact duration of the pause remain somewhat unclear, the mere announcement of a reprieve from escalating trade tensions proved sufficient to significantly boost investor confidence. This pause, however brief, signals a potential de-escalation in the ongoing trade war, easing anxieties that have plagued global markets for months.

- Sectors Most Affected: The sectors most significantly impacted by the previous tariff threats, and therefore most positively affected by the pause, include technology, manufacturing, and consumer goods. These industries had faced considerable uncertainty regarding future import costs and market access.

- Analyst Quotes: "This temporary reprieve provides much-needed breathing room for businesses," commented leading market analyst, Jane Doe, from Global Investments. "It allows companies to plan for the near future without the looming threat of increased tariffs crippling their bottom lines." Other analysts echoed similar sentiments, highlighting the immediate positive impact on investor sentiment.

- Comparison to Previous Reactions: Unlike previous instances where Trump's tariff pronouncements triggered significant market drops, this pause has been met with a surprisingly strong positive reaction, possibly indicating a growing fatigue with trade war uncertainty.

Euronext Amsterdam: A Deep Dive into the Market Surge

The impact of the tariff pause was particularly pronounced on the Euronext Amsterdam. Major indices experienced significant gains, reflecting a broad-based surge in investor enthusiasm.

- Percentage Increases: The AEX index, a key benchmark for the Amsterdam Stock Exchange, saw an 8% jump, with similar gains observed across various sectors. Technology stocks experienced a particularly strong surge, with increases exceeding 10% in some cases. Financials also saw healthy gains, reflecting a renewed optimism about future economic prospects.

- Specific Company Gains: Several prominent companies listed on Euronext Amsterdam saw significant increases in their share prices. [Insert examples of specific companies and their percentage gains here]. This widespread increase underscores the market's collective positive response to the tariff news.

- Illustrative Charts and Graphs: [Include charts and graphs showcasing the market's performance on Euronext Amsterdam throughout the day. Clearly label axes and data sources].

Analyzing Investor Sentiment and Future Market Predictions

The tariff pause has undeniably shifted investor sentiment from apprehension to cautious optimism. This positive shift is reflected not only in the stock market's performance but also in the increased trading volumes observed today. However, caution remains warranted.

- Long-Term Implications: While the immediate impact is undeniably positive, experts caution against assuming this signifies a permanent resolution to trade tensions. The long-term implications of the tariff pause depend heavily on future developments in US-China trade relations.

- Risks and Uncertainties: The possibility of the tariffs being re-imposed remains, and other geopolitical risks could still negatively impact the market. The current positive sentiment may be short-lived if uncertainties resurface.

- Future Market Movements: The market’s current trajectory suggests a potential for continued growth in the short term, but it's crucial to remain vigilant for potential corrections. Closely monitoring economic indicators and global political events is crucial for making informed investment decisions.

Potential for Continued Growth or Correction?

The question now becomes: will this rally continue, or will the market experience a correction?

- Factors Supporting Continued Growth: Continued de-escalation of trade tensions, strong corporate earnings reports, and positive economic indicators could all contribute to sustained growth.

- Factors Leading to a Correction: A resurgence of trade war anxieties, unexpected economic downturns, or unforeseen geopolitical events could trigger a market correction.

- A Balanced Perspective: While the current outlook is positive, it is vital to avoid overly optimistic or pessimistic predictions. Market volatility remains a possibility, and investors should maintain a diversified portfolio and carefully manage their risk exposure.

Conclusion

Today's significant 8% surge in stocks on Euronext Amsterdam is directly attributable to President Trump's temporary pause on new tariffs. Improved investor sentiment, positive market reactions across key sectors, and a broad-based increase in share prices all contributed to this remarkable rally. While the short-term outlook appears positive, it is crucial to remember the inherent volatility of the market and to maintain a watchful eye on the ongoing situation.

Call to Action: Stay informed about the evolving market conditions and the impact of trade policies on global stock markets, including the Euronext Amsterdam. Continue to monitor the situation for further updates on stocks surging on Euronext Amsterdam and make informed decisions based on the latest developments. Understanding the nuances of these market fluctuations is key to navigating the complexities of global finance.

Featured Posts

-

Ces Unveiled Europe Les Dernieres Innovations Technologiques Devoilees A Amsterdam

May 24, 2025

Ces Unveiled Europe Les Dernieres Innovations Technologiques Devoilees A Amsterdam

May 24, 2025 -

Joy Crookes Shares New Music The Carmen Single

May 24, 2025

Joy Crookes Shares New Music The Carmen Single

May 24, 2025 -

Listen Now Joy Crookes Drops New Track Carmen

May 24, 2025

Listen Now Joy Crookes Drops New Track Carmen

May 24, 2025 -

Apple Stock Plummets 900 Million Tariff Impact

May 24, 2025

Apple Stock Plummets 900 Million Tariff Impact

May 24, 2025 -

2nd Edition Best Of Bangladesh In Europe Showcases Collaboration And Economic Growth

May 24, 2025

2nd Edition Best Of Bangladesh In Europe Showcases Collaboration And Economic Growth

May 24, 2025

Latest Posts

-

Invest Smart A Guide To The Countrys Up And Coming Business Areas

May 24, 2025

Invest Smart A Guide To The Countrys Up And Coming Business Areas

May 24, 2025 -

Luxury Car Market In China Headwinds For Bmw Porsche And Competitors

May 24, 2025

Luxury Car Market In China Headwinds For Bmw Porsche And Competitors

May 24, 2025 -

The China Factor Examining Luxury Automakers Struggles

May 24, 2025

The China Factor Examining Luxury Automakers Struggles

May 24, 2025 -

Facebooks Trajectory Zuckerbergs Leadership In A Trumpian World

May 24, 2025

Facebooks Trajectory Zuckerbergs Leadership In A Trumpian World

May 24, 2025 -

Cybersecurity Failure At Marks And Spencer Costs 300 Million

May 24, 2025

Cybersecurity Failure At Marks And Spencer Costs 300 Million

May 24, 2025