Swissquote Bank: Sovereign Bond Market Analysis And Outlook

Table of Contents

Current State of the Sovereign Bond Market

The global interest rate environment is a complex tapestry woven from various threads. Currently, we see a divergence in monetary policies across major economies. Some central banks are maintaining accommodative stances, while others are aggressively tightening monetary policy to combat inflation. This creates a dynamic and often unpredictable landscape for sovereign bond investors. Key macroeconomic factors significantly influence bond yields. Inflation, economic growth forecasts, and, most importantly, central bank policies are the primary drivers. High inflation generally pushes bond yields higher as investors demand a higher return to compensate for the erosion of purchasing power. Conversely, slow economic growth can lead to lower yields as investors seek the safety of government bonds.

- Analysis of US Treasury yields: US Treasury yields, a benchmark for global borrowing costs, have fluctuated significantly in recent months, reflecting uncertainty around inflation and the Federal Reserve's policy trajectory.

- Overview of Eurozone government bond yields: The Eurozone sovereign bond market has shown increased sensitivity to the economic outlook of the region and the ongoing energy crisis. Yields have been influenced by the European Central Bank's (ECB) actions and concerns about the stability of the Eurozone.

- Examination of emerging market sovereign bond yields: Emerging market sovereign bonds offer higher yields but carry greater risk. These yields are highly sensitive to global capital flows, commodity prices, and political stability within the issuing countries.

- Impact of geopolitical events on sovereign bond prices: Geopolitical instability, such as the ongoing war in Ukraine, significantly impacts sovereign bond markets, creating safe-haven demand for bonds from stable economies and increasing risk premiums for bonds from less stable regions. This leads to increased volatility in the sovereign bond market.

Analysis of Key Sovereign Bond Issuers

Major economies like the US, Eurozone, UK, and Japan dominate the sovereign bond market. Assessing their creditworthiness and debt levels is crucial for investors. The credit rating agencies (Moody's, S&P, Fitch) provide assessments of these issuers' ability to repay their debt. These ratings influence investor confidence and ultimately bond yields.

- Credit rating agencies' assessments: Regularly monitoring credit ratings is essential for understanding potential risks associated with specific sovereign bonds. Downgrades can lead to increased yields as investors demand a higher risk premium.

- Analysis of government debt-to-GDP ratios: High debt-to-GDP ratios indicate a higher level of fiscal risk for a country. This can negatively affect investor confidence and lead to higher borrowing costs.

- Discussion on fiscal sustainability: The ability of a government to manage its debt and maintain sustainable fiscal policies is a critical factor in determining the long-term outlook for its sovereign bonds.

- Potential risks associated with specific sovereign issuers: Various factors such as political risks, economic instability, and unexpected external shocks can impact the creditworthiness of specific sovereign bond issuers.

Impact of Central Bank Policies on Sovereign Bonds

Central bank policies, particularly quantitative easing (QE) and interest rate adjustments, profoundly affect sovereign bond yields. QE programs, where central banks purchase government bonds, typically drive down yields. Conversely, interest rate hikes generally increase yields as investors seek higher returns from alternative investments.

- Analysis of the Federal Reserve's monetary policy: The Federal Reserve's actions are a key driver of US Treasury yields and significantly influence global bond markets.

- Impact of the European Central Bank's actions on the Eurozone sovereign bond market: The ECB's monetary policy decisions directly affect the yields of Eurozone government bonds.

- The role of other major central banks: Central banks in Japan, the UK, and other major economies play a crucial role in shaping their respective sovereign bond markets and the broader global landscape.

Risk Assessment and Outlook for the Sovereign Bond Market

Investing in the sovereign bond market involves inherent risks and opportunities. Inflation is a key risk factor, as rising inflation erodes the real return on bonds. Changes in interest rates also impact bond prices; rising rates typically lead to lower bond prices, and vice versa. Geopolitical events can create substantial uncertainty and volatility.

- Assessment of inflation risks and their impact: High and persistent inflation poses a major risk to sovereign bond investors, eroding the purchasing power of their returns.

- Potential for rising interest rates and their effects on bond prices: Anticipating interest rate changes is crucial for managing bond portfolio risk, as rising rates typically lead to capital losses on existing bonds.

- Geopolitical risks and their influence on sovereign bond yields: Unexpected geopolitical events can trigger significant shifts in investor sentiment, leading to increased volatility in sovereign bond markets.

- Opportunities for diversification within the sovereign bond market: Diversifying across different sovereign issuers and maturities can help mitigate some of the risks associated with investing in government bonds.

Conclusion

This analysis of the sovereign bond market, leveraging Swissquote Bank's expertise, highlights the complexities and interconnectedness of global economic factors impacting government bond yields. Understanding current interest rate environments, the creditworthiness of key issuers, and the impact of central bank policies is crucial for navigating this dynamic market. While opportunities exist, careful risk assessment is paramount. To stay informed and make well-informed investment decisions in the sovereign bond market, explore the resources and tools available at Swissquote Bank. Gain a deeper understanding of the current sovereign bond market landscape and refine your investment strategies. Visit Swissquote Bank today for comprehensive market analysis and investment solutions tailored to your needs.

Featured Posts

-

I A Stasi Ton Xairetismon Ermineia Kai Simasia Sta Ierosolyma

May 19, 2025

I A Stasi Ton Xairetismon Ermineia Kai Simasia Sta Ierosolyma

May 19, 2025 -

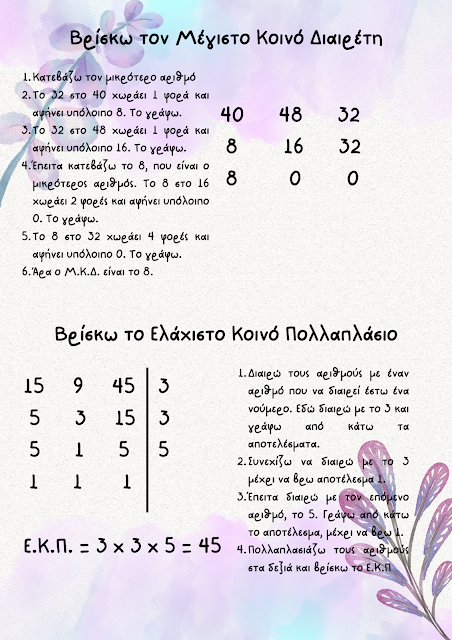

Analyontas Ti Syntrivi Enatenisis Aities Epiptoseis Kai Lyseis

May 19, 2025

Analyontas Ti Syntrivi Enatenisis Aities Epiptoseis Kai Lyseis

May 19, 2025 -

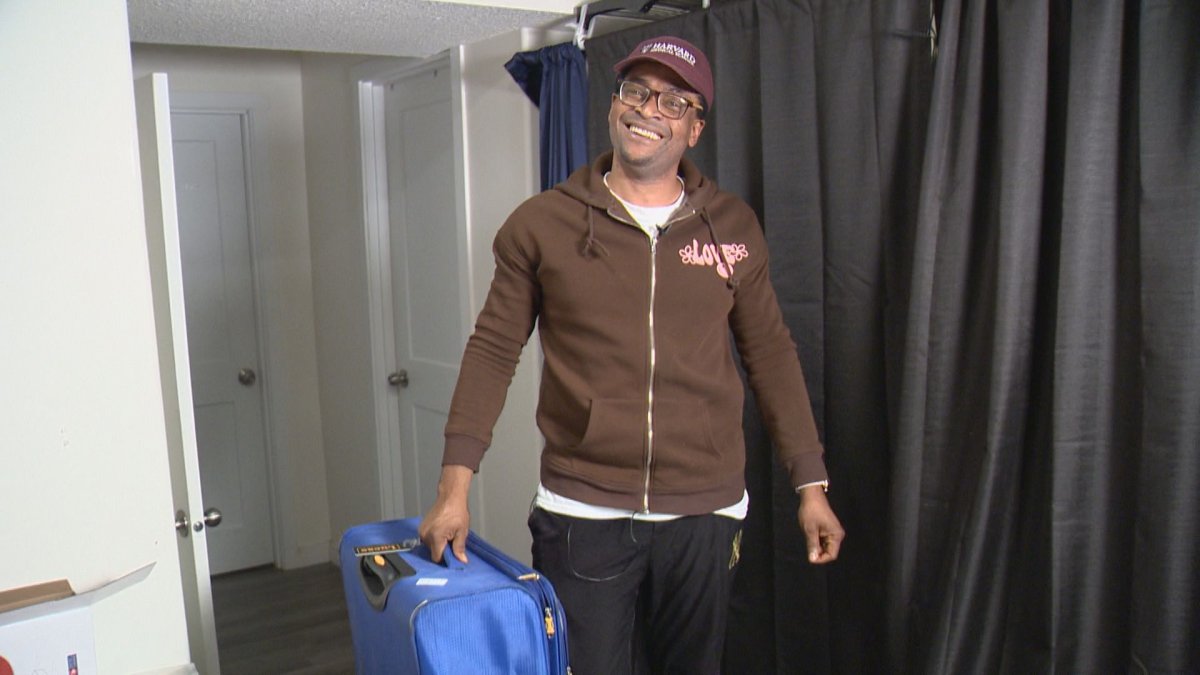

Todays Top 5 News Stories From India Political Drama Spy Arrest And National Updates

May 19, 2025

Todays Top 5 News Stories From India Political Drama Spy Arrest And National Updates

May 19, 2025 -

Gazze Ye Yardim Malzemesi Tasiyan Tirlarin Girisi Son Durum

May 19, 2025

Gazze Ye Yardim Malzemesi Tasiyan Tirlarin Girisi Son Durum

May 19, 2025 -

New Final Destination Bloodlines Trailer Hints At Franchises Most Brutal Installment

May 19, 2025

New Final Destination Bloodlines Trailer Hints At Franchises Most Brutal Installment

May 19, 2025