The Impact Of Musk's Political Stance On Tesla's Q1 Earnings

Table of Contents

Direct Impact on Investor Sentiment and Stock Price

Musk's outspoken political views have demonstrably influenced Tesla's stock price. Understanding these fluctuations is crucial for evaluating the long-term prospects of the company.

Market Reactions to Controversial Tweets and Statements

Musk's social media activity has frequently triggered significant market reactions. For example:

- Specific Instance 1: [Insert date and a brief description of a controversial tweet/statement and the subsequent impact on Tesla's stock price (e.g., percentage drop/rise within a specific timeframe)]. Social media's instantaneous nature amplified the effect, spreading news globally within minutes.

- Specific Instance 2: [Insert date and a brief description of another controversial tweet/statement and the subsequent impact on Tesla's stock price (e.g., percentage drop/rise within a specific timeframe)]. This event highlighted the volatility inherent in Tesla's stock price due to its association with Musk's unpredictable public persona.

- Specific Instance 3: [Insert date and a brief description of another controversial tweet/statement and the subsequent impact on Tesla's stock price (e.g., percentage drop/rise within a specific timeframe)]. This shows a pattern of negative impacts.

These examples illustrate a direct correlation between Musk's controversial statements and short-term stock price volatility.

Investor Confidence and Long-Term Investment Decisions

The uncertainty generated by Musk's political actions casts a shadow over long-term investment decisions.

- Institutional Investors: Many large institutional investors may hesitate to allocate significant capital to Tesla due to the inherent risks associated with Musk's unpredictable behavior.

- Retail Investors: Individual investors, often more susceptible to short-term market fluctuations, may be less inclined to hold Tesla stock for the long term, preferring safer investment options.

- Portfolio Diversification: The volatility introduced by Musk’s political stance forces investors to reassess Tesla's place within their diversified portfolios.

The potential for significant, sudden drops in Tesla's stock price influences long-term investment strategies.

Indirect Impact on Tesla's Brand Image and Consumer Perception

Musk's political activities extend beyond direct market impact, influencing Tesla's brand image and consumer perception.

Alignment with Specific Political Ideologies

Musk's outspoken political views can alienate certain consumer demographics.

- Potential Boycotts: Consumers who disagree with his stances might choose to boycott Tesla, impacting sales figures.

- Shifting Consumer Preferences: Negative public opinion linked to Musk's political associations can lead consumers to explore alternative electric vehicle brands.

- Public Opinion Polls: [Cite any relevant polls or surveys demonstrating the correlation between consumer attitudes towards Tesla and Musk's political views].

The potential for negative consumer sentiment poses a substantial risk to Tesla's brand image and sales.

Damage Control and Brand Management Strategies

Tesla actively engages in damage control, attempting to mitigate the negative impacts of Musk's political actions on its brand image.

- Public Relations Efforts: [Describe any observed PR strategies employed by Tesla to address controversies and mitigate negative publicity].

- Corporate Social Responsibility: Tesla's commitment to environmental sustainability and technological innovation serves as a crucial element of their broader brand-building strategy, aiming to counterbalance negative perceptions stemming from Musk's actions. However, the effectiveness of these strategies is debated.

The success of these strategies is crucial in maintaining a positive brand image and consumer trust.

The Role of Geopolitics and International Markets

Musk's political activities have international implications, significantly impacting Tesla's global operations.

Impact on Tesla's Global Operations

Tesla's operations in various countries are vulnerable to the political fallout from Musk's statements.

- Political Instability: Countries with politically volatile environments might face increased regulatory hurdles or operational challenges as a result of negative associations with Musk.

- Market Access: Negative perceptions of Musk in specific regions could hinder Tesla’s ability to successfully enter new markets or expand existing ones.

- Regulatory Hurdles: Governments may impose stricter regulations on Tesla in response to negative public sentiment or to counter any perceived negative impacts from Musk's controversial statements.

International Consumer Perception and Market Share

Musk’s political stances influence Tesla's global market share and brand perception differently across regions.

- Regional Variations: Consumer responses to Musk's actions vary considerably across different cultural and political landscapes. Some markets might be more tolerant, while others could be highly sensitive.

- Long-Term Implications: The cumulative impact of these regional variations could significantly shape Tesla's long-term global market share and brand positioning.

Navigating these complexities requires a nuanced understanding of regional sensitivities and consumer attitudes.

Analysis of Q1 Earnings Report in Light of Musk's Political Actions

Analyzing Tesla's Q1 2024 earnings report reveals potential correlations between Musk's political stance and the company's financial performance.

Identifying Key Performance Indicators (KPIs)

Analyzing Tesla's Q1 2024 earnings report requires careful attention to key performance indicators that may be sensitive to public sentiment:

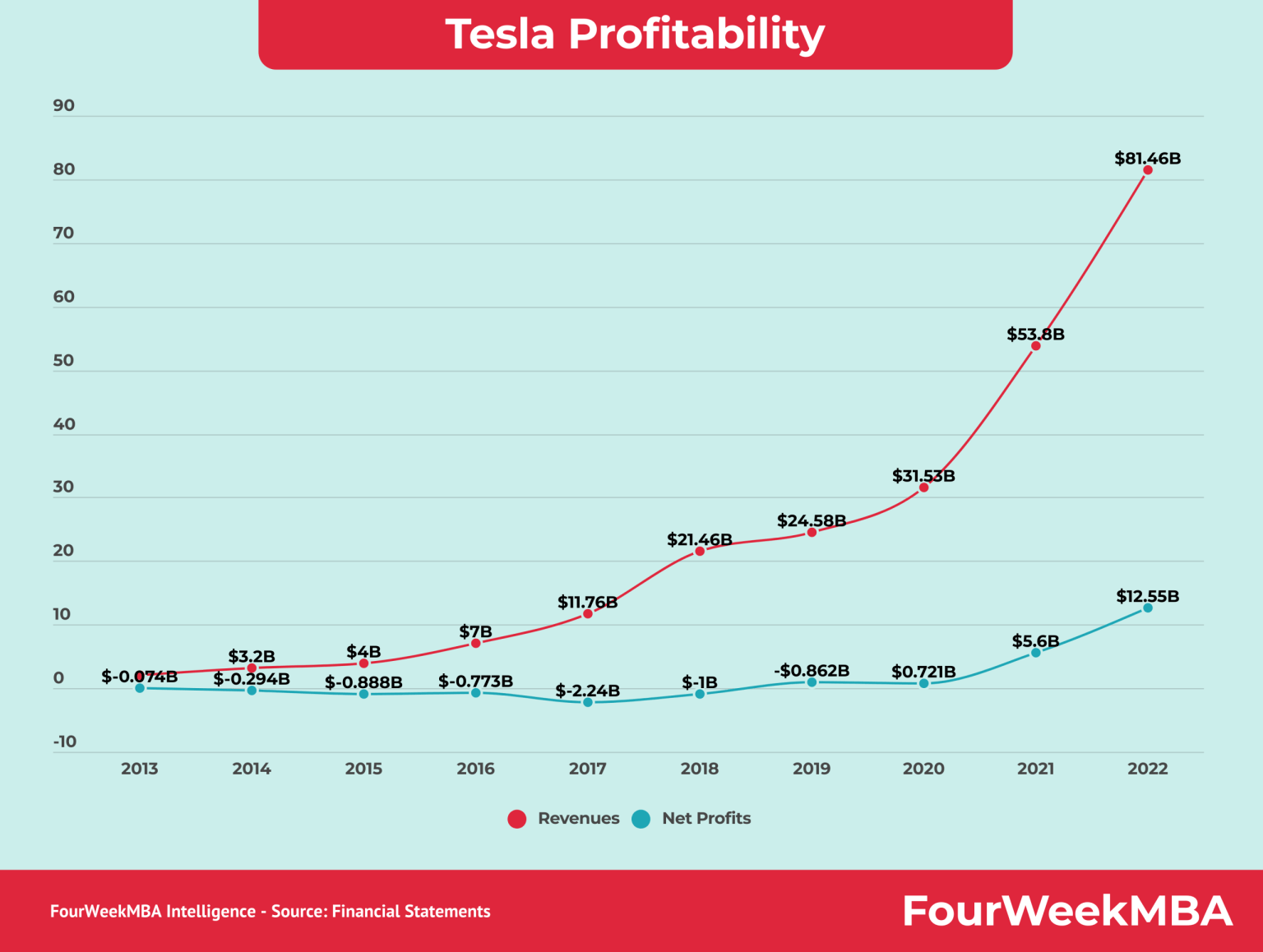

- Sales Figures: [Insert data from the Q1 2024 earnings report. Include visualizations like charts or graphs to illustrate sales data. Compare it to previous quarters for a better understanding of potential deviations].

- Production Numbers: [Insert data from the Q1 2024 earnings report. Include visualizations like charts or graphs. Compare it to previous quarters for a better understanding of potential deviations].

- Profit Margins: [Insert data from the Q1 2024 earnings report. Include visualizations like charts or graphs. Compare it to previous quarters for a better understanding of potential deviations].

Correlation vs. Causation

It's crucial to avoid attributing changes in Tesla's Q1 earnings solely to Musk's political actions. Other external factors play a vital role:

- Global Supply Chain Issues: Supply chain disruptions significantly impact production and profitability for all automotive manufacturers.

- Economic Conditions: Global economic downturns or regional economic fluctuations can affect consumer purchasing behavior and impact sales.

Attributing causation requires a more detailed analysis controlling for other influencing factors.

Conclusion

The relationship between Musk's political stance and Tesla's Q1 earnings is complex and multifaceted. His actions have demonstrably influenced investor sentiment, leading to stock price volatility. Furthermore, his political views have the potential to impact Tesla's brand image and consumer perceptions, particularly in specific markets. While attributing direct causation is challenging, the potential for negative effects is undeniable. A thorough examination of the Q1 2024 report, considering the nuances of global political dynamics and economic conditions, is vital for understanding Tesla's performance.

Call to Action: Stay informed about the ongoing impact of Musk's political activities on Tesla's performance and the broader EV market. Further research into the intricate correlation between CEO behavior and corporate financial outcomes is encouraged. Share your insights and analysis on the impact of Musk's political stance on Tesla's Q1 earnings. The ongoing interplay between Musk’s actions and Tesla's success is a subject worthy of ongoing observation and discussion.

Featured Posts

-

Interest In 65 Hudsons Bay Leases Soars

Apr 24, 2025

Interest In 65 Hudsons Bay Leases Soars

Apr 24, 2025 -

Nba

Apr 24, 2025

Nba

Apr 24, 2025 -

Teslas Reduced Q1 Profitability Analysis Of Factors

Apr 24, 2025

Teslas Reduced Q1 Profitability Analysis Of Factors

Apr 24, 2025 -

Canadas Fiscal Future A Vision For Responsible Spending

Apr 24, 2025

Canadas Fiscal Future A Vision For Responsible Spending

Apr 24, 2025 -

Emerging Market Stocks Outperform Us In 2024 A Year Of Contrasts

Apr 24, 2025

Emerging Market Stocks Outperform Us In 2024 A Year Of Contrasts

Apr 24, 2025