Stock Market Rally: Trump's Influence On US Futures

Table of Contents

Trump's Economic Policies and Their Impact on Market Sentiment

Trump's economic policies significantly influenced market sentiment, driving both substantial gains and periods of uncertainty. Understanding these policies is crucial to analyzing the stock market rally of his presidency.

Tax Cuts and Their Effect on Corporate Profits

The 2017 Tax Cuts and Jobs Act dramatically lowered the US corporate tax rate from 35% to 21%. This reduction had a profound effect on corporate profitability, boosting investor confidence and fueling a stock market rally.

- Increased corporate profitability: Companies saw a significant increase in after-tax earnings, leading to higher stock prices.

- Stock buybacks and dividends: Many corporations used their increased profits to repurchase their own shares, driving up stock prices, and increase dividends to shareholders.

- Impact on specific sectors: The technology sector, in particular, benefited from the tax cuts, experiencing substantial growth.

- Short-term vs. long-term effects: While the short-term impact was largely positive, concerns remain about the long-term effects on the national debt and income inequality.

Deregulation and its Influence on Business Growth

The Trump administration pursued a policy of deregulation across various sectors, aiming to reduce regulatory burdens and stimulate economic activity. This approach also contributed to the stock market rally.

- Examples of specific deregulatory measures: These included measures affecting the financial, energy, and environmental sectors. Specific examples should be detailed here, linking to relevant news articles and official documents for improved SEO.

- Positive and negative impacts on different industries: While some industries benefited from reduced compliance costs, others faced criticism for potential negative consequences.

- Long-term consequences of deregulation: The long-term implications of deregulation are still unfolding and require further analysis.

- Effects on environmental regulations and investor concerns: The relaxation of environmental regulations sparked debates among investors concerned about environmental, social, and governance (ESG) factors.

Trade Wars and Their Volatility on US Futures

Trump's trade policies, including tariffs imposed on goods from China and other countries, created significant market volatility and uncertainty. This impacted the overall trajectory of the stock market rally.

- Impact on specific sectors: Sectors heavily reliant on international trade, such as agriculture and manufacturing, were particularly vulnerable to trade disputes.

- Short-term market reactions to trade announcements: Announcements regarding new tariffs often led to immediate market reactions, causing significant price swings.

- Long-term consequences of trade disputes on US futures: The long-term effects of the trade wars are still being assessed, with potential impacts on global economic growth and supply chains.

- Investor sentiment shifts during periods of trade tension: Investor confidence often declined during periods of heightened trade tensions, impacting market performance and the stock market rally.

The Role of Investor Confidence and Market Psychology

Beyond concrete policy changes, investor confidence and market psychology played a significant role in the stock market rally during the Trump presidency.

Trump's Communication Style and Market Reactions

Trump's communication style – characterized by optimistic pronouncements and frequent use of social media – directly influenced investor sentiment and market reactions.

- Examples of tweets and statements impacting market movement: Specific instances where Trump's statements caused significant market fluctuations should be documented here.

- The role of media coverage in shaping market perception: Media coverage played a crucial role in shaping public and investor perception of Trump's policies and their market implications.

- The impact of uncertainty created by his unpredictable pronouncements: Trump's unpredictable pronouncements sometimes created uncertainty, leading to market volatility.

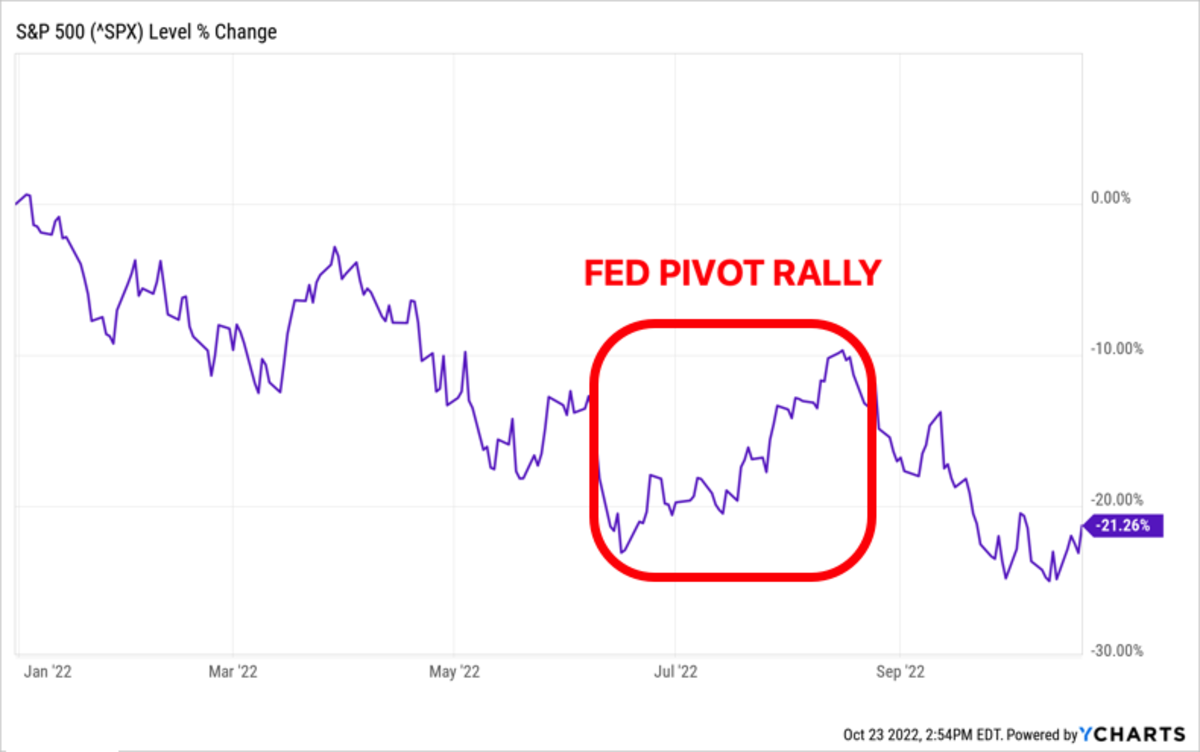

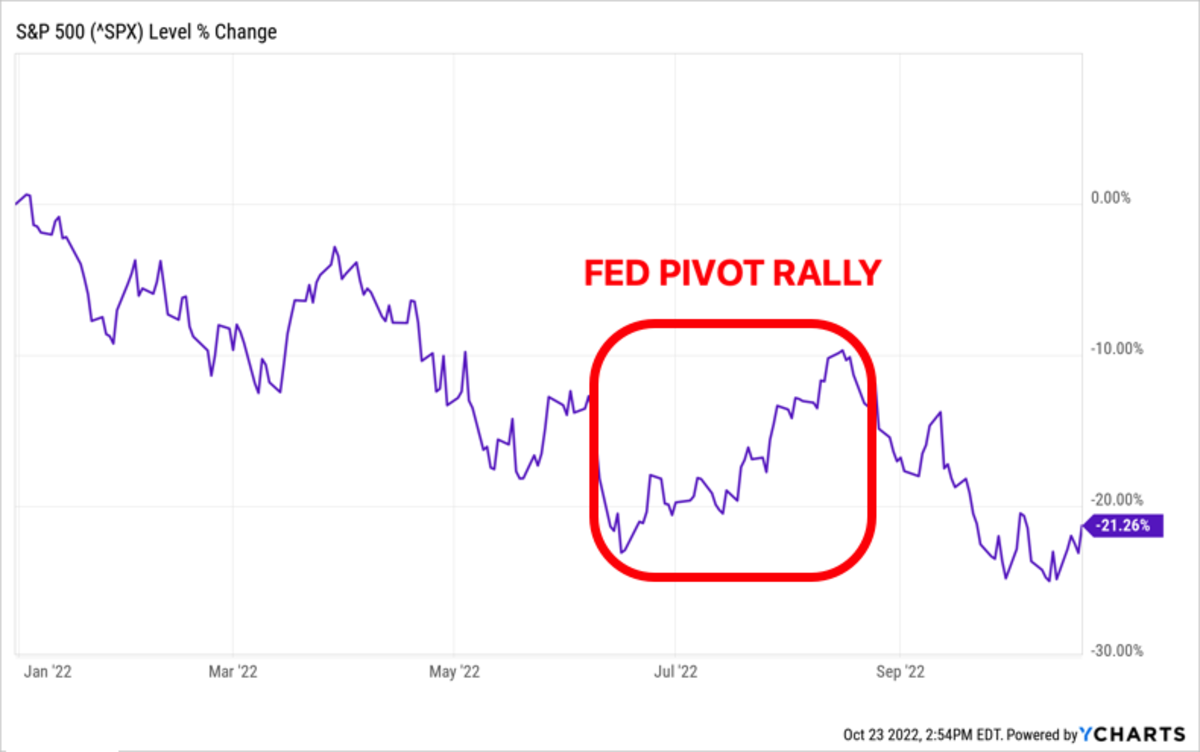

The "Trump Rally" and its Sustainability

The "Trump Rally" refers to the period of significant stock market gains associated with the early part of Trump's presidency. Its sustainability, however, was limited by various factors.

- Defining the timeframe of the rally: Clearly define the period associated with the "Trump Rally."

- Key economic indicators during the rally period: Highlight relevant economic data, such as GDP growth and employment figures.

- Factors contributing to the end of the rally: Identify factors, such as trade wars and rising interest rates, that contributed to the end of the rally.

Analyzing the Long-Term Effects on US Futures Markets

Assessing the lasting impact of Trump's economic policies on US futures markets requires a comprehensive analysis considering both positive and negative consequences.

Assessing the Legacy of Trump's Economic Policies

The long-term effects of Trump's policies continue to unfold, requiring ongoing analysis and observation.

- Long-term effects of tax cuts on the national debt: The substantial tax cuts increased the national debt, raising concerns about long-term economic stability.

- Long-term effects of deregulation on various industries: The long-term consequences of deregulation across different sectors need further investigation and monitoring.

- Long-term impacts of trade wars on global economic stability: Trade disputes had a significant impact on global trade and economic growth, creating long-term uncertainties.

- Overall impact on investor confidence and long-term market trends: The combined effects of these policies on investor confidence and long-term market trends warrant continued observation and research.

Conclusion

The relationship between the stock market rally and Trump's influence on US futures is complex and multifaceted. While his policies initially spurred significant gains driven by tax cuts and deregulation, the volatility introduced by trade wars and his communication style ultimately presented challenges. Understanding these intertwined factors provides valuable insight into market dynamics and helps investors navigate future economic uncertainties. To gain a deeper understanding of the forces shaping US futures markets, further research into economic policy and its influence on investor behavior is recommended. Continue to stay informed about the latest developments impacting the stock market rally and its related factors. Learn to analyze the impact of future presidential administrations on the US futures market and stock market trends to make informed investment decisions.

Featured Posts

-

Trump On Powell No Intention To Remove Fed Chair

Apr 24, 2025

Trump On Powell No Intention To Remove Fed Chair

Apr 24, 2025 -

Addressing Investor Concerns About High Stock Market Valuations Bof As Position

Apr 24, 2025

Addressing Investor Concerns About High Stock Market Valuations Bof As Position

Apr 24, 2025 -

Five Point Plan From Canadian Auto Dealers To Combat Us Trade Threats

Apr 24, 2025

Five Point Plan From Canadian Auto Dealers To Combat Us Trade Threats

Apr 24, 2025 -

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 24, 2025

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 24, 2025 -

Tesla Stock Impact Q1 Earnings Reveal 71 Net Income Decrease Due To Political Issues

Apr 24, 2025

Tesla Stock Impact Q1 Earnings Reveal 71 Net Income Decrease Due To Political Issues

Apr 24, 2025