To Buy Or Not To Buy Palantir Stock Before May 5th: A Data-Driven Analysis

Table of Contents

Palantir's Recent Performance and Financial Health

Analyzing Q4 2023 Earnings and Future Projections

Palantir's Q4 2023 earnings report offered a mixed bag for investors. While the company beat revenue expectations, profit margins were slightly lower than anticipated. Let's delve into the key metrics:

- Revenue Growth: [Insert actual Q4 2023 revenue growth percentage]. While this shows positive growth, it's crucial to compare it to previous quarters and industry averages to assess its significance.

- Profitability: [Insert actual Q4 2023 profit margin]. A decline in profit margin, if present, needs careful consideration alongside explanations from management.

- Future Projections: Analyst predictions for Palantir's 2024 performance vary. Some analysts remain bullish on Palantir's long-term prospects, citing potential growth in the government and commercial sectors. Others are more cautious, pointing to potential challenges in securing new contracts and maintaining revenue growth. Understanding the range of these forecasts is essential. Key aspects to consider are future Palantir earnings and overall stock valuation.

Assessing Palantir's Key Contracts and Government Dependence

Palantir's revenue is significantly reliant on government contracts, particularly in the US. While this provides a stable revenue stream, it also presents risks:

- Government Budgetary Constraints: Changes in government spending can directly impact Palantir's revenue.

- Competition: Palantir faces increasing competition in the government contracting space.

- Commercial Sector Growth: Palantir's success in expanding its commercial client base is crucial for reducing its reliance on government contracts and achieving greater diversification. Analyzing contract wins and losses, and the shift towards commercial clients will give a clearer picture.

Analyzing Palantir's dependence on government contracts is a vital part of any risk assessment before investing in Palantir stock.

Market Sentiment and Investor Expectations

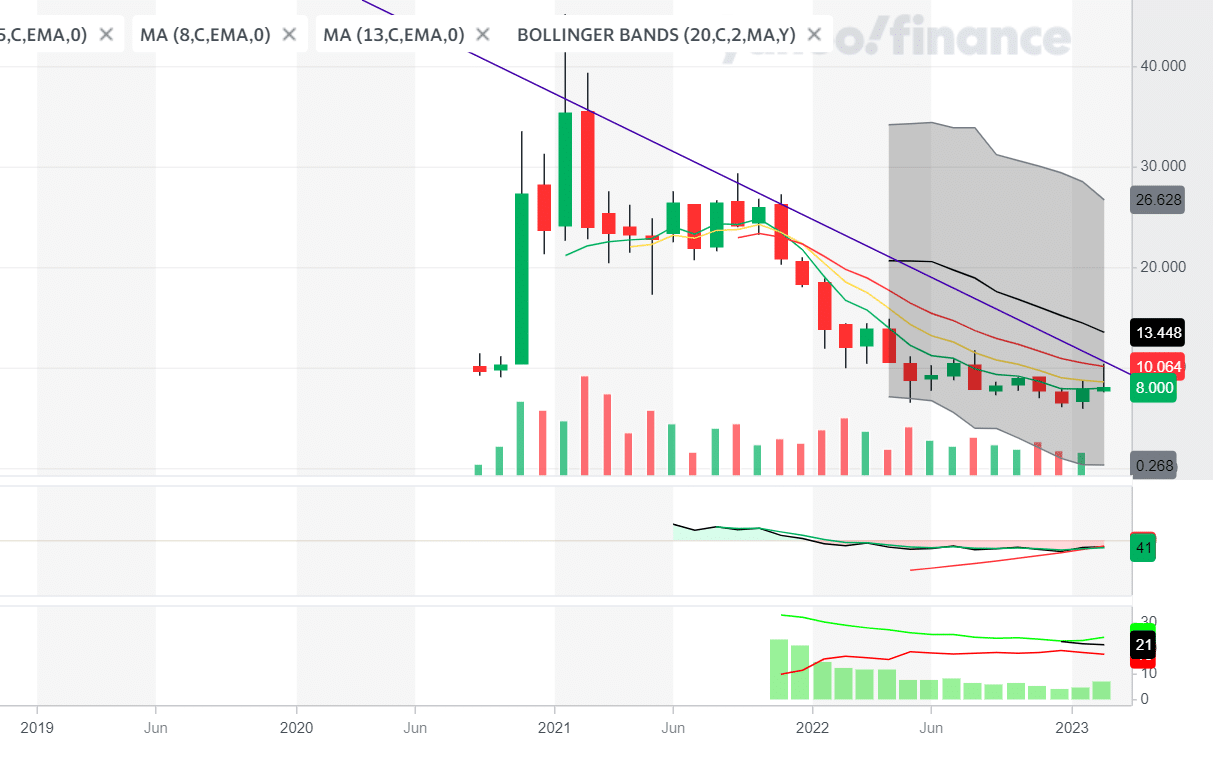

Examining Current Stock Price and Trading Volume

Palantir's stock price has experienced significant volatility recently. [Insert details about recent price trends, including highs and lows]. Analyzing the trading volume is crucial: high trading volume often indicates strong investor interest, while low volume may suggest a lack of conviction. Observing the stock chart analysis alongside other metrics is important.

Evaluating Analyst Ratings and Recommendations

Analyst ratings on Palantir stock are currently mixed. [Insert information on the number of buy, sell, and hold ratings]. It's vital to understand the reasoning behind these differing opinions, considering the factors influencing each recommendation. This will give better insight into the stock outlook.

Potential Catalysts Affecting Palantir Stock Before May 5th

Upcoming Earnings Reports and Company Announcements

The period leading up to May 5th is crucial. Any news regarding new contract wins, significant product launches, or strategic partnerships could significantly impact Palantir's stock price. The earnings announcement and any associated press releases should be carefully examined for insights into the future of Palantir. The market reaction to any of these announcements should be closely monitored.

Broader Market Conditions and Macroeconomic Factors

Macroeconomic factors, such as interest rates and inflation, can significantly influence Palantir's stock performance. A rising interest rate environment, for instance, might negatively impact investor sentiment towards growth stocks. Understanding broader market trends is key to assessing the overall investment climate.

Conclusion

Investing in Palantir stock before May 5th presents both opportunities and risks. While the company shows positive revenue growth in some areas, concerns remain regarding profit margins and reliance on government contracts. The market sentiment is mixed, with analyst opinions varying widely. The period leading up to May 5th is particularly critical, with potential catalysts that could significantly influence Palantir's stock price. Remember that the May 5th date, which likely represents an earnings report or other important announcement, is a key factor in determining the future trajectory of Palantir shares.

Disclaimer: Investing in the stock market involves inherent risks. Past performance is not indicative of future results. This analysis is for informational purposes only and should not be considered financial advice.

Call to Action: While this analysis provides valuable insights, remember that investing in Palantir stock, or any stock, involves risk. Conduct your own thorough due diligence before making any decisions about buying or selling Palantir stock before May 5th. Consider consulting with a qualified financial advisor before making any Palantir investment.

Featured Posts

-

Lilysilk Spring 2024 A Collaboration With Elizabeth Stewart

May 09, 2025

Lilysilk Spring 2024 A Collaboration With Elizabeth Stewart

May 09, 2025 -

Slovenska Dakota Johnson Pozrite Si Jej Fotografiu

May 09, 2025

Slovenska Dakota Johnson Pozrite Si Jej Fotografiu

May 09, 2025 -

Fusion Renaissance Modem Elisabeth Borne Clarifie La Ligne Politique

May 09, 2025

Fusion Renaissance Modem Elisabeth Borne Clarifie La Ligne Politique

May 09, 2025 -

Who Is David Exploring The Top 5 Theories Surrounding He Morgan Brothers High Potential

May 09, 2025

Who Is David Exploring The Top 5 Theories Surrounding He Morgan Brothers High Potential

May 09, 2025 -

Is A 40 Increase In 2025 Enough To Consider Palantir Stock

May 09, 2025

Is A 40 Increase In 2025 Enough To Consider Palantir Stock

May 09, 2025

Latest Posts

-

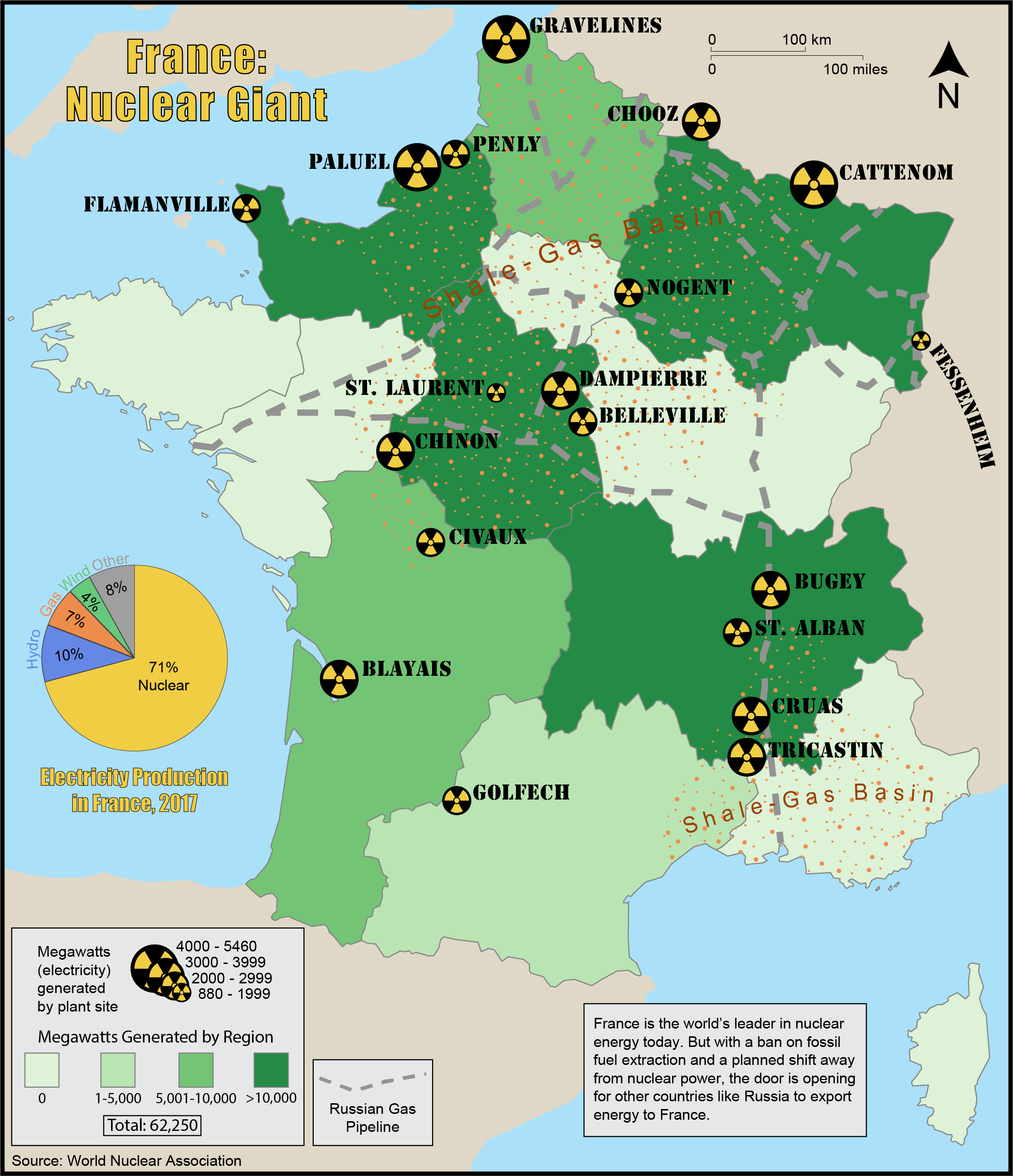

Shared Nuclear Power Frances European Initiative

May 09, 2025

Shared Nuclear Power Frances European Initiative

May 09, 2025 -

Nuclear Energy Collaboration A French Ministers Proposal For Europe

May 09, 2025

Nuclear Energy Collaboration A French Ministers Proposal For Europe

May 09, 2025 -

French Minister Advocates For Shared Nuclear Energy Security In Europe

May 09, 2025

French Minister Advocates For Shared Nuclear Energy Security In Europe

May 09, 2025 -

Europes Nuclear Shield A French Ministers Perspective

May 09, 2025

Europes Nuclear Shield A French Ministers Perspective

May 09, 2025 -

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 09, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 09, 2025