U.S. Fed's Rate Decision: Assessing Inflation And Unemployment Risks

Table of Contents

H2: Inflationary Pressures and the Fed's Response

H3: Current Inflation Rates and Trends

The current economic climate is characterized by persistent inflationary pressures. Recent Consumer Price Index (CPI) and Producer Price Index (PPI) data reveal stubbornly high inflation rates. While the rate of increase may be slowing from its peak, it remains significantly above the Federal Reserve's target of 2%. Several factors contribute to this persistent inflation:

- Supply Chain Disruptions: Ongoing global supply chain bottlenecks continue to constrain the availability of goods, driving up prices.

- Energy Prices: Volatile energy prices, particularly oil and natural gas, exert considerable upward pressure on overall inflation.

- Wage Growth: Strong wage growth, while positive for workers, also contributes to inflationary pressures as businesses pass increased labor costs onto consumers.

- Housing Costs: Soaring housing costs, including rents and home prices, represent a significant component of the CPI, adding further fuel to inflation.

The interaction of these factors creates a complex inflationary environment. For example, higher energy prices increase transportation costs, impacting the prices of various goods, while strong wage growth fuels demand, putting further pressure on already strained supply chains.

H3: The Fed's Tools to Combat Inflation

To combat inflation, the Federal Reserve employs several monetary policy tools:

- Federal Funds Rate Hikes: Increasing the federal funds rate (the target rate banks charge each other for overnight loans) makes borrowing more expensive, slowing down economic activity and reducing demand-pull inflation.

- Quantitative Tightening (QT): This involves reducing the Fed's balance sheet by allowing Treasury bonds and mortgage-backed securities to mature without reinvestment. This reduces the money supply, further curbing inflation.

While these tools aim to curb inflation, they also carry significant risks. Aggressive rate hikes, for instance, could trigger a recession by significantly slowing economic growth and increasing unemployment. The Fed must carefully calibrate its response to achieve a "soft landing"—reducing inflation without causing a sharp economic downturn.

H2: Unemployment and the Labor Market Dynamics

H3: Current Unemployment Rate and Job Growth

The U.S. labor market currently presents a mixed picture. While the unemployment rate remains relatively low, indicating a strong labor market, job growth has shown signs of slowing. The labor force participation rate also remains below pre-pandemic levels, suggesting potential untapped labor supply.

- Unemployment Rate: The current unemployment rate is [insert current data].

- Job Growth: Job growth figures for the past [period] show [insert current data].

- Labor Force Participation Rate: The labor force participation rate currently stands at [insert current data].

The relationship between inflation and unemployment is complex, often described by the Phillips Curve. Historically, low unemployment has been associated with higher inflation, and vice versa. However, the relationship isn't always straightforward, and other factors can influence both inflation and unemployment independently.

H3: The Fed's Balancing Act: Inflation vs. Unemployment

The Fed faces a difficult balancing act. Its primary mandate is to maintain price stability and maximum employment. However, aggressively combating inflation through higher interest rates could lead to job losses and a rise in unemployment, potentially triggering a recession or stagflation (high inflation and high unemployment). Conversely, delaying or easing rate hikes could allow inflation to become entrenched, making it even harder to control in the long run. The potential scenarios and their consequences are numerous, requiring careful consideration of the economic data and potential future impacts. A successful "soft landing" — lowering inflation without triggering a significant recession – is the Fed's ideal outcome, but it is a challenging target to achieve.

H2: Predicting the Next Fed Rate Decision

H3: Analyzing Market Expectations

Market forecasts and expert opinions on the next Fed rate decision vary. Some analysts predict a further rate hike, citing persistent inflation as the primary concern. Others suggest a pause or even a rate cut, emphasizing the risks of triggering a recession. These predictions are often influenced by:

- Economic Indicators: Data on inflation, employment, GDP growth, and consumer confidence.

- Geopolitical Events: Global events, such as the war in Ukraine and other geopolitical risks, can impact economic conditions and influence the Fed's decision.

- Market Sentiment: Overall investor confidence and market volatility can also play a role.

H3: Potential Impacts on Financial Markets

The Fed's rate decision will significantly impact financial markets:

- Stocks: A rate hike could lead to lower stock prices as higher interest rates increase borrowing costs for companies and reduce investor appetite for risk. Conversely, a rate cut could boost stock prices.

- Bonds: Rate hikes generally lead to higher bond yields, while rate cuts lead to lower yields.

- Currency: The U.S. dollar is likely to strengthen following a rate hike and weaken following a rate cut.

The intricate interplay between the Fed's actions, economic indicators, and market expectations creates a dynamic and unpredictable environment. Understanding these factors is crucial for navigating the complexities of the financial markets.

3. Conclusion

The U.S. Fed's Rate Decision is a pivotal event that will significantly shape the U.S. economic landscape in the coming months. The Fed faces a challenging task in balancing the need to combat persistent inflation with the risk of triggering a recession. Understanding the current inflationary pressures, unemployment trends, and the potential impact on financial markets is essential for investors and policymakers alike. To stay informed about the U.S. Fed's rate decisions and their impact, make sure to follow reputable financial news sources and consider subscribing to economic newsletters for in-depth analysis. Staying abreast of future Fed rate decisions and their implications is critical for navigating the current economic climate successfully.

Featured Posts

-

2 Stocks Predicted To Surpass Palantirs Value In 3 Years

May 09, 2025

2 Stocks Predicted To Surpass Palantirs Value In 3 Years

May 09, 2025 -

Bao Hanh Tre Em Tien Giang Phai Co Bien Phap Manh De Bao Ve Tre Nho

May 09, 2025

Bao Hanh Tre Em Tien Giang Phai Co Bien Phap Manh De Bao Ve Tre Nho

May 09, 2025 -

Wynne And Joanna All At Sea Review And Analysis

May 09, 2025

Wynne And Joanna All At Sea Review And Analysis

May 09, 2025 -

Dakota Johnsons Stunning White Dress At Materialists Premiere

May 09, 2025

Dakota Johnsons Stunning White Dress At Materialists Premiere

May 09, 2025 -

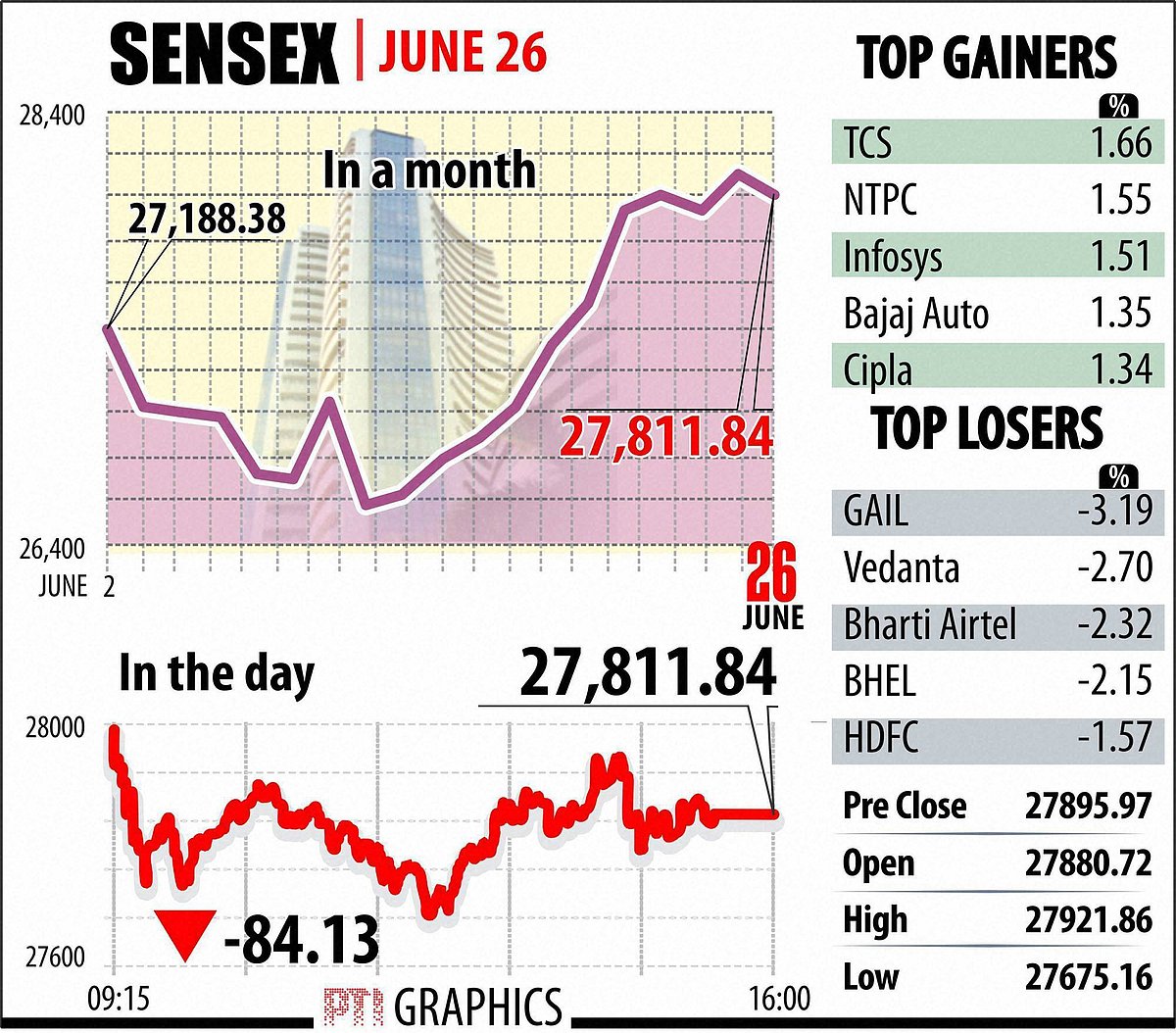

Sensex And Nifty 50 Surge Understanding The 1 400 And 23 800 Point Gains

May 09, 2025

Sensex And Nifty 50 Surge Understanding The 1 400 And 23 800 Point Gains

May 09, 2025

Latest Posts

-

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025 -

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025 -

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025 -

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025