Understanding The Recent Activity In CoreWeave Stock

Table of Contents

CoreWeave's Business Model and Recent Developments

The CoreWeave Value Proposition

CoreWeave is a leading provider of cloud computing infrastructure, specializing in high-performance computing (HPC) solutions built on a foundation of NVIDIA GPUs. Their target market includes companies involved in AI, machine learning, and other computationally intensive tasks. CoreWeave offers a unique value proposition by providing scalable, cost-effective access to powerful GPU clusters, addressing the growing demand for robust data center solutions. This reliance on cutting-edge GPU technology, coupled with a focus on efficiency, is a key driver of their success and a significant factor in the CoreWeave stock valuation. Keywords like "cloud computing," "GPU," "data center," and "high-performance computing" are central to their business model and are reflected in their market position.

Recent Funding and Partnerships

CoreWeave's recent success is partly attributable to significant funding rounds and strategic partnerships. For example, [Insert details about a recent funding round, including the date, amount, and investors involved]. This influx of capital allows CoreWeave to expand its infrastructure, develop new technologies, and further penetrate its target market. Furthermore, strategic alliances with [mention key partners and the nature of the partnership] have broadened their reach and strengthened their position in the competitive cloud computing market. These partnerships provide access to new markets and technologies, further boosting the appeal of CoreWeave stock.

- Specific details about recent funding rounds: [Insert details of specific funding rounds – amount, investors, and the intended use of funds].

- Key aspects of significant partnerships: [Detail the specifics of key partnerships – what each partner brings to the table and the synergistic benefits].

- New product launches or service expansions: [Mention any new offerings and their impact on the business].

Market Analysis and Competitive Landscape

Industry Trends Affecting CoreWeave Stock

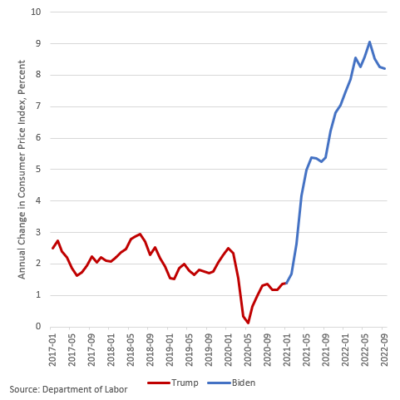

The cloud computing market is experiencing explosive growth, driven by the increasing adoption of AI, machine learning, and big data analytics. This positive industry trend is a major tailwind for CoreWeave. However, economic conditions and technological advancements can also impact CoreWeave stock. For instance, fluctuations in the broader tech sector can affect investor sentiment and market capitalization. Keeping abreast of these macroeconomic factors is essential for understanding the fluctuations in CoreWeave stock. Keywords such as "cloud market," "competitor analysis," "market capitalization," and "stock valuation" are critical for understanding this sector.

Key Competitors and Their Impact

CoreWeave faces competition from major players like AWS, Azure, and Google Cloud. These established giants have significant market share and resources. However, CoreWeave differentiates itself through its specialized focus on high-performance computing and its strong relationships with NVIDIA, giving it a competitive advantage in certain niche markets. [Insert a comparison chart highlighting CoreWeave's strengths and weaknesses against its main competitors]. Understanding the competitive dynamics is key to assessing the long-term prospects of CoreWeave stock. Keywords like "AWS," "Azure," "Google Cloud," "Nvidia," and "competitive advantage" are crucial for understanding the competitive landscape.

- Strengths and weaknesses of CoreWeave compared to competitors: [Specific points of comparison, using quantifiable metrics where possible].

- Analysis of market share and growth potential: [Estimates of market share and projections of future growth].

- Potential threats and opportunities: [Identification of market challenges and potential future growth avenues].

Financial Performance and Stock Valuation

CoreWeave's Financial Health

Analyzing CoreWeave's financial statements reveals key insights into its financial health. [Insert data points from recent financial reports, such as revenue growth, profit margin, and earnings per share (EPS)]. These metrics offer a clear picture of the company's financial performance. Comparing these figures to industry benchmarks provides valuable context for evaluating CoreWeave's success relative to its peers. Keywords like "revenue," "profit margin," "earnings per share (EPS)," and "financial statements" are vital in this analysis.

Stock Price Movements and Volatility

Recent fluctuations in CoreWeave's stock price reflect the dynamic nature of the tech market and investor sentiment. [Discuss recent stock price movements, explaining potential contributing factors, such as news events, market trends, and investor speculation]. Understanding the interplay between fundamental analysis (based on financial health) and technical analysis (based on chart patterns and trading volume) is crucial for interpreting these price movements. Keywords such as "stock price," "volatility," "market sentiment," "technical analysis," and "fundamental analysis" are critical here.

- Key financial indicators and their interpretation: [Detailed explanation of key financial ratios and their implications].

- Comparison of CoreWeave's performance to industry benchmarks: [Comparisons to industry averages and leading competitors].

- Factors contributing to stock price volatility: [Detailed analysis of the factors influencing stock price fluctuations].

Investing in CoreWeave Stock - A Summary and Call to Action

In summary, CoreWeave stock presents a compelling investment opportunity within the rapidly expanding high-performance cloud computing sector. Its innovative business model, strategic partnerships, and strong financial performance create a positive outlook. However, potential investors should carefully consider the competitive landscape and inherent volatility of the tech market before making any investment decisions. The risks associated with investing in CoreWeave shares should be weighed against the potential rewards.

Before investing in CoreWeave stock or any other stock, thorough due diligence is essential. Consult with a financial advisor and research CoreWeave's investor relations page and reputable financial news websites for further information. Understanding the nuances of CoreWeave's business and the broader market trends is critical for making informed decisions regarding CoreWeave shares.

Featured Posts

-

Mampukah Liverpool Juara Liga Inggris 2024 2025 Peran Krusial Sang Pelatih

May 22, 2025

Mampukah Liverpool Juara Liga Inggris 2024 2025 Peran Krusial Sang Pelatih

May 22, 2025 -

National Average Gas Price Jumps By Almost 20 Cents

May 22, 2025

National Average Gas Price Jumps By Almost 20 Cents

May 22, 2025 -

Core Inflation Surge The Bank Of Canadas Policy Challenge

May 22, 2025

Core Inflation Surge The Bank Of Canadas Policy Challenge

May 22, 2025 -

Nouvelle Navette Gratuite En Experimentation La Haye Fouassiere Vers Haute Goulaine

May 22, 2025

Nouvelle Navette Gratuite En Experimentation La Haye Fouassiere Vers Haute Goulaine

May 22, 2025 -

Post Us Attack Security Concerns Rise At Londons Israeli Embassy

May 22, 2025

Post Us Attack Security Concerns Rise At Londons Israeli Embassy

May 22, 2025

Latest Posts

-

Otvet Na Deystviya Rossii Senat S Sh A Rassmatrivaet Rasshirenie Sanktsiy

May 22, 2025

Otvet Na Deystviya Rossii Senat S Sh A Rassmatrivaet Rasshirenie Sanktsiy

May 22, 2025 -

Sarah Milgrim A Life Cut Short Remembering The Jewish American Victim Of The Dc Shooting

May 22, 2025

Sarah Milgrim A Life Cut Short Remembering The Jewish American Victim Of The Dc Shooting

May 22, 2025 -

Who Was Sarah Milgrim Details On The Second Victim Of The Dc Shooting

May 22, 2025

Who Was Sarah Milgrim Details On The Second Victim Of The Dc Shooting

May 22, 2025 -

Post Us Attack Security Concerns Rise At Londons Israeli Embassy

May 22, 2025

Post Us Attack Security Concerns Rise At Londons Israeli Embassy

May 22, 2025 -

Zayavlenie Senata S Sh A Usilenie Sanktsionnogo Davleniya Na Rossiyu

May 22, 2025

Zayavlenie Senata S Sh A Usilenie Sanktsionnogo Davleniya Na Rossiyu

May 22, 2025