Who Will Bear The Cost Of Trump's Economic Policies?

Table of Contents

The Impact on the Working Class

Wage Stagnation and Income Inequality

Trump's economic policies had a demonstrably uneven impact on the working class. While proponents pointed to job growth in certain sectors, a closer look reveals a concerning trend of wage stagnation and widening income inequality.

- Decreased Union Power: The weakening of unions under the Trump administration limited the collective bargaining power of workers, hindering wage increases.

- Impact on Minimum Wage Increases: Limited federal action on raising the minimum wage left many low-wage workers struggling to keep pace with the rising cost of living.

- Effects on Manufacturing Jobs: While some manufacturing jobs were created, many were also lost due to trade policies and automation, disproportionately affecting working-class communities.

The resulting stagnation in real wages for many working-class Americans, coupled with increased costs in other areas, significantly impacted their financial well-being. Analysis of wage growth data during this period clearly demonstrates the disparity between the growth experienced by the top earners and the stagnant wages of many working-class individuals. Understanding the impact of Trump's economic policies on working-class income is crucial for creating more equitable future policies.

Increased Healthcare Costs

Healthcare affordability remains a significant challenge for the working class, a problem exacerbated by changes during the Trump administration.

- Changes to the Affordable Care Act (ACA): Efforts to repeal and replace the ACA, while ultimately unsuccessful, created uncertainty and instability in the healthcare market, potentially leading to higher premiums and reduced coverage.

- Prescription Drug Prices: The administration's approach to prescription drug pricing did little to curb the escalating costs of essential medications, placing a significant burden on working-class families.

- Impact on Rural Healthcare: Cuts to rural healthcare programs further limited access to affordable and quality healthcare in already underserved communities.

The cumulative effect of these factors contributed to increased healthcare costs for working-class Americans, making it increasingly difficult to manage their finances and access necessary medical care. The lack of affordable healthcare significantly affects the well-being and financial stability of this demographic.

The Burden on the Middle Class

Tax Cuts and Their Distributive Effects

While the 2017 tax cuts were touted as benefiting all Americans, the reality is that the greatest benefits accrued to the wealthiest individuals and corporations.

- Analysis of Tax Bracket Changes: The tax cuts disproportionately benefited higher-income earners through lower marginal tax rates and loopholes, offering limited relief to the middle class.

- The Impact of Corporate Tax Cuts on Middle-Class Jobs: The promised job creation stemming from corporate tax cuts failed to materialize significantly, leaving the middle class with limited tangible gains.

- The National Debt Implications: The tax cuts significantly increased the national debt, raising concerns about future economic stability and the potential for increased taxes down the line.

This unequal distribution of tax benefits deepened income inequality and left many middle-class families struggling to maintain their financial stability. Analyzing the distributive effects of these tax cuts reveals a clear disparity in economic benefits.

Rising Costs of Goods and Services

Trump's trade policies and other economic decisions contributed to rising costs of goods and services, further impacting the middle class.

- Tariffs and Their Effect on Consumer Prices: Tariffs imposed on imported goods increased prices for consumers, reducing purchasing power.

- Inflation Rates During the Trump Administration: While inflation remained relatively low compared to historical averages, the increase still contributed to the higher cost of living.

- Impact on Housing Costs: Increased demand and limited supply in certain areas contributed to rising housing costs, impacting middle-class families' ability to afford adequate housing.

The combined effect of these factors significantly eroded the purchasing power of the middle class, making it harder to manage household expenses and maintain their standard of living.

The Benefits (and Costs) for Corporations and the Wealthy

Corporate Tax Cuts and Stock Market Performance

Corporate tax cuts led to increased corporate profits and a surge in stock market performance, primarily benefiting wealthy investors.

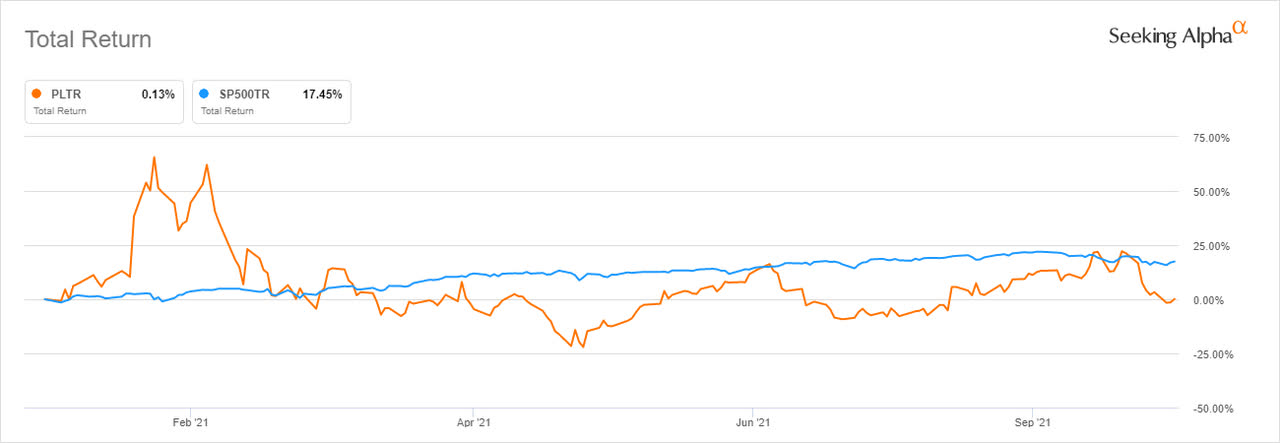

- Stock Market Gains During the Trump Administration: The stock market experienced significant growth during the Trump administration, largely benefiting those with significant investments.

- The Concentration of Wealth Amongst the Top 1%: This growth further concentrated wealth amongst the top 1%, widening the gap between the wealthy and the rest of the population.

- Long-Term Effects of Corporate Tax Cuts: The long-term effects of corporate tax cuts on the economy and income inequality are still being debated.

While corporations saw increased profits, the benefits failed to trickle down to the majority of the population, exacerbating existing income disparities.

Deregulation and its Economic Consequences

Deregulation under the Trump administration aimed to boost corporate profits but also carried potential risks.

- Examples of Specific Deregulation Initiatives: Examples include rollbacks of environmental regulations and worker safety standards.

- Environmental Consequences: Deregulation led to increased pollution and environmental damage, imposing long-term costs on society.

- Worker Safety Concerns: Weakening worker safety regulations increased the risk of workplace accidents and injuries.

While deregulation may have increased short-term profits for some corporations, the long-term costs to the environment and worker safety could outweigh any perceived benefits.

Conclusion

The analysis reveals a clear pattern: Trump's economic policies led to an uneven distribution of costs and benefits. The working and middle classes bore the brunt of increased healthcare costs, stagnant wages, and rising prices, while corporations and the wealthy reaped the rewards of tax cuts and deregulation. The increase in the national debt also poses a long-term financial burden on all Americans. Understanding the true impact of Trump's economic policies requires a thorough examination of these disparate effects.

We need further research and critical analysis of the long-term economic impacts of Trump's policies. It is vital to engage in discussions about equitable economic policies and the need for policies that benefit all segments of society, not just a select few. Let's work towards creating a fairer economic system through informed debate and the development of just and sustainable economic policies that promote prosperity for everyone, not just a privileged few. Let's analyze Trump's economic legacy and strive for better economic policy analysis to create truly fair economic policies for the future.

Featured Posts

-

A Pan Nordic Army Assessing The Contributions Of Sweden And Finland

Apr 22, 2025

A Pan Nordic Army Assessing The Contributions Of Sweden And Finland

Apr 22, 2025 -

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

Apr 22, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

Apr 22, 2025 -

Why Middle Managers Are Crucial For Company And Employee Success

Apr 22, 2025

Why Middle Managers Are Crucial For Company And Employee Success

Apr 22, 2025 -

Trump Administration Targets Harvard 1 Billion Funding Cut Imminent

Apr 22, 2025

Trump Administration Targets Harvard 1 Billion Funding Cut Imminent

Apr 22, 2025 -

Statement On The Passing Of Pope Francis At 88

Apr 22, 2025

Statement On The Passing Of Pope Francis At 88

Apr 22, 2025

Latest Posts

-

Palantir Stock To Buy Or Not To Buy Before May 5th

May 10, 2025

Palantir Stock To Buy Or Not To Buy Before May 5th

May 10, 2025 -

Palantir Stock Investment Should You Buy Before May 5th Analyst Insights

May 10, 2025

Palantir Stock Investment Should You Buy Before May 5th Analyst Insights

May 10, 2025 -

Palantir Stock Before May 5th A Prudent Investment

May 10, 2025

Palantir Stock Before May 5th A Prudent Investment

May 10, 2025 -

Palantir Technology Stock Wall Streets Pre May 5th Prediction

May 10, 2025

Palantir Technology Stock Wall Streets Pre May 5th Prediction

May 10, 2025 -

Should You Invest In Palantir Stock Before May 5th

May 10, 2025

Should You Invest In Palantir Stock Before May 5th

May 10, 2025