Will The Fed Hold Rates? Analyzing Mounting Pressures On Monetary Policy

Table of Contents

Inflationary Pressures: The Primary Driver of Fed Policy

The Federal Reserve's primary mandate is price stability, making inflationary pressures the most significant factor in their decision-making process regarding interest rates. Understanding current inflation levels and expectations is crucial to predicting whether the Fed will hold rates.

Persistent Inflation: A Stubborn Challenge

- Energy Prices: Energy costs remain elevated, contributing significantly to the overall inflation rate.

- Housing Costs: Rent and home prices continue to rise, adding further inflationary pressure.

- Food Prices: Supply chain disruptions and geopolitical instability have impacted food prices, exacerbating inflationary trends.

These persistent inflationary pressures are driven by a complex interplay of factors. Supply chain disruptions, while easing, still impact the availability and cost of goods. Robust wage growth, while positive for workers, also fuels inflationary pressures by increasing businesses' labor costs. The Fed must carefully consider these intertwined elements when deciding whether to hold rates or raise them further to cool the economy.

Inflation Expectations: Anchoring the Future

Consumer and market expectations about future inflation play a crucial role in the Fed's decisions. If consumers and businesses anticipate continued high inflation, they may adjust their spending and pricing accordingly, creating a self-fulfilling prophecy.

- Consumer Surveys: Surveys consistently show elevated consumer inflation expectations.

- Market-Based Inflation Measures: Financial markets reflect expectations of persistent inflation through higher yields on inflation-protected securities.

The Fed aims to "anchor" inflation expectations around its target rate. By communicating its commitment to price stability and acting decisively to curb inflation, the Fed attempts to manage expectations and prevent inflationary spirals. The effectiveness of these communications and actions will heavily influence their decision on whether to hold rates.

Economic Growth and the Risk of Recession

Balancing the fight against inflation with the need to maintain economic growth presents a significant challenge for the Fed. Aggressive interest rate hikes, while potentially curbing inflation, risk triggering a recession.

GDP Growth and its Trajectory: A Delicate Balance

Recent GDP growth figures have shown mixed results, with some quarters experiencing robust growth and others showing signs of slowing.

- Slowing Growth: Several economic indicators suggest a potential slowdown in economic activity.

- Investment Uncertainty: Business investment may be dampened by uncertainty surrounding future interest rate decisions.

The Fed needs to carefully assess the trajectory of GDP growth to determine whether further interest rate hikes are necessary or would exacerbate a potential recession. A significant economic downturn could outweigh the benefits of further rate hikes aimed at curbing inflation.

Labor Market Dynamics: A Two-Sided Coin

A strong labor market, characterized by low unemployment and robust wage growth, presents a double-edged sword for the Fed. While positive for workers, it can also fuel inflation by increasing demand and labor costs.

- Low Unemployment: Unemployment rates remain historically low, indicating a tight labor market.

- Strong Wage Growth: Wage growth continues to outpace inflation in many sectors.

The Fed must weigh the benefits of a strong labor market against the inflationary pressures it generates when deciding whether to hold rates. A decision to raise rates could risk jeopardizing job growth and economic expansion.

Global Economic Factors and Geopolitical Risks

The US economy is deeply interconnected with the global economy, meaning international economic conditions and geopolitical risks significantly influence the Fed's decision-making.

International Economic Conditions: A Global Interdependence

Global economic slowdowns or growth spurts can impact the US economy through various channels, such as trade and capital flows.

- Energy Prices: Global energy markets significantly impact inflation in the US.

- Supply Chain Issues: Global supply chain disruptions can affect US production and prices.

The Fed must consider the global economic landscape when deciding whether to hold rates, as external shocks can influence domestic inflation and growth.

Geopolitical Uncertainty: A Wild Card

Geopolitical events, such as wars or trade disputes, introduce uncertainty into the economic outlook, complicating the Fed's task.

- Geopolitical Instability: The ongoing war in Ukraine and trade tensions continue to introduce uncertainty.

- Investor Sentiment: Geopolitical events can impact investor sentiment and capital flows, affecting economic stability.

The Fed must account for the unpredictable nature of geopolitical events and their potential economic consequences when setting monetary policy.

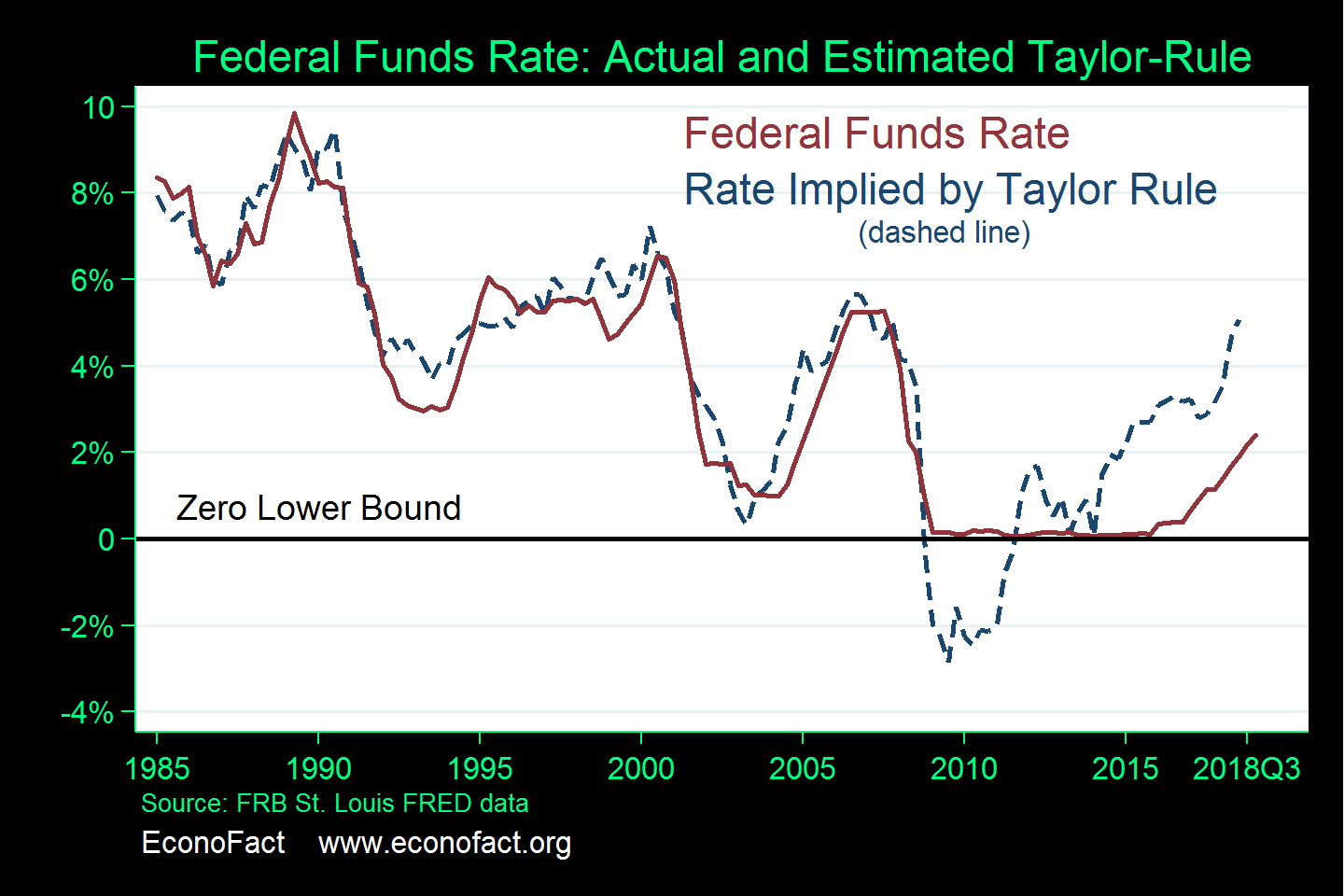

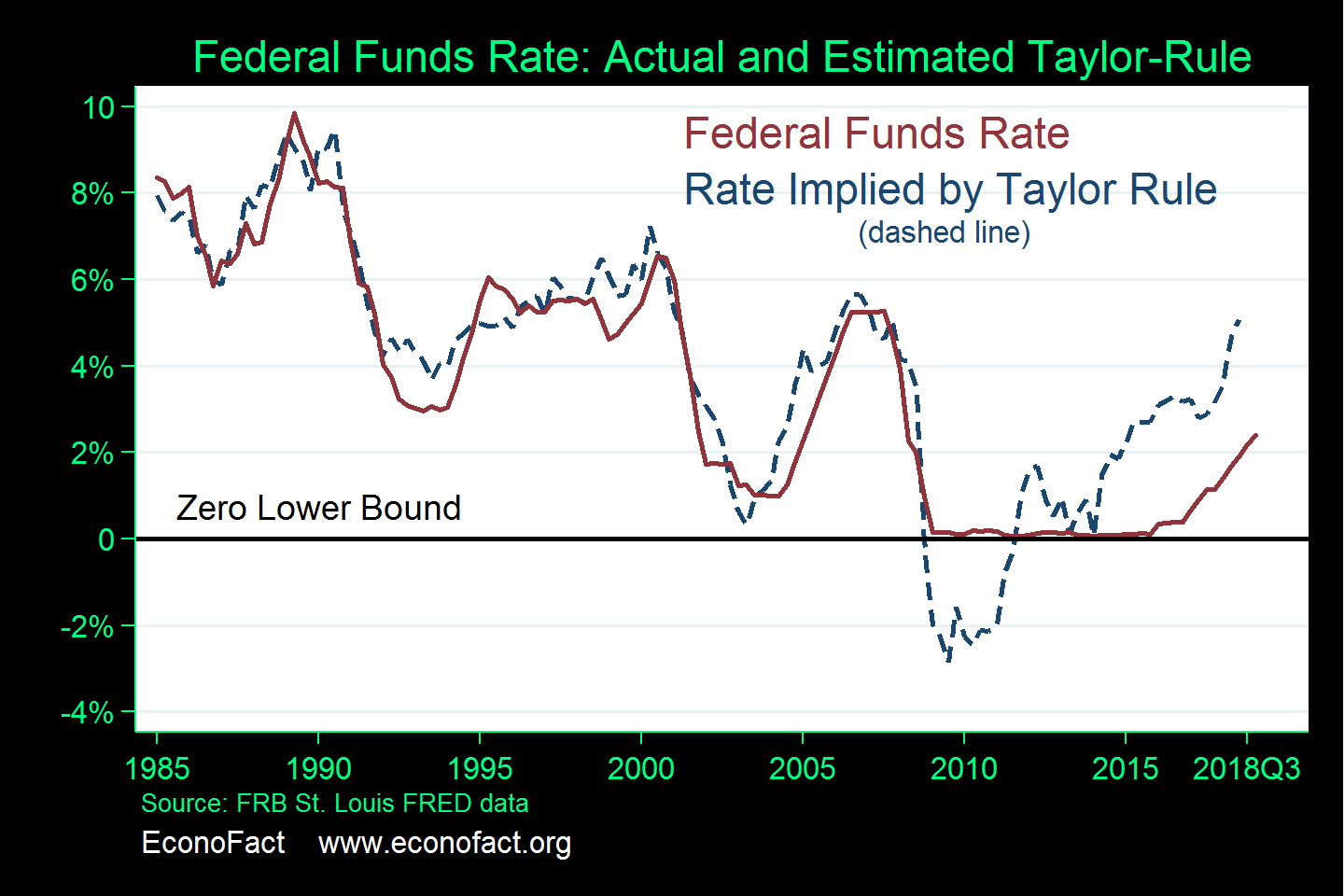

Will the Fed Hold Rates? A Look Ahead

The decision of whether the Fed will hold rates hinges on a careful balancing act between controlling inflation and avoiding a recession. The conflicting pressures of persistent inflation, slowing economic growth, and external factors create a complex scenario. The Fed must consider all these factors and interpret the incoming data carefully before making their next move regarding interest rates.

The potential outcomes range from a continuation of the current interest rate policy to further increases, depending on the evolution of the economic situation. A pause or a hold on rate increases could signal confidence in the ongoing progress in curbing inflation, while a further increase would indicate a more aggressive approach to tackling persistently high prices.

Stay informed about upcoming Fed announcements and continue to monitor economic indicators to understand the ongoing implications of "Will the Fed hold rates?". The economic landscape is dynamic and unpredictable; staying informed is crucial for navigating these uncertain waters. Remember, economic forecasting is inherently complex, and unforeseen events can significantly alter the outlook.

Featured Posts

-

Solve Nyt Strands Game 377 March 15 Complete Hints And Answers

May 09, 2025

Solve Nyt Strands Game 377 March 15 Complete Hints And Answers

May 09, 2025 -

Government Vs Commercial Palantir Stocks Q1 2024 Earnings Breakdown

May 09, 2025

Government Vs Commercial Palantir Stocks Q1 2024 Earnings Breakdown

May 09, 2025 -

Bitcoin Vs Micro Strategy Stock Which To Invest In For 2025

May 09, 2025

Bitcoin Vs Micro Strategy Stock Which To Invest In For 2025

May 09, 2025 -

Matthijs De Ligt Inter Milans Potential Loan Deal With Manchester United

May 09, 2025

Matthijs De Ligt Inter Milans Potential Loan Deal With Manchester United

May 09, 2025 -

Investigacao Prisao De Mulher Que Alega Ser Madeleine Mc Cann No Reino Unido

May 09, 2025

Investigacao Prisao De Mulher Que Alega Ser Madeleine Mc Cann No Reino Unido

May 09, 2025

Latest Posts

-

Putins Limited Ceasefire Analyzing The Victory Day Announcement

May 10, 2025

Putins Limited Ceasefire Analyzing The Victory Day Announcement

May 10, 2025 -

The Putin Victory Day Ceasefire A Closer Look

May 10, 2025

The Putin Victory Day Ceasefire A Closer Look

May 10, 2025 -

Is Putins Victory Day Ceasefire Genuine An Assessment

May 10, 2025

Is Putins Victory Day Ceasefire Genuine An Assessment

May 10, 2025 -

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 10, 2025

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 10, 2025 -

Apple At A Crossroads The Challenge Of Ai Leadership

May 10, 2025

Apple At A Crossroads The Challenge Of Ai Leadership

May 10, 2025