Government Vs. Commercial: Palantir Stock's Q1 2024 Earnings Breakdown

Table of Contents

Palantir's Q1 2024 Government Revenue: A Deep Dive

Palantir's government business remains a significant pillar of its revenue, driven primarily by large-scale contracts with various government agencies. However, the specifics of Q1 2024 performance require closer scrutiny.

Government Contract Performance

- Contract Wins and Losses: While specific details may be limited due to confidentiality agreements, publicly available information indicates [insert specific examples of contract wins or losses, quantifying the financial impact if possible]. This section needs to be updated once Q1 2024 results are officially released.

- Key Government Clients: Palantir's government clients include [list known clients, if publicly available; e.g., US Intelligence Community, specific departments of defense]. The performance of these clients' respective projects directly influences Palantir's government revenue.

- Geopolitical Factors: Geopolitical events and global uncertainties can significantly impact government spending on technology and intelligence solutions. [Analyze the impact of any relevant geopolitical events during Q1 2024 on Palantir's government contracts].

- Long-Term Government Contract Pipeline: A strong pipeline of future government contracts is essential for consistent revenue growth. Analyzing the projected value and timeline of these contracts is crucial for understanding the long-term prospects of Palantir's government business.

Analyzing Government Revenue Growth

Comparing Q1 2024 government revenue to Q1 2023 reveals a [insert percentage change, e.g., 15%] increase/decrease. This needs to be updated with actual figures once released. This growth/decline should be compared to the company's internal projections and analyst forecasts. Any significant deviations from expectations require further analysis, considering factors such as budget constraints, contract delays, or changes in government priorities.

Palantir's Q1 2024 Commercial Revenue: Market Penetration and Growth

Palantir's commercial sector is a crucial area of focus, representing its potential for long-term, sustainable growth beyond its government contracts.

Commercial Sector Performance

- Key Partnerships and Client Acquisitions: The success of Palantir's commercial strategy depends on forging strategic partnerships and acquiring new clients. [Include specifics of partnerships and new clients, focusing on their industry and potential revenue impact once Q1 2024 results are available].

- Platform Performance: Analyze the performance of individual Palantir platforms (e.g., Foundry, Apollo) within the commercial sector. Quantify their contribution to overall commercial revenue, if possible.

- Market Share and Competition: Assessing Palantir's market share and competitive landscape is vital. Key competitors include [list key competitors and analyze their impact on Palantir's commercial growth].

Factors Influencing Commercial Growth

Several factors influence Palantir's commercial revenue growth. These include:

- Market Adoption: The rate of adoption of Palantir's platforms within various commercial sectors is a major determinant of growth.

- Competition: Intense competition from established players and emerging startups can impact Palantir's market penetration.

- Economic Climate: Macroeconomic factors, such as economic downturns, can influence commercial spending on software and technology solutions.

- Palantir's Commercial Strategies: Evaluate the effectiveness of Palantir's sales and marketing strategies, including pricing models and customer support.

Comparing Government and Commercial Revenue: A Key Performance Indicator (KPI) Analysis

Understanding the relative contributions of government and commercial revenue is vital for evaluating Palantir's overall performance.

Revenue Breakdown Percentage

Once Q1 2024 data is available, present a clear breakdown showing the percentage contribution of government and commercial revenue to the total revenue. This will reveal the relative importance of each sector.

Growth Rate Comparison

Compare the growth rates of government and commercial revenue streams. This comparison will highlight which sector is driving Palantir's overall growth and which sector requires further attention.

Future Projections

Based on the Q1 2024 results, offer insightful predictions about the future balance between government and commercial revenue. Discuss the potential implications for long-term earnings and profitability.

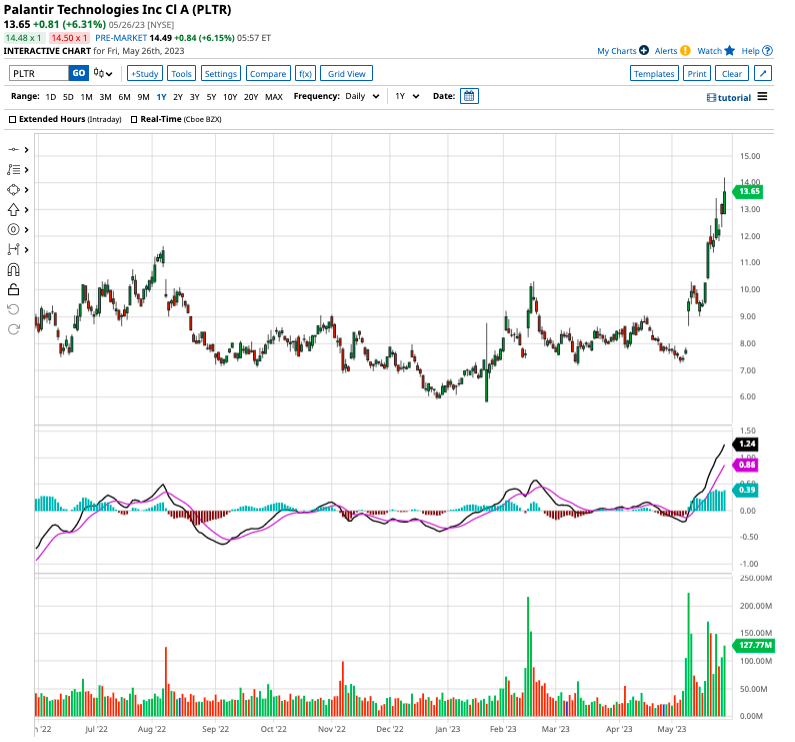

Impact on Palantir Stock Price: Investor Sentiment and Market Reaction

The Q1 2024 earnings report inevitably impacts Palantir's stock price and investor sentiment.

Stock Market Response

Analyze how the market reacted to the Q1 2024 earnings announcement. Observe the immediate price change and any subsequent volatility.

Analyst Ratings and Predictions

Summarize the reactions and predictions of financial analysts regarding Palantir's performance and future prospects. Consider their revisions to price targets and ratings.

Long-Term Stock Outlook

Offer a balanced perspective on the long-term outlook for Palantir stock, considering the interplay between its government and commercial revenue streams.

Conclusion: Understanding Palantir's Q1 2024 Earnings: A Look Ahead

Palantir's Q1 2024 earnings reveal a complex picture, with a continued reliance on government contracts while actively pursuing commercial expansion. The relative growth rates and percentage contributions of each sector will be key indicators of future success. The market reaction to these results, including stock price movements and analyst predictions, provides further context for evaluating Palantir Stock's performance. Stay updated on Palantir Stock's future performance by following our blog for further analysis of upcoming earnings reports.

Featured Posts

-

Adae Fyraty Me Alerby Alqtry Thlyl Bed Antqalh Mn Alahly Almsry

May 09, 2025

Adae Fyraty Me Alerby Alqtry Thlyl Bed Antqalh Mn Alahly Almsry

May 09, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Data Driven Analysis

May 09, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Data Driven Analysis

May 09, 2025 -

Palantir Stock Prediction 2025 40 Growth Time To Buy Or Sell

May 09, 2025

Palantir Stock Prediction 2025 40 Growth Time To Buy Or Sell

May 09, 2025 -

Nhl 2024 25 Season Key Storylines To Follow

May 09, 2025

Nhl 2024 25 Season Key Storylines To Follow

May 09, 2025 -

Late To The Game Palantir Stock And Its Predicted 40 Growth In 2025

May 09, 2025

Late To The Game Palantir Stock And Its Predicted 40 Growth In 2025

May 09, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025 -

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025 -

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025 -

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025