Analyzing The Net Asset Value Of The Amundi DJIA UCITS ETF Distribution

Table of Contents

Factors Influencing the Amundi DJIA UCITS ETF's NAV

The Net Asset Value (NAV) of the Amundi DJIA UCITS ETF, like any ETF, is subject to various factors. Understanding these influences is critical to interpreting NAV movements and making sound investment choices.

-

The Dow Jones Industrial Average (DJIA): The primary driver of the Amundi DJIA UCITS ETF's NAV is the performance of its underlying index, the DJIA. Daily movements in the DJIA directly translate into changes in the ETF's NAV. A rising DJIA generally leads to a higher NAV, while a falling DJIA results in a lower NAV. This direct correlation is a key feature of index-tracking ETFs like this one.

-

Currency Fluctuations: Since the Amundi DJIA UCITS ETF is denominated in a specific currency (likely Euros, given its UCITS structure), fluctuations in exchange rates can impact the NAV for investors holding the ETF in a different currency. For example, a strengthening Euro against the investor's home currency could lead to a perceived increase in the NAV, even if the DJIA itself remains unchanged.

-

Management Fees and Expenses: The ETF's management fees and other operational expenses are deducted from the asset pool, which directly reduces the NAV. These fees are a recurring cost and are crucial to consider when evaluating the ETF's overall performance and long-term return potential.

-

Dividend Distributions: The Amundi DJIA UCITS ETF distributes dividends earned from the underlying DJIA companies to its shareholders. These distributions reduce the ETF's NAV on the ex-dividend date. While this seems like a negative, it represents a return on your investment. Understanding the dividend distribution schedule is essential for proper financial planning and tax preparation.

- Daily DJIA movements directly affect NAV.

- Currency exchange rates can cause NAV fluctuations, especially for international investors.

- Management fees are deducted, leading to a lower NAV over time.

- Dividends are paid out, resulting in a decrease in NAV on the ex-dividend date. However, this is a return of capital to the investor.

Analyzing the NAV Trend and Performance

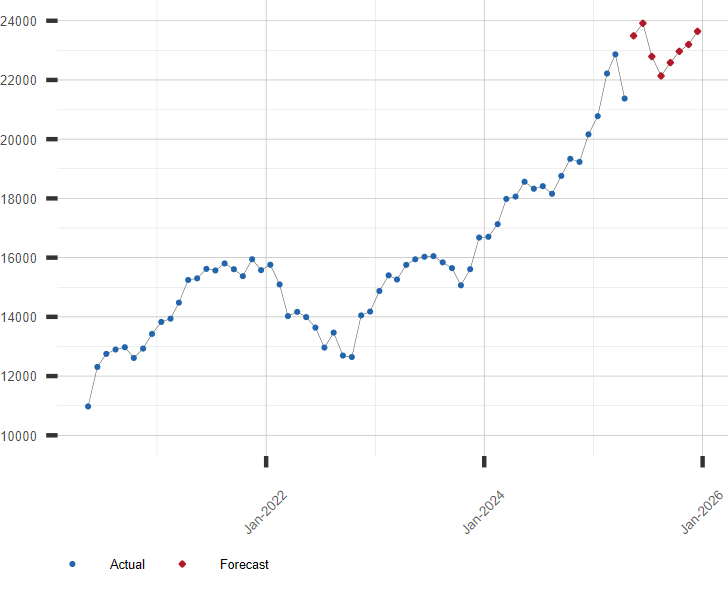

Analyzing the historical NAV data of the Amundi DJIA UCITS ETF is crucial for evaluating its past performance and predicting future trends.

-

Visualizing NAV Trends: Utilizing charting tools and graphs to visualize the NAV's historical performance helps identify trends, volatility, and significant events that impacted the ETF's value. Many online brokerage platforms and financial websites offer this functionality.

-

Benchmarking Against the DJIA: Comparing the ETF's NAV performance against the DJIA benchmark provides insights into the ETF's tracking efficiency. A closely tracking ETF will have a NAV that closely mirrors the DJIA's movements.

-

Tracking Error Analysis: The tracking error represents the difference between the ETF's NAV and the DJIA's performance. A low tracking error indicates efficient index tracking, while a high tracking error suggests the ETF may not accurately reflect the DJIA's performance.

-

Consistent NAV Growth or Decline: Analyzing long-term NAV trends reveals the overall investment performance. Consistent growth indicates positive performance, while consistent decline signals potential problems.

- Utilize charting tools (e.g., those offered by trading platforms) to visualize NAV trends.

- Benchmark performance against the DJIA to assess tracking efficiency.

- Examine the tracking error to evaluate the ETF's ability to mirror the index.

- Long-term NAV trends reveal the overall investment performance over time.

Understanding the Amundi DJIA UCITS ETF Distribution and its Impact on NAV

The Amundi DJIA UCITS ETF distributes dividends periodically, which impacts the NAV. Understanding this process is critical.

-

Nature of Distributions: The distributions represent the dividends earned by the underlying DJIA companies. These are passed on to the ETF shareholders.

-

Frequency and Calculation: The frequency and calculation of distributions are typically outlined in the ETF's prospectus. They are usually calculated based on the dividends received by the ETF from its holdings.

-

Impact on NAV: The NAV decreases by the amount of the distribution on the ex-dividend date, reflecting the payout to investors. This is not a loss; it's a return of capital.

-

Tax Implications: Investors should be aware of the tax implications of receiving dividends. The tax treatment varies depending on the investor's jurisdiction and individual circumstances.

- Many ETFs offer a dividend reinvestment option, allowing shareholders to automatically reinvest their dividends into additional ETF shares.

- The distribution yield is a key metric to assess the income potential of the ETF, indicating the annual dividend payment relative to the NAV.

- The NAV adjusts downwards after a distribution, reflecting the payment made to shareholders.

- Tax implications of distributions vary by jurisdiction and should be considered during investment planning.

Practical Implications for Investors

Understanding the NAV of the Amundi DJIA UCITS ETF empowers investors to make informed decisions.

-

Informed Investment Decisions: Analyzing the NAV trend, along with other factors like the DJIA performance and market conditions, helps investors make better buy/sell decisions.

-

Buy/Sell Decisions: NAV analysis can provide timing signals for entering or exiting positions. However, it shouldn't be the sole factor considered.

-

Risk Assessment and Diversification: Analyzing NAV volatility helps assess the ETF's risk profile and its suitability within a diversified investment portfolio.

-

Comparison with Other ETFs: Comparing the NAV performance of the Amundi DJIA UCITS ETF with similar ETFs allows investors to identify potentially superior investment opportunities.

- Use NAV to inform timing of entries and exits, but consider other market factors as well.

- Assess risk by analyzing the volatility of the NAV over time.

- Compare the NAV performance of the Amundi DJIA UCITS ETF to other similar ETFs.

- Consider the NAV in the context of your broader investment strategy and risk tolerance.

Conclusion: Making Informed Decisions with Amundi DJIA UCITS ETF NAV Analysis

Analyzing the Amundi DJIA UCITS ETF's NAV is essential for making informed investment decisions. Understanding the factors that influence the NAV—the DJIA's performance, currency fluctuations, management fees, and dividend distributions—provides a comprehensive view of the ETF's performance and risk profile. While NAV is a crucial metric, remember to consider it alongside other market analysis and your overall investment strategy. Conduct your own in-depth analysis of the Amundi DJIA UCITS ETF's NAV and related data before investing. Further research into Amundi DJIA UCITS ETF NAV data and other relevant resources will strengthen your investment decisions. Remember to consult a financial advisor for personalized advice.

Featured Posts

-

Record High Followed By Stability Frankfurts Dax Market Opens

May 24, 2025

Record High Followed By Stability Frankfurts Dax Market Opens

May 24, 2025 -

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

A Realistic Escape To The Country Managing Expectations And Challenges

May 24, 2025

A Realistic Escape To The Country Managing Expectations And Challenges

May 24, 2025 -

Meregdraga Porsche 911 Extrak Atalakitasok

May 24, 2025

Meregdraga Porsche 911 Extrak Atalakitasok

May 24, 2025 -

Joy Crookes Releases New Song I Know You D Kill

May 24, 2025

Joy Crookes Releases New Song I Know You D Kill

May 24, 2025

Latest Posts

-

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025 -

One Analyst Predicts Apple Stock At 254 Is It A Buy Around 200

May 24, 2025

One Analyst Predicts Apple Stock At 254 Is It A Buy Around 200

May 24, 2025 -

900 Million Tariff Bite How It Affects Apple Stock

May 24, 2025

900 Million Tariff Bite How It Affects Apple Stock

May 24, 2025