Analyzing The Potential Successor To Warren Buffett: A Canadian Billionaire's Case

Table of Contents

The Buffett Model: Key Characteristics for Success

To understand whether [Insert Canadian Billionaire's Name Here] could truly succeed Warren Buffett, we must first define the “Buffett Model.” This involves more than just impressive returns; it's a holistic approach encompassing investment philosophy, business acumen, and public image.

Investment Philosophy: The Value Investing Approach

Buffett's success is fundamentally rooted in his value investing approach. This entails:

- Long-term perspective: Holding investments for years, even decades, rather than chasing short-term gains.

- Intrinsic value: Focusing on a company's underlying worth, not its market price.

- Understanding businesses: Thoroughly researching and understanding the companies they invest in.

- Patience: Waiting for the right opportunities and resisting impulsive decisions.

- Risk aversion: Minimizing risk through thorough due diligence and diversification.

[Insert Canadian Billionaire's Name Here]'s investment strategy [Explain how their approach aligns with or differs from Buffett's. Provide concrete examples of their investments, highlighting their long-term approach or focus on intrinsic value. For instance: "Unlike Buffett's focus solely on publicly traded companies, [Canadian Billionaire's Name Here] has shown a willingness to invest in private ventures, demonstrating a different facet of long-term value creation."].

Business Acumen and Leadership: The Art of Delegation and Vision

Buffett's leadership style is characterized by:

- Delegation: Trusting capable managers to run his portfolio companies.

- Long-term vision: Focusing on building lasting value, not short-term profits.

- Ethical conduct: Maintaining the highest ethical standards in all business dealings.

- Strong management teams: Surrounding himself with talented individuals.

[Compare and contrast this with [Insert Canadian Billionaire's Name Here]'s leadership. Provide specific examples of their management style, their track record of building strong teams, and any evidence of ethical lapses or failures. For example: "While Buffett is known for his hands-off approach, [Canadian Billionaire's Name Here] actively participates in the day-to-day operations of their companies, suggesting a more hands-on management style."]

Reputation and Public Image: Building Trust and Transparency

Buffett's public image is a crucial element of his success:

- Transparency: Openly communicating with investors and the public.

- Philanthropy: Generous charitable giving, enhancing his reputation.

- Media presence: Effectively using media to communicate his message.

- Trust: Building a strong reputation for integrity and reliability.

Analyze [Insert Canadian Billionaire's Name Here]'s public image. How transparent are they? What is the extent of their philanthropic activities? How do they compare to Buffett in terms of media presence and public trust?

The Canadian Billionaire's Track Record: A Comparative Analysis

Let's examine [Insert Canadian Billionaire's Name Here]'s investment history and business ventures.

Investment Performance: Quantifiable Success

[Provide specific data regarding the Canadian Billionaire's investment performance. Include details on ROI, portfolio growth over specific timeframes, and any significant investments that contributed to their success. Compare this data directly to similar periods in Buffett's career. For example: "Over the past 10 years, [Canadian Billionaire's Name Here]'s portfolio has shown an average annual growth of X%, compared to Buffett's Y% during a comparable period."]

Business Ventures and Acquisitions: Strategic Decision-Making

[Analyze the Canadian billionaire's entrepreneurial endeavors and acquisitions, highlighting successful and unsuccessful ventures. Detail the strategic rationale behind these decisions and compare them to Buffett's investment philosophy. For instance: "Their acquisition of [Company Name] in 20XX demonstrates a strategic focus on [Industry], mirroring Buffett's investment in [Similar Industry Company]."]

Philanthropic Activities: Giving Back to Society

[Discuss the Canadian billionaire's charitable contributions and social impact. Quantify their giving wherever possible, and analyze the types of organizations they support. Compare this to Buffett's philanthropic efforts, emphasizing the importance of philanthropy in building a lasting legacy.]

Challenges and Opportunities for the Canadian Billionaire

Success in the investment world is never guaranteed. [Insert Canadian Billionaire's Name Here] faces several challenges.

Global Economic Landscape: Navigating Uncertain Times

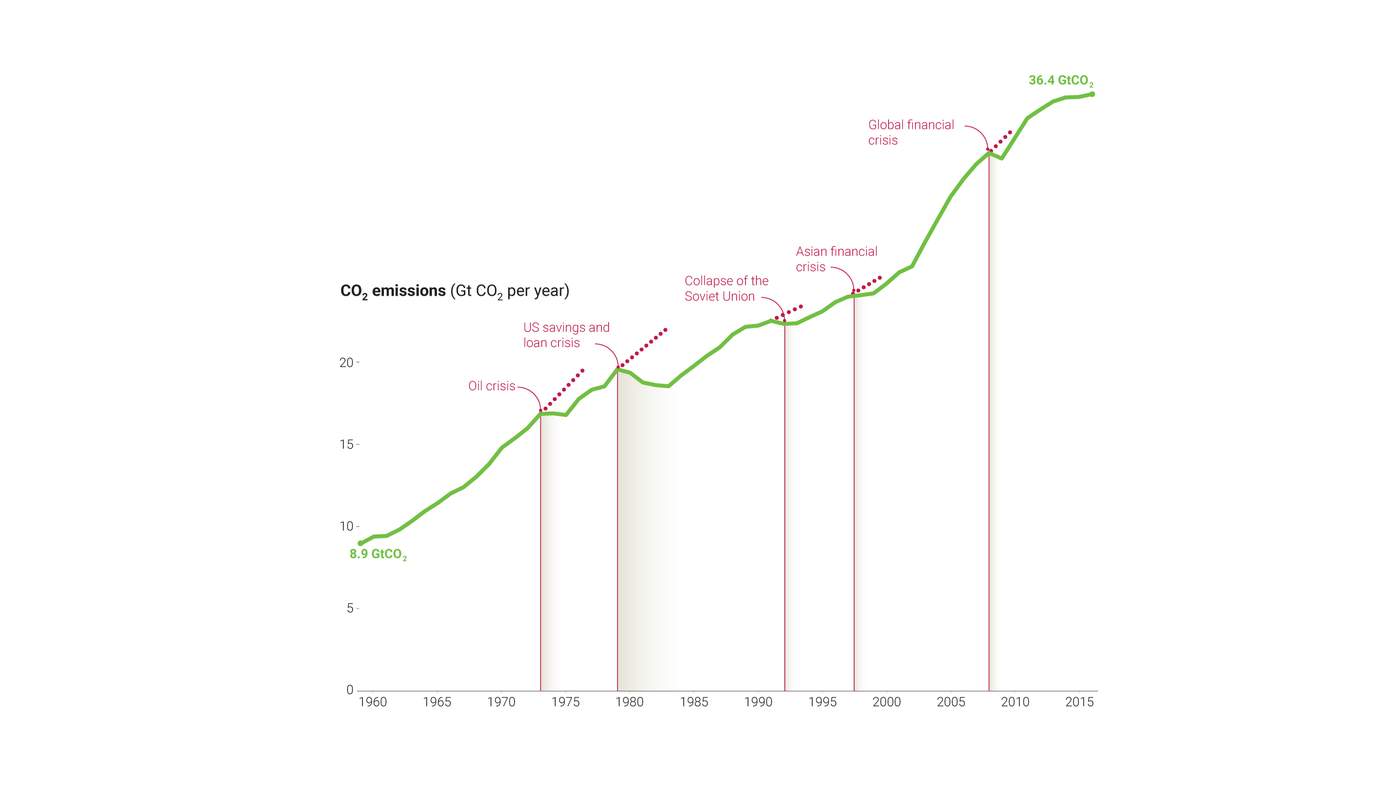

The global economic landscape is constantly evolving, presenting both opportunities and risks:

- Inflation: Rising prices impacting investment returns.

- Interest rates: Fluctuations affecting borrowing costs and investment strategies.

- Geopolitical risks: International conflicts and political instability.

- Market volatility: Unpredictable market swings posing challenges for long-term investors.

How might these factors impact [Insert Canadian Billionaire's Name Here]'s future performance? How does this environment compare to the one Buffett navigated during his career?

Succession Planning: Building a Lasting Legacy

Succession planning is crucial for maintaining long-term success:

- Identifying and training successors: Developing the next generation of leaders.

- Maintaining corporate culture: Preserving the values and principles that define the company.

- Ensuring long-term stability: Putting in place mechanisms to ensure smooth transitions.

How might [Insert Canadian Billionaire's Name Here] address these challenges? How does their approach compare to Buffett's meticulous succession planning at Berkshire Hathaway?

Maintaining Berkshire Hathaway's Standards: A Cultural Fit?

If [Insert Canadian Billionaire's Name Here] were to take over a company like Berkshire Hathaway, how would their style and approach align with its existing culture and values? This is a crucial consideration for ensuring a smooth and successful transition.

Conclusion: Analyzing the Potential Successor to Warren Buffett: A Canadian Billionaire's Case

This analysis has explored the potential of [Insert Canadian Billionaire's Name Here] to succeed Warren Buffett, examining their investment track record, leadership style, and alignment with the “Buffett Model.” While [summarize their strengths, highlighting areas where they excel and areas where they may need improvement], their ultimate success depends on their ability to adapt to evolving economic conditions and maintain the high standards set by their predecessor. Ultimately, whether [Insert Canadian Billionaire's Name Here] can truly become the "next Warren Buffett" remains to be seen, but their career trajectory certainly warrants further observation.

What are your thoughts? Do you believe [Insert Canadian Billionaire's Name Here] possesses the qualities to become a worthy successor to Warren Buffett? Share your opinion on this compelling case of Analyzing the Potential Successor to Warren Buffett on social media using #NextWarrenBuffett or join the discussion in the comments below!

Featured Posts

-

Managing Risk In The Era Of The Great Decoupling

May 09, 2025

Managing Risk In The Era Of The Great Decoupling

May 09, 2025 -

King Pro Maska Ta Trampa Zrada Na Korist Putina

May 09, 2025

King Pro Maska Ta Trampa Zrada Na Korist Putina

May 09, 2025 -

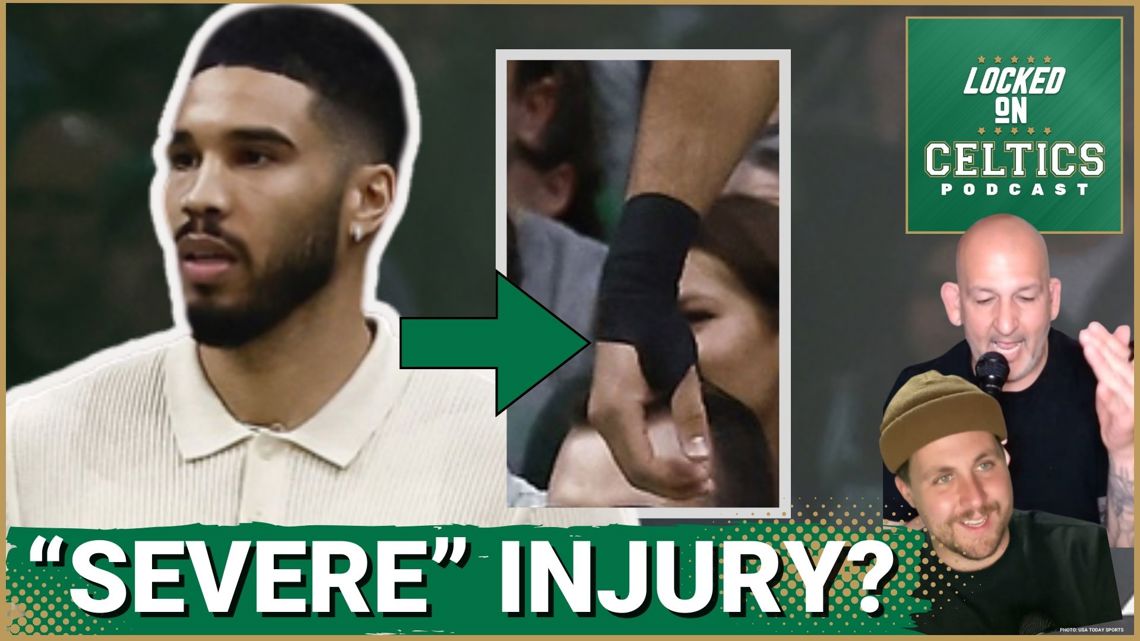

Jayson Tatums Bone Bruise Game 2 Status Update

May 09, 2025

Jayson Tatums Bone Bruise Game 2 Status Update

May 09, 2025 -

Indian Insurers Advocate For Streamlined Bond Forward Regulations

May 09, 2025

Indian Insurers Advocate For Streamlined Bond Forward Regulations

May 09, 2025 -

Blue Origins Launch Scrubbed Details On Vehicle Subsystem Issue

May 09, 2025

Blue Origins Launch Scrubbed Details On Vehicle Subsystem Issue

May 09, 2025

Latest Posts

-

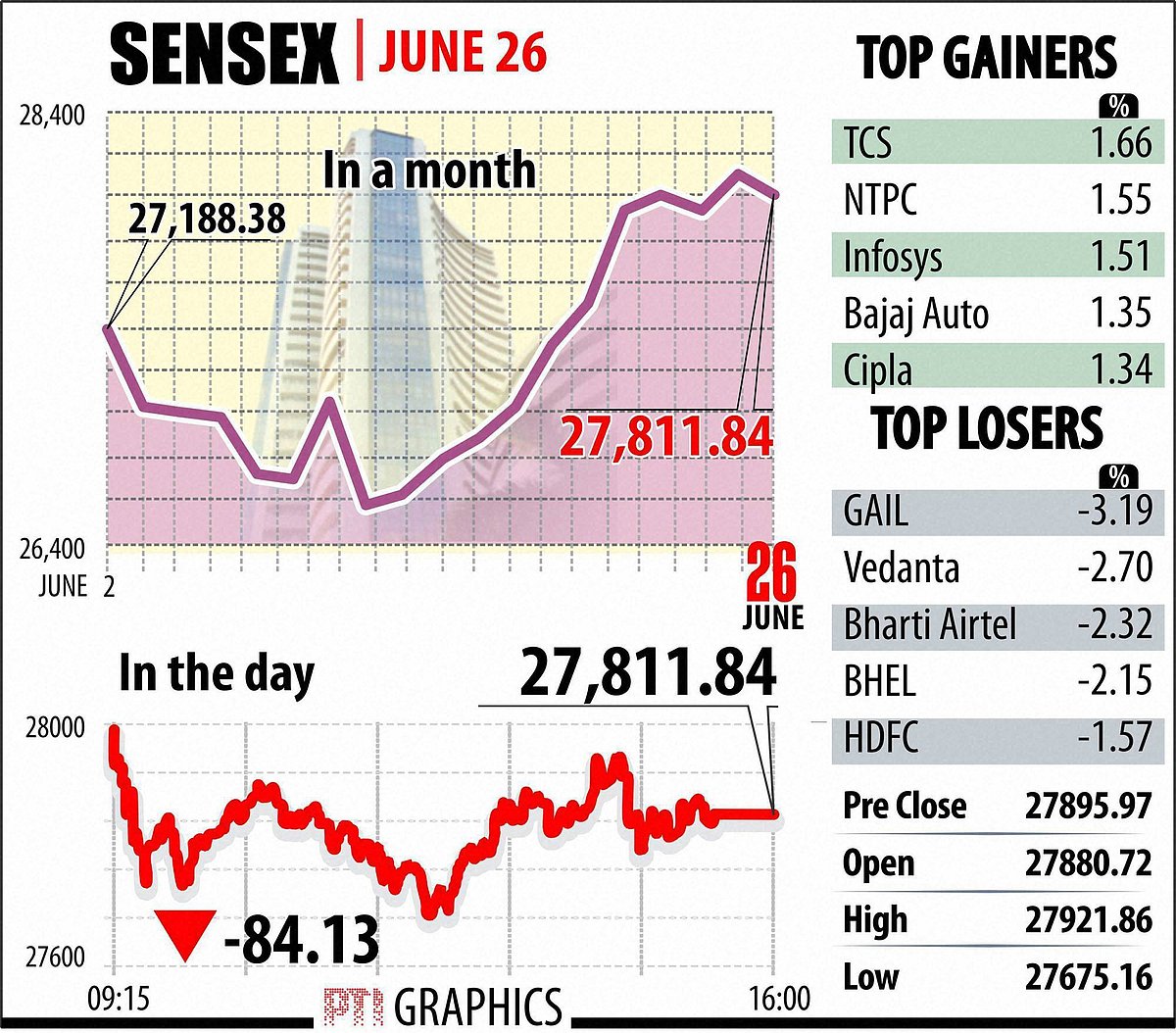

5 Reasons For Todays Significant Increase In Sensex And Nifty 50

May 09, 2025

5 Reasons For Todays Significant Increase In Sensex And Nifty 50

May 09, 2025 -

1078 2025

May 09, 2025

1078 2025

May 09, 2025 -

Sensex And Nifty 50 Surge Understanding The 1 400 And 23 800 Point Gains

May 09, 2025

Sensex And Nifty 50 Surge Understanding The 1 400 And 23 800 Point Gains

May 09, 2025 -

Indian Stock Market Rally 5 Key Factors Behind Sensex And Niftys Sharp Rise

May 09, 2025

Indian Stock Market Rally 5 Key Factors Behind Sensex And Niftys Sharp Rise

May 09, 2025 -

1509 4 5

May 09, 2025

1509 4 5

May 09, 2025