Navigate The Private Credit Boom: 5 Key Do's And Don'ts

Table of Contents

Do Your Due Diligence: Thoroughly research and vet potential private credit investments. Ignoring this crucial step can lead to significant losses. Due diligence in the private credit market requires a meticulous approach, examining both the fund manager and the underlying borrowers.

-

Understand the Fund Manager's Track Record: A successful private credit investment hinges heavily on the expertise and experience of the fund manager. Before committing your capital, rigorously analyze their historical performance, investment strategy, and team expertise.

- Review past fund performance data, including returns and risk metrics. Look beyond simple return figures. Analyze Sharpe ratios, Sortino ratios, and maximum drawdown to assess risk-adjusted returns.

- Assess the team's experience in private credit and relevant industries. A deep understanding of the target market and proven success in navigating economic cycles is critical. Look for a team with a long-standing track record and relevant industry expertise.

- Examine the fund's investment process and risk management framework. A well-defined investment process, including deal sourcing, underwriting, and monitoring, significantly reduces risk. A robust risk management framework, incorporating stress testing and scenario analysis, is equally important.

- Look for transparency and a clear investment strategy. A transparent fund manager will provide clear and concise information about their investment strategy, fees, and risk management policies. Avoid funds that lack transparency.

-

Analyze the Borrower's Financial Health: The financial health of the borrower is paramount. Scrutinize their financial statements, credit history, and industry position to assess their ability to repay the debt.

- Verify the accuracy and reliability of financial information. Independent verification of financial statements by reputable firms is essential.

- Assess the borrower's ability to repay the debt based on their cash flow and assets. Conduct thorough cash flow analysis, stress tests, and sensitivity analysis to gauge their repayment capacity under various economic scenarios.

- Investigate the borrower's industry outlook and competitive landscape. Understanding the borrower's industry dynamics, competitive pressures, and regulatory environment is vital to assess long-term viability.

- Consider potential downside scenarios and sensitivity analysis. Develop realistic worst-case scenarios to assess the potential impact on your investment.

Diversify Your Private Credit Portfolio: Don't put all your eggs in one basket. Diversification across various funds, strategies, and borrowers is crucial to mitigate risk in the private debt market.

- Diversification by Strategy: Invest across various private credit strategies, such as direct lending, mezzanine financing, and distressed debt. Each strategy carries a different risk-reward profile.

- Diversification by Borrower: Avoid concentrating investments in a single sector or borrower. Spread your investments across diverse industries and borrower profiles to reduce the impact of a single default.

- Diversification by Geography: Consider geographic diversification to reduce risk associated with regional economic downturns.

Understand the Risks Involved: Private credit investments carry inherent risks that require careful consideration. These risks include illiquidity, default risk, and valuation challenges.

- Illiquidity Risk: Private credit investments are not easily tradable, limiting your ability to quickly liquidate your position.

- Default Risk: Borrowers may default on their debt obligations, resulting in potential losses.

- Valuation Challenges: Valuing private credit investments can be difficult and subjective, leading to inaccurate assessments of portfolio performance.

Don't Neglect Liquidity Management: Ensure you have sufficient liquidity to meet unexpected expenses and potential investment opportunities within your alternative lending portfolio.

- Cash Reserves: Maintain adequate cash reserves to cover potential shortfalls and unexpected expenses. The illiquid nature of private credit necessitates a higher level of cash reserves.

- Alternative Investment Vehicles: Balance private credit investments with liquid assets to maintain flexibility and manage risk.

Don't Overlook Professional Advice: Seek guidance from experienced financial advisors specialized in private credit investments.

- Financial Advisors: Consult with a financial advisor specializing in alternative investments, including private debt and direct lending strategies.

- Legal Counsel: Secure legal advice when structuring private credit investments to ensure compliance and protect your interests.

Conclusion:

The private credit boom presents significant opportunities but also considerable risks. By following these do's and don'ts – conducting thorough due diligence, diversifying your portfolio, understanding the risks inherent in the private credit market, managing liquidity effectively, and seeking professional advice – you can significantly increase your chances of success in this dynamic market. Remember, navigating the complexities of the private credit market requires careful planning and a strategic approach. Don't hesitate to seek expert guidance before making any private credit investments. Start navigating the private credit boom responsibly today!

Featured Posts

-

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 22, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 22, 2025 -

Ftcs Appeal Could Block Microsofts Activision Blizzard Acquisition

Apr 22, 2025

Ftcs Appeal Could Block Microsofts Activision Blizzard Acquisition

Apr 22, 2025 -

Netflix Bucks Big Tech Trend Tariff Implications And Stock Performance

Apr 22, 2025

Netflix Bucks Big Tech Trend Tariff Implications And Stock Performance

Apr 22, 2025 -

A Compassionate Shepherd Pope Francis Life And Legacy Conclude

Apr 22, 2025

A Compassionate Shepherd Pope Francis Life And Legacy Conclude

Apr 22, 2025 -

Pope Franciss Legacy The Conclaves Crucial Test

Apr 22, 2025

Pope Franciss Legacy The Conclaves Crucial Test

Apr 22, 2025

Latest Posts

-

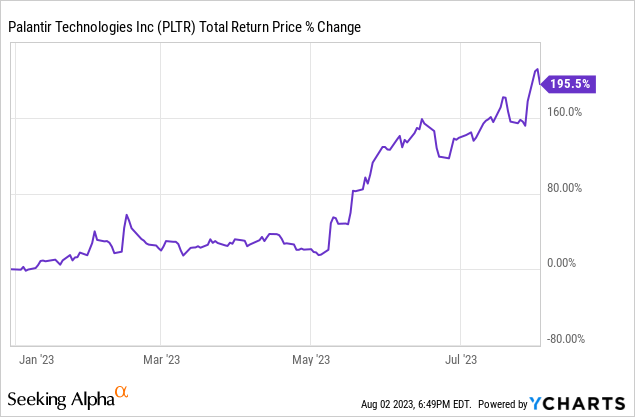

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025 -

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025 -

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025 -

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025 -

Palantir Stock Forecast 2025 Analyzing The Potential For A 40 Jump

May 10, 2025

Palantir Stock Forecast 2025 Analyzing The Potential For A 40 Jump

May 10, 2025