BigBear.ai Sued: A Deep Dive Into The Securities Law Allegations

Table of Contents

The Securities Fraud Allegations Against BigBear.ai

The lawsuit against BigBear.ai centers on serious allegations of securities fraud, claiming the company misled investors about its financial performance and prospects. The plaintiffs, who are likely a group of investors and shareholders (specific details would need to be sourced from court documents), contend that BigBear.ai engaged in deceptive practices that artificially inflated its stock price. Key allegations include:

- Misrepresentation of financial performance: The lawsuit claims BigBear.ai misrepresented its revenue and profitability, painting a rosier picture than the reality. This could involve manipulating financial statements or selectively highlighting positive results while downplaying negative aspects.

- Inflated revenue projections: Plaintiffs allege that BigBear.ai made unrealistic and unsubstantiated claims about future revenue growth, leading investors to believe the company was on a trajectory of significant financial success that it did not realistically possess.

- Omission of material information: The lawsuit likely points to instances where BigBear.ai failed to disclose crucial information that would have significantly impacted investors' decisions, thereby violating its disclosure obligations under securities law. This omission of material information is a critical element in many securities fraud cases.

- Violation of Section 10(b) of the Securities Exchange Act of 1934: This is a common charge in securities fraud lawsuits, alleging the intentional use of manipulative or deceptive devices in connection with the purchase or sale of securities. This section is the cornerstone of many securities fraud claims.

Further details about specific quotes from the lawsuit and related regulatory investigations would require accessing and analyzing the official court filings.

BigBear.ai's Response to the Lawsuit

BigBear.ai has yet to officially issue a detailed public response. (This section needs to be updated with information from official statements when available). However, depending on their response, we might expect to see one of several strategies: outright denial of the allegations, an admission of some mistakes with a claim of unintentional errors, or a more nuanced strategy that addresses specific aspects of the complaint while defending against the overall claims of fraud. Their defense strategy will likely significantly impact the trajectory of the case and influence investor confidence. Any public statements by company executives will also be closely scrutinized.

Potential Impact on BigBear.ai and its Stock Price

The "BigBear.ai Sued" situation carries substantial implications for the company and its investors. The lawsuit's outcome could result in:

- Significant financial penalties: If found guilty, BigBear.ai could face substantial fines and settlements.

- Reputational damage: The lawsuit itself damages the company's credibility and trust among investors.

- Impact on future contracts and partnerships: Potential clients and partners might hesitate to engage with a company facing such serious allegations.

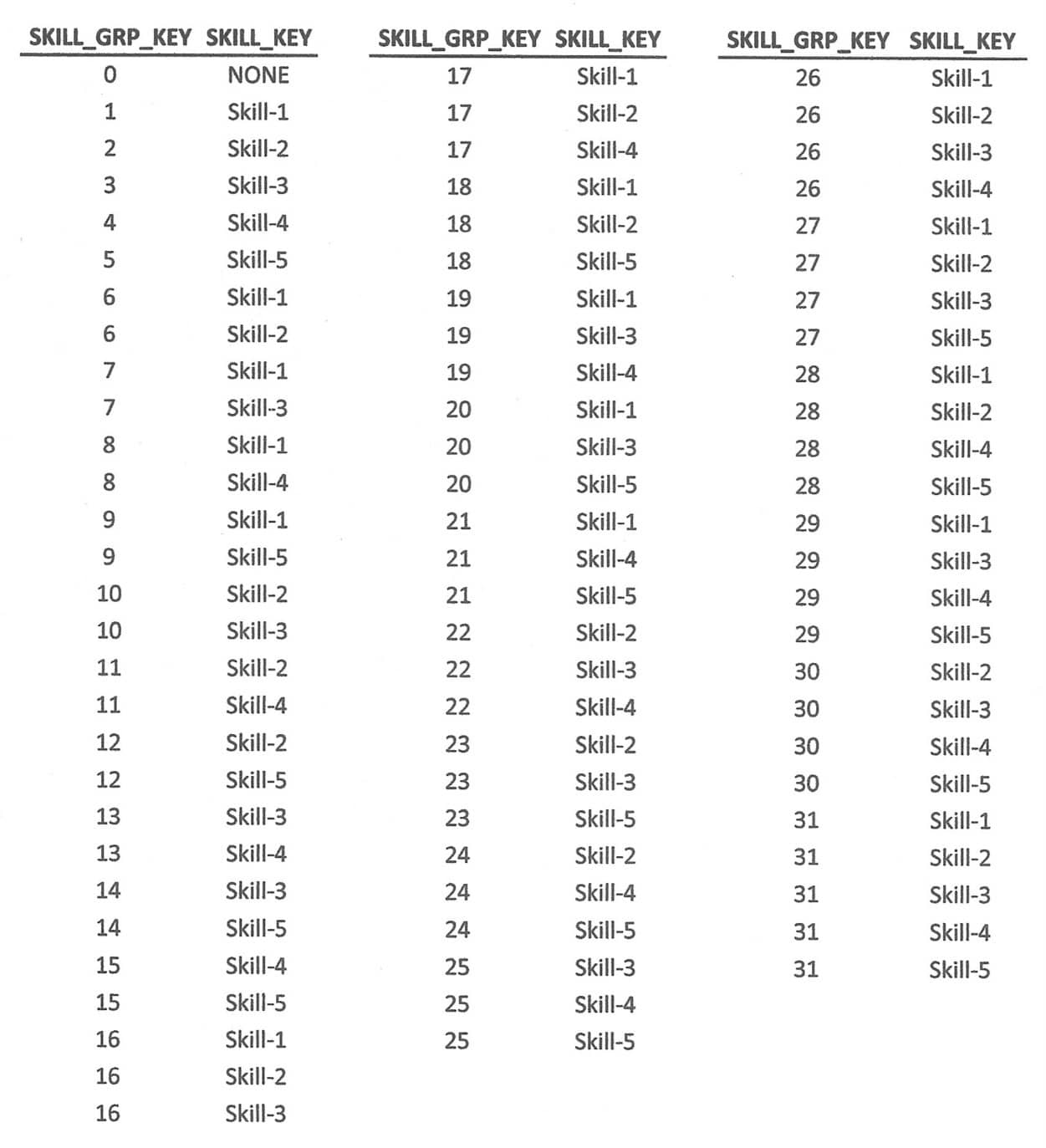

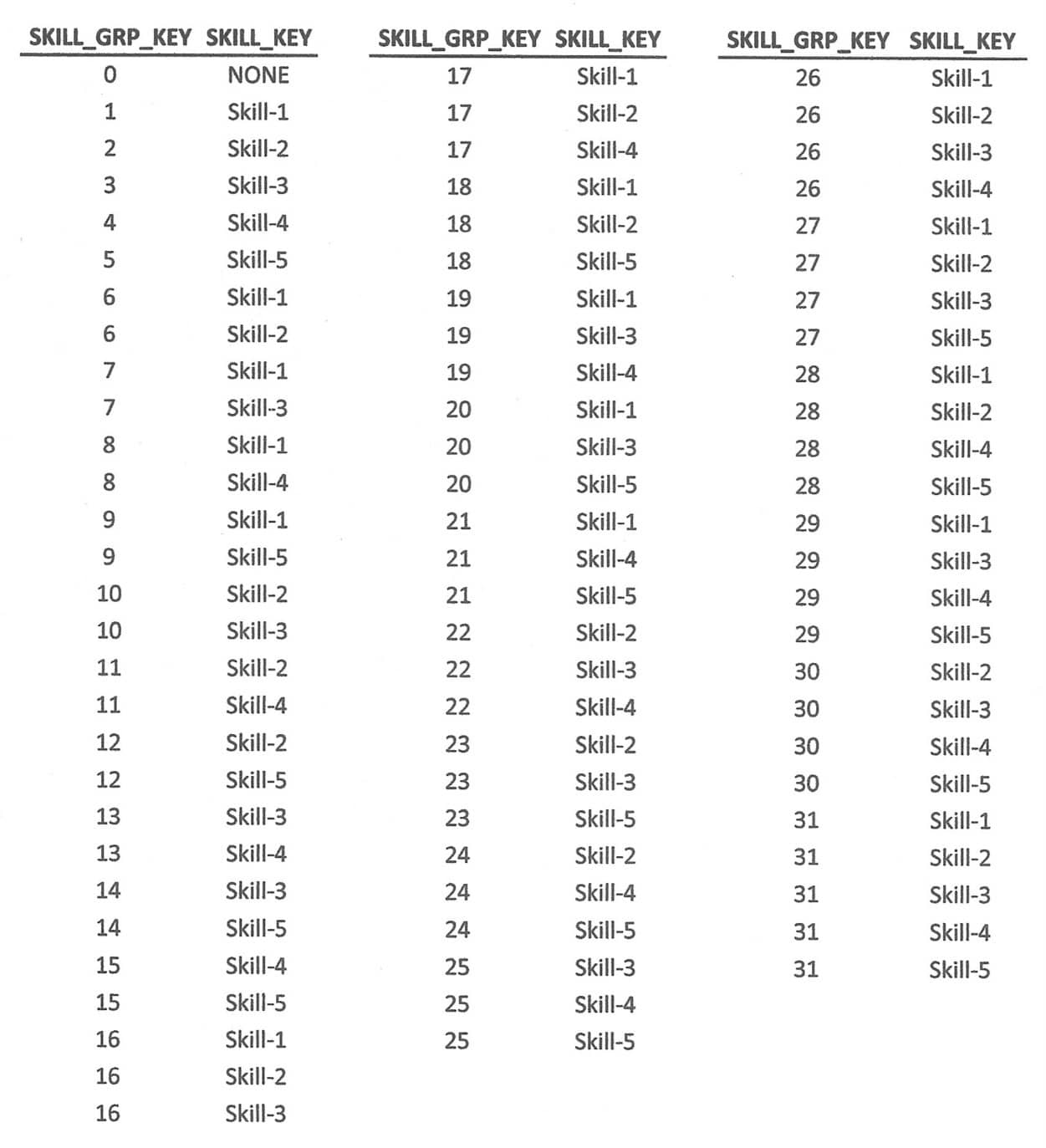

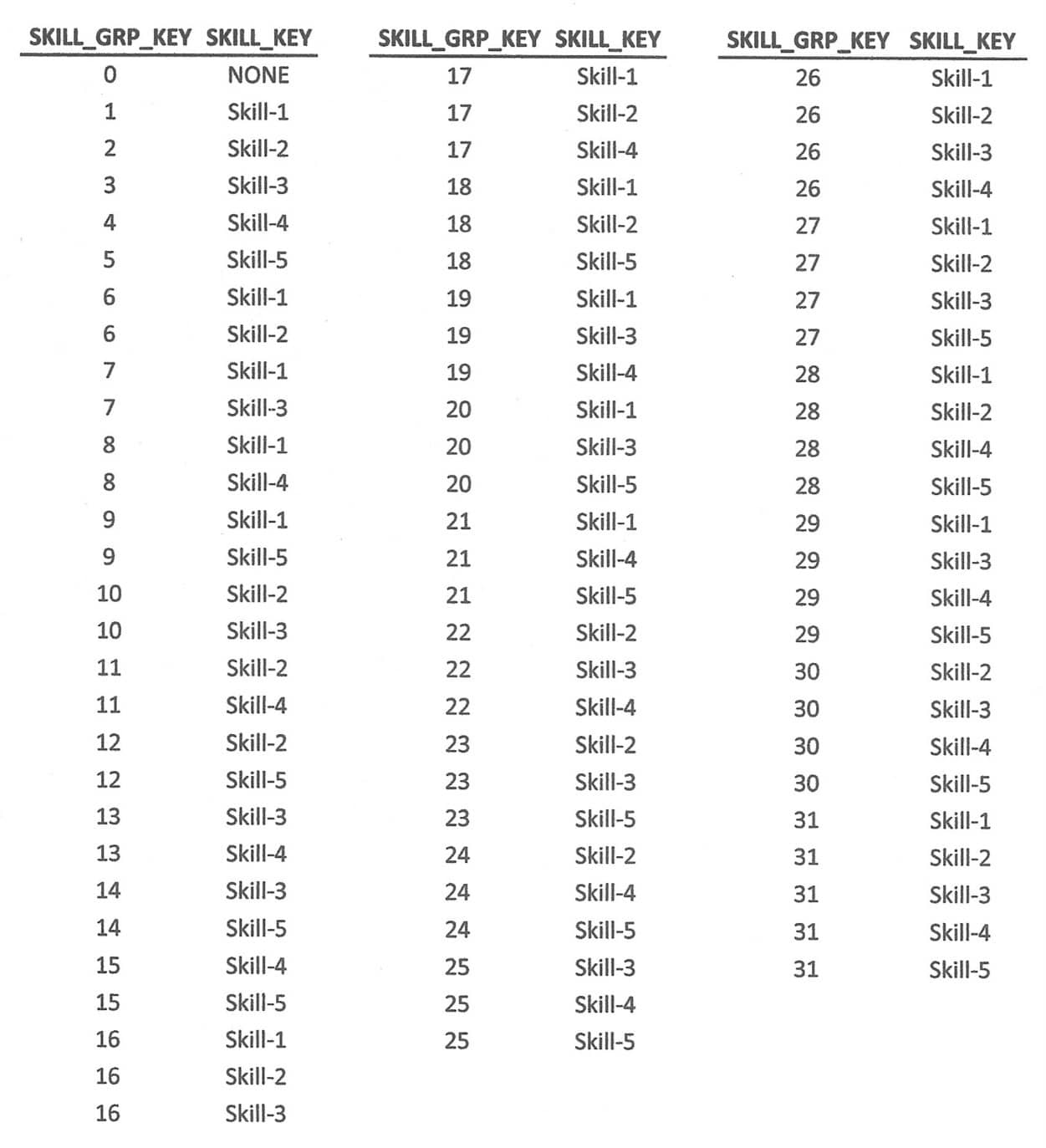

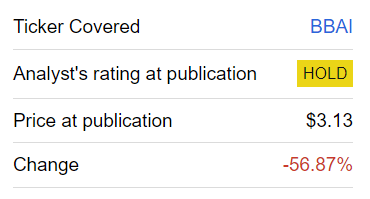

The short-term effects are already visible in the stock price fluctuations since the lawsuit was filed. Analyst ratings and predictions will undoubtedly reflect this uncertainty, and overall investor sentiment will likely be negatively impacted until the case is resolved. (Specific data on stock price movement and analyst ratings would need to be added here.)

Legal Experts' Analysis of the BigBear.ai Securities Case

Legal experts specializing in securities law will play a crucial role in evaluating the strength of both sides' arguments. (This section requires input from legal professionals specializing in securities law. Their analysis will consider relevant case law and precedents, offering insights into the probability of success for the plaintiffs and the defendant. Expert predictions on the outcome, including potential settlements or judgments, are important elements to include.)

Conclusion: BigBear.ai Lawsuit – Implications and Next Steps

The "BigBear.ai Sued" case highlights the critical importance of transparency and ethical practices in the tech industry and the broader securities market. The uncertainty surrounding the outcome carries significant consequences for BigBear.ai, its investors, and the wider investment community. The potential for significant financial penalties, reputational damage, and impact on future business operations underscores the gravity of the situation. To stay informed about the progress of this case and other similar securities litigations, follow reputable financial news sources and legal databases for updates on the "BigBear.ai Sued" case and related developments. Understanding the complexities of securities law and remaining informed about such high-profile cases is crucial for all investors.

Featured Posts

-

Good Morning America Behind The Scenes Chaos And Potential Job Losses

May 21, 2025

Good Morning America Behind The Scenes Chaos And Potential Job Losses

May 21, 2025 -

Big Bear Ai Sued A Deep Dive Into The Securities Law Allegations

May 21, 2025

Big Bear Ai Sued A Deep Dive Into The Securities Law Allegations

May 21, 2025 -

Groeiend Autobezit Stuwt Occasionverkoop Bij Abn Amro

May 21, 2025

Groeiend Autobezit Stuwt Occasionverkoop Bij Abn Amro

May 21, 2025 -

Big Bear Ai Bbai Investment Outlook Defense Sector Growth And Stock Rating

May 21, 2025

Big Bear Ai Bbai Investment Outlook Defense Sector Growth And Stock Rating

May 21, 2025 -

Real Madrid Manager Search Klopps Agent Responds To Rumors

May 21, 2025

Real Madrid Manager Search Klopps Agent Responds To Rumors

May 21, 2025

Latest Posts

-

The Goldbergs Impact And Cultural Significance

May 22, 2025

The Goldbergs Impact And Cultural Significance

May 22, 2025 -

Vybz Kartel On Skin Bleaching A Journey Of Self Love And Acceptance

May 22, 2025

Vybz Kartel On Skin Bleaching A Journey Of Self Love And Acceptance

May 22, 2025 -

Exploring The Enduring Appeal Of The Goldbergs

May 22, 2025

Exploring The Enduring Appeal Of The Goldbergs

May 22, 2025 -

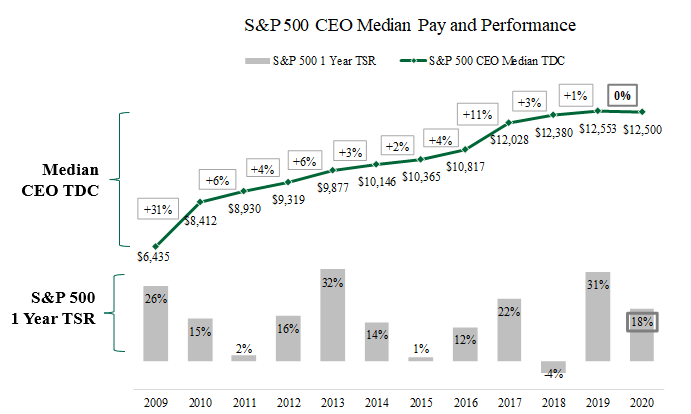

Bp Announces 31 Decrease In Ceo Compensation

May 22, 2025

Bp Announces 31 Decrease In Ceo Compensation

May 22, 2025 -

The Impact Of Low Self Esteem Vybz Kartels Experience With Skin Bleaching

May 22, 2025

The Impact Of Low Self Esteem Vybz Kartels Experience With Skin Bleaching

May 22, 2025