China's Steel Sector Slowdown: Its Effect On Global Iron Ore Demand

Table of Contents

The Decline in Chinese Steel Production

The slowdown in China's steel production is a multifaceted issue stemming from several key drivers. The Chinese government's stringent carbon emission reduction policies are playing a major role, limiting steel production to curb environmental damage. Simultaneously, a weakening real estate market, a crucial consumer of steel, has significantly reduced demand. Lower infrastructure investment, another significant driver of steel consumption, further contributes to the decline.

-

Government Policies: China's commitment to carbon neutrality has resulted in stricter regulations on steel production, leading to production cuts and plant closures. This includes stricter emission standards and limitations on steel production capacity.

-

Real Estate Slump: The ongoing crisis in China's real estate sector, marked by the defaults of major developers, has drastically reduced demand for steel used in construction. This has led to a significant drop in steel consumption.

-

Infrastructure Investment Slowdown: Government spending on infrastructure projects, a major driver of steel demand in previous years, has slowed considerably, further dampening the demand for steel products.

These factors have combined to create a significant "steel production decline," impacting the Chinese steel industry and its global influence. Keywords such as "Chinese steel industry," "carbon emission reduction policies," "real estate slump," and "infrastructure investment" highlight the interconnected nature of this slowdown.

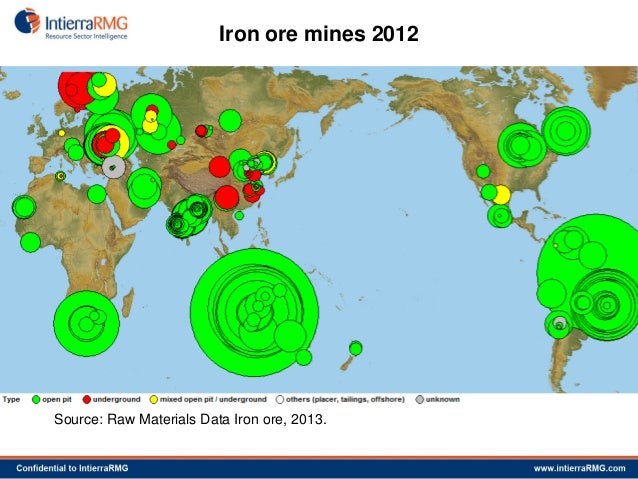

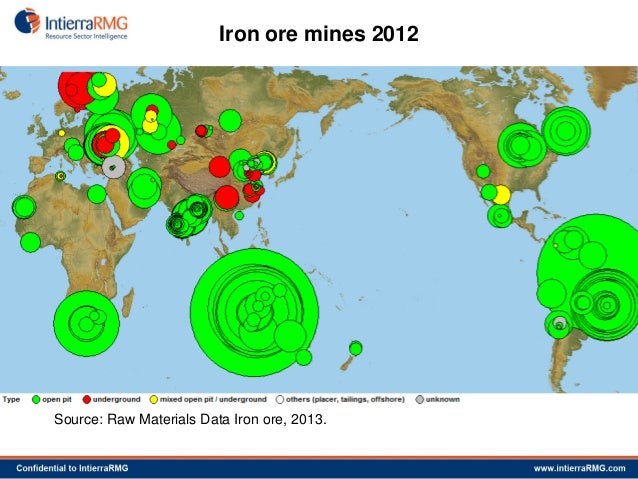

Impact on Iron Ore Imports

The reduced steel production in China directly translates to lower demand for iron ore, a vital raw material in steelmaking. This decreased demand has profound implications for major iron ore exporters like Australia and Brazil, who heavily rely on the Chinese market.

-

Reduced Imports: China's decreased steel production has led to a substantial drop in iron ore imports. While precise figures fluctuate, reports indicate a significant percentage decrease in yearly import volumes.

-

Impact on Exporters: Australian and Brazilian iron ore exporters are experiencing a downturn, impacting their revenue streams and potentially leading to adjustments in production levels and export strategies. This decline in iron ore demand impacts the economies of these exporting nations.

The keywords "iron ore imports," "iron ore demand," "Australian iron ore exports," and "Brazilian iron ore exports" accurately reflect this section's focus. The decreased demand significantly affects global "iron ore prices," creating market volatility.

Price Fluctuations in the Iron Ore Market

The decreased demand for iron ore, primarily driven by China's steel sector slowdown, has resulted in significant price volatility in the global iron ore market. This instability creates challenges for mining companies and related businesses.

-

Price Volatility: The reduced demand has led to fluctuating iron ore prices, creating uncertainty for businesses involved in the iron ore trade. Predicting "iron ore price forecast" has become considerably more difficult.

-

Impact on Mining Companies: Mining companies face decreased revenue and profit margins due to lower prices and reduced demand. This necessitates robust "risk management strategies" and potentially, production adjustments.

-

Hedging Strategies: Businesses engaged in commodity trading are employing hedging strategies to mitigate the risks associated with price volatility. These strategies aim to protect against substantial losses resulting from price fluctuations.

The keywords "iron ore price volatility," "iron ore price forecast," "mining industry impact," "commodity trading," and "risk management strategies" reflect the challenges and responses within this volatile market.

Implications for the Global Economy

The consequences of China's steel sector slowdown extend far beyond the iron ore market, impacting global supply chains, trade balances, and overall economic growth.

-

Supply Chain Disruptions: The reduced steel production and iron ore demand contribute to supply chain disruptions affecting various industries reliant on steel and related materials.

-

Trade Imbalances: The slowdown could lead to trade imbalances as countries adjust to the decreased demand for their exports.

-

Global Economic Growth: The overall impact on global economic growth remains uncertain, with potential negative consequences for countries heavily reliant on steel and iron ore trade.

The keywords "global economic impact," "supply chain disruptions," "trade imbalances," "global economic growth," and "international trade" highlight the broader economic consequences of this slowdown.

Conclusion: Navigating the Shifting Landscape of China's Steel Sector Slowdown and Iron Ore Demand

China's steel sector slowdown is undeniably having a significant impact on global iron ore demand. The interplay between government policies, economic shifts within China, and the resulting fluctuations in iron ore prices presents a complex challenge for all stakeholders. Understanding the multifaceted nature of this situation – from the effects of China's steel production slowdown on iron ore imports to the broader global economic implications – is vital for informed decision-making. The future of the Chinese steel sector and its impact on the global iron ore market require continuous monitoring and analysis. Stay informed about developments in China's steel sector and their effects on global iron ore demand by following reputable news sources and conducting further research. Understanding the nuances of this situation is key to navigating the challenges presented by China's steel sector slowdown.

Featured Posts

-

Intervention Des Pompiers Suite A Un Depart D Incendie A La Mediatheque Champollion Dijon

May 09, 2025

Intervention Des Pompiers Suite A Un Depart D Incendie A La Mediatheque Champollion Dijon

May 09, 2025 -

Surgeon General Nominee Casey Means A Deep Dive Into His Background And The Maha Movement

May 09, 2025

Surgeon General Nominee Casey Means A Deep Dive Into His Background And The Maha Movement

May 09, 2025 -

Nottingham Attacks Inquiry Retired Judge Appointed

May 09, 2025

Nottingham Attacks Inquiry Retired Judge Appointed

May 09, 2025 -

Indonesias Falling Reserves Impact Of Rupiah Weakness On Economic Stability

May 09, 2025

Indonesias Falling Reserves Impact Of Rupiah Weakness On Economic Stability

May 09, 2025 -

Palantir Stock Before May 5th Is It A Smart Investment

May 09, 2025

Palantir Stock Before May 5th Is It A Smart Investment

May 09, 2025

Latest Posts

-

Joint Effort Pakistan Sri Lanka And Bangladesh Enhance Capital Market Cooperation

May 10, 2025

Joint Effort Pakistan Sri Lanka And Bangladesh Enhance Capital Market Cooperation

May 10, 2025 -

Dakota Johnson And Melanie Griffith Shine At Materialists Screening

May 10, 2025

Dakota Johnson And Melanie Griffith Shine At Materialists Screening

May 10, 2025 -

Pakistan Stock Market In Freefall The Impact Of Operation Sindoor

May 10, 2025

Pakistan Stock Market In Freefall The Impact Of Operation Sindoor

May 10, 2025 -

Pakistan Sri Lanka And Bangladesh A New Era Of Capital Market Integration

May 10, 2025

Pakistan Sri Lanka And Bangladesh A New Era Of Capital Market Integration

May 10, 2025 -

Operation Sindoor Fallout Kse 100 Trading Suspended Amidst Sharp Decline

May 10, 2025

Operation Sindoor Fallout Kse 100 Trading Suspended Amidst Sharp Decline

May 10, 2025